In a world when screens dominate our lives however, the attraction of tangible printed objects hasn't waned. Whatever the reason, whether for education such as creative projects or just adding an individual touch to the area, Tax Saver Elss Schemes have become a valuable source. With this guide, you'll dive into the sphere of "Tax Saver Elss Schemes," exploring the different types of printables, where to find them and how they can be used to enhance different aspects of your lives.

Get Latest Tax Saver Elss Schemes Below

Tax Saver Elss Schemes

Tax Saver Elss Schemes -

Synopsis Investing in tax saving ELSS mutual funds Taxpayers can make last minute investments under Section 80C of the Income Tax Act to avail tax benefits ELSS with a three year lock in period offers potential for higher returns compared to other fixed income products ET Online How to invest in ELSS mutual funds

An ELSS fund or an equity linked savings scheme is the only kind of mutual funds eligible for tax deductions under the provisions of Section 80C of the Income Tax Act 1961 You can claim a tax rebate of up to Rs 1 50 000 and save up to Rs 46 800 a year in taxes by investing in ELSS mutual funds

The Tax Saver Elss Schemes are a huge assortment of printable, downloadable materials online, at no cost. These resources come in various forms, like worksheets coloring pages, templates and much more. One of the advantages of Tax Saver Elss Schemes lies in their versatility as well as accessibility.

More of Tax Saver Elss Schemes

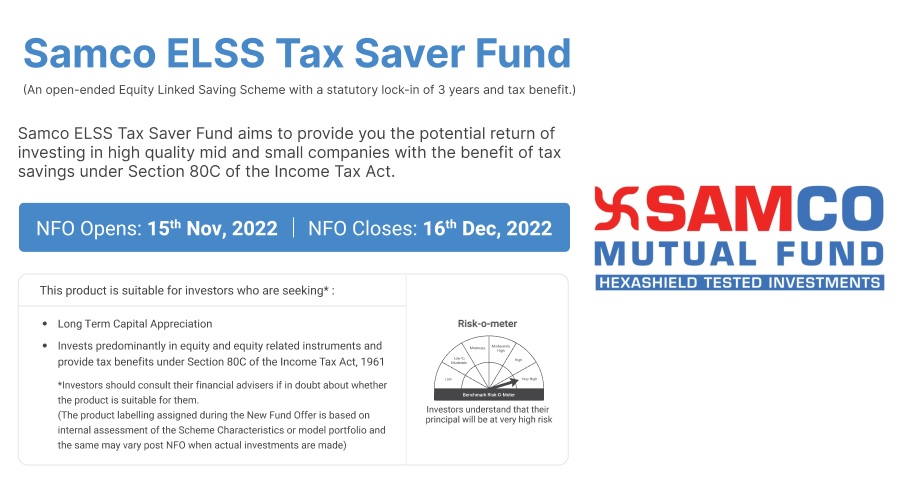

Samco Mutual Fund Introduces A Differentiated ELSS Tax Saver Fund

Samco Mutual Fund Introduces A Differentiated ELSS Tax Saver Fund

You can save Rs 31 200 a year in taxes if you invest Rs 1 5 lakh per year in ELSS and fall in the 20 income tax bracket Moreover you can save Rs 46 800 a year in taxes if you invest Rs 1 5 lakh per year in ELSS and fall in the 30 income tax bracket Comparison with other Tax Saving Investments

45 000 Cr Investment managed 800 Cr Monthly MF investment Objectivity with returns When choosing a financial product to save or invest you shouldn t be blinded by returns alone The tapering of interest rates on the guaranteed return tax saving instrument is a reality that one should accept

Tax Saver Elss Schemes have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Individualization You can tailor printed materials to meet your requirements, whether it's designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: Free educational printables provide for students from all ages, making them an essential tool for parents and educators.

-

An easy way to access HTML0: immediate access numerous designs and templates is time-saving and saves effort.

Where to Find more Tax Saver Elss Schemes

11 I Top 11 ELSS Tax Saver

11 I Top 11 ELSS Tax Saver

What is PGIM India ELSS Tax Saver Fund PGIM India Long Term Equity Fund is an open ended Equity Linked Savings Scheme with lock in of 3 years and offers tax benefit under section 80 C of the Income Tax Act 1961 The fund invests in companies across a wide range of sectors and market capitalization

ELSS funds are tax saving mutual funds under section 80C of the Income Tax Act of 1961 By investing in ELSS schemes you can claim a tax deduction on your income of up to 1 50 000 as per the old Tax Regime What are tax saving mutual funds and how are they different from other equity mutual funds

In the event that we've stirred your curiosity about Tax Saver Elss Schemes, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Saver Elss Schemes to suit a variety of motives.

- Explore categories like interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs covered cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Tax Saver Elss Schemes

Here are some creative ways to make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Saver Elss Schemes are a treasure trove of fun and practical tools that can meet the needs of a variety of people and pursuits. Their accessibility and flexibility make them an essential part of every aspect of your life, both professional and personal. Explore the wide world of Tax Saver Elss Schemes today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Saver Elss Schemes truly absolutely free?

- Yes, they are! You can print and download these files for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's based on the conditions of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright issues with Tax Saver Elss Schemes?

- Certain printables might have limitations on their use. Be sure to read these terms and conditions as set out by the author.

-

How do I print Tax Saver Elss Schemes?

- Print them at home using either a printer at home or in a print shop in your area for the highest quality prints.

-

What program do I need to run Tax Saver Elss Schemes?

- The majority are printed in PDF format, which can be opened with free software like Adobe Reader.

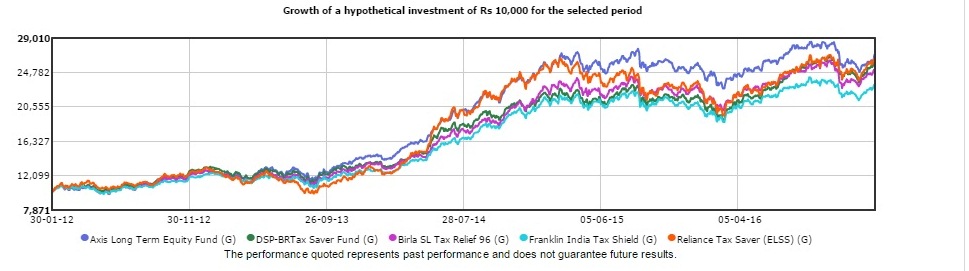

Should You Invest In Multiple Equity Linked Saving Schemes ELSS

Top 6 Best ELSS Tax Saving Mutual Fund SIP Schemes 2016

Check more sample of Tax Saver Elss Schemes below

DSP Tax Saver Fund ELSS Best Performing Large Cap Mutual Funds 2019

ELSS Tax Saving Mutual Funds Mens6

Media Kit Samco ELSS Tax Saver Fund

Mirae Asset Tax Saver Fund Direct Plan 2022 Should You Invest

ELSS Dialabank Best Offers 2020

Introducing Samco ELSS Tax Saver Fund

https://cleartax.in/s/elss

An ELSS fund or an equity linked savings scheme is the only kind of mutual funds eligible for tax deductions under the provisions of Section 80C of the Income Tax Act 1961 You can claim a tax rebate of up to Rs 1 50 000 and save up to Rs 46 800 a year in taxes by investing in ELSS mutual funds

https://www.etmoney.com/learn/mutual-funds/elss-mutual-funds

ELSS or Equity Linked Savings Scheme are tax saving mutual funds in India They combine the benefits of equity investments with tax deductions under Section 80C ELSS has a 3 year lock in period offering the potential for high returns and tax savings making it a popular choice for long term investors

An ELSS fund or an equity linked savings scheme is the only kind of mutual funds eligible for tax deductions under the provisions of Section 80C of the Income Tax Act 1961 You can claim a tax rebate of up to Rs 1 50 000 and save up to Rs 46 800 a year in taxes by investing in ELSS mutual funds

ELSS or Equity Linked Savings Scheme are tax saving mutual funds in India They combine the benefits of equity investments with tax deductions under Section 80C ELSS has a 3 year lock in period offering the potential for high returns and tax savings making it a popular choice for long term investors

Mirae Asset Tax Saver Fund Direct Plan 2022 Should You Invest

ELSS Tax Saving Mutual Funds Mens6

ELSS Dialabank Best Offers 2020

Introducing Samco ELSS Tax Saver Fund

MyMoney Myway Top 5 Tax Saving Mutual Fund Schemes ELSS For 2017

Top Performing ELSS Schemes For Investment 2023

Top Performing ELSS Schemes For Investment 2023

Nippon India Tax Saver elss Fund Snapshot Latest NAV