In a world in which screens are the norm it's no wonder that the appeal of tangible printed objects hasn't waned. For educational purposes or creative projects, or simply to add an individual touch to your space, Tax Return Philippines can be an excellent source. Here, we'll take a dive deep into the realm of "Tax Return Philippines," exploring the different types of printables, where you can find them, and how they can enrich various aspects of your life.

Get Latest Tax Return Philippines Below

Tax Return Philippines

Tax Return Philippines -

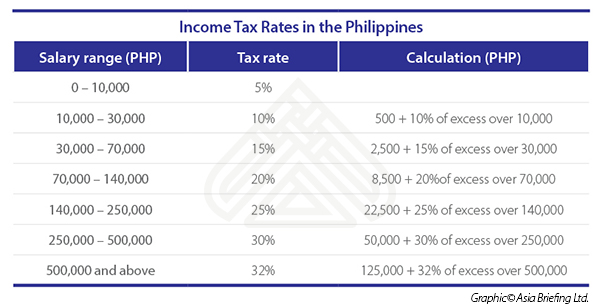

Types of Taxes in the Philippines Direct taxes Income tax Withholding tax Fringe Benefit Tax Capital Gains Tax Estate Tax Donor s Tax Indirect taxes Value Added Tax Excise Tax Documentary Stamp Tax Local Taxes Real Property Tax Business Tax Tax on Transfer of Real Property Ownership Tax on Business of Printing

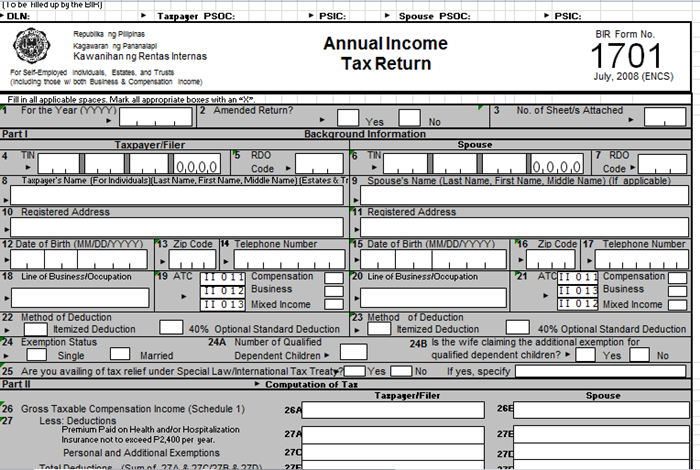

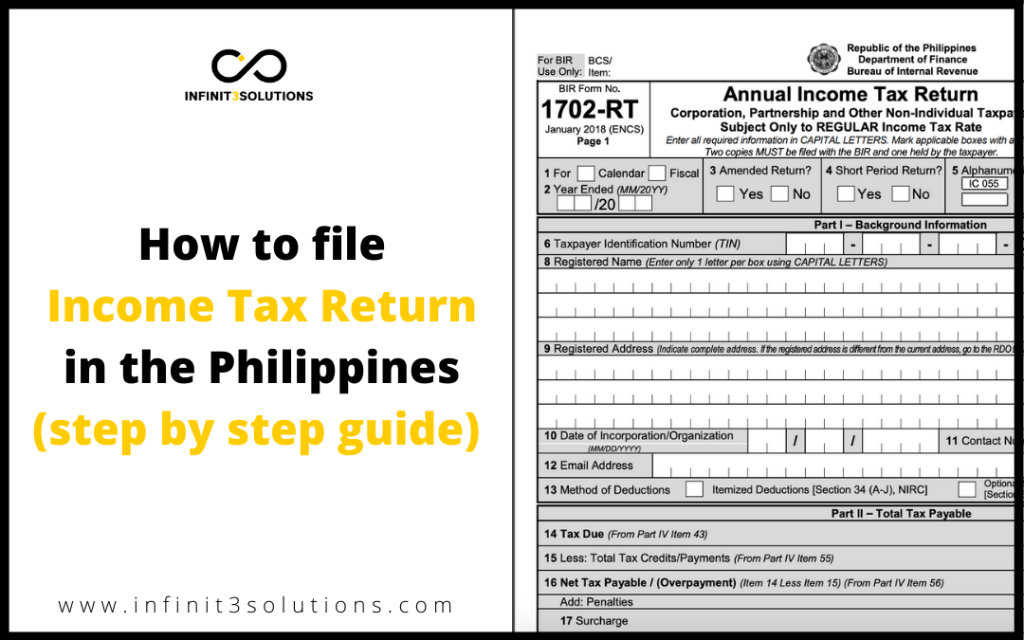

What Is an Income Tax Return Why You Should File and Pay Taxes 1 Access to loans and credit cards 2 Income document for visa application 3 Business growth 4 Compliance with the law Who Are Required To File an ITR and Pay Taxes 1 Individual taxpayers 2 Non individual Corporate taxpayers

Tax Return Philippines cover a large array of printable materials online, at no cost. These resources come in many forms, including worksheets, coloring pages, templates and many more. One of the advantages of Tax Return Philippines is in their variety and accessibility.

More of Tax Return Philippines

New Income Tax Table 2023 In The Philippines Free Nude Porn Photos

New Income Tax Table 2023 In The Philippines Free Nude Porn Photos

1 How to Get Taxpayer Identification Number TIN a How to Get a TIN Using BIR Tax Forms Walk in Registration b How to Get a TIN Using the BIR eReg Website Online Registration 2 How to Verify TIN If It Has Been Lost or Forgotten 3 How to Get TIN ID Card in the Philippines What Are the Different Types of Taxes in the

The Philippine Tax Whiz discusses Revenue Memorandum Circular 51 2024 and Bank Bulletin 2024 01 of the BIR which indicate the newest guidelines on annual income tax returns for calendar year

Tax Return Philippines have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

The ability to customize: You can tailor designs to suit your personal needs such as designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value: The free educational worksheets offer a wide range of educational content for learners of all ages, which makes them a great aid for parents as well as educators.

-

Easy to use: Instant access to many designs and templates can save you time and energy.

Where to Find more Tax Return Philippines

Types Of Income Tax In The Philippines Bovenmen Shop

Types Of Income Tax In The Philippines Bovenmen Shop

Step 1 Determine Your Gross Sales or Receipts Step 2 Gather Income and Expense Records Step 3 Refer to the Graduated Income Tax Rates Table Step 4 Compute Your Net Taxable Income Step 5 Determine Your Tax Due Step 6 Pay the Tax Due How to Compute Income Tax on Passive Income

A Beginner s Guide to Filing Your Income Tax Return in the Philippines It s the season for filing your annual income tax return in the Philippines once again You might have noticed all your accountant friends and family are in

Now that we've ignited your interest in printables for free We'll take a look around to see where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Tax Return Philippines for different objectives.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing including flashcards, learning tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a broad variety of topics, ranging from DIY projects to party planning.

Maximizing Tax Return Philippines

Here are some inventive ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Tax Return Philippines are a treasure trove of practical and innovative resources that can meet the needs of a variety of people and interests. Their access and versatility makes they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast world of Tax Return Philippines today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes, they are! You can download and print these materials for free.

-

Can I use free printables for commercial uses?

- It's contingent upon the specific terms of use. Make sure you read the guidelines for the creator before using their printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables could be restricted on usage. Make sure to read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home with a printer or visit a print shop in your area for more high-quality prints.

-

What software do I require to view printables free of charge?

- Most printables come in PDF format. They can be opened using free software, such as Adobe Reader.

How To Compute Income Tax Refund In The Philippines A Definitive Guide

Withholding Tax On Savings Account Philippines Tanya Tanya

Check more sample of Tax Return Philippines below

How To File Income Tax Return In The Philippines During Corona Virus

Philippines New Annual Income Tax Return Form 01 IAF JUNE 2013 Tax

Filing Income Tax Return ITR In The Philippines Philippines

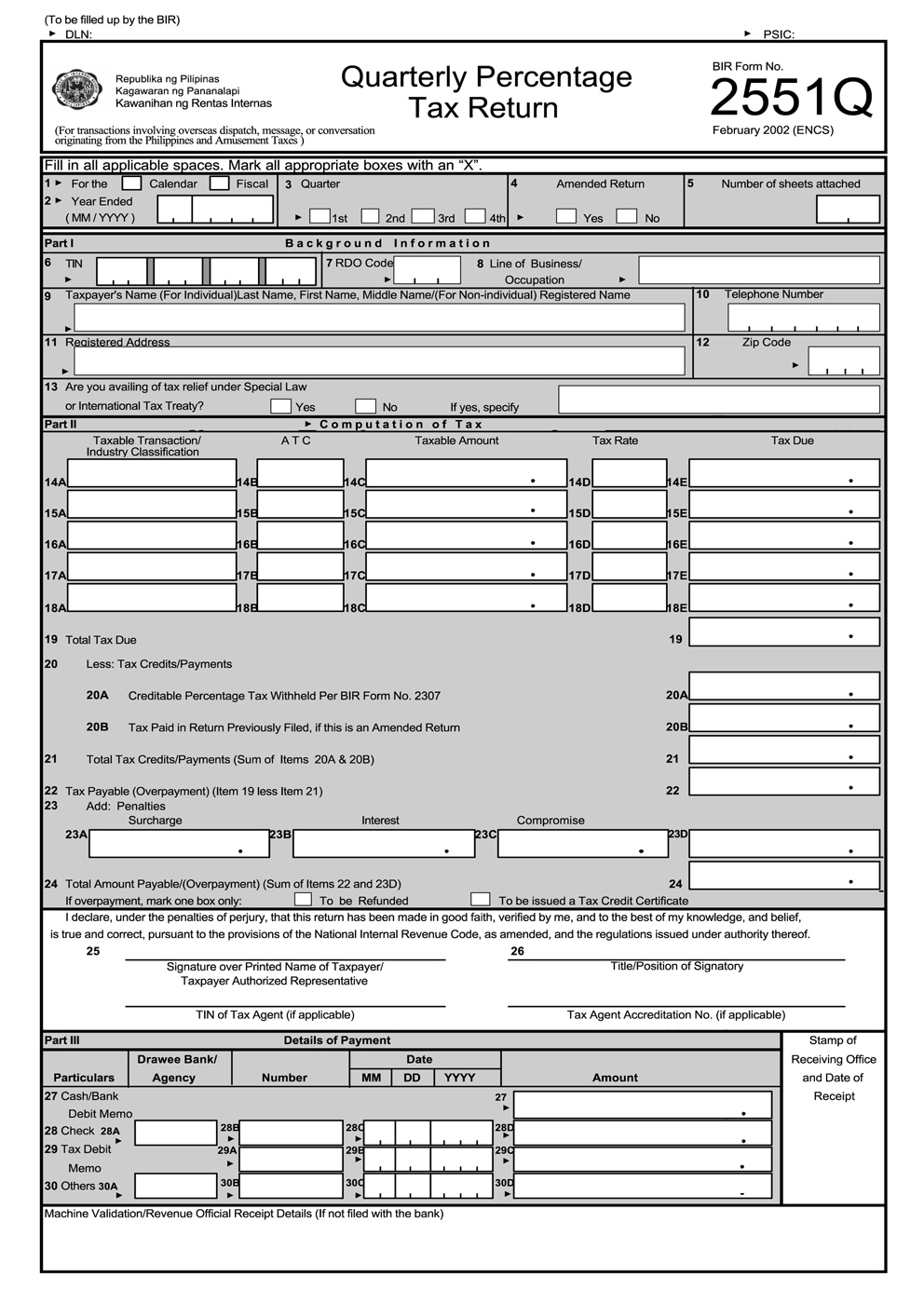

BIR FORM 2551M PDF

Income Tax Tables In The Philippines 2022 187 Pinoy Money Talk Riset

Income Tax Return

https://filipiknow.net/income-tax-return

What Is an Income Tax Return Why You Should File and Pay Taxes 1 Access to loans and credit cards 2 Income document for visa application 3 Business growth 4 Compliance with the law Who Are Required To File an ITR and Pay Taxes 1 Individual taxpayers 2 Non individual Corporate taxpayers

https://www.bir.gov.ph/index.php/tax-information/income-tax.html

Who are Required to File Income Tax Returns Individuals Resident citizens receiving income from sources within or outside the Philippines Employees deriving purely compensation income from two or more employers concurrently or successively at any time during the taxable year

What Is an Income Tax Return Why You Should File and Pay Taxes 1 Access to loans and credit cards 2 Income document for visa application 3 Business growth 4 Compliance with the law Who Are Required To File an ITR and Pay Taxes 1 Individual taxpayers 2 Non individual Corporate taxpayers

Who are Required to File Income Tax Returns Individuals Resident citizens receiving income from sources within or outside the Philippines Employees deriving purely compensation income from two or more employers concurrently or successively at any time during the taxable year

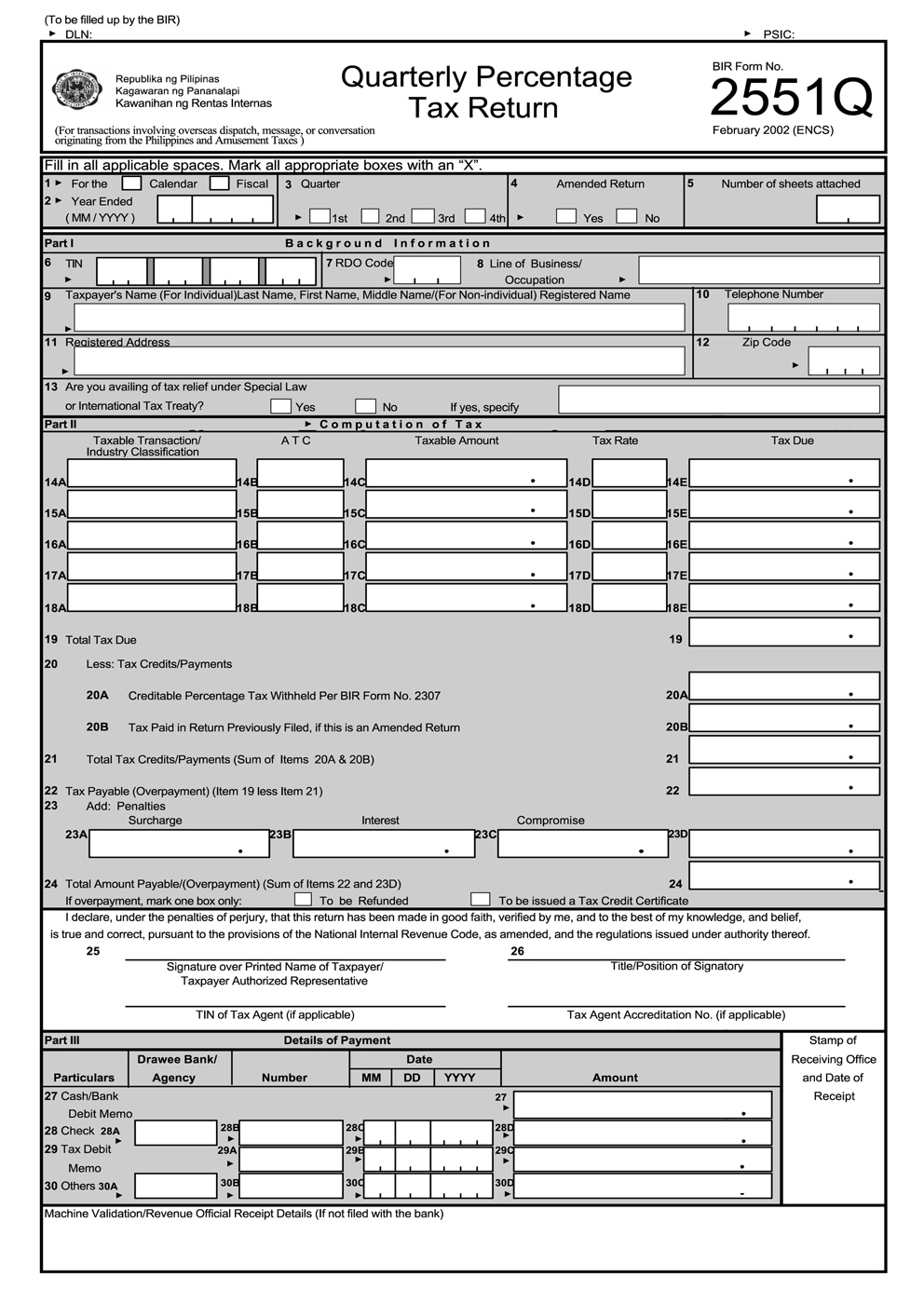

BIR FORM 2551M PDF

Philippines New Annual Income Tax Return Form 01 IAF JUNE 2013 Tax

Income Tax Tables In The Philippines 2022 187 Pinoy Money Talk Riset

Income Tax Return

Thing To Know About BIR Form 1701Q Or Quarterly Income Tax Return F Q

How To Claim Tax Refund Philippines Latest News Update

How To Claim Tax Refund Philippines Latest News Update

23 Tips For The Preparation Of Annual Income Tax Return ITR In The