In the digital age, where screens have become the dominant feature of our lives yet the appeal of tangible printed products hasn't decreased. In the case of educational materials and creative work, or simply to add a personal touch to your home, printables for free are now an essential source. Through this post, we'll take a dive through the vast world of "Tax Return On Charitable Donations Canada," exploring what they are, how to get them, as well as how they can add value to various aspects of your life.

Get Latest Tax Return On Charitable Donations Canada Below

Tax Return On Charitable Donations Canada

Tax Return On Charitable Donations Canada -

Key Takeaways You can receive a 15 tax credit on your first 200 donated and 29 tax credit on amounts donated above 200 The maximum donation credit you can claim is 75 of your net income for the year You can only claim donation credits from registered charities

For a quick estimate of your charitable tax credit for the current tax year try out the Charitable donation tax credit calculator For more information about claiming your charitable donations see the General Income Tax and Benefits Guide

Tax Return On Charitable Donations Canada include a broad variety of printable, downloadable resources available online for download at no cost. They are available in numerous types, such as worksheets coloring pages, templates and many more. One of the advantages of Tax Return On Charitable Donations Canada lies in their versatility and accessibility.

More of Tax Return On Charitable Donations Canada

Tips On Tax Deductions For Donations

Tips On Tax Deductions For Donations

Key Takeaways The charitable donation tax credit in Canada helps reduce your taxable income You may qualify for 15 to 29 of eligible charity donations made You can accumulate deductions for multiple years and get a higher tax credit for amounts over 200

Federal charitable donation tax credit 30 15 on the first 200 145 29 on the remaining 500 175 30 145 is their total federal tax credit Provincial charitable donation tax credit 20 10 on the first 200 105 21 on the remaining 500 125 20 105 is their total provincial tax credit

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Individualization Your HTML0 customization options allow you to customize printables to fit your particular needs for invitations, whether that's creating them and schedules, or decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free are designed to appeal to students of all ages. This makes them a vital aid for parents as well as educators.

-

Easy to use: The instant accessibility to various designs and templates will save you time and effort.

Where to Find more Tax Return On Charitable Donations Canada

Tax Benefits Of Charitable Donations 2022 TurboTax Canada Tips

Tax Benefits Of Charitable Donations 2022 TurboTax Canada Tips

By donating to your favourite charity you may receive as much as 49 of the amount you donated back at tax time That could mean a 494 tax credit on a total of 1000 donated in a single year in some provinces Donate securities eliminate the capital gains tax and get a larger tax credit

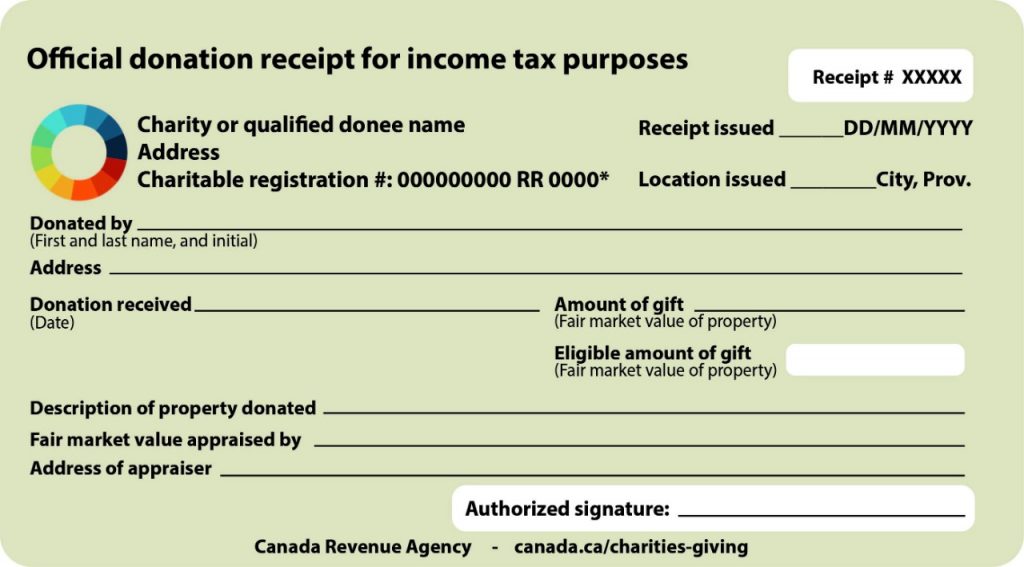

In these situations the Canada Revenue Agency accepts your T4 slip as your official receipt for income tax purposes For more information about claiming charitable donations go to Line 349 Donations and Gifts For more information about filing your income tax return go to Learn about your taxes

We've now piqued your interest in printables for free Let's take a look at where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Tax Return On Charitable Donations Canada for all applications.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free including flashcards, learning materials.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a broad selection of subjects, from DIY projects to party planning.

Maximizing Tax Return On Charitable Donations Canada

Here are some new ways of making the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Return On Charitable Donations Canada are a treasure trove of practical and imaginative resources designed to meet a range of needs and pursuits. Their access and versatility makes they a beneficial addition to the professional and personal lives of both. Explore the vast array that is Tax Return On Charitable Donations Canada today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I make use of free printables to make commercial products?

- It depends on the specific usage guidelines. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download Tax Return On Charitable Donations Canada?

- Some printables may come with restrictions in use. Check the terms and conditions set forth by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to an area print shop for high-quality prints.

-

What program will I need to access printables at no cost?

- The majority of printed documents are with PDF formats, which is open with no cost software like Adobe Reader.

Guide To Claiming Charitable Donation Reciept CanadaHelps Donate To

How Much Do Charitable Donations Reduce Taxes In Canada

Check more sample of Tax Return On Charitable Donations Canada below

Tax Deductions On Charitable Donations In Canada Remitbee

Charitable Donations In Canada How To Save The Most Tax Virtual

How To Make The Most Of Your Charitable Donations In Canada

TIL One Of The Largest Charitable Donations Made By A Lottery Winner

:max_bytes(150000):strip_icc()/GettyImages-517812930-5a82f8d5d8fdd50037850a9e.jpg)

How To Make The Most Of Your Charitable Donations In Canada

How To Ensure You Get Tax Relief On Charitable Donations

https://www.canada.ca/.../calculate-charitable-tax-credits.html

For a quick estimate of your charitable tax credit for the current tax year try out the Charitable donation tax credit calculator For more information about claiming your charitable donations see the General Income Tax and Benefits Guide

https://www.canada.ca/en/revenue-agency/services/...

Line 34900 Donations and gifts Canada ca If you or your spouse or common law partner made a gift of money or other property to certain institutions you may be able to claim federal and provincial or territorial non refundable tax credits when you file your income tax and benefit return

For a quick estimate of your charitable tax credit for the current tax year try out the Charitable donation tax credit calculator For more information about claiming your charitable donations see the General Income Tax and Benefits Guide

Line 34900 Donations and gifts Canada ca If you or your spouse or common law partner made a gift of money or other property to certain institutions you may be able to claim federal and provincial or territorial non refundable tax credits when you file your income tax and benefit return

:max_bytes(150000):strip_icc()/GettyImages-517812930-5a82f8d5d8fdd50037850a9e.jpg)

TIL One Of The Largest Charitable Donations Made By A Lottery Winner

Charitable Donations In Canada How To Save The Most Tax Virtual

How To Make The Most Of Your Charitable Donations In Canada

How To Ensure You Get Tax Relief On Charitable Donations

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

How Do I Use The Charitable Donation Tax Credit YouTube

How Do I Use The Charitable Donation Tax Credit YouTube

How Much Do Charitable Donations Reduce Taxes In Canada