In this day and age when screens dominate our lives it's no wonder that the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education for creative projects, simply to add personal touches to your space, Tax Return Interest On Student Loans have proven to be a valuable source. In this article, we'll take a dive into the world "Tax Return Interest On Student Loans," exploring the different types of printables, where to find them and how they can enrich various aspects of your daily life.

Get Latest Tax Return Interest On Student Loans Below

Tax Return Interest On Student Loans

Tax Return Interest On Student Loans -

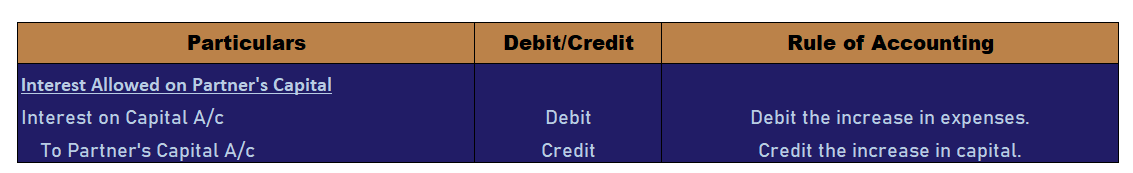

This interview will help you determine if you can deduct the interest you paid on a student or educational loan Information you ll need Filing status Basic income information Your adjusted gross income Educational expenses paid with nontaxable funds

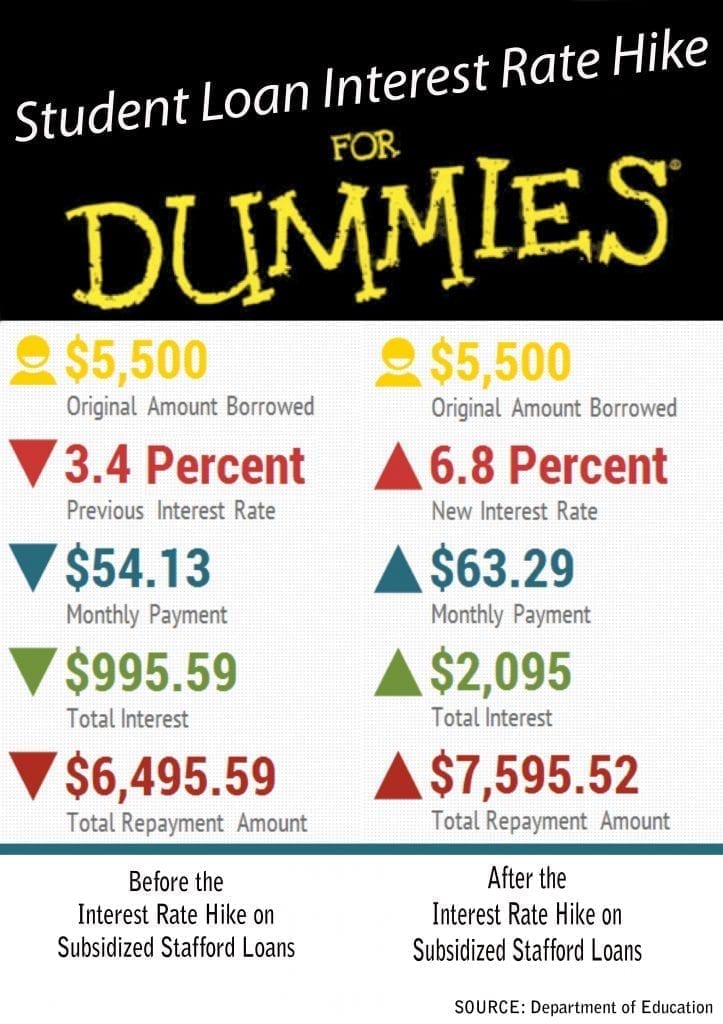

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

Tax Return Interest On Student Loans include a broad variety of printable, downloadable material that is available online at no cost. These printables come in different forms, like worksheets templates, coloring pages, and much more. The appealingness of Tax Return Interest On Student Loans is their versatility and accessibility.

More of Tax Return Interest On Student Loans

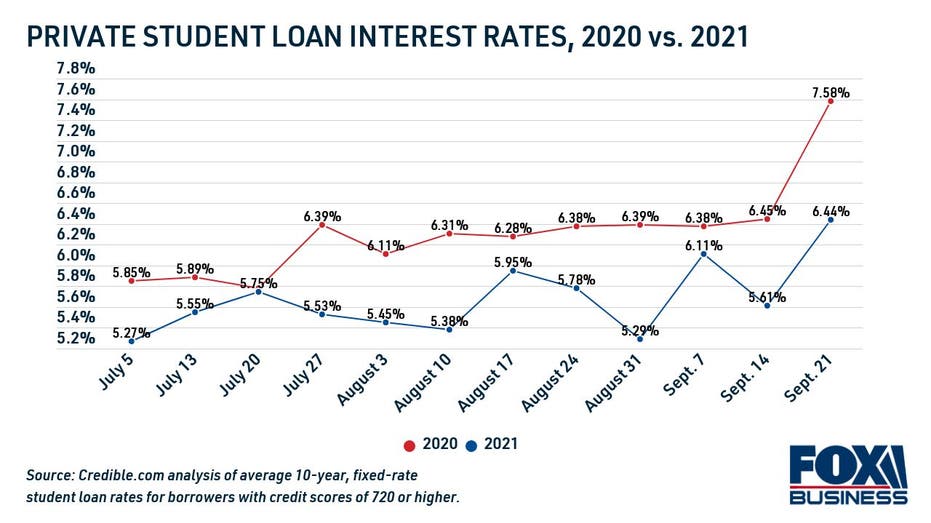

QoD New Interest Rate On Federal Student Loans For 2020 21 Blog

.png?1589760253409)

QoD New Interest Rate On Federal Student Loans For 2020 21 Blog

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in interest paid from your

If you ve paid interest on your student loans you may be able to reduce your federal taxable income by up to 2 500 thanks to the student loan interest deduction or SLID

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Personalization Your HTML0 customization options allow you to customize designs to suit your personal needs for invitations, whether that's creating them to organize your schedule or even decorating your home.

-

Educational value: Education-related printables at no charge are designed to appeal to students of all ages. This makes them a great device for teachers and parents.

-

Accessibility: Access to a variety of designs and templates reduces time and effort.

Where to Find more Tax Return Interest On Student Loans

What Are Interest Expenses On Tax Return JacAnswers

What Are Interest Expenses On Tax Return JacAnswers

For 2023 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 75 000 and 90 000 155 000 and 185 000 if you file a joint return You can t claim the deduction if your MAGI is 90 000 or more 185 000 or more if you file a joint return

If you re paying off your student loans you may qualify for a student loan interest deduction which can reduce your taxable income and make up for some of the educational costs

We've now piqued your interest in Tax Return Interest On Student Loans, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Tax Return Interest On Student Loans for a variety needs.

- Explore categories such as decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free, flashcards, and learning tools.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a wide selection of subjects, that includes DIY projects to party planning.

Maximizing Tax Return Interest On Student Loans

Here are some creative ways that you can make use of Tax Return Interest On Student Loans:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home and in class.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Tax Return Interest On Student Loans are an abundance of fun and practical tools designed to meet a range of needs and desires. Their access and versatility makes them a fantastic addition to each day life. Explore the wide world of Tax Return Interest On Student Loans and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes you can! You can download and print these free resources for no cost.

-

Are there any free printables to make commercial products?

- It's dependent on the particular conditions of use. Always check the creator's guidelines before using printables for commercial projects.

-

Do you have any copyright concerns when using Tax Return Interest On Student Loans?

- Certain printables may be subject to restrictions regarding usage. Be sure to read the terms and conditions set forth by the creator.

-

How do I print Tax Return Interest On Student Loans?

- Print them at home using any printer or head to a local print shop for more high-quality prints.

-

What software do I require to open printables for free?

- The majority of printed documents are with PDF formats, which can be opened using free software like Adobe Reader.

What Is Capitalized Interest On Student Loans Clever Girl Finance In

12 Interest On Student Loans Not So Simple

Check more sample of Tax Return Interest On Student Loans below

Student Loan Interest Rates 2022 Federal Student Loan Interest Rates

How To Consolidate Student Loans In 2023 BengaliNewz

12 Interest On Student Loans Not So Simple Chase De Vere Dental

A Simple Explanation Of How Student Loan Interest Is Calculated

How Does Interest Capitalize On Student Loans

IRS Adjusts 2023 Tax Rates For Inflation How It Will Impact Your Fina

https://www.irs.gov/taxtopics/tc456

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

.png?1589760253409?w=186)

https://www.forbes.com/advisor/taxes/student-loan-interest-tax-deduction

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan during the

A Simple Explanation Of How Student Loan Interest Is Calculated

How To Consolidate Student Loans In 2023 BengaliNewz

How Does Interest Capitalize On Student Loans

IRS Adjusts 2023 Tax Rates For Inflation How It Will Impact Your Fina

How To Calculate Interest On Student Loans 11888 XSJ

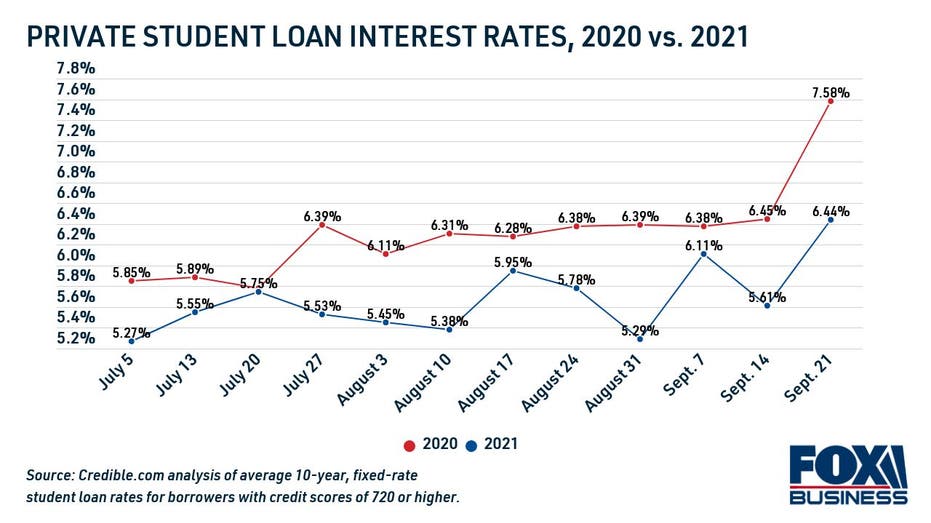

Average Private Student Loan Interest Rates Remain Low Data Shows How

Average Private Student Loan Interest Rates Remain Low Data Shows How

Canada Eliminates Interest On Student Loans