In this age of electronic devices, where screens rule our lives, the charm of tangible printed objects hasn't waned. No matter whether it's for educational uses or creative projects, or just adding the personal touch to your home, printables for free are a great source. For this piece, we'll dive to the depths of "Tax Relief On Medical Insurance Premiums," exploring what they are, where to get them, as well as ways they can help you improve many aspects of your life.

Get Latest Tax Relief On Medical Insurance Premiums Below

Tax Relief On Medical Insurance Premiums

Tax Relief On Medical Insurance Premiums -

Resident individuals are entitled to relief on premiums paid for life education and health policies Every resident individual is entitled to an insurance relief of 15 of the amount of premiums paid for self spouse or child subject to a maximum of Kshs 60 000 per annum

Alex Cheong Pui Yin 5th April 2024 6 min read There are quite a few types of tax reliefs that you can claim to reduce your chargeable income and thus pay less in taxes and some of the biggest reliefs you can get are from any insurance policies that you may own

Tax Relief On Medical Insurance Premiums provide a diverse range of downloadable, printable items that are available online at no cost. They come in many forms, including worksheets, templates, coloring pages and many more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Tax Relief On Medical Insurance Premiums

Why Do Medical Insurance Premiums Increase Every Year Bowtie SG

Why Do Medical Insurance Premiums Increase Every Year Bowtie SG

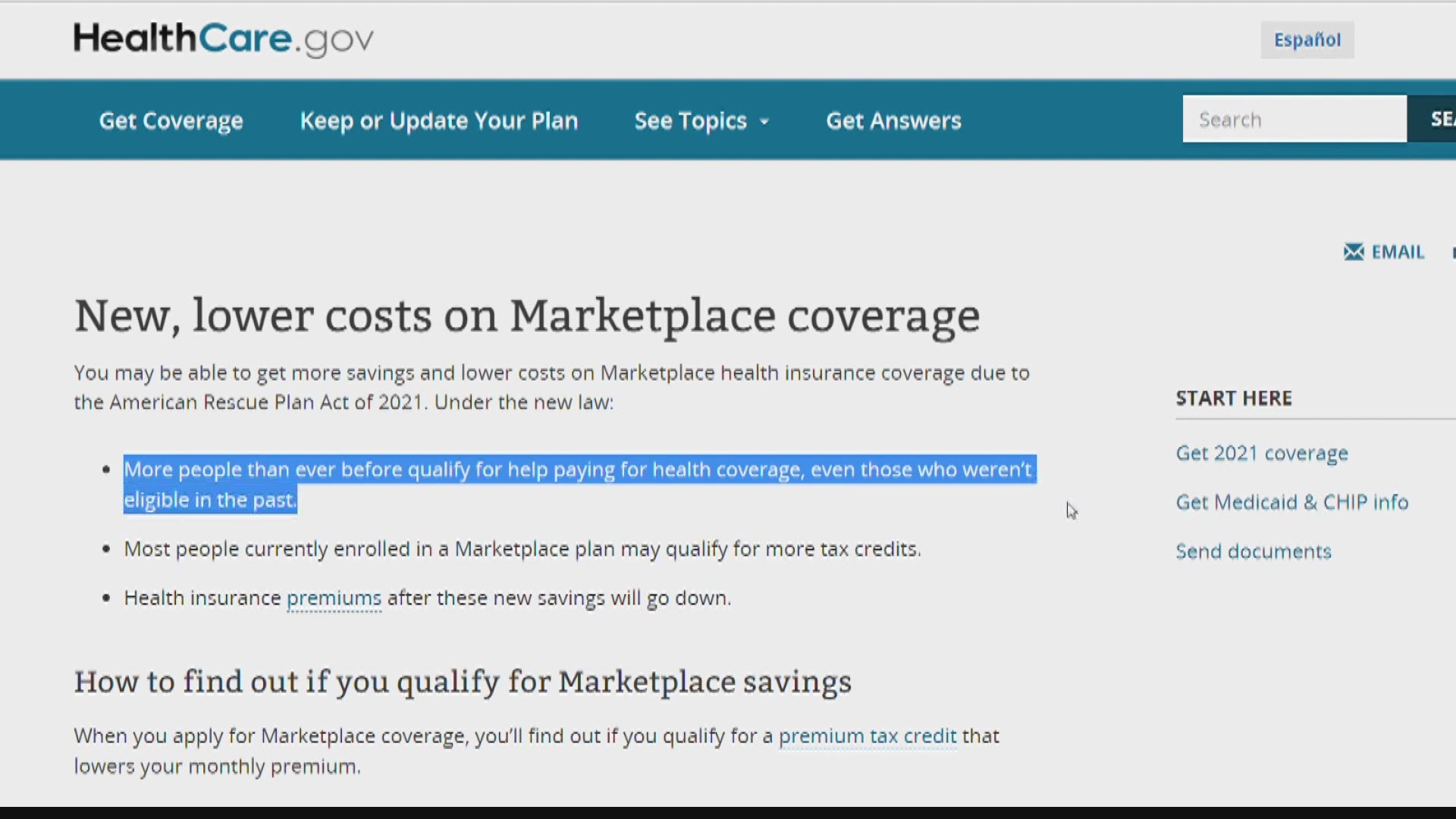

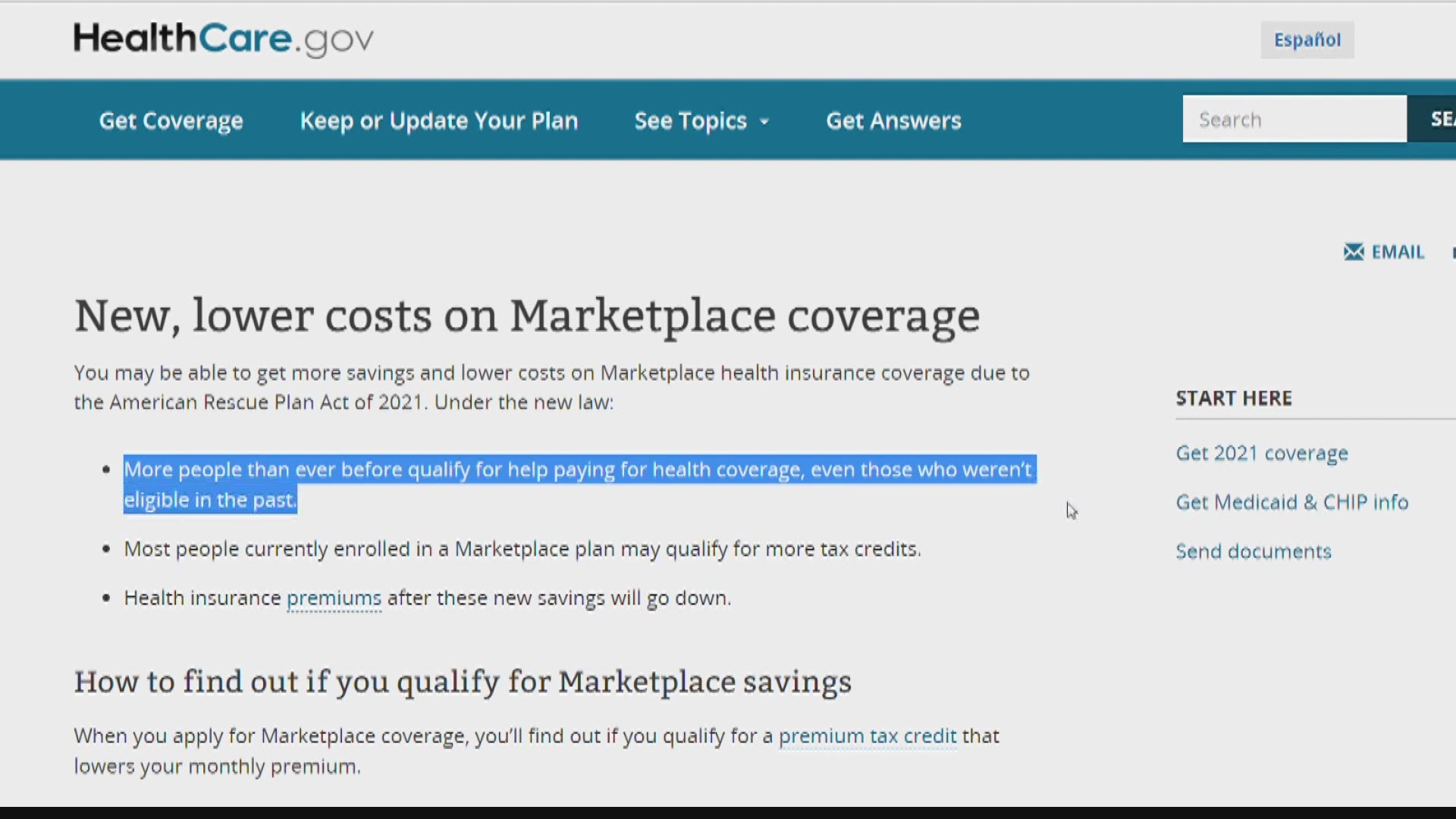

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain

The Tax Relief On Medical Insurance Premiums have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Modifications: There is the possibility of tailoring printables to your specific needs, whether it's designing invitations or arranging your schedule or even decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free provide for students from all ages, making these printables a powerful tool for teachers and parents.

-

Simple: instant access a myriad of designs as well as templates helps save time and effort.

Where to Find more Tax Relief On Medical Insurance Premiums

How To Claim Tax Benefits On Medical Insurance Premiums

How To Claim Tax Benefits On Medical Insurance Premiums

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

We hope we've stimulated your interest in Tax Relief On Medical Insurance Premiums We'll take a look around to see where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in Tax Relief On Medical Insurance Premiums for different reasons.

- Explore categories such as decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a broad range of topics, all the way from DIY projects to planning a party.

Maximizing Tax Relief On Medical Insurance Premiums

Here are some new ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Tax Relief On Medical Insurance Premiums are an abundance with useful and creative ideas for a variety of needs and needs and. Their availability and versatility make them an invaluable addition to your professional and personal life. Explore the vast collection of Tax Relief On Medical Insurance Premiums to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can print and download these free resources for no cost.

-

Does it allow me to use free printables to make commercial products?

- It's determined by the specific conditions of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may have restrictions regarding their use. Make sure to read the conditions and terms of use provided by the designer.

-

How do I print Tax Relief On Medical Insurance Premiums?

- Print them at home using an printer, or go to an in-store print shop to get better quality prints.

-

What software do I need in order to open printables free of charge?

- The majority of printed documents are in PDF format. They can be opened with free programs like Adobe Reader.

Personal Tax Relief 2022 L Co Accountants

Innovative Approach Can Reduce Road Fatalities Says Michael

Check more sample of Tax Relief On Medical Insurance Premiums below

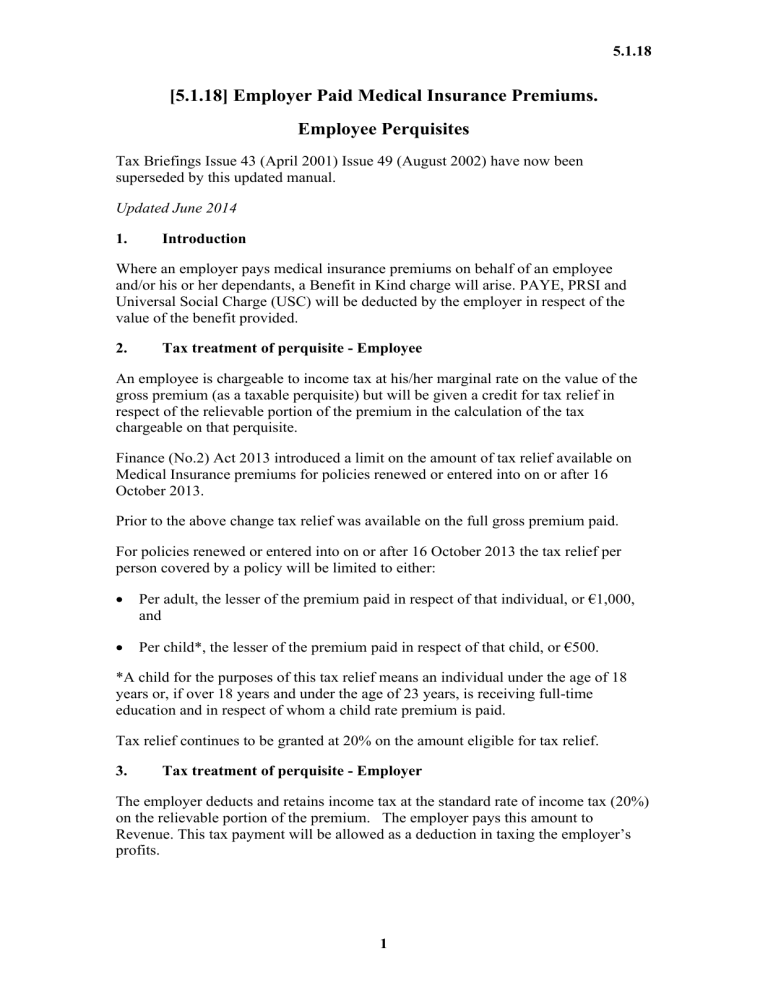

Employer Paid Medical Insurance Premiums

Qualified Business Income Deduction And The Self Employed The CPA Journal

Treating Medical Insurance Premiums

A Federal Relief Package Is Lowering Premiums For People Who Got

Health Insurance Costs Premiums Deductibles Co Pays Co Insurance

Medical Insurance Premiums On The Rise Allied Health World Blog

https://ringgitplus.com/en/blog/income-tax/how-to...

Alex Cheong Pui Yin 5th April 2024 6 min read There are quite a few types of tax reliefs that you can claim to reduce your chargeable income and thus pay less in taxes and some of the biggest reliefs you can get are from any insurance policies that you may own

https://www.citizensinformation.ie/en/money-and...

You can claim tax relief on medical expenses you pay for yourself or for any other person You must claim tax relief within the 4 years following the year in which you paid for the healthcare Tax relief is also available for premiums paid for health insurance

Alex Cheong Pui Yin 5th April 2024 6 min read There are quite a few types of tax reliefs that you can claim to reduce your chargeable income and thus pay less in taxes and some of the biggest reliefs you can get are from any insurance policies that you may own

You can claim tax relief on medical expenses you pay for yourself or for any other person You must claim tax relief within the 4 years following the year in which you paid for the healthcare Tax relief is also available for premiums paid for health insurance

A Federal Relief Package Is Lowering Premiums For People Who Got

Qualified Business Income Deduction And The Self Employed The CPA Journal

Health Insurance Costs Premiums Deductibles Co Pays Co Insurance

Medical Insurance Premiums On The Rise Allied Health World Blog

Partners Life To Increase Medical Premiums RiskinfoNZ

Changes To Medical Insurance Relief For

Changes To Medical Insurance Relief For

Eased Truck Insurance Premiums Enforcement Gives Much Needed Relief In