Today, where screens have become the dominant feature of our lives but the value of tangible printed objects hasn't waned. In the case of educational materials, creative projects, or simply adding an individual touch to the space, Tax Relief On Charitable Donations For Companies have become a valuable source. In this article, we'll dive deeper into "Tax Relief On Charitable Donations For Companies," exploring their purpose, where they are, and what they can do to improve different aspects of your daily life.

Get Latest Tax Relief On Charitable Donations For Companies Below

Tax Relief On Charitable Donations For Companies

Tax Relief On Charitable Donations For Companies -

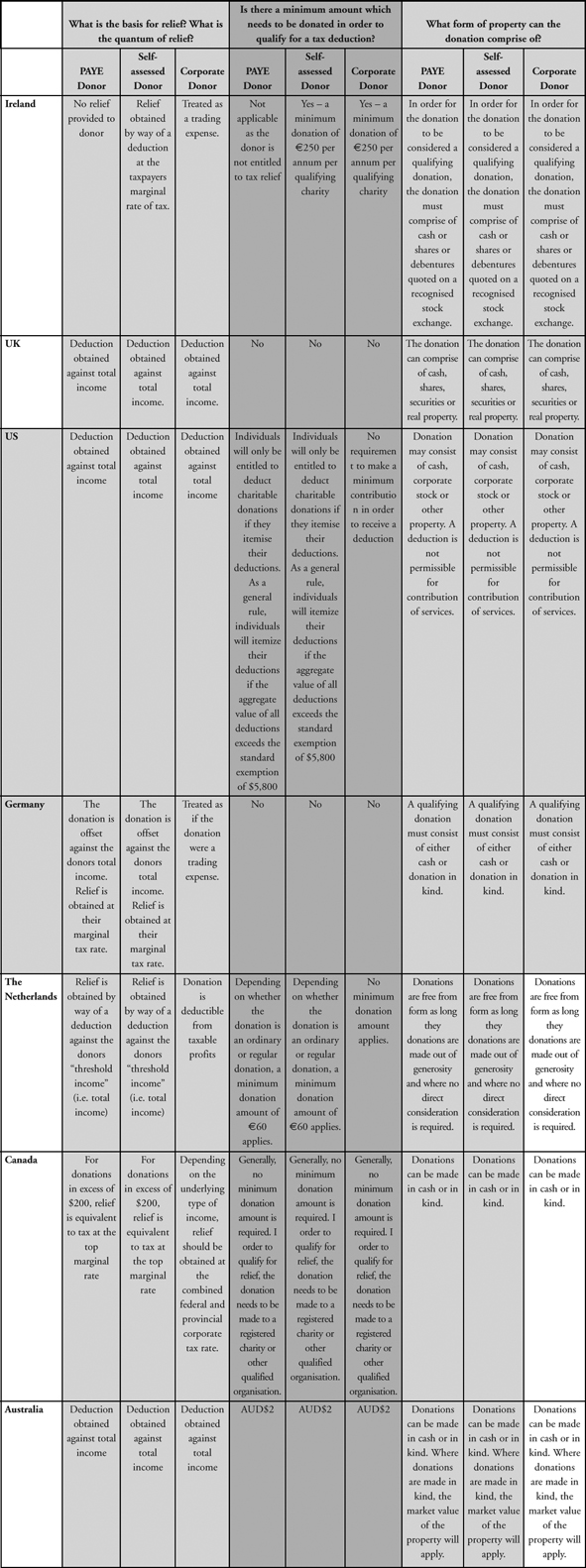

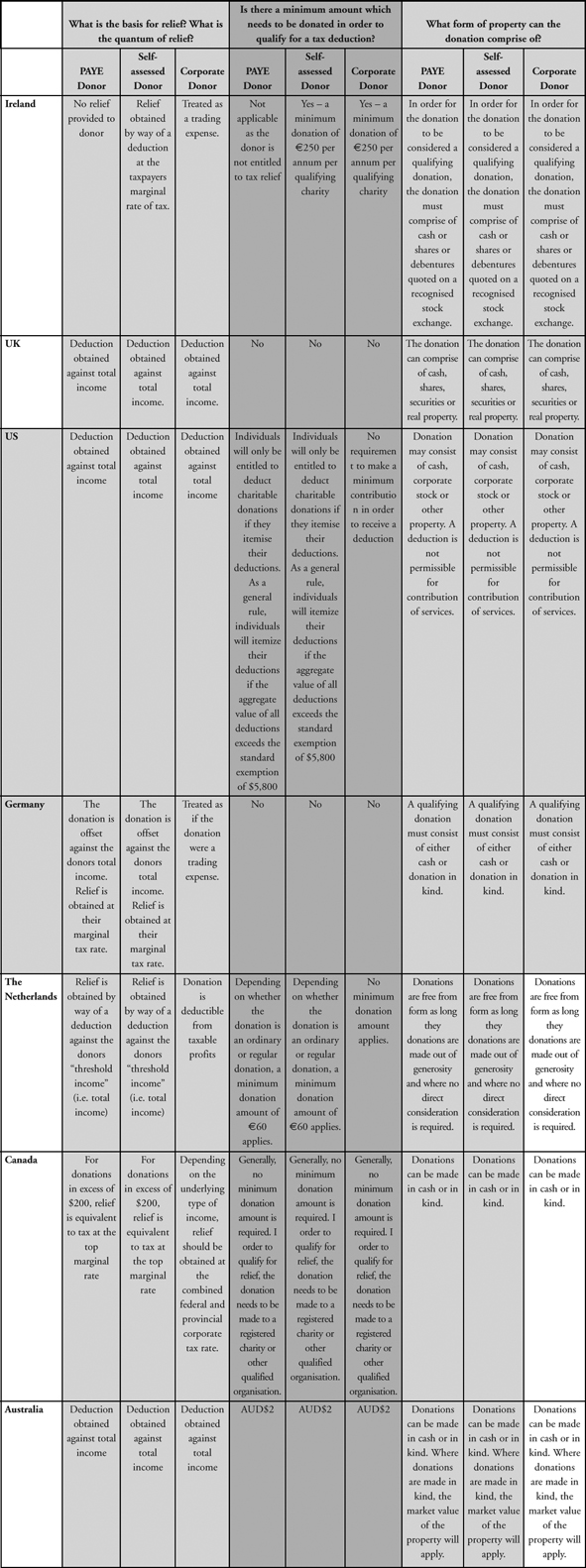

Companies can obtain corporation tax relief for qualifying payments or certain transfers of assets to charity under the qualifying charitable donations regime Definition of qualifying charitable donation The definition of qualifying charitable donations includes qualifying cash donations to charity

22 April 2024 See all updates Search this manual Contents CTM01000 CTM09000 CTM09005 Corporation Tax charitable donations relief introduction Historical note Charitable

Tax Relief On Charitable Donations For Companies cover a large variety of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of forms, like worksheets coloring pages, templates and much more. The value of Tax Relief On Charitable Donations For Companies is their flexibility and accessibility.

More of Tax Relief On Charitable Donations For Companies

Treasury To Review Level Of Tax Relief On Charitable Donations

Treasury To Review Level Of Tax Relief On Charitable Donations

Companies are entitled to tax relief for qualifying charitable donations made to charities The donations are paid gross without the deduction of income tax The donations are deductible from the company s total profits in the year in which the donations are made

Tax Tax Relief Can sole traders and limited companies receive tax relief by donating to charity Donating as a sole trader or partnership Comprehensive tax return services What is Gift Aid Claiming tax relief on Gift Aid donations For example Donating to charity as a limited company Payments your limited company make that don t qualify

Tax Relief On Charitable Donations For Companies have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring the templates to meet your individual needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Use: These Tax Relief On Charitable Donations For Companies can be used by students of all ages, making these printables a powerful aid for parents as well as educators.

-

Affordability: Fast access many designs and templates is time-saving and saves effort.

Where to Find more Tax Relief On Charitable Donations For Companies

Charity Tax Relief On Charitable Donations In The UK IBISS CO

Charity Tax Relief On Charitable Donations In The UK IBISS CO

Tax efficient charity donations through your limited company Contractors and consultants can make charity donations and save money on their tax bill As an owner of a limited company you can give to worthy causes and reduce your corporation tax

Companies who make donations to these charities and claim UK tax relief What will the impact be UK charitable tax relief will be withdrawn either immediately i e from 15 March 2023 or where the transitional period applies from April 2024

If we've already piqued your interest in printables for free we'll explore the places you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with Tax Relief On Charitable Donations For Companies for all objectives.

- Explore categories like decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs are a vast range of topics, ranging from DIY projects to party planning.

Maximizing Tax Relief On Charitable Donations For Companies

Here are some inventive ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Relief On Charitable Donations For Companies are an abundance of practical and imaginative resources that can meet the needs of a variety of people and desires. Their access and versatility makes them an essential part of both personal and professional life. Explore the vast array of Tax Relief On Charitable Donations For Companies and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes they are! You can print and download these materials for free.

-

Can I download free printables to make commercial products?

- It's dependent on the particular terms of use. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Are there any copyright problems with Tax Relief On Charitable Donations For Companies?

- Certain printables may be subject to restrictions regarding their use. You should read the terms and conditions offered by the creator.

-

How do I print Tax Relief On Charitable Donations For Companies?

- You can print them at home with either a printer at home or in the local print shop for better quality prints.

-

What software must I use to open printables for free?

- The majority are printed in the format PDF. This is open with no cost software, such as Adobe Reader.

Tax Relief On Charitable Gifts

Charity Tax Relief Tax Relief On Charitable Donations In The UK

Check more sample of Tax Relief On Charitable Donations For Companies below

Tax Reliefs Which

Charitable Deductions For 2020

Charity Tax Relief Tax Relief On Charitable Donations In The UK

Charitable Donation Tax Credits Tax Tip Weekly YouTube

Charitable Giving Charitable Donations Auction Donations Charitable

Charity Tax Row Donors Warn Of brake On Donations BBC News

https://www.gov.uk/hmrc-internal-manuals/company...

22 April 2024 See all updates Search this manual Contents CTM01000 CTM09000 CTM09005 Corporation Tax charitable donations relief introduction Historical note Charitable

https://www.gov.uk/government/publications/...

Guidance Chapter 3 Gift Aid Updated 27 March 2024 Chapter 3 1 Introduction This chapter covers the Gift Aid Schemes for donations to charity by individuals legislation at sections 413 to

22 April 2024 See all updates Search this manual Contents CTM01000 CTM09000 CTM09005 Corporation Tax charitable donations relief introduction Historical note Charitable

Guidance Chapter 3 Gift Aid Updated 27 March 2024 Chapter 3 1 Introduction This chapter covers the Gift Aid Schemes for donations to charity by individuals legislation at sections 413 to

Charitable Donation Tax Credits Tax Tip Weekly YouTube

Charitable Deductions For 2020

Charitable Giving Charitable Donations Auction Donations Charitable

Charity Tax Row Donors Warn Of brake On Donations BBC News

How To Ensure You Get Tax Relief On Charitable Donations

Tax Relief On Charitable Donations

Tax Relief On Charitable Donations

Rules About Charitable Giving For Small Businesses Made Simple