In a world in which screens are the norm and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. No matter whether it's for educational uses as well as creative projects or simply to add an individual touch to your area, Tax Relief Course Fees have become an invaluable resource. The following article is a dive to the depths of "Tax Relief Course Fees," exploring the different types of printables, where to get them, as well as how they can be used to enhance different aspects of your lives.

Get Latest Tax Relief Course Fees Below

Tax Relief Course Fees

Tax Relief Course Fees -

Amount claimable Maximum of 5 500 The relief can be claimed on aptitude test fees examination fees registration or enrolment fees and tuition fees TIP If your assessable income is 22 000 or below you can defer your claim for course fees relief The dependant was living in your household

Overview You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at an approved college Other charges and levies do not qualify for relief such as administration fees student centre levy sports centre charge

Printables for free include a vast collection of printable content that can be downloaded from the internet at no cost. They are available in numerous forms, including worksheets, templates, coloring pages and much more. The great thing about Tax Relief Course Fees is in their variety and accessibility.

More of Tax Relief Course Fees

Self loading Pistol Olympic Arms OA 98 Relief Course

Self loading Pistol Olympic Arms OA 98 Relief Course

Tax relief reduces taxable income at the standard rate of income tax 20 subject to the maximum level of tuition fees allowable for undergraduate courses fees of maximum EUR 7 000 per course for ICT and languages fees ranging from EUR 315 to EUR 1 270 per course Eligible costs Tuition fees

Course or exam fees You may pay course and exam fees for your employees or repay them for the fees they have already paid This is not a taxable benefit if the course or exam is relevant to your business A course is relevant to your business if it allows your employees to gain knowledge necessary for their role

Tax Relief Course Fees have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Modifications: The Customization feature lets you tailor printed materials to meet your requirements be it designing invitations or arranging your schedule or even decorating your home.

-

Educational value: Educational printables that can be downloaded for free cater to learners of all ages, which makes them a great source for educators and parents.

-

The convenience of You have instant access many designs and templates, which saves time as well as effort.

Where to Find more Tax Relief Course Fees

Migraine Relief Course How To Prevent Treat Chronic Headaches

Migraine Relief Course How To Prevent Treat Chronic Headaches

The relief is claimed by completing the tuition fees section on your Form 11 annual tax return at the end of the year If you receive any grant scholarship or payment towards the fees you must include this information when claiming the relief

Tax Treatment of Training Provided Summary Table Nature Taxable Not taxable 1 Subsidies for course fees training fees for staff development examination fees and scholarship awards Not taxable if this is part of training provided by the employer and the benefits are available to all staff

After we've peaked your interest in printables for free Let's see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Tax Relief Course Fees for different objectives.

- Explore categories like decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free, flashcards, and learning materials.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a broad selection of subjects, including DIY projects to planning a party.

Maximizing Tax Relief Course Fees

Here are some creative ways in order to maximize the use use of Tax Relief Course Fees:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Relief Course Fees are an abundance with useful and creative ideas that satisfy a wide range of requirements and pursuits. Their accessibility and versatility make them a valuable addition to both professional and personal lives. Explore the vast array of Tax Relief Course Fees and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes they are! You can download and print these materials for free.

-

Do I have the right to use free printables to make commercial products?

- It is contingent on the specific usage guidelines. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables could have limitations on use. Make sure to read the terms and conditions offered by the creator.

-

How can I print Tax Relief Course Fees?

- You can print them at home with a printer or visit the local print shop for top quality prints.

-

What program do I need to run printables free of charge?

- A majority of printed materials are with PDF formats, which can be opened with free programs like Adobe Reader.

List Of Personal Tax Relief And Incentives In Malaysia 2023

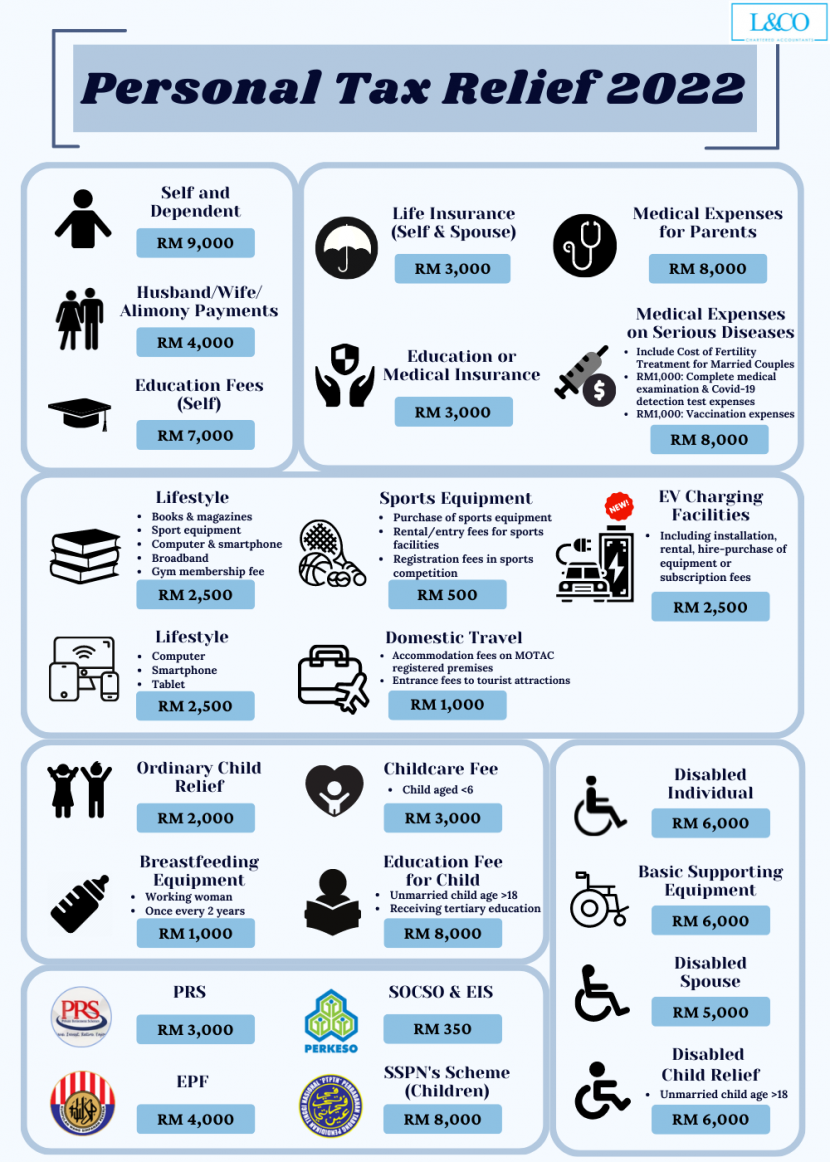

Personal Tax Relief 2022 L Co Accountants

Check more sample of Tax Relief Course Fees below

Foot Pain Relief Nooro

List Of Personal Tax Relief And Incentives In Malaysia 2023

Malaysia Personal Income Tax Relief 2022

Tableau M tal Relief Course Cycliste L120 X H80 Cm

Herbal Wife Relief Course Increase Semen Count 00923036494983

Learn How To Generate Tax Debt Relief Leads At Broker Calls

https://www.revenue.ie/en/personal-tax-credits...

Overview You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at an approved college Other charges and levies do not qualify for relief such as administration fees student centre levy sports centre charge

https://www.gov.uk/hmrc-internal-manuals/...

EIM32401 EIM32540 Other expenses education and training where education is part of the duties of the employment medical course and exam list EIM32535 outlines the requirements that must be

Overview You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at an approved college Other charges and levies do not qualify for relief such as administration fees student centre levy sports centre charge

EIM32401 EIM32540 Other expenses education and training where education is part of the duties of the employment medical course and exam list EIM32535 outlines the requirements that must be

Tableau M tal Relief Course Cycliste L120 X H80 Cm

List Of Personal Tax Relief And Incentives In Malaysia 2023

Herbal Wife Relief Course Increase Semen Count 00923036494983

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Claiming Tax Relief On UNISON Fees Tax Rebates

Tableau Country Corner D occasion

Tableau Country Corner D occasion

IMF World Bank COVID 19 Relief Open Praxis Forum