In this day and age where screens have become the dominant feature of our lives yet the appeal of tangible, printed materials hasn't diminished. If it's to aid in education in creative or artistic projects, or simply adding an element of personalization to your home, printables for free are a great resource. For this piece, we'll take a dive through the vast world of "Tax Rebate Washington State Working Families," exploring the benefits of them, where they are available, and how they can enhance various aspects of your life.

Get Latest Tax Rebate Washington State Working Families Below

Tax Rebate Washington State Working Families

Tax Rebate Washington State Working Families -

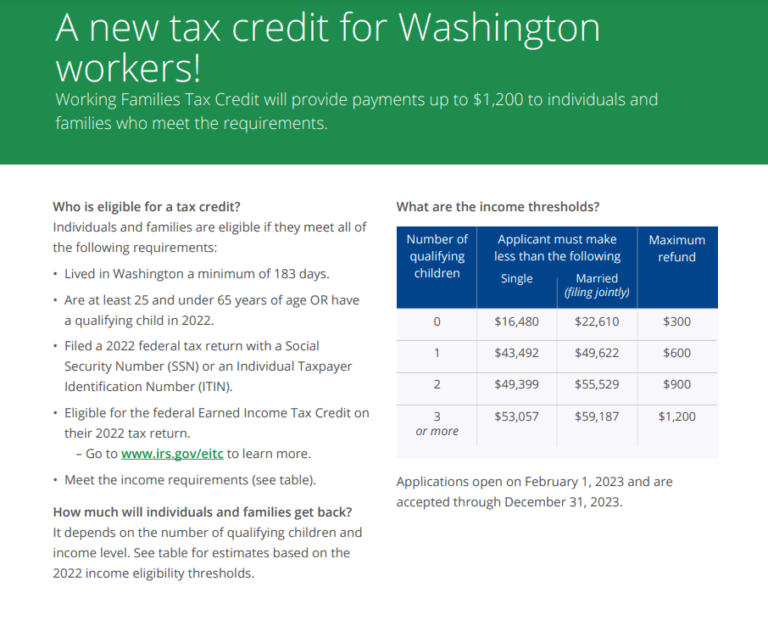

Web Working Families Tax Credit will provide payments up to 1 200 to individuals and families who meet the requirements Who is eligible for a tax credit Lived in Washington a minimum of 183 days Are at least 25 and under 65 years of

Web What you ll need to apply To apply for the Working Families Tax Credit you will need the following A copy of your federal tax return that you filed with the IRS Your Social Security Number or ITIN and dates of birth for you your spouse and children

Printables for free include a vast range of printable, free materials that are accessible online for free cost. They come in many styles, from worksheets to templates, coloring pages and many more. The appeal of printables for free is their flexibility and accessibility.

More of Tax Rebate Washington State Working Families

Jan 6 Terrorist Assault On Twitter RT ElliAdventurer Looks Good To

Jan 6 Terrorist Assault On Twitter RT ElliAdventurer Looks Good To

Web Policy Priorities gt State Budget amp Revenue gt Working Families Tax Credit The Working Families Tax Credit WFTC is a new annual cash tax rebate of up to 1 200 for more than 400 000 Washington state households

Web 31 janv 2023 nbsp 0183 32 by Jamie Housen on January 31 2023 Seattle Starting on February 1 Seattle residents will be able to apply for a new annual tax credit that will provide payments up to 1 200 for low to moderate income individuals and families in Washington

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Customization: You can tailor printing templates to your own specific requirements when it comes to designing invitations to organize your schedule or decorating your home.

-

Education Value These Tax Rebate Washington State Working Families cater to learners of all ages. This makes these printables a powerful resource for educators and parents.

-

Affordability: immediate access the vast array of design and templates is time-saving and saves effort.

Where to Find more Tax Rebate Washington State Working Families

UPDATE GOP Says State Can do Better Than Whitmer s Proposed 500 Tax

UPDATE GOP Says State Can do Better Than Whitmer s Proposed 500 Tax

Web 23 f 233 vr 2010 nbsp 0183 32 The WFTR is a step toward making our tax system more equitable Washington state taxes families with low and moderate incomes more than any other state in the country households earning 20 000 a year or less pay 17 percent of their incomes in state and local taxes while the richest 1 percent pay just 3 percent of their

Web 3 f 233 vr 2023 nbsp 0183 32 Washington s Working Families Tax Credit WFTC officially launched on Feb 1 For qualified families this credit will provide for up to a 1 200 cash refund Roughly 400 000 households will qualify The application portal is now open on the state Department of Revenue s website Today s launch marks a major step forward in the progress

We hope we've stimulated your interest in printables for free, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of goals.

- Explore categories like decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free, flashcards, and learning tools.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs are a vast range of interests, including DIY projects to planning a party.

Maximizing Tax Rebate Washington State Working Families

Here are some creative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Rebate Washington State Working Families are an abundance of innovative and useful resources that meet a variety of needs and desires. Their availability and versatility make them a wonderful addition to your professional and personal life. Explore the plethora of Tax Rebate Washington State Working Families now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Rebate Washington State Working Families really available for download?

- Yes they are! You can download and print these resources at no cost.

-

Does it allow me to use free printables for commercial use?

- It's contingent upon the specific rules of usage. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Do you have any copyright issues with Tax Rebate Washington State Working Families?

- Some printables may contain restrictions on usage. Make sure to read the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using an printer, or go to any local print store for high-quality prints.

-

What software do I need to open printables that are free?

- The majority are printed in PDF format. They is open with no cost programs like Adobe Reader.

Understanding The Washington Tax Rebate 2023 A Comprehensive Guide

AZSenateRepublicans On Twitter FOR IMMEDIATE RELEASE Senate

Check more sample of Tax Rebate Washington State Working Families below

Electric Car Rebates Washington State 2023 Carrebate

Infographic Washington State Working Families Tax Credit

Illinois Tax Rebate Tracker Rebate2022

Financial Relief For Families How To Get Your Share Of Direct

300 Bonus Tax Rebate For Thousands Of Families Do You Qualify

Breaking Down The Rebate Will The IRS Make People Pay Taxes On State

https://workingfamiliescredit.wa.gov/apply

Web What you ll need to apply To apply for the Working Families Tax Credit you will need the following A copy of your federal tax return that you filed with the IRS Your Social Security Number or ITIN and dates of birth for you your spouse and children

https://dor.wa.gov/about/news-releases/2023/applications-now-being...

Web The maximum credit amount for a single person is 300 with an increase of 300 for each qualifying child up to a maximum of 1 200 for a family with 3 or more children Income eligibility thresholds are based on the 2022 Federal Earned Income Tax Credit Eligibility thresholds may change for future tax years Ways to file

Web What you ll need to apply To apply for the Working Families Tax Credit you will need the following A copy of your federal tax return that you filed with the IRS Your Social Security Number or ITIN and dates of birth for you your spouse and children

Web The maximum credit amount for a single person is 300 with an increase of 300 for each qualifying child up to a maximum of 1 200 for a family with 3 or more children Income eligibility thresholds are based on the 2022 Federal Earned Income Tax Credit Eligibility thresholds may change for future tax years Ways to file

Financial Relief For Families How To Get Your Share Of Direct

Infographic Washington State Working Families Tax Credit

300 Bonus Tax Rebate For Thousands Of Families Do You Qualify

Breaking Down The Rebate Will The IRS Make People Pay Taxes On State

States Tapping Historic Surpluses For Tax Cuts And Rebates Washington

Christopher Luxon Announces Childcare Tax Rebate Policy Expected To

Christopher Luxon Announces Childcare Tax Rebate Policy Expected To

Opinion Cadillac Tax Is Bad For Working Families The Washington Post