In this digital age, where screens rule our lives it's no wonder that the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses such as creative projects or simply to add an extra personal touch to your space, Tax Rebate Under 80c For Senior Citizens are now a vital resource. Through this post, we'll dive into the sphere of "Tax Rebate Under 80c For Senior Citizens," exploring the benefits of them, where to get them, as well as how they can improve various aspects of your daily life.

Get Latest Tax Rebate Under 80c For Senior Citizens Below

Tax Rebate Under 80c For Senior Citizens

Tax Rebate Under 80c For Senior Citizens -

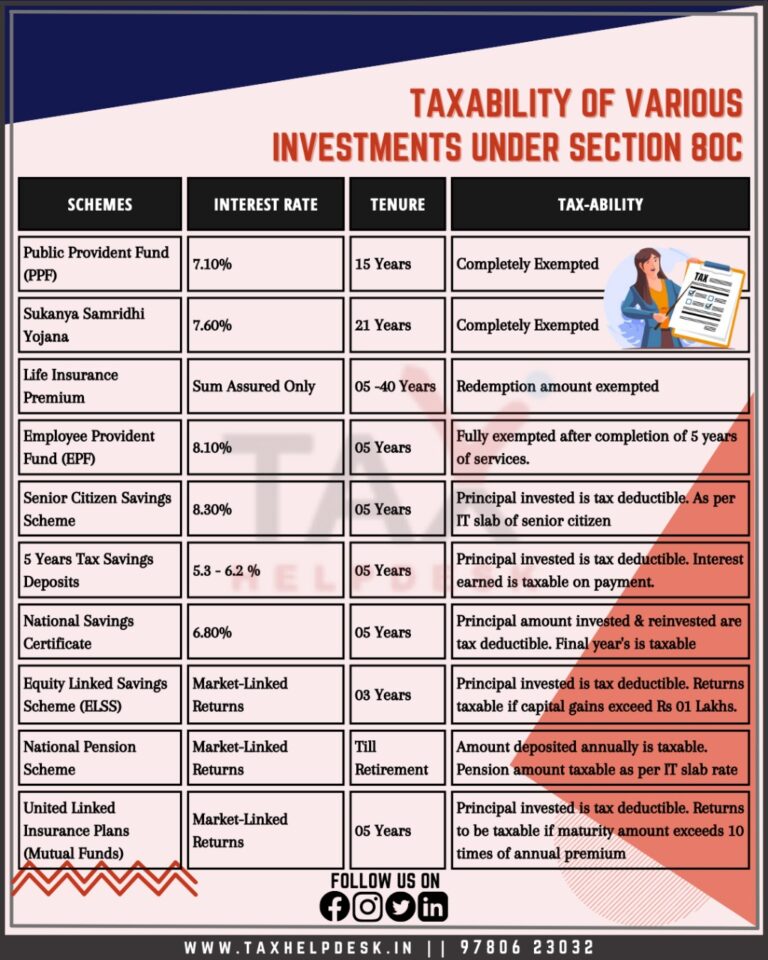

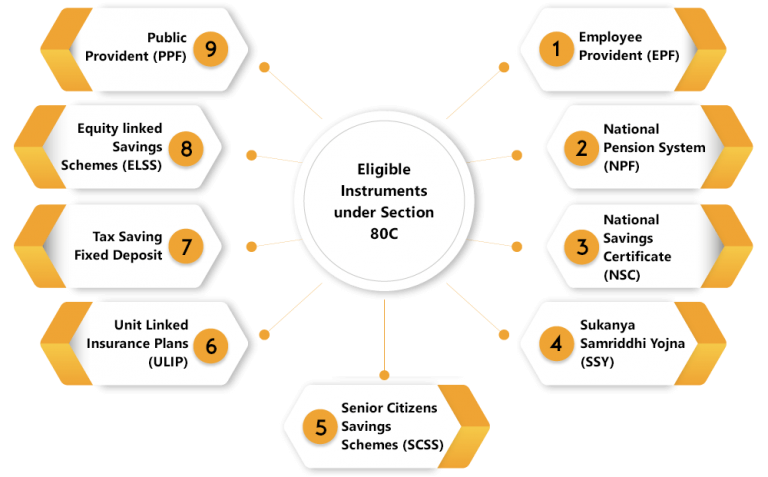

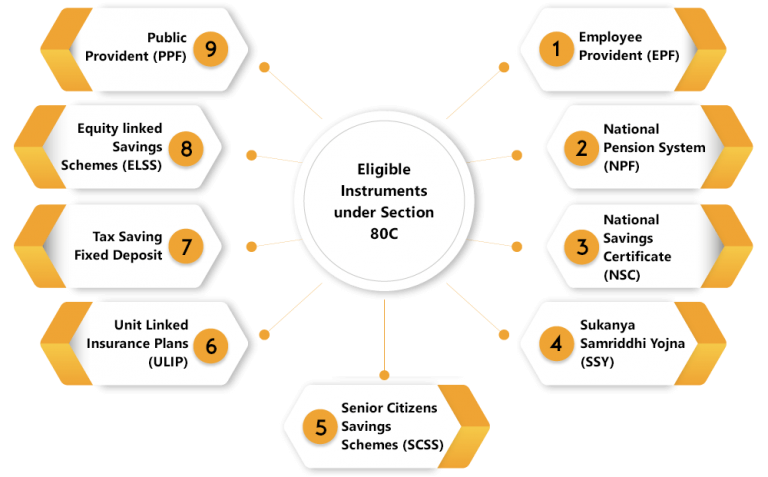

Section 80C is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is Rs 1 50 000 For claiming the tax benefit ITR filing is mandatory Tax

Section 80C of the Income Tax Act allows senior citizens to claim deductions and reduce their taxable income Eligible investments for deductions under 80C include options like

Tax Rebate Under 80c For Senior Citizens provide a diverse collection of printable materials available online at no cost. These materials come in a variety of kinds, including worksheets coloring pages, templates and many more. One of the advantages of Tax Rebate Under 80c For Senior Citizens is their flexibility and accessibility.

More of Tax Rebate Under 80c For Senior Citizens

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

4 min read 28 Dec 2022 06 23 PM IST Vipul Das Taxpayers especially senior citizens can pick the new tax regime for FY 2022 2023 or stay with the existing system Here s

Explainers Section 80C Income tax deduction and limits under section 80C 80CCD in 2023 Want to save on taxes Discover how 80C deductions can help you

Tax Rebate Under 80c For Senior Citizens have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

customization: There is the possibility of tailoring the templates to meet your individual needs whether you're designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: The free educational worksheets are designed to appeal to students of all ages. This makes them a great instrument for parents and teachers.

-

Accessibility: Fast access a variety of designs and templates, which saves time as well as effort.

Where to Find more Tax Rebate Under 80c For Senior Citizens

Post office schemes for senior citizens girl child tax benefits under

Post office schemes for senior citizens girl child tax benefits under

Section 80C works as a tax deduction for the purpose of reducing taxable income and subsequently reducing tax liabilities This provision includes specific

Senior citizens can opt for annuity schemes which ensure regular flow of money is your account and also lets you save on taxes One such scheme is Senior

We've now piqued your curiosity about Tax Rebate Under 80c For Senior Citizens Let's look into where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection with Tax Rebate Under 80c For Senior Citizens for all reasons.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free, flashcards, and learning materials.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a broad range of topics, from DIY projects to party planning.

Maximizing Tax Rebate Under 80c For Senior Citizens

Here are some inventive ways that you can make use use of Tax Rebate Under 80c For Senior Citizens:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Rebate Under 80c For Senior Citizens are an abundance of fun and practical tools that meet a variety of needs and passions. Their accessibility and flexibility make them a valuable addition to both professional and personal lives. Explore the wide world of Tax Rebate Under 80c For Senior Citizens to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Rebate Under 80c For Senior Citizens truly completely free?

- Yes, they are! You can print and download the resources for free.

-

Can I download free templates for commercial use?

- It's based on the rules of usage. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download Tax Rebate Under 80c For Senior Citizens?

- Some printables may come with restrictions on usage. Always read the terms of service and conditions provided by the designer.

-

How do I print printables for free?

- Print them at home using any printer or head to the local print shop for high-quality prints.

-

What program do I require to view printables for free?

- Most printables come in the format PDF. This is open with no cost software, such as Adobe Reader.

Section 80C Deductions List To Save Income Tax FinCalC Blog

What Are The Tax Saving Investments Other Than Section 80C For Senior

Check more sample of Tax Rebate Under 80c For Senior Citizens below

Understand About Taxability Of Various Investments Under Section 80C

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

NPS Tax Benefit Sec 80C And Additional Tax Rebate YouTube

Best Deposit Scheme For Senior Citizens In India with 80C Tax Benefit

Unlock The Benefits Of Section 80C Under Chapter VI A

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

https://greatsenioryears.com/tax-deductions-for...

Section 80C of the Income Tax Act allows senior citizens to claim deductions and reduce their taxable income Eligible investments for deductions under 80C include options like

https://www.incometax.gov.in/iec/foportal/help/...

Senior and Super Senior Citizens can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting

Section 80C of the Income Tax Act allows senior citizens to claim deductions and reduce their taxable income Eligible investments for deductions under 80C include options like

Senior and Super Senior Citizens can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting

Best Deposit Scheme For Senior Citizens In India with 80C Tax Benefit

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Unlock The Benefits Of Section 80C Under Chapter VI A

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

What Is Income Tax Limit For Property Tax And Insurance

Deduction Of 80C 80CCC 80CCD Under Income Tax

Deduction Of 80C 80CCC 80CCD Under Income Tax

Section 80C Deduction For Tax Saving Investments Learn By Quicko