In this age of electronic devices, where screens rule our lives yet the appeal of tangible printed material hasn't diminished. Be it for educational use or creative projects, or simply adding an individual touch to the area, Tax Rebate U S 87a For Senior Citizens are now an essential resource. With this guide, you'll dive deeper into "Tax Rebate U S 87a For Senior Citizens," exploring the benefits of them, where they are, and what they can do to improve different aspects of your lives.

Get Latest Tax Rebate U S 87a For Senior Citizens Below

Tax Rebate U S 87a For Senior Citizens

Tax Rebate U S 87a For Senior Citizens -

Senior citizens above 60 years and below 80 years of age can avail a rebate under Section 87A The amount of rebate will be lower than the limit specified

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old

Tax Rebate U S 87a For Senior Citizens provide a diverse assortment of printable, downloadable content that can be downloaded from the internet at no cost. They come in many kinds, including worksheets coloring pages, templates and many more. The great thing about Tax Rebate U S 87a For Senior Citizens lies in their versatility and accessibility.

More of Tax Rebate U S 87a For Senior Citizens

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Rebate U s 87A For The Financial Year 2022 23

Senior citizens above 60 years and up to 80 years of age are eligible to claim rebates under Section 87A Super senior citizens above 80 years are not eligible

Premium Senior citizens For tax liability on income other than equity fund long term gains you fully get a rebate under Section 87A

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor designs to suit your personal needs whether you're designing invitations to organize your schedule or even decorating your home.

-

Educational value: Free educational printables are designed to appeal to students from all ages, making them an invaluable tool for parents and educators.

-

Convenience: You have instant access a plethora of designs and templates helps save time and effort.

Where to Find more Tax Rebate U S 87a For Senior Citizens

Income Tax Sec 87A Amendment Rebate YouTube

Income Tax Sec 87A Amendment Rebate YouTube

Any individual whose annual net income does not exceed Rs 5 Lakh qualifies to claim tax rebate under Section 87a of the Income Tax Act 1961 This implies an individual can

ISuper senior citizens above the age of 80 years do not hold eligibility to claim rebates u s 87A The rebate amount will also be lower than the specified limit under Section 87A

After we've peaked your interest in Tax Rebate U S 87a For Senior Citizens Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Tax Rebate U S 87a For Senior Citizens for various motives.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a wide array of topics, ranging including DIY projects to planning a party.

Maximizing Tax Rebate U S 87a For Senior Citizens

Here are some fresh ways of making the most use of Tax Rebate U S 87a For Senior Citizens:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home and in class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Tax Rebate U S 87a For Senior Citizens are an abundance of practical and innovative resources that cater to various needs and needs and. Their availability and versatility make they a beneficial addition to your professional and personal life. Explore the plethora of Tax Rebate U S 87a For Senior Citizens and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can print and download these documents for free.

-

Can I utilize free templates for commercial use?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues when you download Tax Rebate U S 87a For Senior Citizens?

- Some printables may contain restrictions regarding their use. Be sure to read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- Print them at home using a printer or visit an area print shop for high-quality prints.

-

What program is required to open printables free of charge?

- Most printables come in the format of PDF, which can be opened using free programs like Adobe Reader.

What Is Income Tax Rebate Under Section 87A HDFC Life

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

Check more sample of Tax Rebate U S 87a For Senior Citizens below

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

Tax Planning V Financial Services

Rebate U s 87A Of I Tax Act Income Tax

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

https://www.incometax.gov.in/iec/foportal/help/...

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old

https://greatsenioryears.com/guide-rebate-u-s-87a...

For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old

For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate

Rebate U s 87A Of I Tax Act Income Tax

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

Breathtaking Income Tax Calculation Statement Two Types Of Financial

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

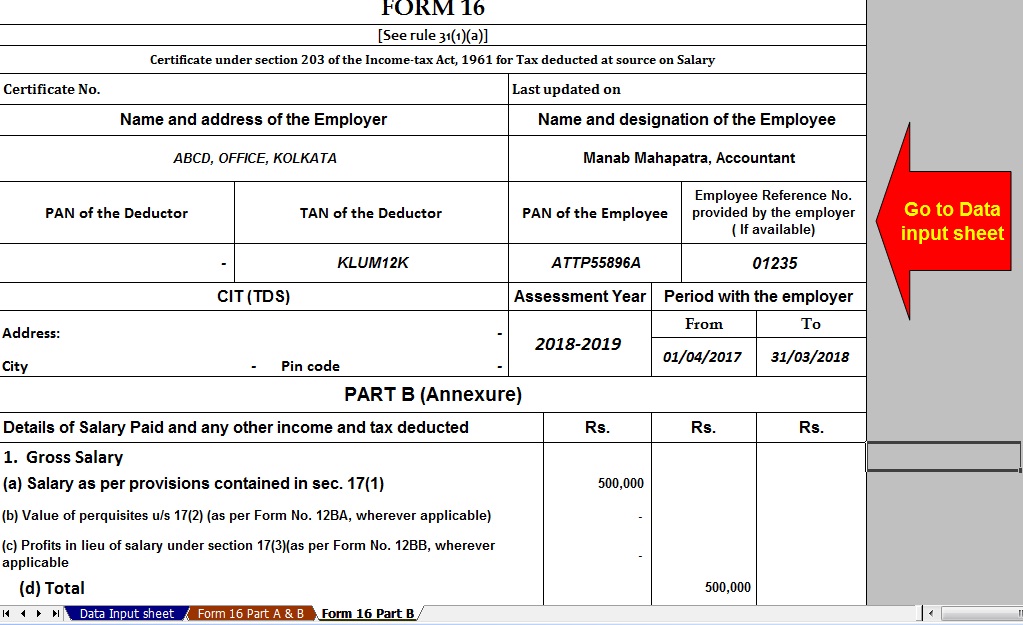

Download Automated Tax Computed Sheet HRA Calculation Arrears

Rebate U s 87A For A Y 2020 21 ca Inter ca Intermediate YouTube

Rebate U s 87A For A Y 2020 21 ca Inter ca Intermediate YouTube

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19