In this digital age, when screens dominate our lives The appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons such as creative projects or simply to add a personal touch to your home, printables for free are now an essential resource. In this article, we'll take a dive in the world of "Tax Rebate On Plug In Hybrid," exploring the benefits of them, where you can find them, and ways they can help you improve many aspects of your lives.

Get Latest Tax Rebate On Plug In Hybrid Below

Tax Rebate On Plug In Hybrid

Tax Rebate On Plug In Hybrid -

Web 5 mai 2023 nbsp 0183 32 The Inflation Reduction Act passed in August 2022 changed the eligibility criteria for plug in hybrid electric vehicles PHEVs to qualify for the clean vehicle tax credit As of August 16 th 2022 only PHEVs

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Tax Rebate On Plug In Hybrid provide a diverse assortment of printable resources available online for download at no cost. They come in many kinds, including worksheets templates, coloring pages, and much more. One of the advantages of Tax Rebate On Plug In Hybrid is their versatility and accessibility.

More of Tax Rebate On Plug In Hybrid

Federal Plug In Hybrid Rebate Used Cars 2022 Carrebate

Federal Plug In Hybrid Rebate Used Cars 2022 Carrebate

Web 16 mai 2022 nbsp 0183 32 If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S

Web 18 avr 2023 nbsp 0183 32 The only exception is compact Plug In Hybrid Electric Vehicles PHEVs which would have the tax credit capped at 7 000 The IRS issued a safe harbor notice for 2023 that all EVs have an incremental cost of at least 7 500 except compact PHEVs which have an incremental cost of 7 000

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization We can customize the design to meet your needs, whether it's designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Education-related printables at no charge cater to learners of all ages, making them a useful instrument for parents and teachers.

-

Easy to use: Instant access to many designs and templates will save you time and effort.

Where to Find more Tax Rebate On Plug In Hybrid

Fillable Online PLUG IN HYBRID VEHICLE CHARGING STATION REBATE

Fillable Online PLUG IN HYBRID VEHICLE CHARGING STATION REBATE

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed once in a

After we've peaked your curiosity about Tax Rebate On Plug In Hybrid Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Tax Rebate On Plug In Hybrid designed for a variety motives.

- Explore categories like home decor, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs covered cover a wide variety of topics, everything from DIY projects to party planning.

Maximizing Tax Rebate On Plug In Hybrid

Here are some innovative ways how you could make the most of Tax Rebate On Plug In Hybrid:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Utilize free printable worksheets to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Rebate On Plug In Hybrid are a treasure trove of practical and innovative resources that cater to various needs and desires. Their accessibility and flexibility make them an invaluable addition to any professional or personal life. Explore the wide world of Tax Rebate On Plug In Hybrid now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can download and print these documents for free.

-

Can I download free printouts for commercial usage?

- It's determined by the specific usage guidelines. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright violations with Tax Rebate On Plug In Hybrid?

- Certain printables may be subject to restrictions in use. Check the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home using the printer, or go to the local print shops for the highest quality prints.

-

What software will I need to access Tax Rebate On Plug In Hybrid?

- The majority of printables are as PDF files, which can be opened with free software like Adobe Reader.

Boulder Hybrids Bouldering Prius Repair

Table 1 From Characterizing Plug In Hybrid Electric Vehicle Consumers

Check more sample of Tax Rebate On Plug In Hybrid below

California Rebates For Hybrid Cars 2023 Carrebate

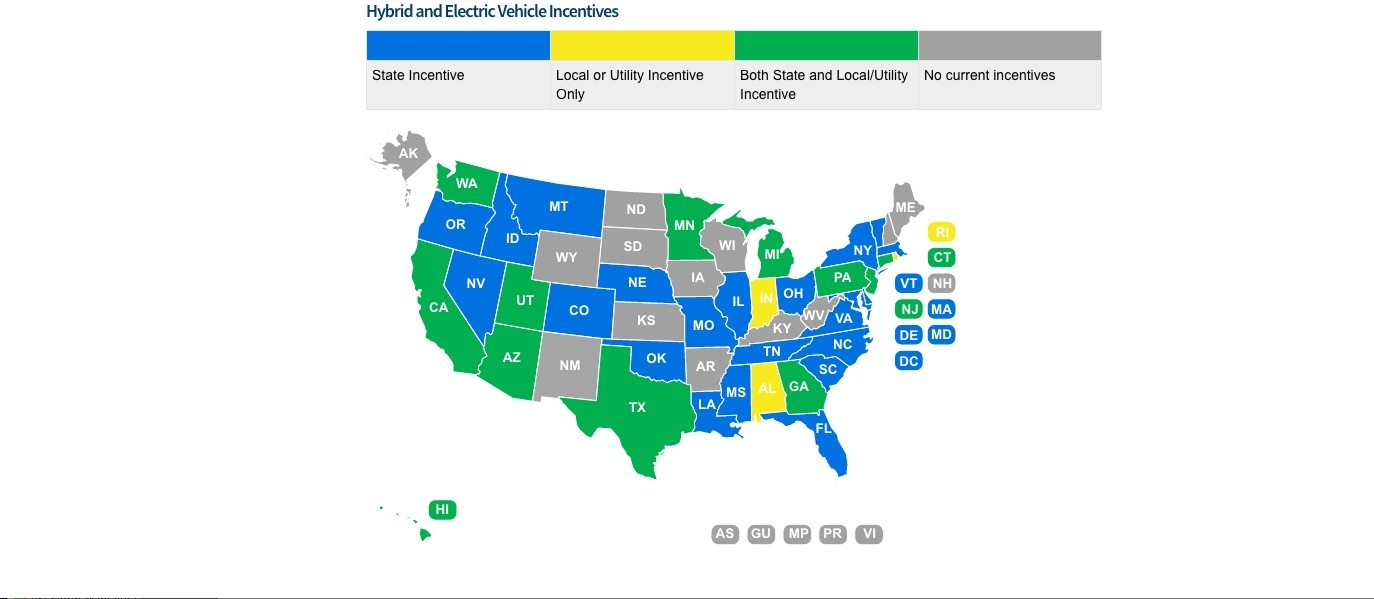

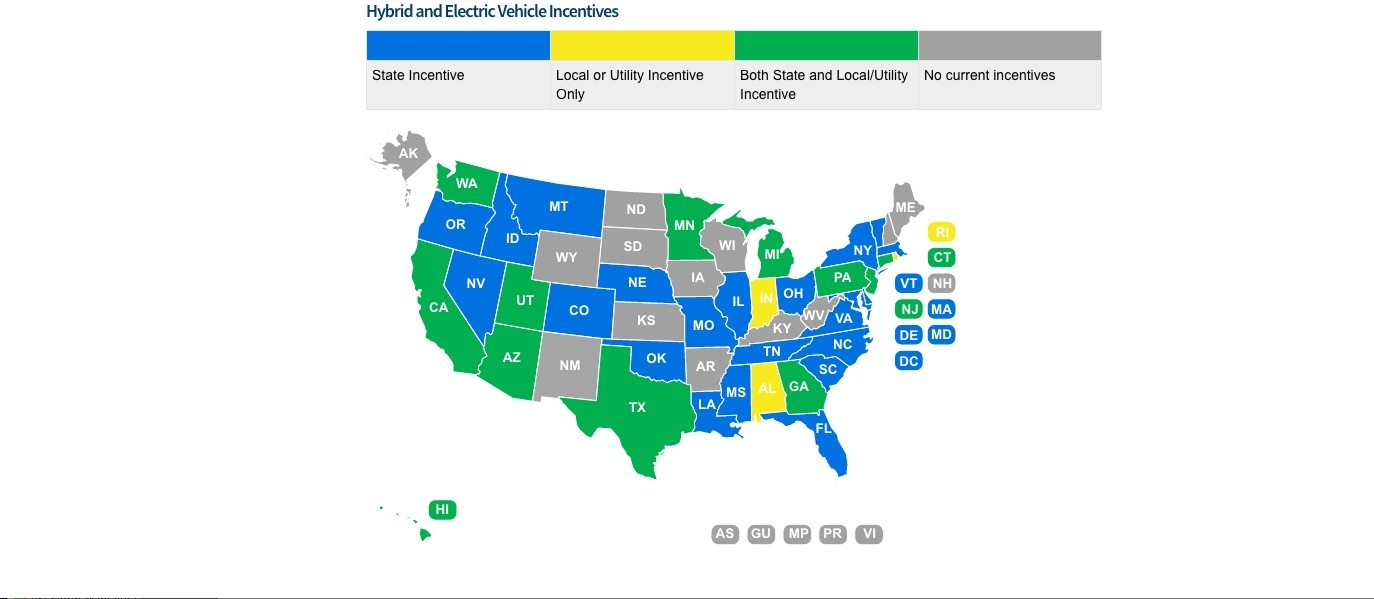

Electric Car Rebates By State ElectricRebate

Budget 2023 India May Allow Income Tax Rebate On Electric Vehicles

The Florida Hybrid Car Rebate Save Money And Help The Environment

Florida Offering 5 000 Rebates For Plug in Hybrid Prius Conversions

Massachusetts Rebates For Hybrid Cars 2023 Carrebate

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

https://fueleconomy.gov/feg/tax2022.shtml

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug in Electric Vehicles and New Clean Vehicles Attach to your tax return

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

The Florida Hybrid Car Rebate Save Money And Help The Environment

Electric Car Rebates By State ElectricRebate

Florida Offering 5 000 Rebates For Plug in Hybrid Prius Conversions

Massachusetts Rebates For Hybrid Cars 2023 Carrebate

Tax Rebates For Toyota Avalon Hybrid Car 2022 Carrebate Rebate2022

Tax Rebate On Hybrid Cars 2022 Colorado 2023 Carrebate

Tax Rebate On Hybrid Cars 2022 Colorado 2023 Carrebate

Federal Rebate Hybrid Car 2023 Carrebate