In this day and age where screens dominate our lives The appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses for creative projects, just adding an extra personal touch to your space, Tax Rebate On Joint Housing Loan have become an invaluable resource. For this piece, we'll dive into the world of "Tax Rebate On Joint Housing Loan," exploring the different types of printables, where they are available, and how they can add value to various aspects of your lives.

Get Latest Tax Rebate On Joint Housing Loan Below

Tax Rebate On Joint Housing Loan

Tax Rebate On Joint Housing Loan - Tax Exemption On Joint Housing Loan, Joint Home Loan Tax Benefits, Who Can Claim Tax Benefit On Housing Loan, Income Tax Rebate On Second Housing Loan Interest, How To Claim Joint Home Loan In Income Tax

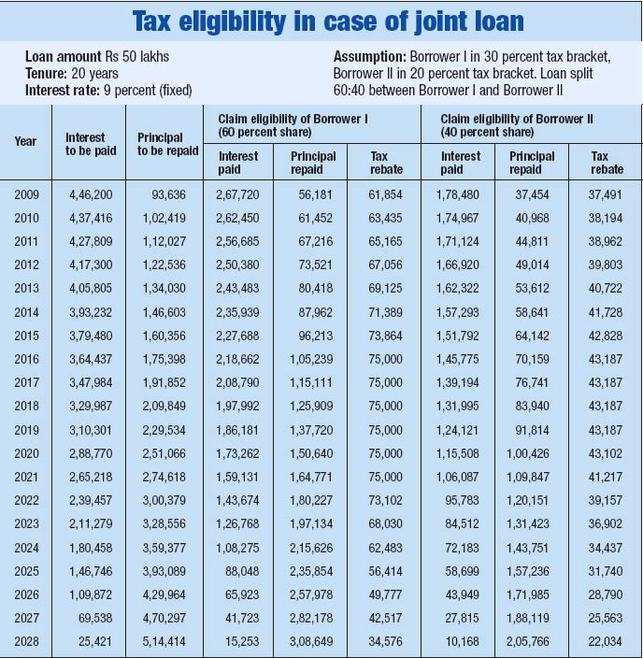

Web 31 mai 2022 nbsp 0183 32 Also borrowers with a joint loan who are also co owners of a property can claim tax rebates on housing credit Property must be fully constructed to claim tax deductions In case the house is not built it

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Tax Rebate On Joint Housing Loan offer a wide collection of printable resources available online for download at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages and much more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Tax Rebate On Joint Housing Loan

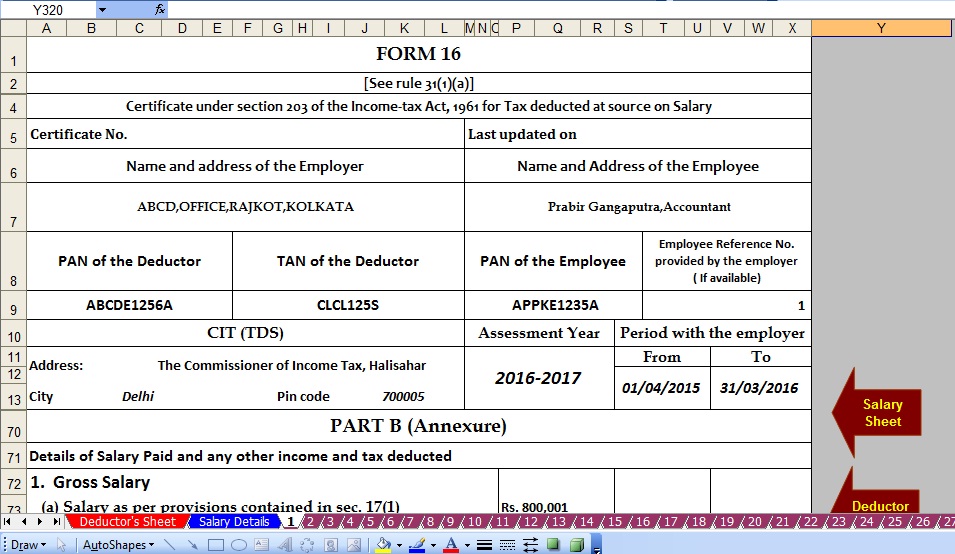

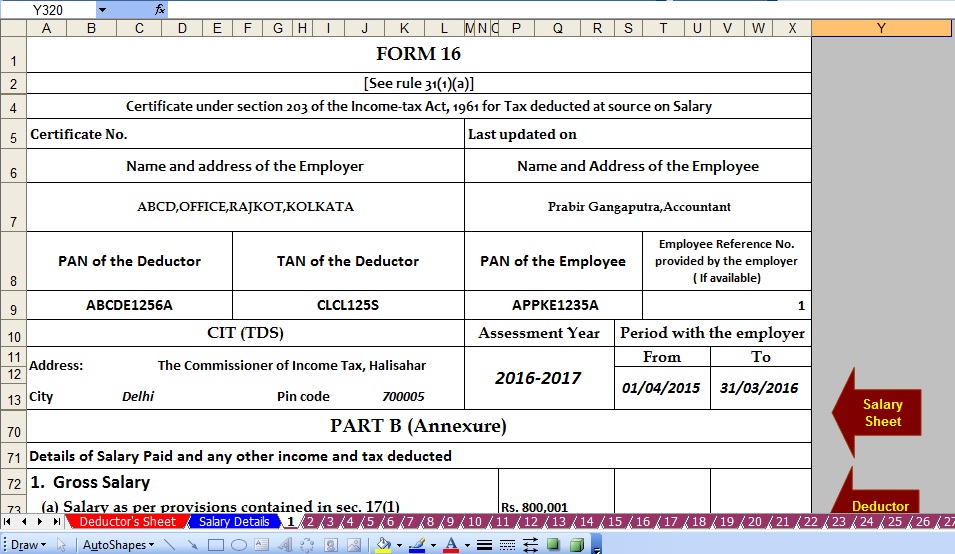

Housing Loans Joint Declaration Form For Housing Loan

Housing Loans Joint Declaration Form For Housing Loan

Web 10 juil 2020 nbsp 0183 32 Both you and your wife will qualify for a rebate on home loan interest rates as well as higher tax benefits with registration fees as lenders offer reduced interest rates to female borrowers If you want to

Web 16 oct 2012 nbsp 0183 32 A maximum of 4 to 6 joint applicants are eligible for tax rebate under this clause Thus availing a joint home loan is certainly a lucrative financial option to buy a

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Modifications: It is possible to tailor printables to fit your particular needs whether you're designing invitations making your schedule, or even decorating your home.

-

Educational value: Free educational printables are designed to appeal to students from all ages, making them a great instrument for parents and teachers.

-

Convenience: You have instant access a plethora of designs and templates can save you time and energy.

Where to Find more Tax Rebate On Joint Housing Loan

Joint Home Loan Declaration Form For Income Tax Savings And Non

Joint Home Loan Declaration Form For Income Tax Savings And Non

Web if you have taken a home loan but continue to reside in a rented property you can claim tax benefits against HRA as well in the case of a joint home loan both borrowers can claim

Web 11 avr 2023 nbsp 0183 32 In the case of a joint home loan both co borrowers can claim a deduction of up to Rs 50 000 each provided they are both first time home buyers and the loan

Now that we've piqued your interest in printables for free, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Tax Rebate On Joint Housing Loan for a variety objectives.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing including flashcards, learning materials.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a wide range of interests, from DIY projects to planning a party.

Maximizing Tax Rebate On Joint Housing Loan

Here are some ways of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print free worksheets for teaching at-home (or in the learning environment).

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Rebate On Joint Housing Loan are an abundance with useful and creative ideas for a variety of needs and pursuits. Their access and versatility makes them a great addition to the professional and personal lives of both. Explore the many options of Tax Rebate On Joint Housing Loan now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes they are! You can print and download these materials for free.

-

Can I make use of free printables for commercial use?

- It's based on the conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright problems with Tax Rebate On Joint Housing Loan?

- Certain printables could be restricted on their use. Be sure to review the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- Print them at home using your printer or visit the local print shop for superior prints.

-

What program do I require to open Tax Rebate On Joint Housing Loan?

- Most PDF-based printables are available with PDF formats, which is open with no cost software such as Adobe Reader.

Tax Benefits Of A Joint Home Loan To Co borrowers The Economic Times

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Check more sample of Tax Rebate On Joint Housing Loan below

How To Calculate Tax Rebate On Home Loan Grizzbye

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Home Loan Tax Benefit Calculator FrankiSoumya

FREE 8 Loan Receipt Templates Examples In MS Word PDF

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://housing.com/news/claim-tax-benefits-joint-home-loans

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

https://taxguru.in/income-tax/tax-benefits-home-loan-joint-owners.html

Web 26 juil 2019 nbsp 0183 32 Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Web 26 juil 2019 nbsp 0183 32 Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on

FREE 8 Loan Receipt Templates Examples In MS Word PDF

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

GST HST New Housing Rebate Rebates House With Land Home Construction