In this day and age with screens dominating our lives and the appeal of physical printed material hasn't diminished. Whatever the reason, whether for education and creative work, or simply to add an element of personalization to your area, Tax Rebate For Spouse Contribution are a great resource. In this article, we'll dive into the world "Tax Rebate For Spouse Contribution," exploring the different types of printables, where to find them and the ways that they can benefit different aspects of your life.

Get Latest Tax Rebate For Spouse Contribution Below

Tax Rebate For Spouse Contribution

Tax Rebate For Spouse Contribution -

You are entitled to a tax offset of up to 540 for 2021 22 if the sum of your spouse s assessable income excluding any assessable First home super saver

Spouse Super Contributions Tax Offset A contribution to the super fund of your spouse may eligible for a tax offset if the qualifying requirements can be met Calculation formula for 2021 22 2022 23 2023 24 and years 2017 18 to 2020 21 The current formula applies from 1 July 2017 and in later years unless See more

Tax Rebate For Spouse Contribution cover a large array of printable resources available online for download at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages, and many more. One of the advantages of Tax Rebate For Spouse Contribution is their flexibility and accessibility.

More of Tax Rebate For Spouse Contribution

Tax Rebate For Spouse Super Contribution The Wealth Navigator

Tax Rebate For Spouse Super Contribution The Wealth Navigator

If your spouse s total assessable income is 37 000 or less and you make an after tax contribution of at least 3 000 then you can access the maximum tax offset of 540

Spouse contributions are contributions you make on behalf of your partner from your after tax income Depending on how much your partner earns adding to your partner s super

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization You can tailor printed materials to meet your requirements such as designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational value: Printing educational materials for no cost are designed to appeal to students of all ages. This makes them an essential device for teachers and parents.

-

The convenience of Access to a myriad of designs as well as templates will save you time and effort.

Where to Find more Tax Rebate For Spouse Contribution

Tax Rebate For Individuals Swaper Investing Blog

Tax Rebate For Individuals Swaper Investing Blog

A spouse contribution tax offset is a personal tax offset received for making a contribution into your spouse s superannuation account The tax offset you receive for

If you and your spouse both meet the eligibility criteria you can claim a tax offset of up to 18 on contributions up to 3 000 per financial year This can help build your couples

Now that we've piqued your interest in Tax Rebate For Spouse Contribution Let's see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of goals.

- Explore categories such as home decor, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning tools.

- Great for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide range of topics, all the way from DIY projects to party planning.

Maximizing Tax Rebate For Spouse Contribution

Here are some unique ways create the maximum value of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Tax Rebate For Spouse Contribution are an abundance of fun and practical tools designed to meet a range of needs and hobbies. Their accessibility and flexibility make they a beneficial addition to your professional and personal life. Explore the vast array of Tax Rebate For Spouse Contribution today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Rebate For Spouse Contribution truly for free?

- Yes you can! You can print and download the resources for free.

-

Are there any free printables to make commercial products?

- It's based on the conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables could have limitations in their usage. You should read the conditions and terms of use provided by the author.

-

How do I print printables for free?

- Print them at home with either a printer or go to a print shop in your area for high-quality prints.

-

What software will I need to access Tax Rebate For Spouse Contribution?

- The majority are printed in the format PDF. This is open with no cost software, such as Adobe Reader.

Sharing The Spoils Spouse Contribution Splitting McEwen

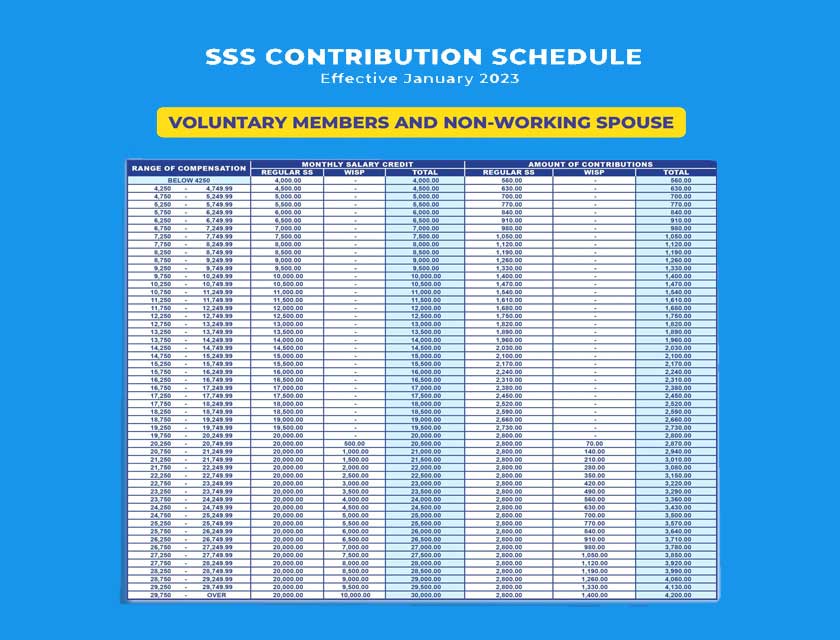

SSS Voluntary Members Contribution Table 2023

Check more sample of Tax Rebate For Spouse Contribution below

Spouse Contribution Rest Super

Reporting Group Maintenance

Spouse Contributions Plum

Don t Lose Your Tax Refund Because Of Your Spouse s Debt Fox Business

2022 Property Tax Rebate Application For Seniors Braedon Clark

Fsa 2023 Contribution Limits 2023 Calendar

https://atotaxrates.info/tax-offset/spouse-super-contributions-tax-offset

Spouse Super Contributions Tax Offset A contribution to the super fund of your spouse may eligible for a tax offset if the qualifying requirements can be met Calculation formula for 2021 22 2022 23 2023 24 and years 2017 18 to 2020 21 The current formula applies from 1 July 2017 and in later years unless See more

https://www.ato.gov.au/.../spouse-super-contributions

You may be able to claim a tax offset of up to 540 per year if you make a super contribution on behalf of your spouse married or de facto if their income is below

Spouse Super Contributions Tax Offset A contribution to the super fund of your spouse may eligible for a tax offset if the qualifying requirements can be met Calculation formula for 2021 22 2022 23 2023 24 and years 2017 18 to 2020 21 The current formula applies from 1 July 2017 and in later years unless See more

You may be able to claim a tax offset of up to 540 per year if you make a super contribution on behalf of your spouse married or de facto if their income is below

Don t Lose Your Tax Refund Because Of Your Spouse s Debt Fox Business

Reporting Group Maintenance

2022 Property Tax Rebate Application For Seniors Braedon Clark

Fsa 2023 Contribution Limits 2023 Calendar

Claim A Tax Rebate For Your Uniform Rmt

Deadline For Tax And Rent Relief Extended

Deadline For Tax And Rent Relief Extended

Recovery Rebate Credit 2020 Calculator KwameDawson