In the age of digital, in which screens are the norm yet the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education, creative projects, or simply to add an individual touch to the area, Tax Free Fd In India are now an essential resource. We'll dive in the world of "Tax Free Fd In India," exploring what they are, how they can be found, and the ways that they can benefit different aspects of your life.

Get Latest Tax Free Fd In India Below

Tax Free Fd In India

Tax Free Fd In India -

Income Tax Exemption on FD Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks The principal component of Tax Saver FDs of up to Rs 1 5 lakhs each financial year would qualify for

Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest income from FDs attract a TDS of 10 and a TDS of 20 if PAN details are not provided to the bank

The Tax Free Fd In India are a huge assortment of printable material that is available online at no cost. These resources come in many designs, including worksheets templates, coloring pages, and much more. The beauty of Tax Free Fd In India is in their variety and accessibility.

More of Tax Free Fd In India

Know How Much Interest Can You Earn On 2 Crore Bank FD In India

Know How Much Interest Can You Earn On 2 Crore Bank FD In India

Tax Saver FD Five Years Tax Saving Fixed Deposit A fixed deposit to save tax while earning interest All You Need To Know TERMS CONDITIONS FEATURES ELIGIBILITY FEES CHARGES Minimum Amount Rs 100 in Multiples of Rs 100 Maximum amount Rs 1 5 Lakhs in a FY Tenure 5 Years Lock In

Tax saving deposits are a type of deposit scheme that allows you to enjoy a deduction of up to 1 5 lakh under Section 80C of the Income Tax Act They come with a lock in period of 5 years Just like other fixed deposits returns on a tax saving FD are fixed for the term of the FD They don t change no matter what

Tax Free Fd In India have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Flexible: They can make printing templates to your own specific requirements when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: Education-related printables at no charge offer a wide range of educational content for learners from all ages, making them an essential aid for parents as well as educators.

-

Convenience: Access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Tax Free Fd In India

Banks Propose Reduction Of Tax free FD Tenure To 3 Years

Banks Propose Reduction Of Tax free FD Tenure To 3 Years

Fixed deposits FDs are uncomplicated risk free interest yielding term deposits offered by banks in India They are considered as one of the safest and most common investment options

TDS is applicable on the interest income earned from Fixed and recurring deposits However there will be no tax deducted at source TDS for interest income of up to Rs 40 000 non senior citizens This is applicable for interest earned from banks as well as from post office deposits

After we've peaked your interest in Tax Free Fd In India We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of reasons.

- Explore categories like home decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free including flashcards, learning materials.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs covered cover a wide range of topics, that range from DIY projects to party planning.

Maximizing Tax Free Fd In India

Here are some innovative ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets to enhance learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Free Fd In India are an abundance of useful and creative resources that meet a variety of needs and passions. Their accessibility and versatility make them an invaluable addition to your professional and personal life. Explore the endless world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can print and download the resources for free.

-

Can I download free printables for commercial use?

- It depends on the specific rules of usage. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in Tax Free Fd In India?

- Certain printables could be restricted on usage. Check the terms and conditions offered by the author.

-

How do I print Tax Free Fd In India?

- You can print them at home using either a printer at home or in a local print shop to purchase higher quality prints.

-

What program must I use to open printables for free?

- The majority of PDF documents are provided with PDF formats, which can be opened using free software such as Adobe Reader.

How Do Banks Calculate Interest On Savings Accounts FD In India

Deposit Insurance For Fixed Deposit Insurance Cover For FD In India

Check more sample of Tax Free Fd In India below

Indian Bank FD Rates 2023 October Revised

Chart Of The Day Bank FD Rates From 1976 Capitalmind Better Investing

Fixed Deposit Interest Rate India Dollar Keg

Best Interest Rates On Tax Saving FD In India Jan 2013

400bhp Tuned Mazda RX 7 FD Drive My Blogs Drive

Fixed Deposit Interest Rate In India Dollar Keg

https://cleartax.in/s/income-tax-on-fixed-deposit-interest

Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest income from FDs attract a TDS of 10 and a TDS of 20 if PAN details are not provided to the bank

https://cleartax.in/s/fixed-deposit

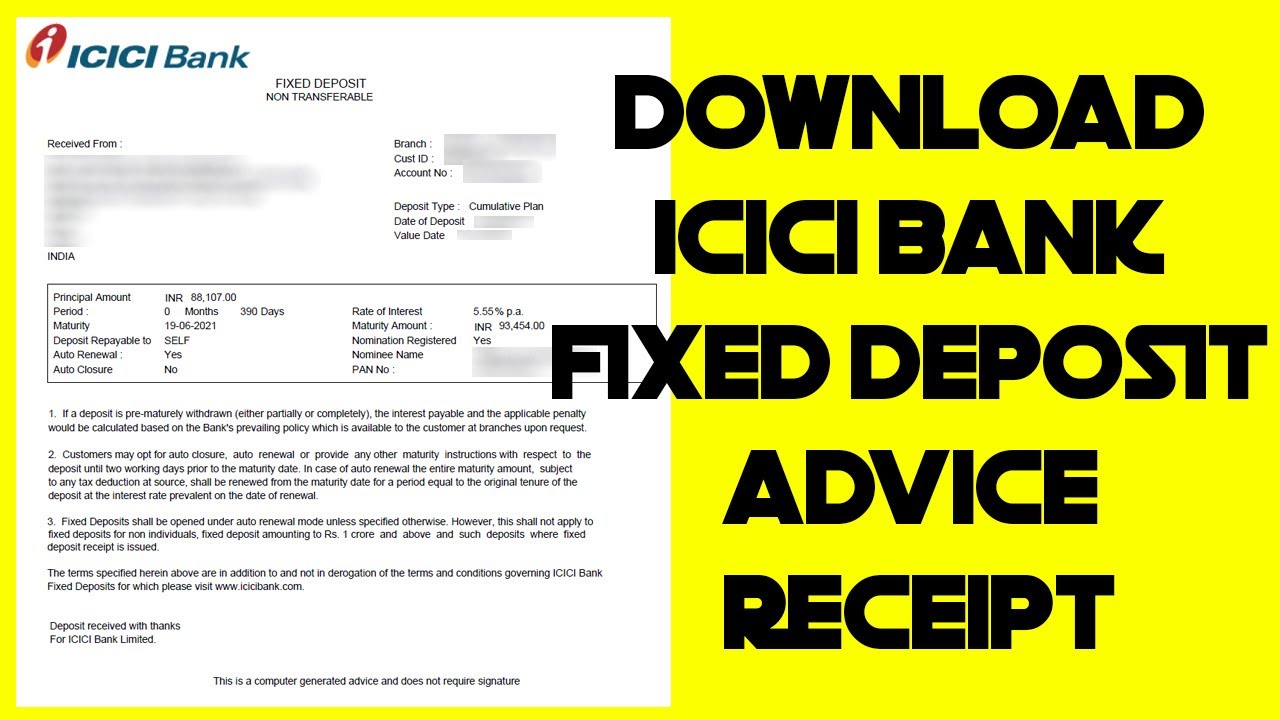

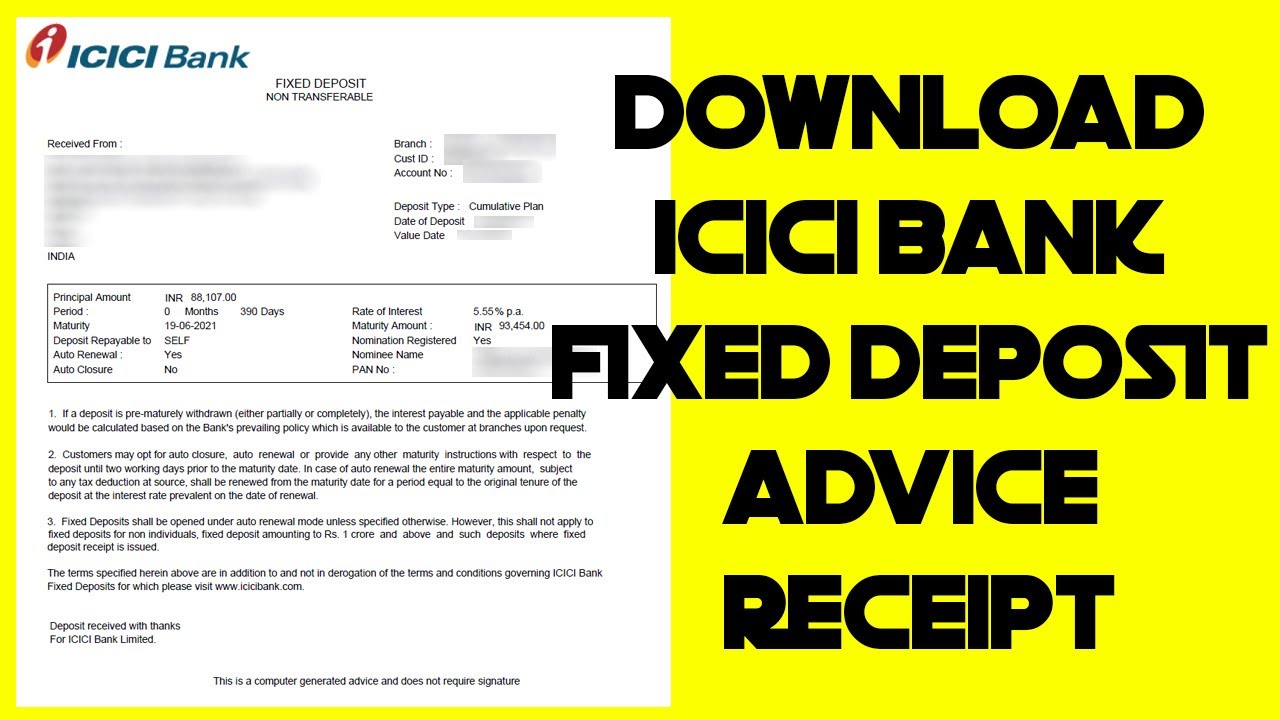

Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can reinvest the sum for another term Loan against FDs are available Investors will accumulate higher returns if they invest for an extended period

Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest income from FDs attract a TDS of 10 and a TDS of 20 if PAN details are not provided to the bank

Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can reinvest the sum for another term Loan against FDs are available Investors will accumulate higher returns if they invest for an extended period

Best Interest Rates On Tax Saving FD In India Jan 2013

Chart Of The Day Bank FD Rates From 1976 Capitalmind Better Investing

400bhp Tuned Mazda RX 7 FD Drive My Blogs Drive

Fixed Deposit Interest Rate In India Dollar Keg

This 111 year old Nationalized Bank Hikes Fixed Deposit Rates Check

Apa Itu Fixed Deposit Mary Dyer

Apa Itu Fixed Deposit Mary Dyer

Latest Bank FD Interest Rates In India Mar 2013