In the digital age, when screens dominate our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes as well as creative projects or simply to add personal touches to your home, printables for free have become an invaluable source. For this piece, we'll dive in the world of "Tax Exemption On Nps Contribution By Employee," exploring their purpose, where to find them, and how they can enrich various aspects of your life.

Get Latest Tax Exemption On Nps Contribution By Employee Below

Tax Exemption On Nps Contribution By Employee

Tax Exemption On Nps Contribution By Employee -

Tax Deduction under 80CCD 1 on NPS investment by Salaried individual except Central Govt employees An Employee can contribute to Government notified

Yes employer contribution to NPS should be added to gross salary as per Section 17 1 of the Income tax act However you can claim deduction u s 80CCD 2

Tax Exemption On Nps Contribution By Employee offer a wide assortment of printable material that is available online at no cost. They come in many forms, like worksheets coloring pages, templates and much more. The great thing about Tax Exemption On Nps Contribution By Employee is in their variety and accessibility.

More of Tax Exemption On Nps Contribution By Employee

Additional Tax Saving On 50000 Should You Invest In NPS Tier 1 For

Additional Tax Saving On 50000 Should You Invest In NPS Tier 1 For

Employer s NPS contribution for the benefit of employee up to 10 of salary Basic DA is deductible from taxable income up to 7 5 Lakh Corporates Employer s

Tax benefits to employees on Self Contribution Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary

Tax Exemption On Nps Contribution By Employee have risen to immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization: It is possible to tailor print-ready templates to your specific requirements whether you're designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Use: Printing educational materials for no cost provide for students of all ages, which makes the perfect source for educators and parents.

-

The convenience of immediate access an array of designs and templates can save you time and energy.

Where to Find more Tax Exemption On Nps Contribution By Employee

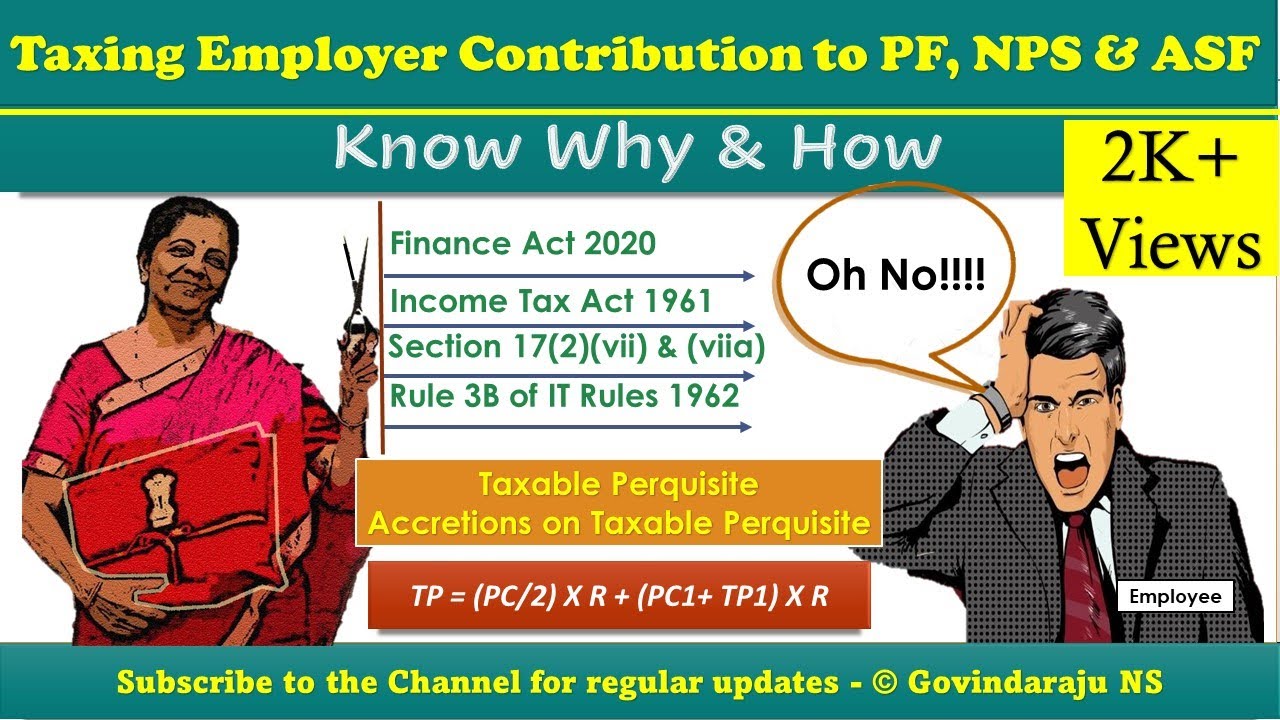

Taxing Employer Contribution To PF NPS ASF Know Why How YouTube

Taxing Employer Contribution To PF NPS ASF Know Why How YouTube

This comes under the overall Rs 1 5 lakh limit of Section 80C If you are an employee contributing to NPS then the above deduction is capped at 10 of salary

Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD

We've now piqued your interest in Tax Exemption On Nps Contribution By Employee Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Tax Exemption On Nps Contribution By Employee for various goals.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a broad selection of subjects, starting from DIY projects to party planning.

Maximizing Tax Exemption On Nps Contribution By Employee

Here are some fresh ways to make the most use of Tax Exemption On Nps Contribution By Employee:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet for teaching at-home as well as in the class.

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Exemption On Nps Contribution By Employee are an abundance of innovative and useful resources that cater to various needs and interests. Their access and versatility makes them an essential part of both professional and personal lives. Explore the endless world of Tax Exemption On Nps Contribution By Employee to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can download and print these documents for free.

-

Can I download free printables to make commercial products?

- It's determined by the specific rules of usage. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables could have limitations on usage. You should read the terms of service and conditions provided by the creator.

-

How can I print Tax Exemption On Nps Contribution By Employee?

- Print them at home using either a printer or go to a print shop in your area for superior prints.

-

What program will I need to access printables that are free?

- The majority of PDF documents are provided in the PDF format, and can be opened using free programs like Adobe Reader.

What Is The Tax Exemption On The Maturity Of The National Pension

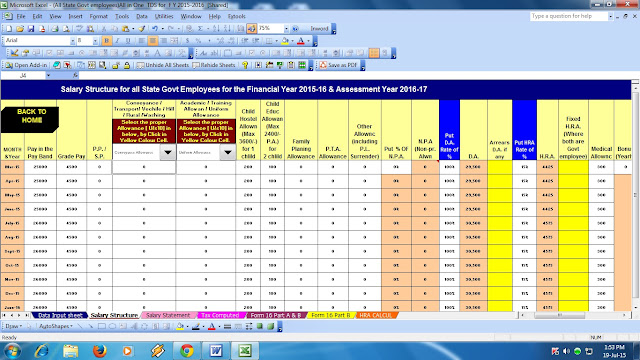

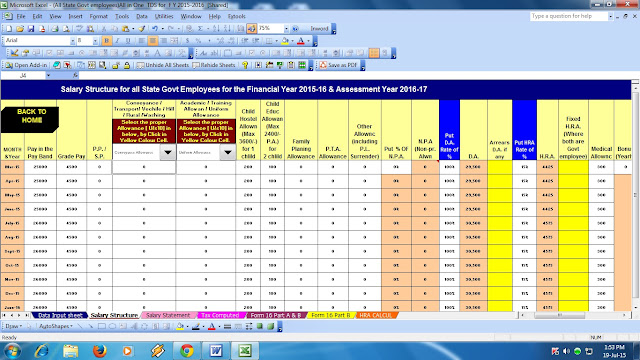

Nps Contribution By Employee Werohmedia

Check more sample of Tax Exemption On Nps Contribution By Employee below

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

How To Make Online Contributions To NPS Tier I And Tier II Accounts

Employer Contribution May Be Tax Free Under National Pension Scheme

Budget 2022 NPS Update Budget 2022 Hikes Tax Exemption On Employer s

Additional Income Tax Exemption Under Section 80 CCD 1 For

NPS Tax Queries Can You Claim Deduction For NPS Contribution Made By

https://cleartax.in/s/taxability-on-nps-employers-contribution

Yes employer contribution to NPS should be added to gross salary as per Section 17 1 of the Income tax act However you can claim deduction u s 80CCD 2

https://www.etmoney.com/learn/nps/np…

What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then you can claim a tax deduction

Yes employer contribution to NPS should be added to gross salary as per Section 17 1 of the Income tax act However you can claim deduction u s 80CCD 2

What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then you can claim a tax deduction

Budget 2022 NPS Update Budget 2022 Hikes Tax Exemption On Employer s

How To Make Online Contributions To NPS Tier I And Tier II Accounts

Additional Income Tax Exemption Under Section 80 CCD 1 For

NPS Tax Queries Can You Claim Deduction For NPS Contribution Made By

Budget 2022 NPS

NPS Contribution With UPI Online Payment At ENPS Portal

NPS Contribution With UPI Online Payment At ENPS Portal

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh Taxed