In this age of electronic devices, where screens rule our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses for creative projects, just adding an individual touch to your home, printables for free are a great source. For this piece, we'll dive in the world of "Tax Exemption On Housing Loan Interest Section," exploring what they are, how they are available, and how they can improve various aspects of your life.

Get Latest Tax Exemption On Housing Loan Interest Section Below

Tax Exemption On Housing Loan Interest Section

Tax Exemption On Housing Loan Interest Section -

Verkko 9 helmik 2018 nbsp 0183 32 Section 80EE Interest on Home Loan for first time home buyers If you are a first time home buyer you will be allowed an additional Rs 50 000 as a tax deduction This is for the interest paid on your Home Loan under Section 80EE of the Income Tax Act This benefit is over the Rs 2 00 000 allowed under Section 24

Verkko 5 helmik 2023 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can claim an additional deduction of Rs 1 5 lakh We have discussed Section 80EEA later in this article

Tax Exemption On Housing Loan Interest Section cover a large range of downloadable, printable materials online, at no cost. These materials come in a variety of designs, including worksheets coloring pages, templates and much more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Tax Exemption On Housing Loan Interest Section

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

Verkko The government has now extended the interest deduction allowed for low cost housing loans under section 80EEA Read here to know more about 80EEA

Verkko 11 tammik 2023 nbsp 0183 32 Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law Section 24 Section 80EE Section 80EEA Upper limit on tax

The Tax Exemption On Housing Loan Interest Section have gained huge popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor the design to meet your needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Value The free educational worksheets can be used by students of all ages, making them a valuable device for teachers and parents.

-

Easy to use: Fast access many designs and templates will save you time and effort.

Where to Find more Tax Exemption On Housing Loan Interest Section

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

Verkko 31 toukok 2022 nbsp 0183 32 Individuals and HUF Hindu Undivided Family can claim tax exemption under Section 80C 2 Section 24 b Tax Deduction On Interest Paid You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your home loan when the

Verkko 20 lokak 2023 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24 b As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of self occupied as well as vacant residential properties

We hope we've stimulated your interest in Tax Exemption On Housing Loan Interest Section, let's explore where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Exemption On Housing Loan Interest Section designed for a variety uses.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast array of topics, ranging that includes DIY projects to party planning.

Maximizing Tax Exemption On Housing Loan Interest Section

Here are some innovative ways in order to maximize the use use of Tax Exemption On Housing Loan Interest Section:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Tax Exemption On Housing Loan Interest Section are an abundance filled with creative and practical information that meet a variety of needs and needs and. Their access and versatility makes them an invaluable addition to the professional and personal lives of both. Explore the world of Tax Exemption On Housing Loan Interest Section and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can print and download these items for free.

-

Do I have the right to use free printables for commercial uses?

- It's based on the rules of usage. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may contain restrictions regarding their use. Always read the terms and conditions provided by the designer.

-

How do I print Tax Exemption On Housing Loan Interest Section?

- Print them at home using an printer, or go to an in-store print shop to get better quality prints.

-

What software do I need to open printables for free?

- Many printables are offered as PDF files, which is open with no cost software like Adobe Reader.

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Section 80EE Of Income Tax Act Deduction On Home Loan

Check more sample of Tax Exemption On Housing Loan Interest Section below

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Housing Loan Tax Exemption On Interest Paid On Housing Loan

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

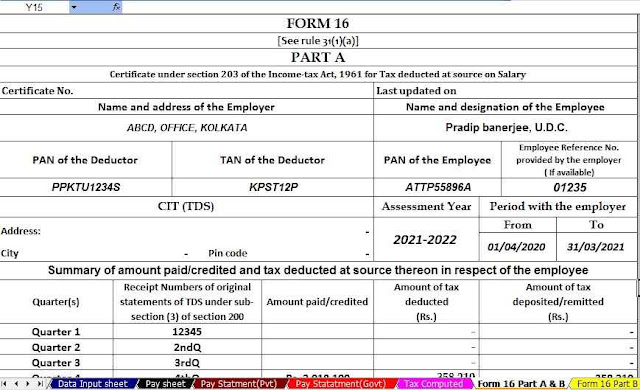

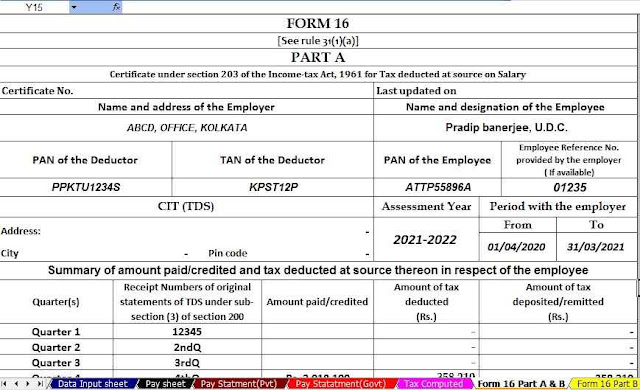

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Tax Deduction On Home Loan Interest Under Section 80EE Wishfin

https://cleartax.in/s/home-loan-tax-benefit

Verkko 5 helmik 2023 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can claim an additional deduction of Rs 1 5 lakh We have discussed Section 80EEA later in this article

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Verkko 1 maalisk 2023 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year You can continue to claim this deduction until you have fully repaid the loan

Verkko 5 helmik 2023 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan is eligible for deduction under Section 80EEA you can claim an additional deduction of Rs 1 5 lakh We have discussed Section 80EEA later in this article

Verkko 1 maalisk 2023 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year You can continue to claim this deduction until you have fully repaid the loan

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

Housing Loan Tax Exemption On Interest Paid On Housing Loan

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Tax Deduction On Home Loan Interest Under Section 80EE Wishfin

Section 24 Of Income Tax Act Deduction For Home Loan Interest

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Tax Benefit For Electric Vehicle Purchase Loan