In a world where screens rule our lives but the value of tangible printed objects isn't diminished. In the case of educational materials such as creative projects or simply to add an extra personal touch to your area, Tax Exemption On Dividend Income In India are a great source. The following article is a take a dive into the sphere of "Tax Exemption On Dividend Income In India," exploring the different types of printables, where they are, and how they can enhance various aspects of your daily life.

Get Latest Tax Exemption On Dividend Income In India Below

Tax Exemption On Dividend Income In India

Tax Exemption On Dividend Income In India -

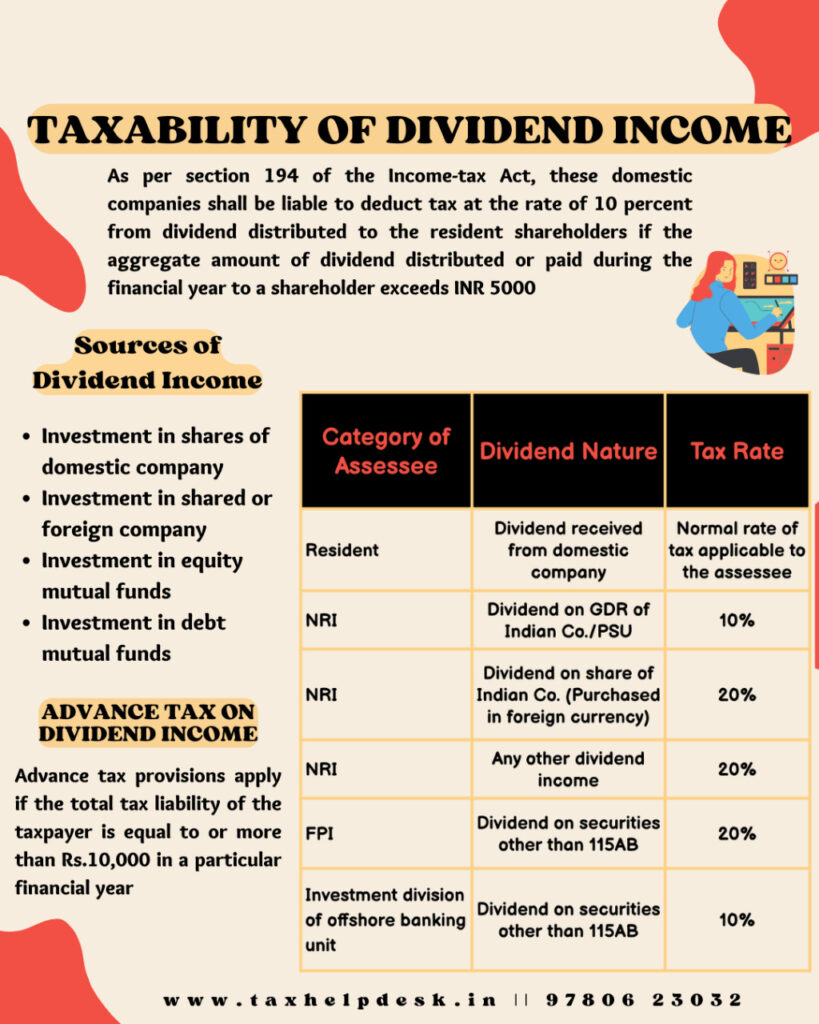

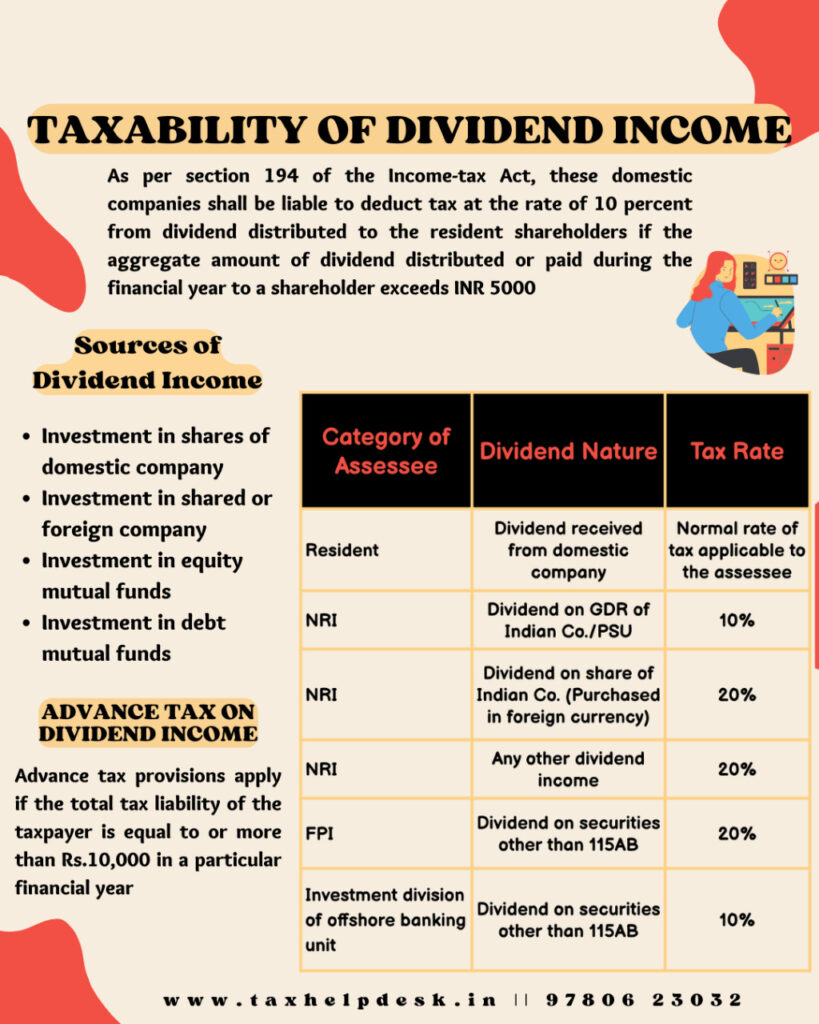

Finance Act 2020 has made major amendments to the taxation of dividends With these amendments the general notion that dividends are exempt is no longer the same This Guide will help our fellow member CA s Students and shareholders to understand the taxability of dividends First lets understand the two types of dividend 1

Exemption Until March 31 2020 FY 2019 20 Until March 31 2020 dividends received from Indian companies were exempt from income tax in the hands of the investor shareholder This exemption was because the company declaring the dividend was already liable to pay Dividend Distribution Tax DDT before making the

Tax Exemption On Dividend Income In India encompass a wide selection of printable and downloadable material that is available online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and much more. The appeal of printables for free is their versatility and accessibility.

More of Tax Exemption On Dividend Income In India

Income Tax On Dividend Income In India For AY 2020 21 Baba Tax

Income Tax On Dividend Income In India For AY 2020 21 Baba Tax

Section 10 34 which provides an exemption to the shareholders in respect of dividend income is withdrawn from Assessment Year 2021 20 Thus dividend received during the financial year 2020 21 and onwards shall now be taxable in

The dividend income shall be taxable in the following circumstances Final dividend According to section 8 of the Income tax Act final dividend including deemed dividend shall be taxable in the year in which dividend is declared distributed or paid whichever is earlier

Tax Exemption On Dividend Income In India have gained a lot of popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: They can make the templates to meet your individual needs whether you're designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value: Educational printables that can be downloaded for free cater to learners of all ages, which makes these printables a powerful resource for educators and parents.

-

It's easy: instant access a myriad of designs as well as templates can save you time and energy.

Where to Find more Tax Exemption On Dividend Income In India

Income Tax On Dividend Income From Shares Mutual Funds In India Save

Income Tax On Dividend Income From Shares Mutual Funds In India Save

Taxpayers whose gross annual income is below the basic exemption limit of Rs 2 50 000 and senior citizens whose tax payable is nil can claim dividend income without TDS Senior citizens should submit Form 15H to

Everyone thinks Income Tax on dividend income for AY 2020 21 in India is exempt upto Rs 10 lakh for FY 2019 20 However this is not scene in every type of dividends Lets discuss the dividend and taxation on dividend in this article

In the event that we've stirred your interest in Tax Exemption On Dividend Income In India We'll take a look around to see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of motives.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast selection of subjects, including DIY projects to party planning.

Maximizing Tax Exemption On Dividend Income In India

Here are some new ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home and in class.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Exemption On Dividend Income In India are a treasure trove of useful and creative resources designed to meet a range of needs and interest. Their accessibility and versatility make these printables a useful addition to any professional or personal life. Explore the plethora of Tax Exemption On Dividend Income In India to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I make use of free templates for commercial use?

- It's determined by the specific rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using Tax Exemption On Dividend Income In India?

- Some printables may come with restrictions concerning their use. Be sure to check the terms and conditions set forth by the designer.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in a print shop in your area for the highest quality prints.

-

What program will I need to access printables for free?

- Most printables come in the format of PDF, which can be opened with free software such as Adobe Reader.

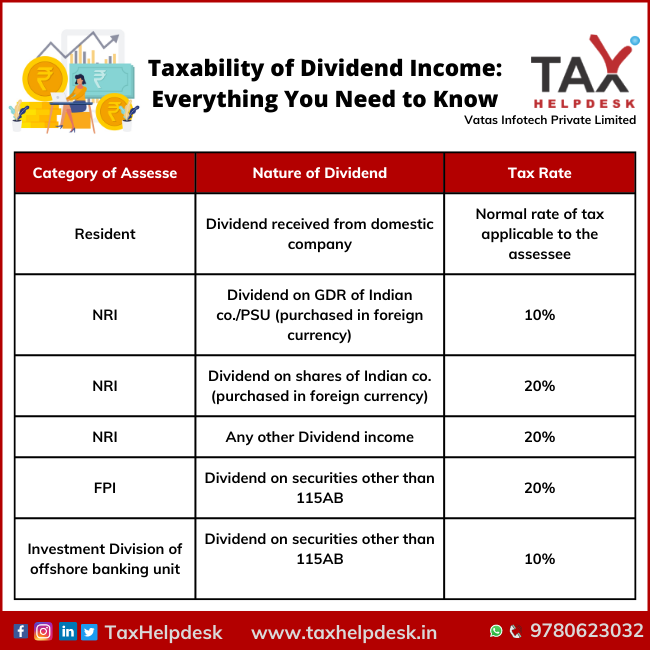

Taxability Of Dividend Income Everything You Need To Know

Tax On Dividend Income More Increases On The Way Alterledger

Check more sample of Tax Exemption On Dividend Income In India below

Dividend Stocks 2023 Dividend Paying Stocks In India 2023 HIGH

CTIM Hails Tax Exemption For Foreign sourced Dividend Income KLSE

Is Stock Dividend Taxable Income In India Plan Your Finances

Tax On Dividend Income In The Philippines 2020 KG Consult Group Inc

Taxability Of Dividend Income Everything You Need To Know

Understanding Tax On Dividend Income In India Fi Money

.webp)

https://tax2win.in/guide/income-tax-on-dividend

Exemption Until March 31 2020 FY 2019 20 Until March 31 2020 dividends received from Indian companies were exempt from income tax in the hands of the investor shareholder This exemption was because the company declaring the dividend was already liable to pay Dividend Distribution Tax DDT before making the

https://taxguru.in/income-tax/exemption-dividend...

Section 115BBDA levies a tax at the rate of 10 on the dividend income exceeding INR 10 Lakhs Understanding the exemption available under section 10 34 with an example Suppose Mr A has earned a dividend of

Exemption Until March 31 2020 FY 2019 20 Until March 31 2020 dividends received from Indian companies were exempt from income tax in the hands of the investor shareholder This exemption was because the company declaring the dividend was already liable to pay Dividend Distribution Tax DDT before making the

Section 115BBDA levies a tax at the rate of 10 on the dividend income exceeding INR 10 Lakhs Understanding the exemption available under section 10 34 with an example Suppose Mr A has earned a dividend of

Tax On Dividend Income In The Philippines 2020 KG Consult Group Inc

CTIM Hails Tax Exemption For Foreign sourced Dividend Income KLSE

Taxability Of Dividend Income Everything You Need To Know

.webp)

Understanding Tax On Dividend Income In India Fi Money

How To Avoid TDS On Dividend Income For FY 2023 24 AY 2024 25 Mint

Understanding Tax On Dividend Income In India Fi Money

Understanding Tax On Dividend Income In India Fi Money

Do You Pay Taxes On Money Market Accounts Leia Aqui What Are The