Today, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. For educational purposes in creative or artistic projects, or simply adding an individual touch to the space, Tax Exemption Laws In India are now an essential source. The following article is a dive into the sphere of "Tax Exemption Laws In India," exploring the different types of printables, where they can be found, and how they can enhance various aspects of your lives.

Get Latest Tax Exemption Laws In India Below

Tax Exemption Laws In India

Tax Exemption Laws In India -

The basic exemption limit for resident individuals who are 60 years of age or more but less than 80 years of age at any time during the tax year is INR 300 000 For resident individuals who are 80 years of age or more it is INR 500 000 Surcharge

Standard Deduction For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction

The Tax Exemption Laws In India are a huge selection of printable and downloadable materials available online at no cost. These printables come in different kinds, including worksheets coloring pages, templates and many more. The great thing about Tax Exemption Laws In India lies in their versatility and accessibility.

More of Tax Exemption Laws In India

Getting Rid Of Engineering Licensing Exemption Law Machine Design

Getting Rid Of Engineering Licensing Exemption Law Machine Design

Exemptions and deductions not claimable under the new tax regime The following are some of the major deductions and exemptions you cannot claim under the new tax regime The deduction under Section 80TTA 80TTB Interest on Savings account Professional tax and entertainment allowance on salaries Leave Travel Allowance LTA

There are certain incomes which are excluded from total income They are exempt from tax Certain incomes are totally exempt from tax or partially exempt from tax Thus to the extent these incomes are exempt they are not included in the total income The following incomes do not form part of total income

Tax Exemption Laws In India have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization They can make printables to your specific needs in designing invitations making your schedule, or decorating your home.

-

Educational Worth: Printables for education that are free offer a wide range of educational content for learners of all ages, which makes them a useful source for educators and parents.

-

The convenience of Fast access the vast array of design and templates helps save time and effort.

Where to Find more Tax Exemption Laws In India

Tax Deduction Letter Sign Templates Jotform

Tax Deduction Letter Sign Templates Jotform

Section 110 Determination of tax where total income includes income on which no tax is payable Section 115VF Tonnage income Section 14A Expenditure incurred in relation to income not includible in total income Section 115BBI Specified income of certain institutions Section 4

Income tax law consists of the 1961 act Income Tax Rules 1962 Notifications and Circulars issued by the Central Board of Direct Taxes CBDT annual Finance Acts and judicial pronouncements by the Supreme and high courts

Since we've got your curiosity about Tax Exemption Laws In India and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Tax Exemption Laws In India for various needs.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets with flashcards and other teaching materials.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a broad variety of topics, all the way from DIY projects to party planning.

Maximizing Tax Exemption Laws In India

Here are some inventive ways for you to get the best use of Tax Exemption Laws In India:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Tax Exemption Laws In India are a treasure trove with useful and creative ideas that cater to various needs and preferences. Their accessibility and versatility make them a great addition to each day life. Explore the world of Tax Exemption Laws In India to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes they are! You can download and print these items for free.

-

Can I use free printables for commercial use?

- It's based on the usage guidelines. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Are there any copyright issues when you download Tax Exemption Laws In India?

- Certain printables may be subject to restrictions on their use. Make sure to read the terms and conditions set forth by the designer.

-

How do I print Tax Exemption Laws In India?

- Print them at home using the printer, or go to an area print shop for higher quality prints.

-

What software do I need to run printables that are free?

- The majority are printed in the format of PDF, which can be opened with free software like Adobe Reader.

Sales Tax Exemption Certificate Wisconsin

New Arizona Exemption Laws And What They Could Mean To You YouTube

Check more sample of Tax Exemption Laws In India below

STATE HOMESTEAD EXEMPTION LAWS

Why Tax Exemption To Corporates

Property Tax Exemption To Boost Market For Small Houses In Mumbai

Saibaba Temple Of Shirdi Gets Tax Exemption Of Rs 175 Crore

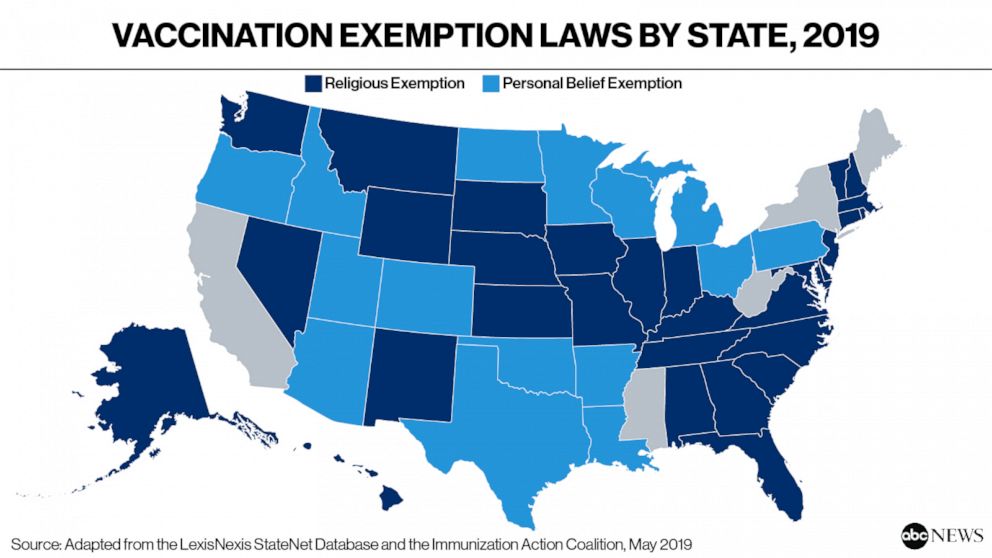

Religious Exemption Laws The Conservative Legal Movement By

HRA Exemption India Rent Calculator Save Tax Pay To Wife Or Parent

https://cleartax.in/s/income-tax-allowances-and-deductions

Standard Deduction For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction

https://cleartax.in/s/income-tax-slabs

Income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs up to Rs 3 00 000 for senior citizens aged above 60 years but less than 80 years up to Rs 5 00 000 for super senior citizens aged above 80 years Surcharge and cess will be applicable over and above the tax rates

Standard Deduction For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction

Income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs up to Rs 3 00 000 for senior citizens aged above 60 years but less than 80 years up to Rs 5 00 000 for super senior citizens aged above 80 years Surcharge and cess will be applicable over and above the tax rates

Saibaba Temple Of Shirdi Gets Tax Exemption Of Rs 175 Crore

Why Tax Exemption To Corporates

Religious Exemption Laws The Conservative Legal Movement By

HRA Exemption India Rent Calculator Save Tax Pay To Wife Or Parent

Purvanchal Expressway Toll Starte From Today

Flipboard Chinese Firm Gets 23 year Tax Exemption In Pakistan

Flipboard Chinese Firm Gets 23 year Tax Exemption In Pakistan

As States Cut Vaccine Exemptions Skeptical Parents May Switch Tactics