In a world where screens rule our lives The appeal of tangible printed items hasn't gone away. If it's to aid in education for creative projects, simply to add an element of personalization to your space, Tax Exemption For Spouse Education Fees have proven to be a valuable resource. In this article, we'll take a dive to the depths of "Tax Exemption For Spouse Education Fees," exploring their purpose, where to find them and the ways that they can benefit different aspects of your life.

Get Latest Tax Exemption For Spouse Education Fees Below

Tax Exemption For Spouse Education Fees

Tax Exemption For Spouse Education Fees -

March 16 2020 If you re paying higher education costs for yourself a spouse or a dependent you may be eligible to save some money with education tax credits or the

2 If you filed a paper Income Tax Return or are unable to re file online Please email us a your request to claim or revise the relief b the amount of relief that you wish to claim or

Printables for free cover a broad assortment of printable materials online, at no cost. These resources come in many types, like worksheets, templates, coloring pages, and more. The appeal of printables for free is their versatility and accessibility.

More of Tax Exemption For Spouse Education Fees

Make Use Of The Capital Gains Tax Inter spouse Exemption Arthur Boyd Co

Make Use Of The Capital Gains Tax Inter spouse Exemption Arthur Boyd Co

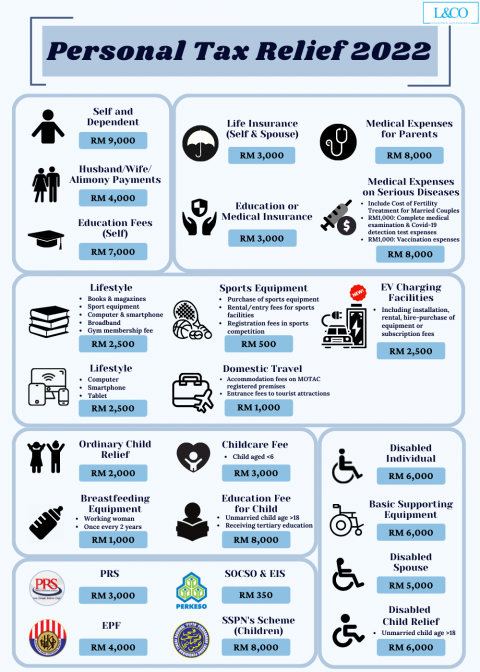

Purchase of basic supporting equipment for disabled self spouse child or parent 6 000 Restricted 4 Disabled individual 6 000 5 Education fees Self Other than a degree

Key Takeaways Money in an IRA can be withdrawn early to pay for tuition and other qualified higher education expenses for you your spouse children or

Tax Exemption For Spouse Education Fees have risen to immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Personalization They can make printing templates to your own specific requirements in designing invitations making your schedule, or decorating your home.

-

Educational Impact: Educational printables that can be downloaded for free cater to learners from all ages, making them an invaluable source for educators and parents.

-

Easy to use: You have instant access an array of designs and templates saves time and effort.

Where to Find more Tax Exemption For Spouse Education Fees

How Can My Spouse Be Tax Dependent Workcloud

How Can My Spouse Be Tax Dependent Workcloud

Eligible expenses include tuition and required fees for yourself your spouse or a dependent you claim on your tax return

You may exclude certain educational assistance benefits from your income That means that you won t have to pay any tax on them However it also means that you

We hope we've stimulated your interest in printables for free Let's take a look at where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Exemption For Spouse Education Fees for various motives.

- Explore categories like the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing Tax Exemption For Spouse Education Fees

Here are some unique ways of making the most use of Tax Exemption For Spouse Education Fees:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Exemption For Spouse Education Fees are an abundance of practical and imaginative resources catering to different needs and interests. Their availability and versatility make them a great addition to any professional or personal life. Explore the plethora of Tax Exemption For Spouse Education Fees to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes they are! You can download and print these resources at no cost.

-

Can I make use of free templates for commercial use?

- It is contingent on the specific rules of usage. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with Tax Exemption For Spouse Education Fees?

- Certain printables could be restricted on usage. Be sure to read the conditions and terms of use provided by the author.

-

How do I print Tax Exemption For Spouse Education Fees?

- Print them at home with printing equipment or visit an in-store print shop to get premium prints.

-

What software do I require to view Tax Exemption For Spouse Education Fees?

- Most printables come in the format of PDF, which can be opened using free software like Adobe Reader.

Ken Dodd And The Spouse Exemption CooleBevis LLP

Tax Exemption Limit For Women What Are The Income Tax Exemptions And

Check more sample of Tax Exemption For Spouse Education Fees below

1 6

Avoid The 10 Penalty Qualified Education Expenses Exemption

Personal Tax Relief 2022 L Co Accountants

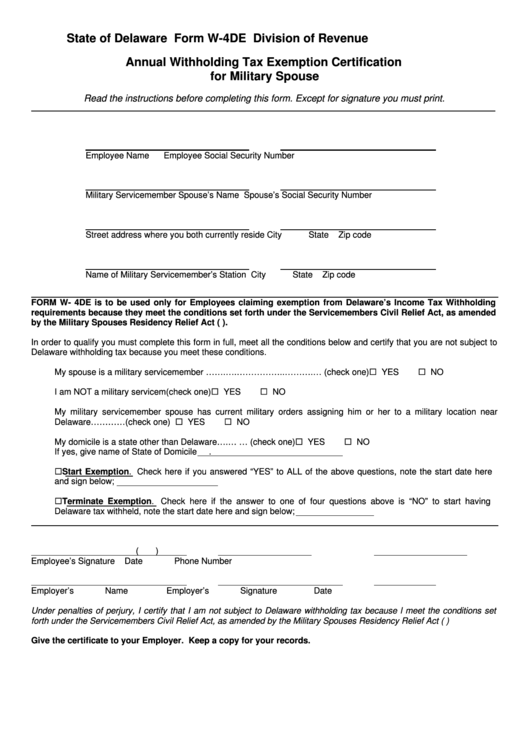

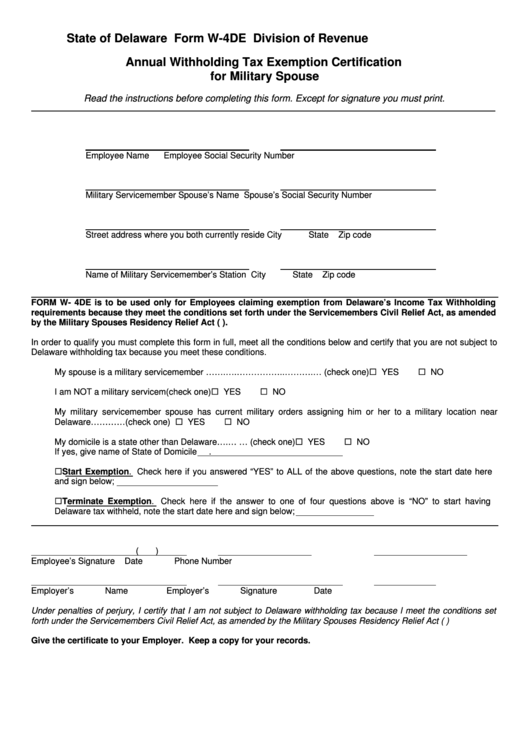

Military Spouse Tax Exemption Form California ExemptForm

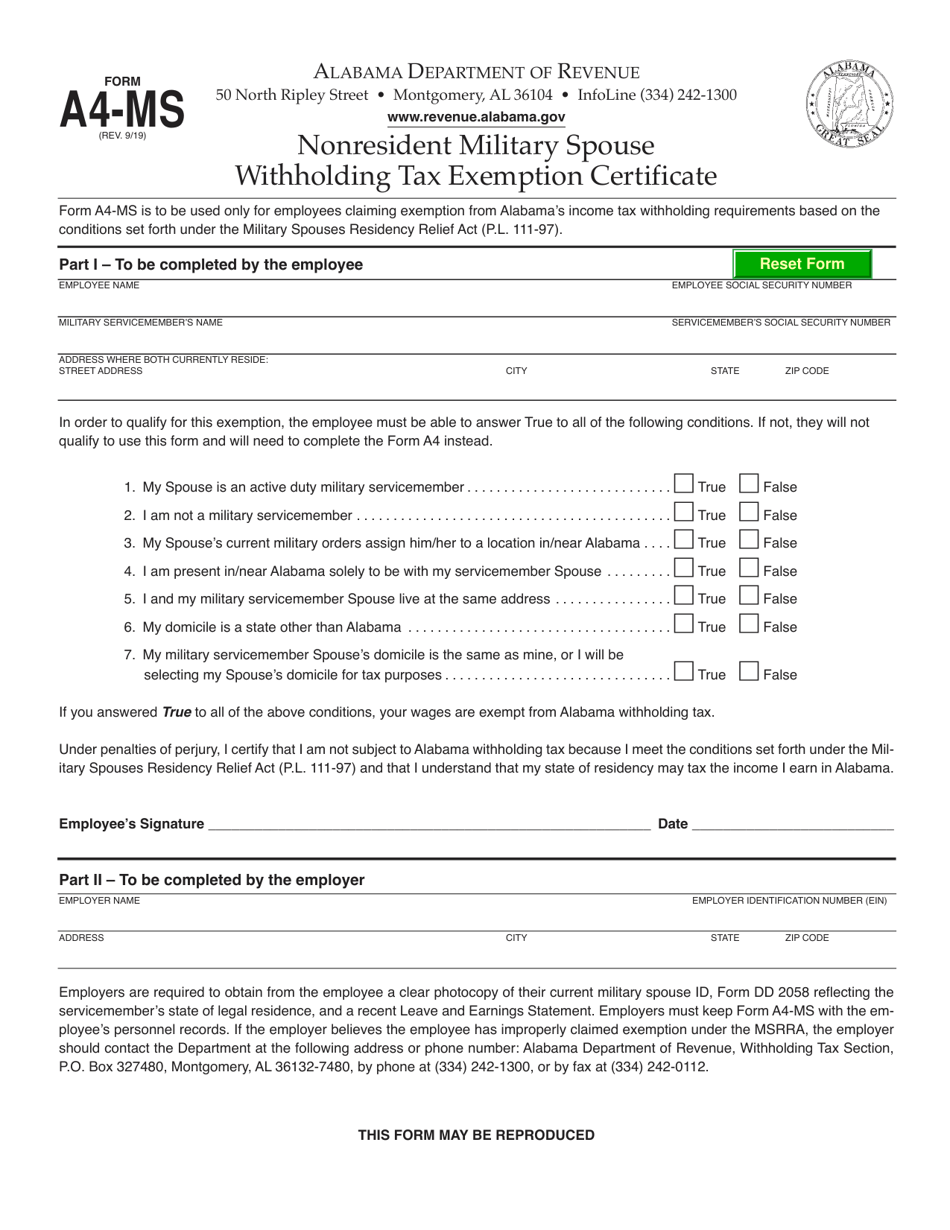

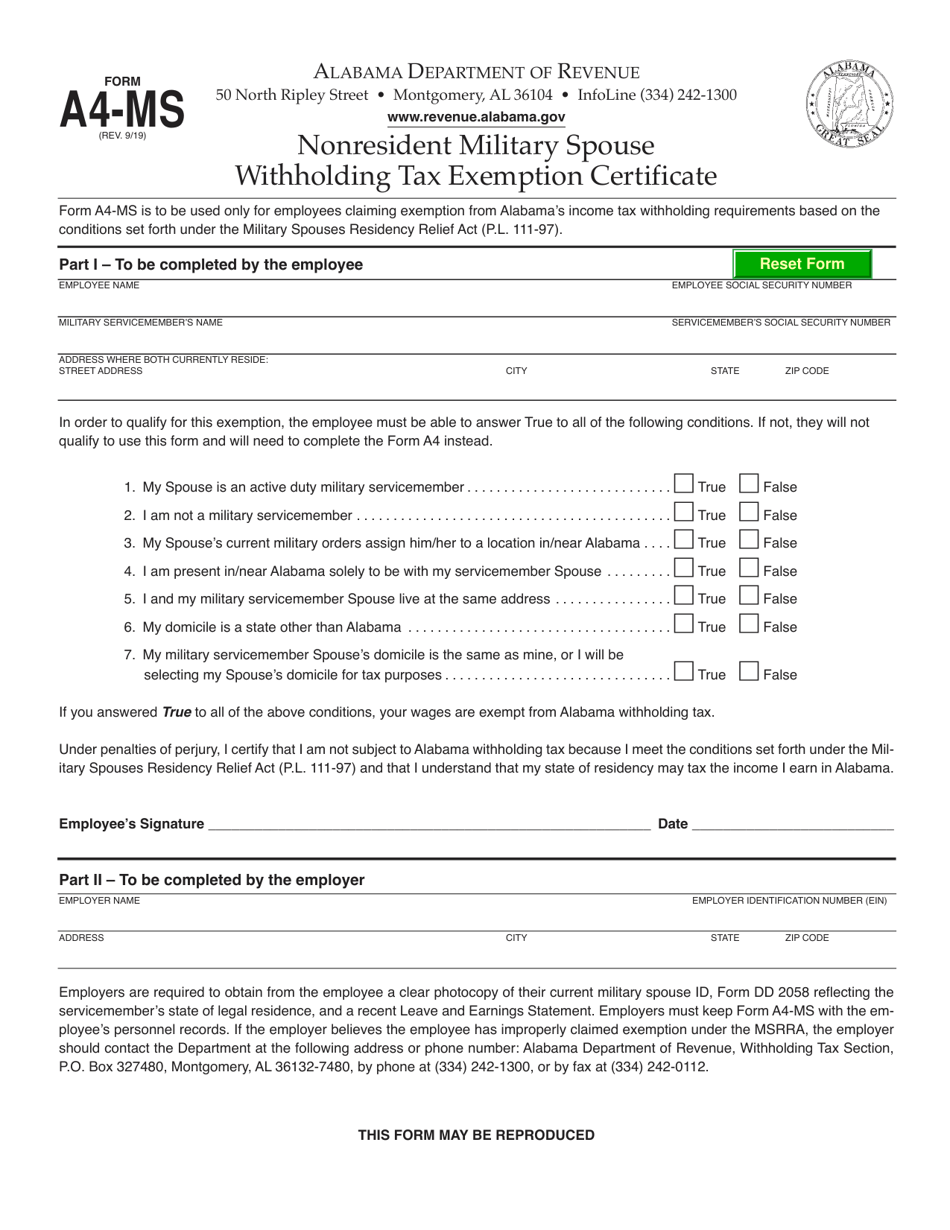

Alabama Form A 4 Employee S Withholding Tax Exemption Certificate 2023

Disabled Veteran Or Surviving Spouse Exemption Claim 150 303 086 Use

https://www.iras.gov.sg/.../tax-reliefs/course-fees-relief

2 If you filed a paper Income Tax Return or are unable to re file online Please email us a your request to claim or revise the relief b the amount of relief that you wish to claim or

https://ttlc.intuit.com/community/college...

1 Best answer georgesT New Member Yes you can claim the education credit for your wife college tuition if you meet the IRS requirements Qualifications for

2 If you filed a paper Income Tax Return or are unable to re file online Please email us a your request to claim or revise the relief b the amount of relief that you wish to claim or

1 Best answer georgesT New Member Yes you can claim the education credit for your wife college tuition if you meet the IRS requirements Qualifications for

Military Spouse Tax Exemption Form California ExemptForm

Avoid The 10 Penalty Qualified Education Expenses Exemption

Alabama Form A 4 Employee S Withholding Tax Exemption Certificate 2023

Disabled Veteran Or Surviving Spouse Exemption Claim 150 303 086 Use

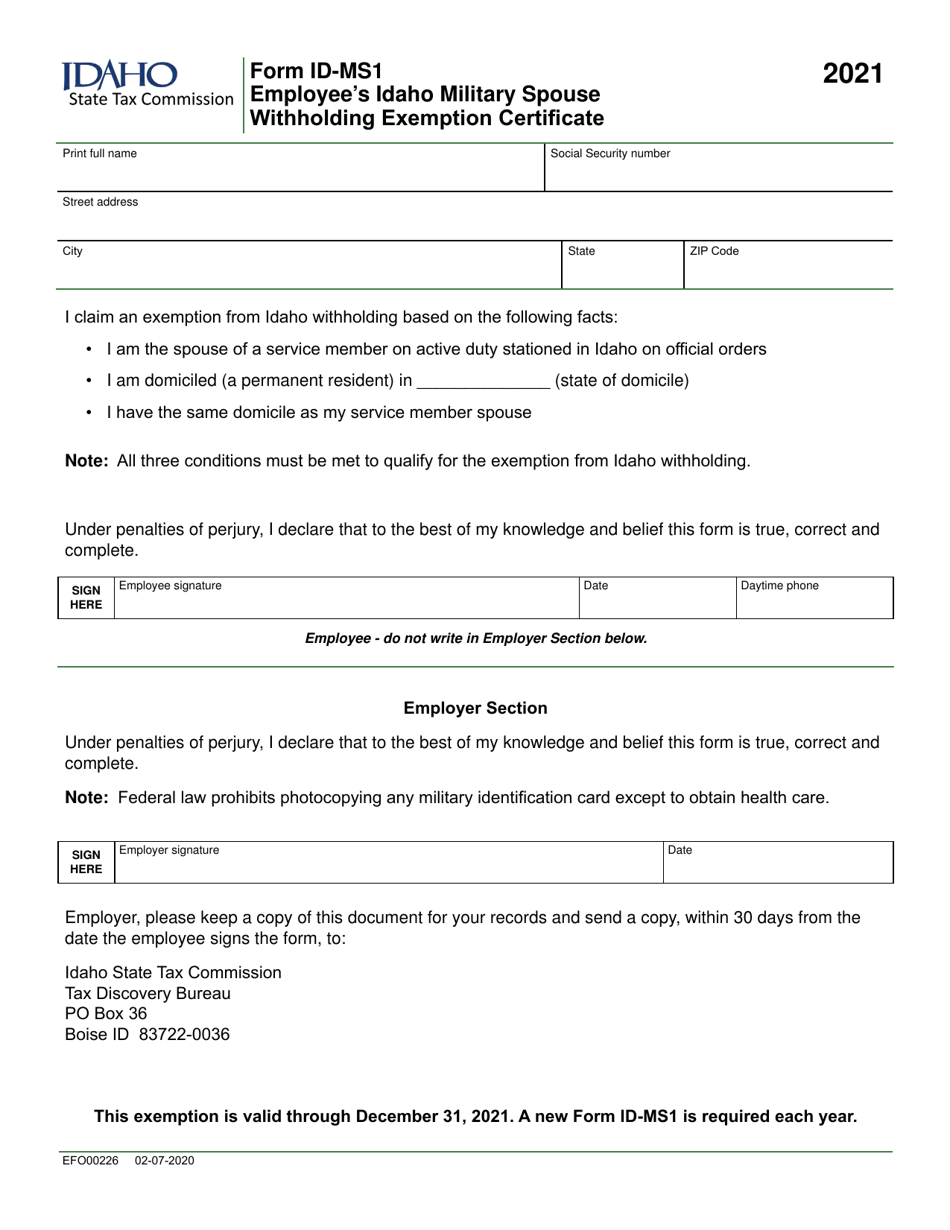

Form ID MS1 EFO00226 Download Fillable PDF Or Fill Online Employee s

HRA Tax Exemption For Rent Paid To Parents And Spouse

HRA Tax Exemption For Rent Paid To Parents And Spouse

Weiss LLP Miss The Portability Election Deadline For A Deceased