In the age of digital, where screens have become the dominant feature of our lives and the appeal of physical printed objects isn't diminished. No matter whether it's for educational uses such as creative projects or simply to add a personal touch to your space, Tax Exemption For Donation have become a valuable resource. The following article is a take a dive into the world "Tax Exemption For Donation," exploring their purpose, where you can find them, and what they can do to improve different aspects of your daily life.

Get Latest Tax Exemption For Donation Below

Tax Exemption For Donation

Tax Exemption For Donation -

Both company and non company can claim a deduction under Section 80G of the Income Tax Act for donations made to eligible charitable institutions or funds The following persons can claim deduction under section 80G Individuals Companies Firms Hindu Undivided Family HUF Non Resident Indian NRI Any other person

To claim a tax deductible donation you must itemize on your taxes The amount of charitable donations you can deduct may range from 20 to 60 of your AGI

Printables for free include a vast variety of printable, downloadable materials online, at no cost. These printables come in different designs, including worksheets templates, coloring pages and much more. The appealingness of Tax Exemption For Donation is their flexibility and accessibility.

More of Tax Exemption For Donation

Tax Exempt Form Request Letter Inspirational Agreement With Regard To

Tax Exempt Form Request Letter Inspirational Agreement With Regard To

Charitable contribution tax information search exempt organizations eligible for tax deductible contributions learn what records to keep and how to report contributions find tips on making donations

Contributions to relief funds and humanitarian organizations can be deducted under Section 80G of the Internal Revenue Code Any taxpayer whether a person a corporation a partnership or another entity may claim this

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization: There is the possibility of tailoring designs to suit your personal needs such as designing invitations and schedules, or even decorating your home.

-

Educational Benefits: These Tax Exemption For Donation cater to learners of all ages. This makes these printables a powerful aid for parents as well as educators.

-

Easy to use: immediate access a variety of designs and templates helps save time and effort.

Where to Find more Tax Exemption For Donation

Fingers Raised At Tax Exemption For Temple Donation VHP Says Got

Fingers Raised At Tax Exemption For Temple Donation VHP Says Got

The 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60 for cash donations for qualified

Section 80GGC provides for tax deductions with respect to donations made by taxpayers towards political parties or any electoral trusts Section 80GGC of the Income Tax Act was introduced to bring about transparency in electoral funding and free it

After we've peaked your interest in printables for free Let's see where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Tax Exemption For Donation to suit a variety of applications.

- Explore categories like decorations for the home, education and the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing including flashcards, learning materials.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to planning a party.

Maximizing Tax Exemption For Donation

Here are some ideas how you could make the most of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Tax Exemption For Donation are a treasure trove of innovative and useful resources that meet a variety of needs and interest. Their accessibility and versatility make them a wonderful addition to any professional or personal life. Explore the vast world of Tax Exemption For Donation now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes, they are! You can download and print these materials for free.

-

Can I utilize free templates for commercial use?

- It is contingent on the specific usage guidelines. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright rights issues with Tax Exemption For Donation?

- Some printables could have limitations on use. Always read the conditions and terms of use provided by the author.

-

How do I print Tax Exemption For Donation?

- Print them at home using either a printer or go to an area print shop for the highest quality prints.

-

What software do I need to open printables for free?

- The majority of PDF documents are provided in the format of PDF, which is open with no cost software like Adobe Reader.

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

Donor Tax Receipt Template Premium Printable Receipt Templates

Check more sample of Tax Exemption For Donation below

Blank Fillable Ohio Tax Exempt Form Printable Forms Free Online

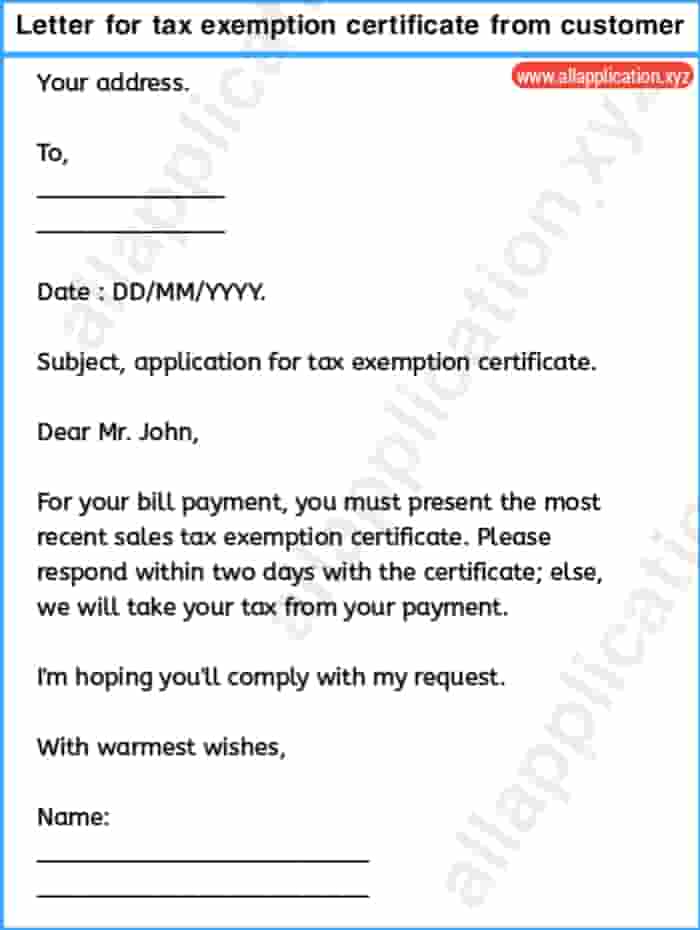

Letter Requesting Tax Exemption Certificate From Customer

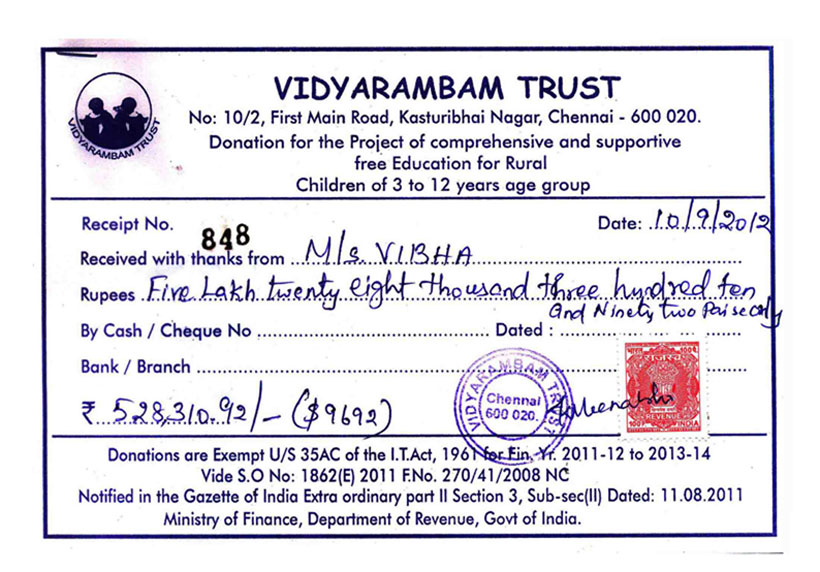

The Donation Receipt For Donations Is Shown In This Document Which

Request Letter For Tax Exemption And Certificate SemiOffice Com

Printable Purchase Exempt Form Printable Forms Free Online

Free Goodwill Donation Receipt Template PDF EForms

https://www.nerdwallet.com/article/taxes/tax...

To claim a tax deductible donation you must itemize on your taxes The amount of charitable donations you can deduct may range from 20 to 60 of your AGI

https://www.irs.gov/charities-non-profits/...

A corporation may deduct qualified contributions of up to 25 percent of its taxable income Contributions that exceed that amount can carry over to the next tax year To qualify the contribution must be a cash contribution made to a qualifying organization made during the calendar year 2020

To claim a tax deductible donation you must itemize on your taxes The amount of charitable donations you can deduct may range from 20 to 60 of your AGI

A corporation may deduct qualified contributions of up to 25 percent of its taxable income Contributions that exceed that amount can carry over to the next tax year To qualify the contribution must be a cash contribution made to a qualifying organization made during the calendar year 2020

Request Letter For Tax Exemption And Certificate SemiOffice Com

Letter Requesting Tax Exemption Certificate From Customer

Printable Purchase Exempt Form Printable Forms Free Online

Free Goodwill Donation Receipt Template PDF EForms

Tax Exemption 80G Certificate

Individual Mail In Donation Form Thank You For Your Contribution

Individual Mail In Donation Form Thank You For Your Contribution

Donation Exemption For Income Tax Malaysia Tax Exemption For Ngos