In this day and age with screens dominating our lives, the charm of tangible printed materials hasn't faded away. Whether it's for educational purposes project ideas, artistic or just adding some personal flair to your space, Tax Exemption For Dependents 2022 are a great source. In this article, we'll take a dive to the depths of "Tax Exemption For Dependents 2022," exploring what they are, where they are, and how they can be used to enhance different aspects of your life.

Get Latest Tax Exemption For Dependents 2022 Below

Tax Exemption For Dependents 2022

Tax Exemption For Dependents 2022 -

December 2 2021 The IRS Announces New Tax Numbers for 2022 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and exemption amounts

Because it could save you thousands of dollars on your taxes For tax years prior to 2018 every qualified dependent you claimed could reduce your taxable income by up to the exemption amount equal to 4 050 in 2017 In 2023 exemption deductions are replaced by An increased standard deduction

The Tax Exemption For Dependents 2022 are a huge selection of printable and downloadable items that are available online at no cost. The resources are offered in a variety formats, such as worksheets, coloring pages, templates and much more. The benefit of Tax Exemption For Dependents 2022 is in their variety and accessibility.

More of Tax Exemption For Dependents 2022

Georgia Allows Fetuses To Be Listed As Dependents On Tax Returns To

Georgia Allows Fetuses To Be Listed As Dependents On Tax Returns To

Tags 2021 2022 2023 2024 dependent Exemption irs The IRS dependent exemption in 2023 and 2024 is aimed at taxpayers who need to pay for dependents Most commonly parents would apply for this because they have children However it also applies to other dependents

Part 1 Rules for All Dependents This part of the publication discusses the filing requirements for dependents who is responsible for a child s return how to figure a dependent s standard deduction and whether a dependent can claim exemption from federal income tax withholding

Tax Exemption For Dependents 2022 have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: Your HTML0 customization options allow you to customize printables to fit your particular needs be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Impact: Education-related printables at no charge can be used by students of all ages, which makes them an essential tool for teachers and parents.

-

Easy to use: Access to various designs and templates, which saves time as well as effort.

Where to Find more Tax Exemption For Dependents 2022

Wisconsin Withholding Form 2023 Printable Forms Free Online

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png)

Wisconsin Withholding Form 2023 Printable Forms Free Online

2022 Personal Exemption The personal exemption for 2022 remains at 0 The Tax Cuts and Jobs Act of 2017 eliminated the personal exemption until tax year 2025 2022 Alternative Minimum Tax Exemption The alternative minimum tax AMT is a tax imposed on taxpayers who earn above certain thresholds estates and trusts

Personal Exemptions and Dependents on the 2022 Federal Income Tax Return February 8 2023 Edward A Zurndorfer Certified Financial Planner The Tax Cuts and Jobs Act TCJA reduced the exemption deduction to 0 for the years 2018 to 2025 thereby suspending the deduction for exemptions

After we've peaked your curiosity about Tax Exemption For Dependents 2022 We'll take a look around to see where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Tax Exemption For Dependents 2022 for various purposes.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs covered cover a wide selection of subjects, ranging from DIY projects to party planning.

Maximizing Tax Exemption For Dependents 2022

Here are some inventive ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities for teaching at-home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Exemption For Dependents 2022 are a treasure trove of creative and practical resources that can meet the needs of a variety of people and hobbies. Their accessibility and versatility make them a great addition to both professional and personal life. Explore the vast array of Tax Exemption For Dependents 2022 to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes, they are! You can download and print these resources at no cost.

-

Can I use the free printouts for commercial usage?

- It's all dependent on the conditions of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright violations with Tax Exemption For Dependents 2022?

- Some printables may come with restrictions regarding usage. Be sure to read the terms and conditions offered by the designer.

-

How can I print printables for free?

- You can print them at home using the printer, or go to the local print shop for premium prints.

-

What program will I need to access Tax Exemption For Dependents 2022?

- The majority of printables are with PDF formats, which is open with no cost software, such as Adobe Reader.

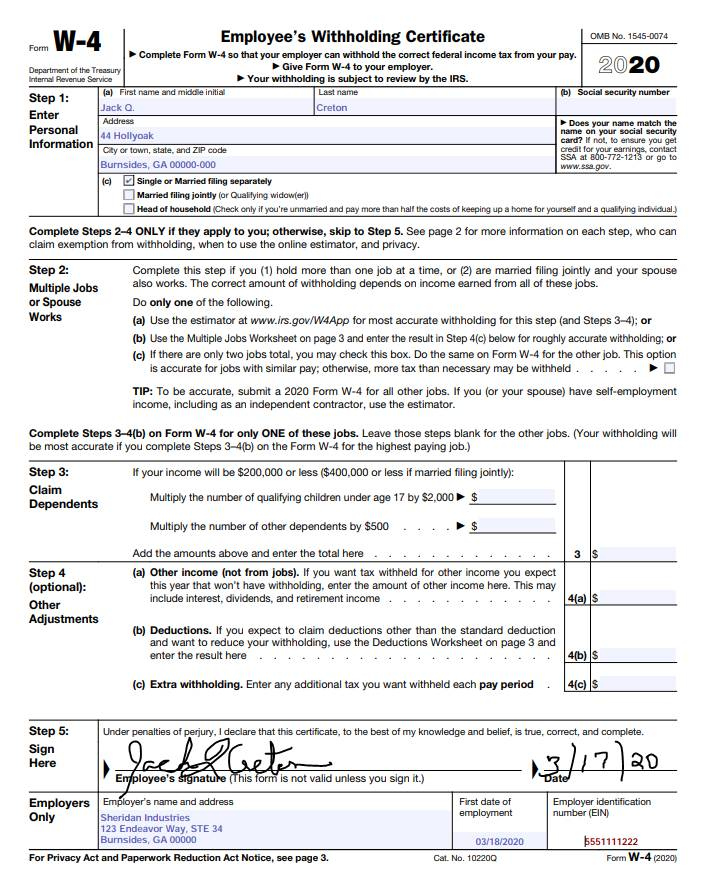

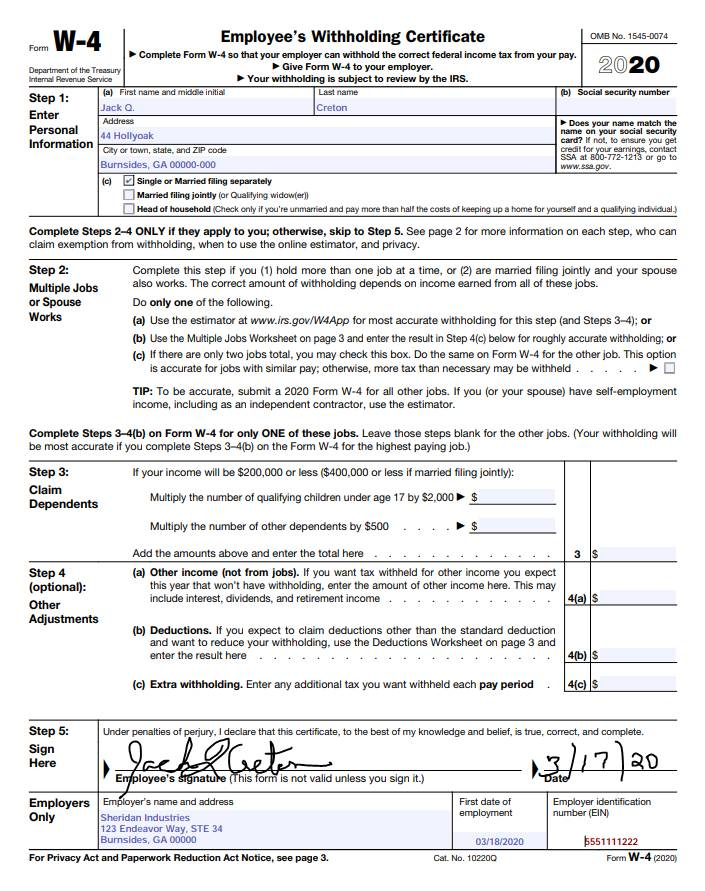

How To Reduce Withholding Tax Outsiderough11

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

Printable W4 Form

Check more sample of Tax Exemption For Dependents 2022 below

Federal W4 Form Printable

Standard Deduction For Dependents

Tax Brackets 2022 Head Of Household With Dependents

Should Churches File For 501 c 3 Tax Exemption

Captivating Pictures That Tell A Story As Well 52 Pics Izismile

Standard Deduction Worksheet For Dependents

https://turbotax.intuit.com/tax-tips/family/rules...

Because it could save you thousands of dollars on your taxes For tax years prior to 2018 every qualified dependent you claimed could reduce your taxable income by up to the exemption amount equal to 4 050 in 2017 In 2023 exemption deductions are replaced by An increased standard deduction

https://www.investopedia.com/ask/answers/102015/...

A 1 000 tax deduction reduces your taxable income by 1 000 So if you fall into the 22 tax bracket that 1 000 deduction would save you 220 1 000 22

Because it could save you thousands of dollars on your taxes For tax years prior to 2018 every qualified dependent you claimed could reduce your taxable income by up to the exemption amount equal to 4 050 in 2017 In 2023 exemption deductions are replaced by An increased standard deduction

A 1 000 tax deduction reduces your taxable income by 1 000 So if you fall into the 22 tax bracket that 1 000 deduction would save you 220 1 000 22

Should Churches File For 501 c 3 Tax Exemption

Standard Deduction For Dependents

Captivating Pictures That Tell A Story As Well 52 Pics Izismile

Standard Deduction Worksheet For Dependents

Publication 929 Tax Rules For Children And Dependents Tax Rules For

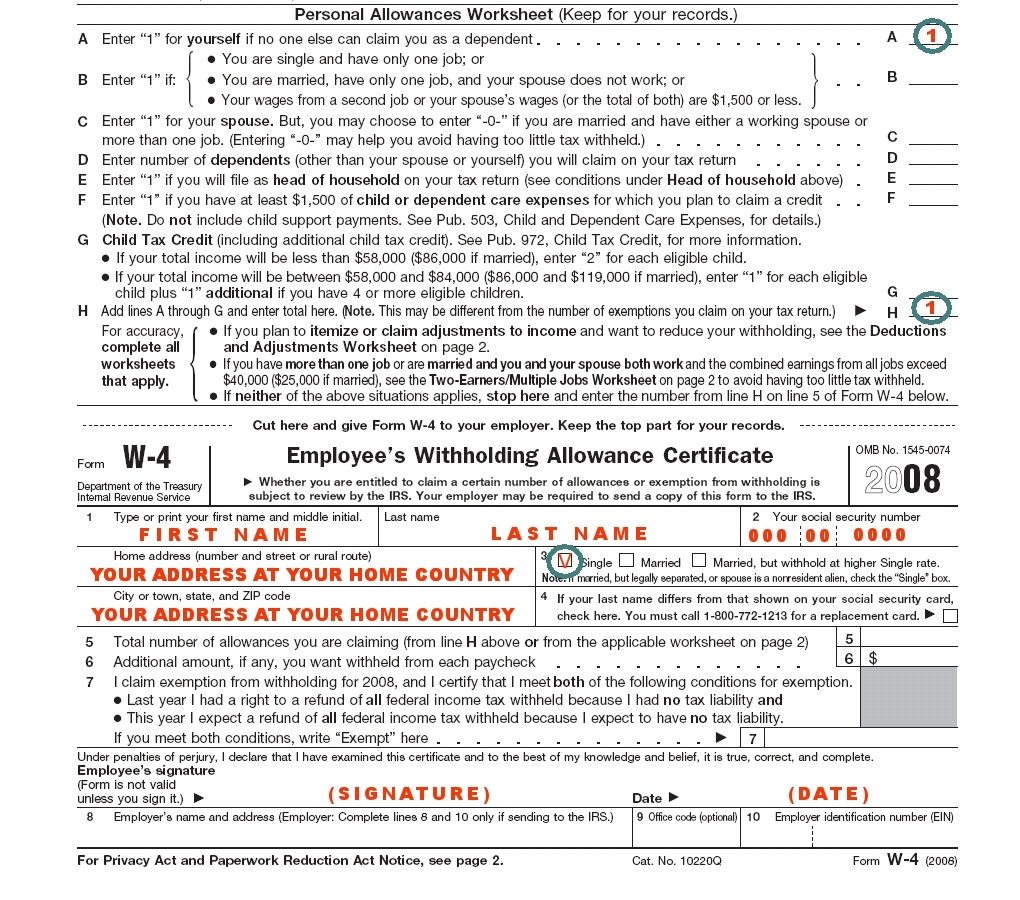

Figuring Out Your Form W4 How Many Allowances Should You

Figuring Out Your Form W4 How Many Allowances Should You

Captivating Pictures That Tell A Story As Well 52 Pics Izismile