In this age of electronic devices, in which screens are the norm and the appeal of physical printed objects isn't diminished. For educational purposes such as creative projects or simply adding a personal touch to your home, printables for free have become a valuable source. In this article, we'll dive in the world of "Tax Exemption Amount For Ladies In India," exploring their purpose, where you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Tax Exemption Amount For Ladies In India Below

Tax Exemption Amount For Ladies In India

Tax Exemption Amount For Ladies In India -

Income Tax Exemption for Women Under Old Tax Regime FY 2022 23 FY 2023 24 Under the old tax regime females can avail of certain deductions and

Women over 60 years of age but less than 80 years are required to pay taxes based on the following income tax slabs if they have opted for the old income tax regime The tax

Printables for free cover a broad array of printable resources available online for download at no cost. They come in many kinds, including worksheets templates, coloring pages, and many more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Tax Exemption Amount For Ladies In India

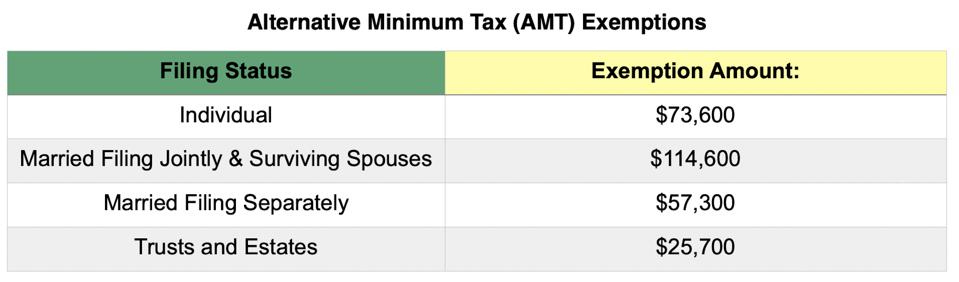

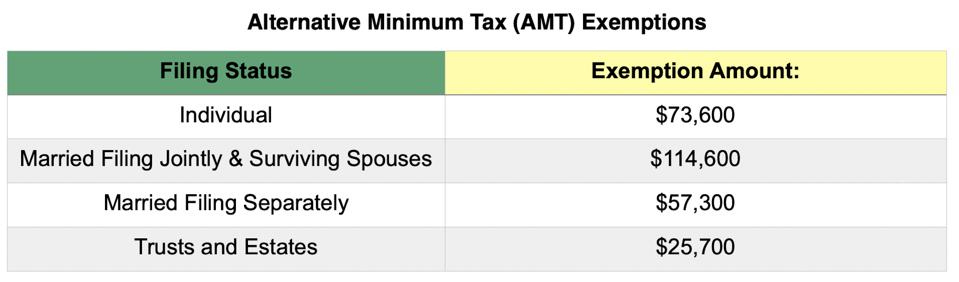

Don t Forget Income Taxes When Planning Your Estate NKSFB LLC

Don t Forget Income Taxes When Planning Your Estate NKSFB LLC

Housewives in India have an income tax exemption limit of 3 lakhs for FY 2022 23 under the new tax regime and Rs 2 5 lakhs for FY 2022 23 under the old tax regime What is

For lower income women with income up to Rs 7 lakhs in the new regime a tax rebate of up to Rs 25 000 can be availed In the old regime where income is up to

Tax Exemption Amount For Ladies In India have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Customization: It is possible to tailor printables to your specific needs in designing invitations making your schedule, or decorating your home.

-

Educational Use: Education-related printables at no charge offer a wide range of educational content for learners from all ages, making them a vital instrument for parents and teachers.

-

Easy to use: Instant access to a plethora of designs and templates helps save time and effort.

Where to Find more Tax Exemption Amount For Ladies In India

Estate Tax Exemption For 2023 Kiplinger

Estate Tax Exemption For 2023 Kiplinger

1 Section 16 ia Standard Deduction Every employee including women employee may claim a standard salary deduction of upto Rs 50 000 u s 16 ia of the

For resident women up to the age of 65 years there is no income tax on net income up to Rs 1 90 000 This is slightly higher than the bar for men which is Rs 1 80 000 With effect from April 1st 2011 salaried women

We hope we've stimulated your curiosity about Tax Exemption Amount For Ladies In India Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of reasons.

- Explore categories like decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free, flashcards, and learning tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast spectrum of interests, all the way from DIY projects to planning a party.

Maximizing Tax Exemption Amount For Ladies In India

Here are some unique ways ensure you get the very most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Exemption Amount For Ladies In India are a treasure trove of creative and practical resources catering to different needs and desires. Their accessibility and versatility make them an invaluable addition to the professional and personal lives of both. Explore the vast collection of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes, they are! You can print and download these tools for free.

-

Can I use the free printables in commercial projects?

- It's based on specific usage guidelines. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright issues when you download Tax Exemption Amount For Ladies In India?

- Certain printables might have limitations in their usage. Make sure to read the terms of service and conditions provided by the author.

-

How do I print Tax Exemption Amount For Ladies In India?

- Print them at home with the printer, or go to the local print shops for better quality prints.

-

What program do I require to view printables for free?

- Many printables are offered in the PDF format, and is open with no cost software like Adobe Reader.

Federal Estate And Gift Tax Exemption Set To Rise Substantially For

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Check more sample of Tax Exemption Amount For Ladies In India below

Estate Tax Exemption Increased For 2023 Anchin Block Anchin LLP

IRS Estate Tax Exemption Amount Goes Up For 2023 SDG Accountants

March 2022 Newsletter

New Tax Exemption Amounts 2022 Estate Planning JAH

Historical Estate Tax Exemption Amounts And Tax Rates

IRS Releases 2021 Tax Rates Standard Deduction Amounts And More The

https://www.godigit.com/income-tax/income-tax-slab-for-women

Women over 60 years of age but less than 80 years are required to pay taxes based on the following income tax slabs if they have opted for the old income tax regime The tax

https://cleartax.in/s/income-tax-slabs

Income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs up to Rs 3 00 000 for senior citizens aged above 60 years but

Women over 60 years of age but less than 80 years are required to pay taxes based on the following income tax slabs if they have opted for the old income tax regime The tax

Income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs up to Rs 3 00 000 for senior citizens aged above 60 years but

New Tax Exemption Amounts 2022 Estate Planning JAH

IRS Estate Tax Exemption Amount Goes Up For 2023 SDG Accountants

Historical Estate Tax Exemption Amounts And Tax Rates

IRS Releases 2021 Tax Rates Standard Deduction Amounts And More The

Increases To 2023 Estate And Gift Tax Exemptions Announced Varnum LLP

Increases To Estate Gift Tax Exemptions Easy Estate Probate

Increases To Estate Gift Tax Exemptions Easy Estate Probate

Q Is Inflation Impacting The 2022 Federal Estate Tax Exemption Amount