In this age of electronic devices, where screens rule our lives but the value of tangible printed materials hasn't faded away. Be it for educational use such as creative projects or simply to add an individual touch to the space, Tax Deduction Upto 5 Lakhs are now an essential resource. Through this post, we'll dive into the world of "Tax Deduction Upto 5 Lakhs," exploring their purpose, where to find them and the ways that they can benefit different aspects of your lives.

Get Latest Tax Deduction Upto 5 Lakhs Below

Tax Deduction Upto 5 Lakhs

Tax Deduction Upto 5 Lakhs -

No tax is needed to be paid by an individual earning an annual income of Rs 5 lakhs As per the announcements made under the Union Budget 2023 if an employee is earning

Tax rate Tax in Up to 2 5 lakhs Nil Nil Nil 2 5 5 lakh 250 000 5 12 500 5 10 lakh 5 00 000 20 1 00 000 Above 10 lakh 3 90 000 30 1 17 000 Total Tax A 2 29 500 Health and education cess B

Tax Deduction Upto 5 Lakhs encompass a wide assortment of printable materials that are accessible online for free cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Tax Deduction Upto 5 Lakhs

Reality Of No Income Tax Upto 5 Lakhs Here Is The Truth About Budget

Reality Of No Income Tax Upto 5 Lakhs Here Is The Truth About Budget

However in the case of a new tax regime the tax rebate has been increased to Rs 25 000 if the taxable income is less than Rs 7 00 000 and continues to be

5 lakhs 7 lakhs Standard Deduction 50 000 50 000 Effective Tax Free Salary income 5 5 lakhs 5 lakhs 7 5 lakhs Rebate u s 87A 12 500 12 500 25 000

Tax Deduction Upto 5 Lakhs have risen to immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: There is the possibility of tailoring printables to your specific needs whether you're designing invitations and schedules, or even decorating your house.

-

Educational Value: Printing educational materials for no cost are designed to appeal to students from all ages, making them a great resource for educators and parents.

-

Affordability: The instant accessibility to many designs and templates, which saves time as well as effort.

Where to Find more Tax Deduction Upto 5 Lakhs

How Much Income Tax Upto 5 Lakhs what Is Rebate Income Tax sec 87A

How Much Income Tax Upto 5 Lakhs what Is Rebate Income Tax sec 87A

1 INCOME DETAILS 2 DEDUCTIONS 3 SUMMARY 4 Basic Details What is Your Current Age Below 60 years 60 to 80 years 80 years above Do you live in a metro

However you can also get a rebate of Rs 2 500 under section 87A if you have a total income of up to Rs 3 5 lacs for FY 2018 19 From FY 2019 20 onwards the rebate has been increased to Rs 12 500 for an income up

Now that we've ignited your interest in printables for free Let's take a look at where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Deduction Upto 5 Lakhs for various reasons.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning tools.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide array of topics, ranging including DIY projects to planning a party.

Maximizing Tax Deduction Upto 5 Lakhs

Here are some creative ways ensure you get the very most use of Tax Deduction Upto 5 Lakhs:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home (or in the learning environment).

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Deduction Upto 5 Lakhs are a treasure trove filled with creative and practical information designed to meet a range of needs and hobbies. Their accessibility and versatility make they a beneficial addition to each day life. Explore the vast collection of Tax Deduction Upto 5 Lakhs to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Deduction Upto 5 Lakhs really for free?

- Yes they are! You can download and print these tools for free.

-

Are there any free printables in commercial projects?

- It's based on the terms of use. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in Tax Deduction Upto 5 Lakhs?

- Some printables may have restrictions on use. Check the terms and conditions provided by the designer.

-

How do I print Tax Deduction Upto 5 Lakhs?

- You can print them at home with the printer, or go to the local print shop for better quality prints.

-

What software do I require to open printables that are free?

- The majority of printed documents are in PDF format. They is open with no cost software like Adobe Reader.

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Budget 2017 18 No Income Tax Upto Rs 3 Lakh And 5 Percent Upto Rs 5

Check more sample of Tax Deduction Upto 5 Lakhs below

How To Save Income Tax On Salary 5 TIPS To Save Income Tax Upto 12

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint

No Income Tax Upto Rs 9 5 Lakhs Subscribe To Https taxyadnya in

Take Home Salary Calculator India 2021 22 Excel Download

Old Vs New Tax Regime Which Is Better New Or Old Tax Regime For

Salary Slip Or Payslip Format Validity C Importance And Components

https://www.etmoney.com/.../income-ta…

Tax rate Tax in Up to 2 5 lakhs Nil Nil Nil 2 5 5 lakh 250 000 5 12 500 5 10 lakh 5 00 000 20 1 00 000 Above 10 lakh 3 90 000 30 1 17 000 Total Tax A 2 29 500 Health and education cess B

https://m.economictimes.com/wealth/tax/why-you...

Any individual having net taxable income not exceeding Rs 5 lakh for FY 2022 23 AY 2023 24 irrespective if they have selected the old or new tax regime gets

Tax rate Tax in Up to 2 5 lakhs Nil Nil Nil 2 5 5 lakh 250 000 5 12 500 5 10 lakh 5 00 000 20 1 00 000 Above 10 lakh 3 90 000 30 1 17 000 Total Tax A 2 29 500 Health and education cess B

Any individual having net taxable income not exceeding Rs 5 lakh for FY 2022 23 AY 2023 24 irrespective if they have selected the old or new tax regime gets

Take Home Salary Calculator India 2021 22 Excel Download

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint

Old Vs New Tax Regime Which Is Better New Or Old Tax Regime For

Salary Slip Or Payslip Format Validity C Importance And Components

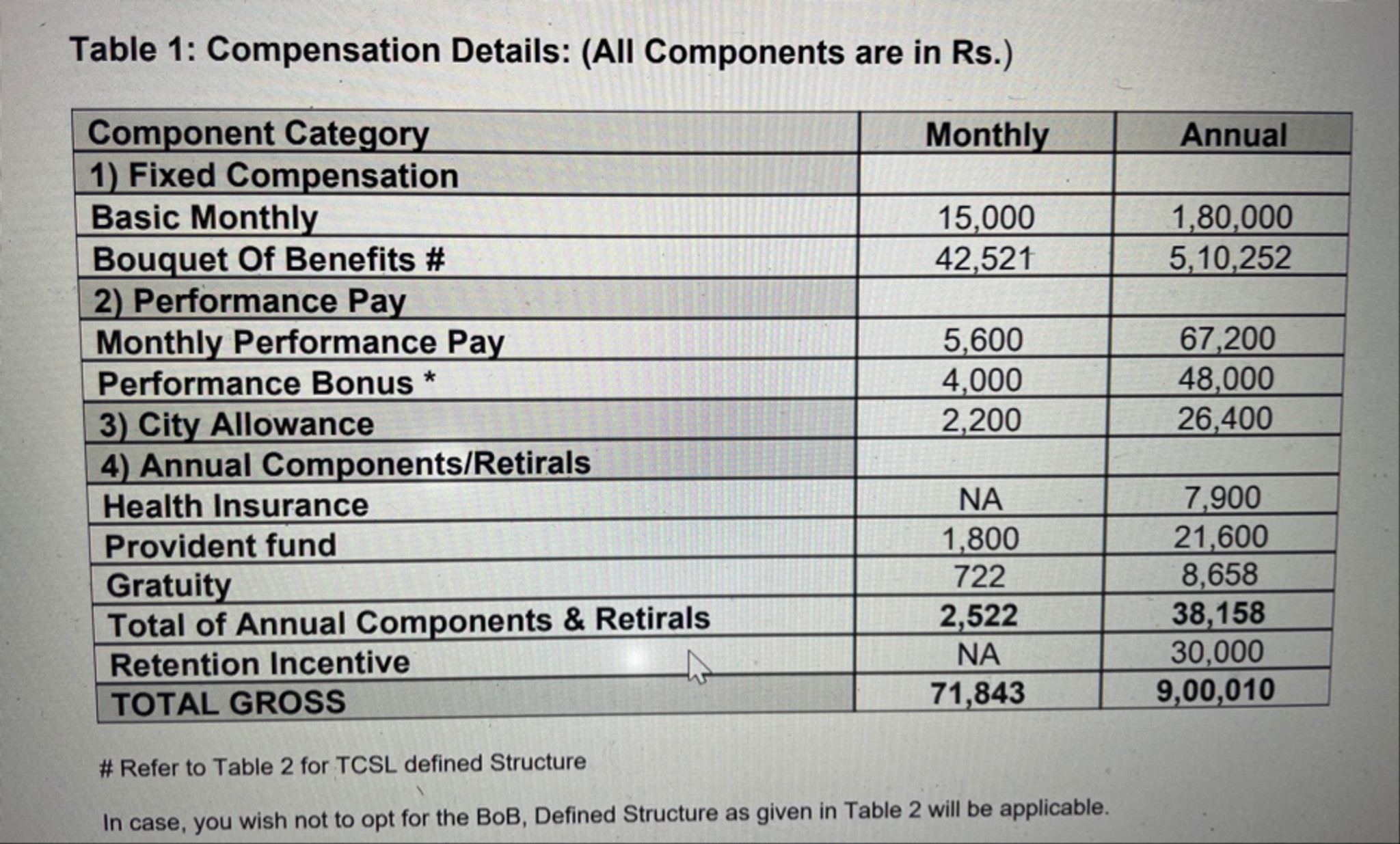

Hello TCSers What Will Be In Hand Salary Of 9 LPA Fishbowl

Budget Prediction 2020 Income Tax Return Tax Deductions Budgeting

Budget Prediction 2020 Income Tax Return Tax Deductions Budgeting

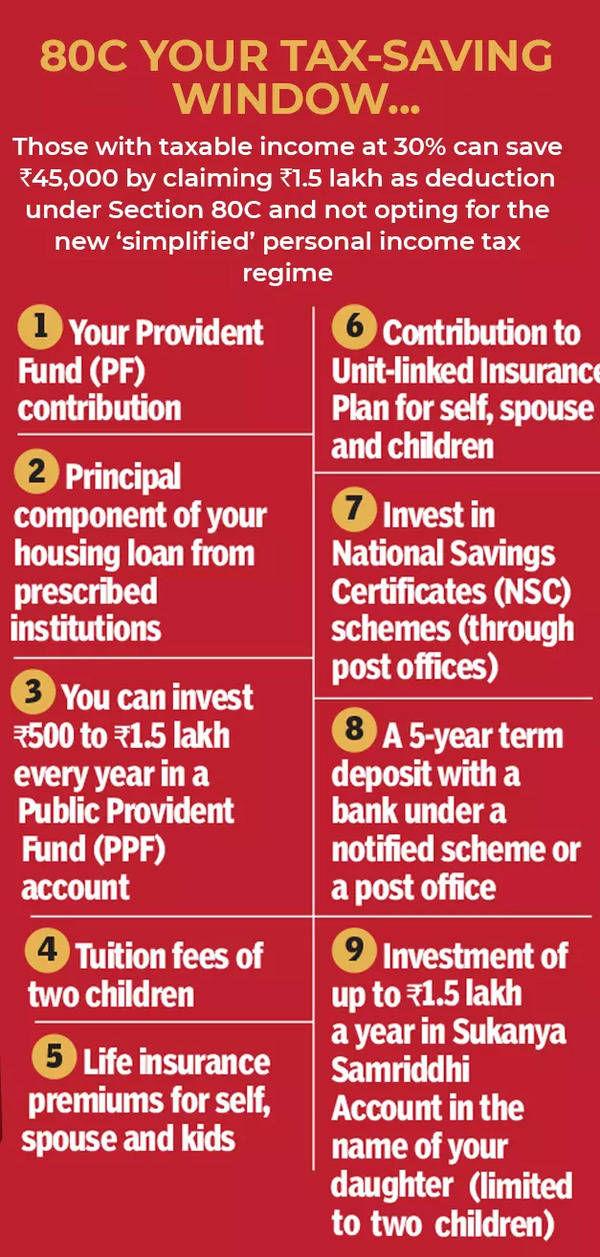

Union Budget 2022 Your Tax saving Window Section 80C And Beyond