In this age of electronic devices, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. In the case of educational materials or creative projects, or just adding a personal touch to your space, Tax Deduction Student Loan Payments are now an essential resource. This article will take a dive into the world of "Tax Deduction Student Loan Payments," exploring the different types of printables, where they are available, and how they can enhance various aspects of your daily life.

Get Latest Tax Deduction Student Loan Payments Below

Tax Deduction Student Loan Payments

Tax Deduction Student Loan Payments -

OVERVIEW When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

Tax Deduction Student Loan Payments include a broad collection of printable materials available online at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages and many more. One of the advantages of Tax Deduction Student Loan Payments is their flexibility and accessibility.

More of Tax Deduction Student Loan Payments

Student Loan Tax Deduction Milliken Perkins Brunelle

Student Loan Tax Deduction Milliken Perkins Brunelle

Student loan interest deduction You can t deduct as interest on a student loan any interest paid by your employer after March 27 2000 and before January 1 2026 under an educational assistance program See chapter

Feb 8 2024 at 9 53 a m Getty Images You may be eligible for a tax reduction based on your student loan interest Key Takeaways If you took out an educational loan for

Tax Deduction Student Loan Payments have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: The Customization feature lets you tailor printing templates to your own specific requirements in designing invitations or arranging your schedule or decorating your home.

-

Educational Worth: The free educational worksheets cater to learners of all ages, which makes these printables a powerful tool for parents and teachers.

-

Affordability: Access to many designs and templates cuts down on time and efforts.

Where to Find more Tax Deduction Student Loan Payments

Student Loan Debt Tax Deduction Write Off DO THIS TO SAVE With

Student Loan Debt Tax Deduction Write Off DO THIS TO SAVE With

Update August 24 2022 President Biden Vice President Harris and the U S Department of Education announced a three part student loan debt relief plan that includes an extension of the pause on

The Student Loan Interest Deduction is a tax deduction that may allow you to reduce your taxable income by the amount you paid in student loan interest up to

We've now piqued your curiosity about Tax Deduction Student Loan Payments Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Tax Deduction Student Loan Payments designed for a variety goals.

- Explore categories such as interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a wide spectrum of interests, that includes DIY projects to planning a party.

Maximizing Tax Deduction Student Loan Payments

Here are some ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Tax Deduction Student Loan Payments are an abundance of practical and innovative resources which cater to a wide range of needs and needs and. Their accessibility and versatility make them a great addition to both professional and personal lives. Explore the wide world that is Tax Deduction Student Loan Payments today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes they are! You can print and download these items for free.

-

Can I use free printables for commercial use?

- It's determined by the specific rules of usage. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may come with restrictions regarding their use. Always read the terms and regulations provided by the creator.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in the local print shop for superior prints.

-

What software is required to open printables free of charge?

- A majority of printed materials are in PDF format, which is open with no cost software such as Adobe Reader.

How To Claim The Student Loan Interest Deduction Tomcaligist

How Do Student Loans Affect Your Taxes Earnest

Check more sample of Tax Deduction Student Loan Payments below

Student Loan Interest Deduction Worksheet

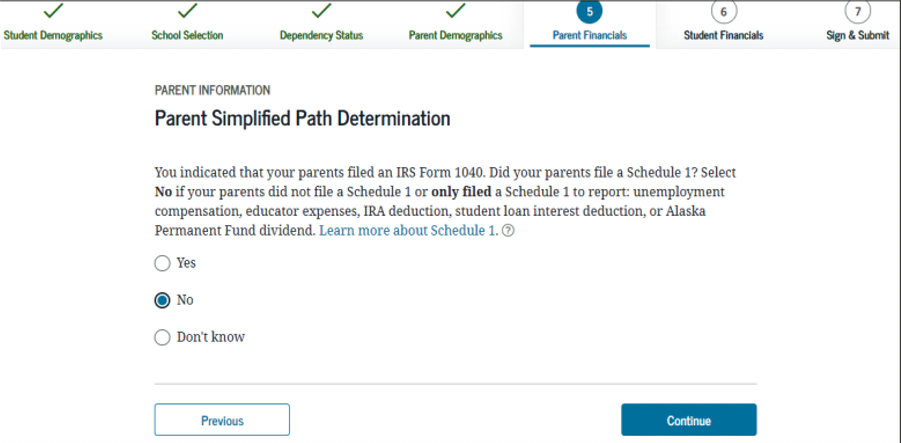

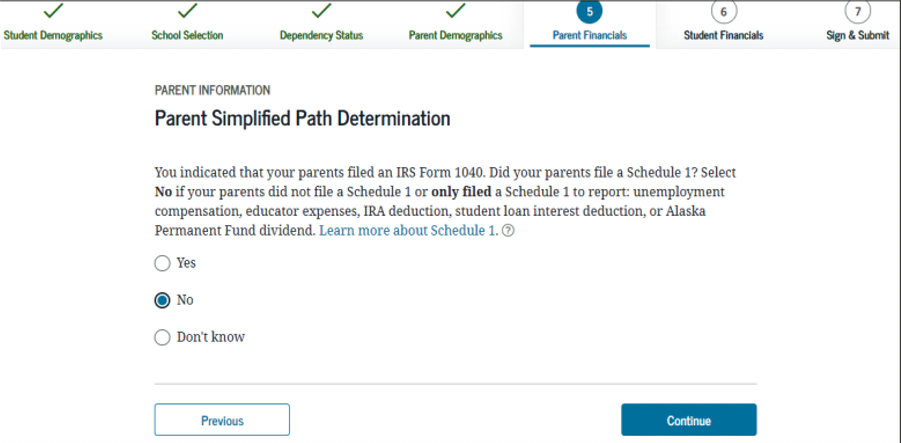

How To Answer FAFSA Question 79 Parent s Eligibility For Schedule 1

Your 2019 Guide To Student Loan Interest Deduction

How To Get The Student Loan Interest Deduction NerdWallet

Student Loan Interest Deduction Are You Eligible LendEDU

Can I Claim Student Loan Interest Deduction College Raptor

https://www.forbes.com/advisor/taxes/student-loan...

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

https://www.irs.gov/taxtopics/tc456

You claim this deduction as an adjustment to income so you don t need to itemize your deductions You can claim the deduction if all of the following apply You

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

You claim this deduction as an adjustment to income so you don t need to itemize your deductions You can claim the deduction if all of the following apply You

How To Get The Student Loan Interest Deduction NerdWallet

How To Answer FAFSA Question 79 Parent s Eligibility For Schedule 1

Student Loan Interest Deduction Are You Eligible LendEDU

Can I Claim Student Loan Interest Deduction College Raptor

3 Ways Student Loans Affect Your Taxes

Can You Claim A Student Loan Tax Deduction Student Loan Planner

Can You Claim A Student Loan Tax Deduction Student Loan Planner

Can I Get A Student Loan Tax Deduction TheStreet