Today, with screens dominating our lives yet the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses and creative work, or simply to add a personal touch to your area, Tax Deduction On Salary In India 2022 have become a valuable resource. We'll dive through the vast world of "Tax Deduction On Salary In India 2022," exploring what they are, how you can find them, and how they can enrich various aspects of your life.

Get Latest Tax Deduction On Salary In India 2022 Below

Tax Deduction On Salary In India 2022

Tax Deduction On Salary In India 2022 -

Advisory Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct position prevailing law before relying upon

Standard Deduction For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried

Tax Deduction On Salary In India 2022 provide a diverse range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in numerous formats, such as worksheets, coloring pages, templates and much more. The attraction of printables that are free is in their variety and accessibility.

More of Tax Deduction On Salary In India 2022

Salary Break Up Calculator Online LaynaCsenge

Salary Break Up Calculator Online LaynaCsenge

Calculate Deductions You can claim deductions under various sections of the Income Tax Act such as Section 80C for investments like Provident Fund PPF or life

A quick and efficient way to compare annual salaries in India in 2022 review j2 tax deductions for annual j2 in India and estimate your 2022 tax returns for your Annual

Tax Deduction On Salary In India 2022 have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization Your HTML0 customization options allow you to customize printables to your specific needs such as designing invitations planning your schedule or even decorating your home.

-

Education Value Education-related printables at no charge are designed to appeal to students of all ages, making these printables a powerful tool for parents and teachers.

-

Easy to use: The instant accessibility to numerous designs and templates will save you time and effort.

Where to Find more Tax Deduction On Salary In India 2022

Standard Deduction On Salary For AY 2022 23 New Tax Route

Standard Deduction On Salary For AY 2022 23 New Tax Route

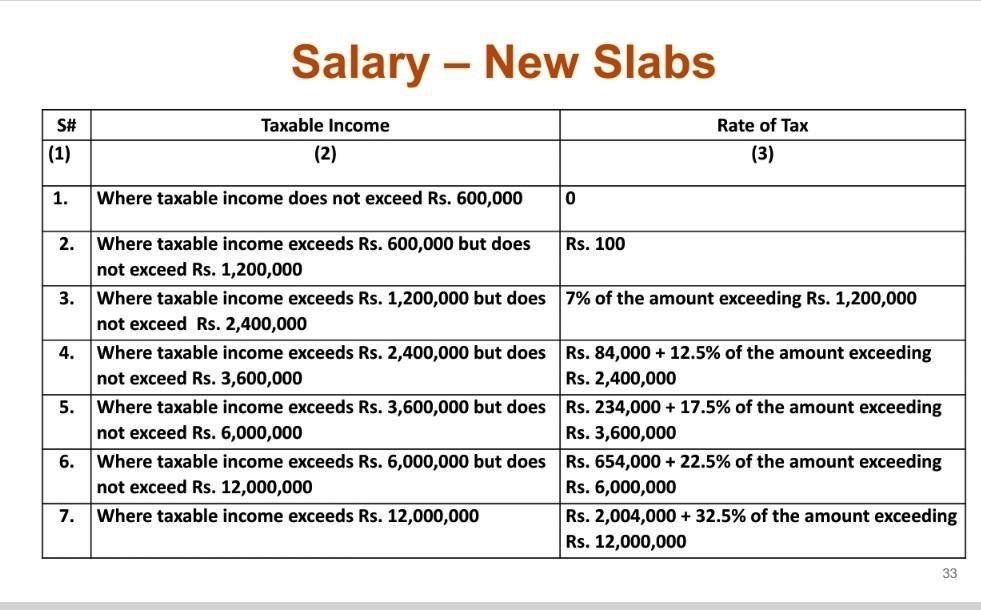

Latest Income Tax Slab Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax

The income tax department of India has notified new ITR forms for the financial year 2022 23 Nirmala Sitharaman also proposed a reduction in corporate surcharge and said that the transfer of any virtual

Now that we've ignited your curiosity about Tax Deduction On Salary In India 2022 Let's look into where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Tax Deduction On Salary In India 2022 designed for a variety goals.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a wide selection of subjects, all the way from DIY projects to party planning.

Maximizing Tax Deduction On Salary In India 2022

Here are some unique ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Tax Deduction On Salary In India 2022 are an abundance of useful and creative resources that meet a variety of needs and needs and. Their access and versatility makes these printables a useful addition to the professional and personal lives of both. Explore the many options of Tax Deduction On Salary In India 2022 to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes, they are! You can print and download these tools for free.

-

Does it allow me to use free printables in commercial projects?

- It's dependent on the particular rules of usage. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright issues with Tax Deduction On Salary In India 2022?

- Some printables may contain restrictions in their usage. You should read the terms and conditions offered by the creator.

-

How can I print Tax Deduction On Salary In India 2022?

- You can print them at home with the printer, or go to an in-store print shop to get premium prints.

-

What program do I require to view printables for free?

- The majority of printed documents are in PDF format. These can be opened using free software such as Adobe Reader.

Standard Deduction On Salary In India 2023 Limits Calims

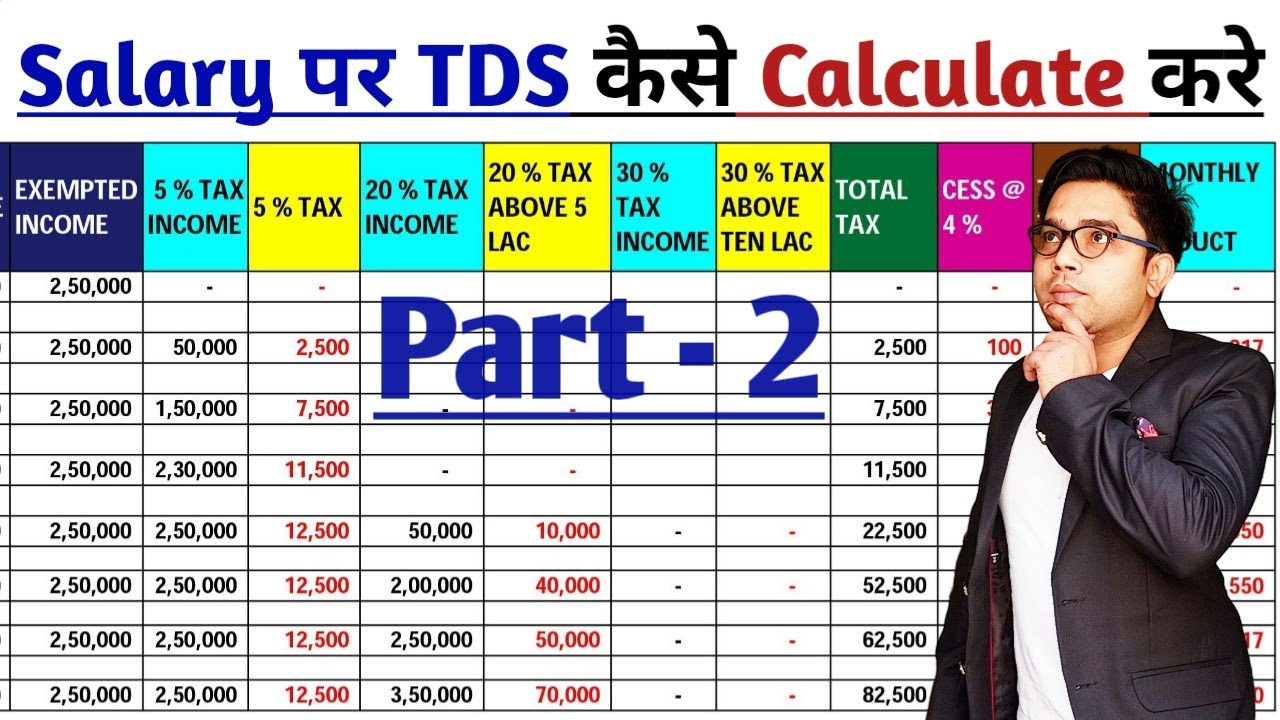

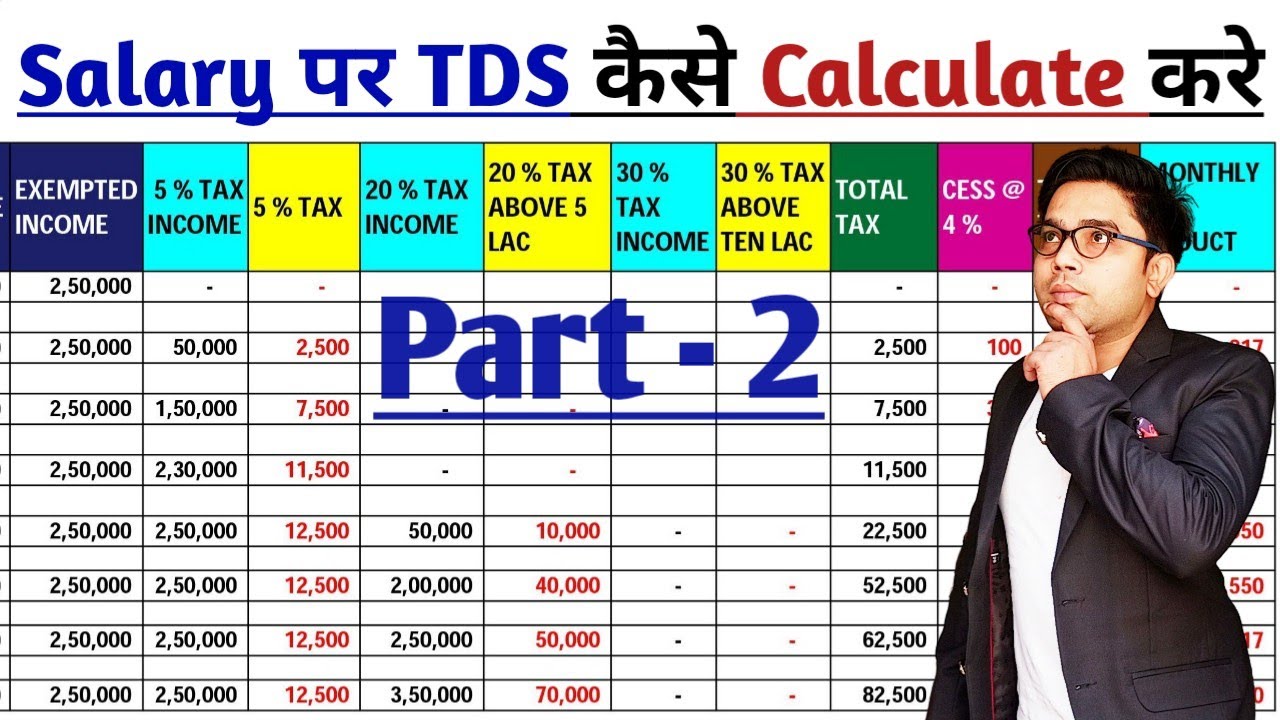

TDS On Salary Calculation Tax Deduction On Salary FinCalC

Check more sample of Tax Deduction On Salary In India 2022 below

Tax Deduction On Salary Budget 2023 24 Income Tax On Income From

Standard Deduction 2020 Self Employed Standard Deduction 2021

Income Tax Slabs Year 2022 23 Info Ghar Educational News

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

TDS On Salary Calculation Tax Deduction On Salary FinCalC

https://cleartax.in/s/income-tax-allowances-and-deductions

Standard Deduction For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried

https://www.incometax.gov.in/iec/foportal/income-tax-calculator

Overview The Income and Tax Calculator service enables both registered and unregistered e Filing users to calculate tax as per the provisions of Income Tax Act Income tax

Standard Deduction For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried

Overview The Income and Tax Calculator service enables both registered and unregistered e Filing users to calculate tax as per the provisions of Income Tax Act Income tax

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

TDS On Salary Calculation Tax Deduction On Salary FinCalC

Irs Tax Refund Calculator 2022 Kitchen Cabinet

2023 Tax Tables Australia IMAGESEE

2023 Tax Tables Australia IMAGESEE

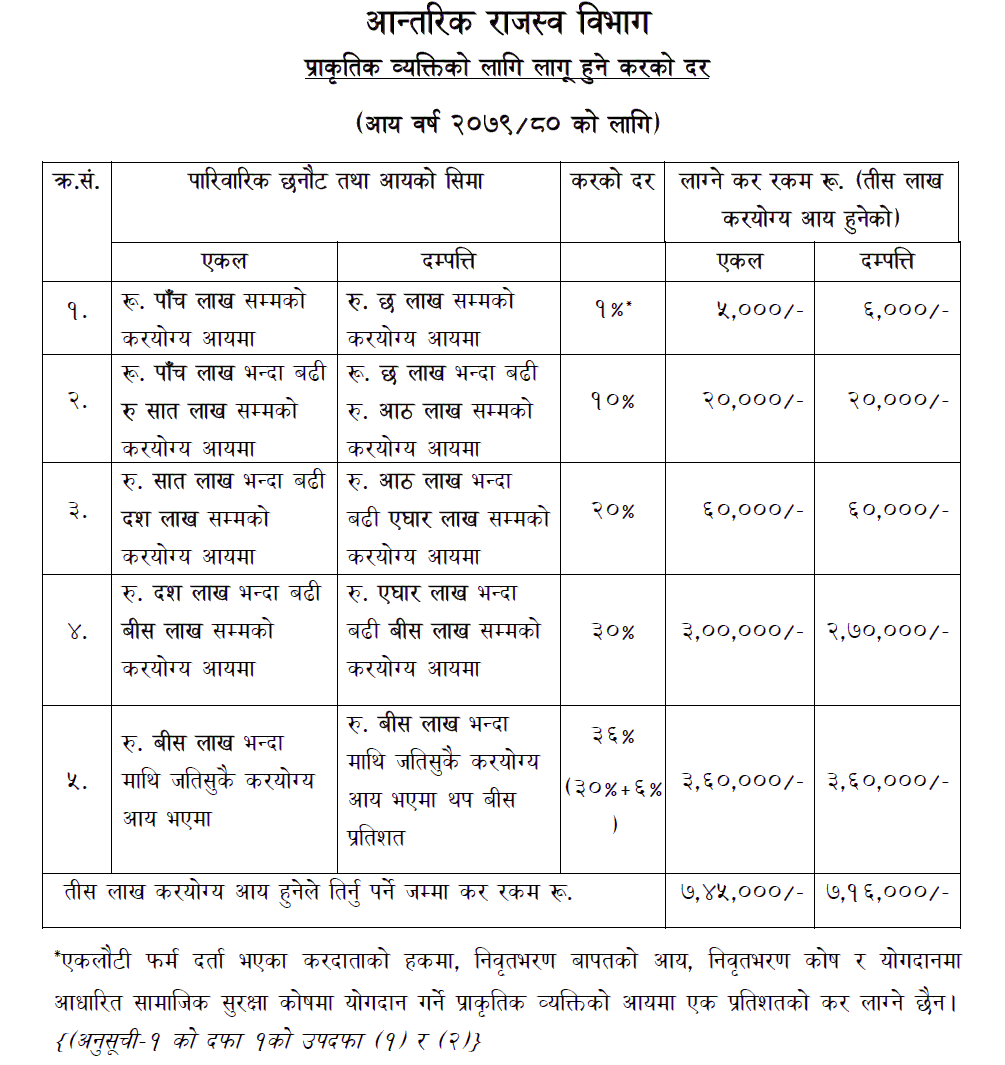

Income Tax Rate In Nepal For Fiscal Year 2079 80 For Natural Person