In the age of digital, with screens dominating our lives but the value of tangible printed materials isn't diminishing. Be it for educational use, creative projects, or just adding an extra personal touch to your space, Tax Deduction On Medical Expenses Of Senior Citizens have become a valuable source. Here, we'll take a dive deeper into "Tax Deduction On Medical Expenses Of Senior Citizens," exploring what they are, how you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Tax Deduction On Medical Expenses Of Senior Citizens Below

Tax Deduction On Medical Expenses Of Senior Citizens

Tax Deduction On Medical Expenses Of Senior Citizens -

If you re married filing jointly or separately the extra standard deduction amount is 1 500 per qualifying individual If you are 65 or older and blind the extra standard deduction is 3 700

Medical expenses that are tax deductible include Items such as false teeth eyeglasses hearing aids artificial limbs and wheelchairs Hospital service fees such as lab work therapy nursing services and surgery Medical services fees from doctors dentists surgeons and specialists

Tax Deduction On Medical Expenses Of Senior Citizens include a broad range of printable, free content that can be downloaded from the internet at no cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages and more. The appealingness of Tax Deduction On Medical Expenses Of Senior Citizens is their flexibility and accessibility.

More of Tax Deduction On Medical Expenses Of Senior Citizens

Tax Back On Medical And Dental Expenses My Tax Rebate

Tax Back On Medical And Dental Expenses My Tax Rebate

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions TABLE OF CONTENTS Deducting medical expenses How to claim medical expense deductions

When Medical Expenses Are Tax Deductible Many medical expenses can be tax deductible but the rules have always been complicated To qualify for this tax break you need to itemize your deductions and then you can only deduct the expenses after they exceed 7 5 of your adjusted gross income

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Customization: They can make printables to your specific needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: Education-related printables at no charge offer a wide range of educational content for learners from all ages, making them a valuable instrument for parents and teachers.

-

Convenience: Access to numerous designs and templates helps save time and effort.

Where to Find more Tax Deduction On Medical Expenses Of Senior Citizens

Tax Q A Medical Expenses Of Seniors During Personal Injury Recovery

Tax Q A Medical Expenses Of Seniors During Personal Injury Recovery

You can deduct the amount of your medical and dental expenses that exceed 7 5 of your adjusted gross income AGI If you have very little income during retirement then the deduction may not help you Many people who receive only Social Security benefits during retirement do not need to file taxes at all

Medical and Dental Expenses You can deduct certain medical and dental expenses you paid for yourself your spouse and your dependent s if you itemize your deductions on Schedule A Form 1040 Table 4 1 shows some common items that you can or can t include in figuring your medical expense deduction For more information see the following

We've now piqued your curiosity about Tax Deduction On Medical Expenses Of Senior Citizens We'll take a look around to see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Tax Deduction On Medical Expenses Of Senior Citizens suitable for many needs.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a broad range of interests, everything from DIY projects to planning a party.

Maximizing Tax Deduction On Medical Expenses Of Senior Citizens

Here are some ideas for you to get the best use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Deduction On Medical Expenses Of Senior Citizens are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and needs and. Their availability and versatility make them a wonderful addition to both professional and personal life. Explore the endless world of Tax Deduction On Medical Expenses Of Senior Citizens right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Deduction On Medical Expenses Of Senior Citizens really gratis?

- Yes you can! You can download and print these resources at no cost.

-

Can I use the free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may have restrictions in use. Check the conditions and terms of use provided by the creator.

-

How can I print printables for free?

- Print them at home using either a printer or go to a local print shop to purchase the highest quality prints.

-

What program do I need in order to open printables at no cost?

- The majority are printed with PDF formats, which can be opened with free software, such as Adobe Reader.

How To Save On Medical Expenses Small Steps With Big Results Hosbeg

7 Surprising Medical Expenses That Are Tax Deductible GoodRx

Check more sample of Tax Deduction On Medical Expenses Of Senior Citizens below

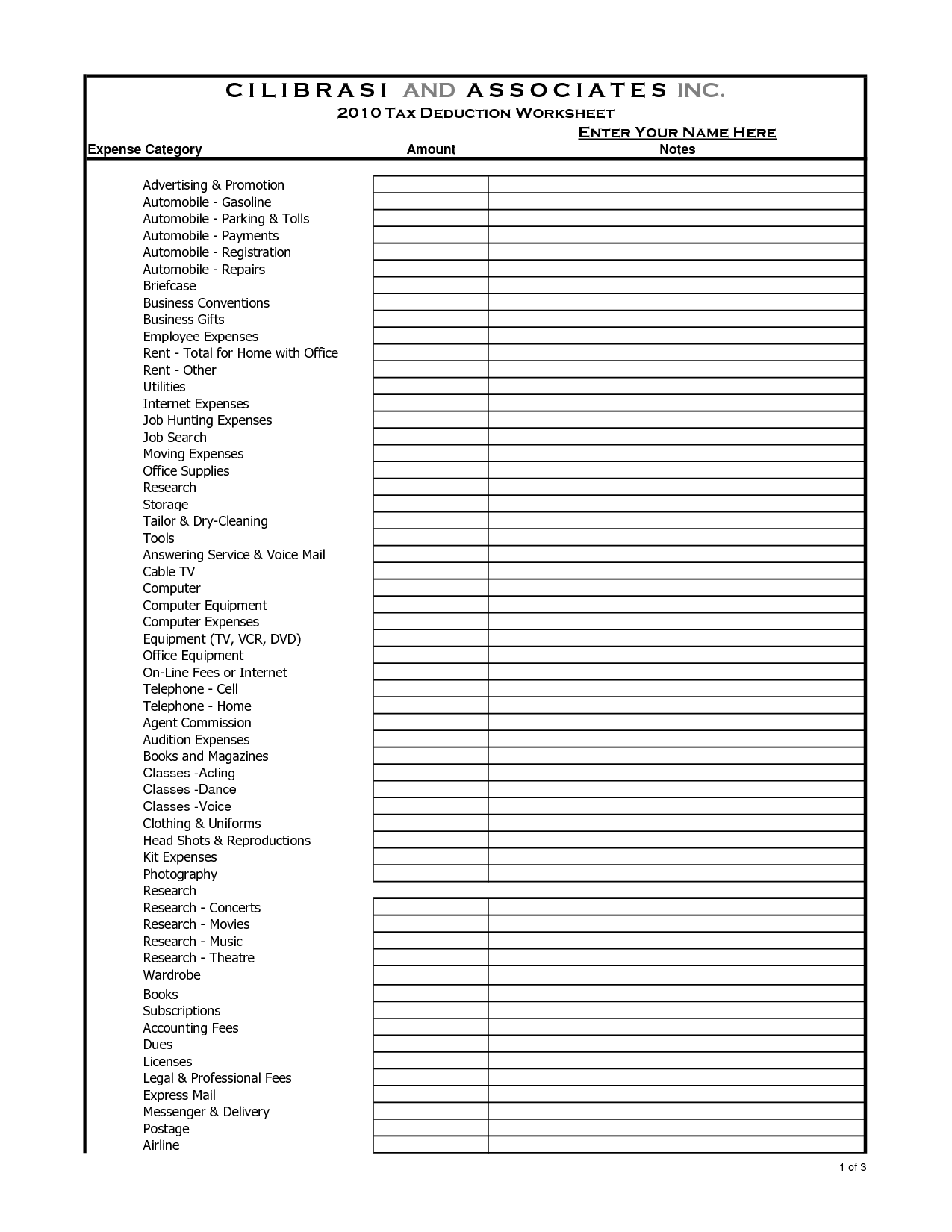

16 Tax Organizer Worksheet Worksheeto

2021 Taxes For Retirees Explained Cardinal Guide

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

Skills Of Senior Citizens An Untapped Resource

Report Consumers Out of pocket Medical Expenses Rising

50 Secrets Maximizing Tax Deductions On Medical Expenses 2023

https://www.seniorliving.org/finance/tax-deductions

Medical expenses that are tax deductible include Items such as false teeth eyeglasses hearing aids artificial limbs and wheelchairs Hospital service fees such as lab work therapy nursing services and surgery Medical services fees from doctors dentists surgeons and specialists

https://m.economictimes.com/wealth/tax/your-senior...

Budget 2018 amended Section 80D of the Income tax Act which allows a deduction for medical expenditure incurred on senior citizens However senior citizens must not be covered under any health insurance policy Do keep in mind that this deduction can be claimed only under the old tax regime

Medical expenses that are tax deductible include Items such as false teeth eyeglasses hearing aids artificial limbs and wheelchairs Hospital service fees such as lab work therapy nursing services and surgery Medical services fees from doctors dentists surgeons and specialists

Budget 2018 amended Section 80D of the Income tax Act which allows a deduction for medical expenditure incurred on senior citizens However senior citizens must not be covered under any health insurance policy Do keep in mind that this deduction can be claimed only under the old tax regime

Skills Of Senior Citizens An Untapped Resource

2021 Taxes For Retirees Explained Cardinal Guide

Report Consumers Out of pocket Medical Expenses Rising

50 Secrets Maximizing Tax Deductions On Medical Expenses 2023

Preventive Check Up 80d Wkcn

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto