In a world when screens dominate our lives but the value of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply to add an individual touch to your space, Tax Deduction On Electric Scooter are now a useful source. Here, we'll dive into the world of "Tax Deduction On Electric Scooter," exploring what they are, where they can be found, and how they can improve various aspects of your daily life.

Get Latest Tax Deduction On Electric Scooter Below

Tax Deduction On Electric Scooter

Tax Deduction On Electric Scooter -

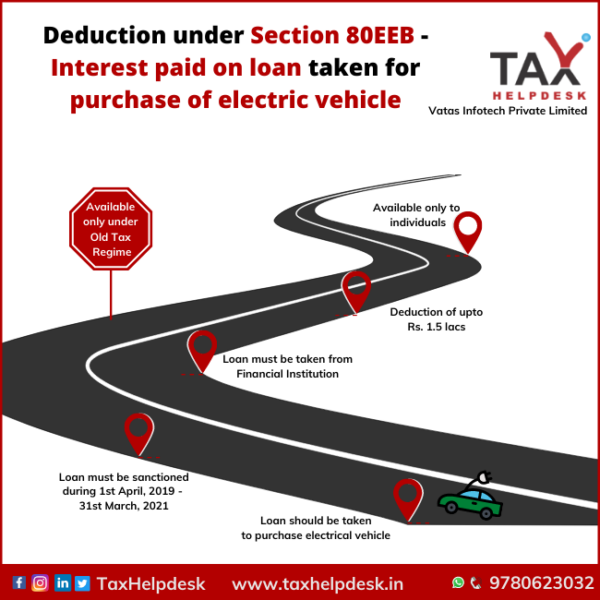

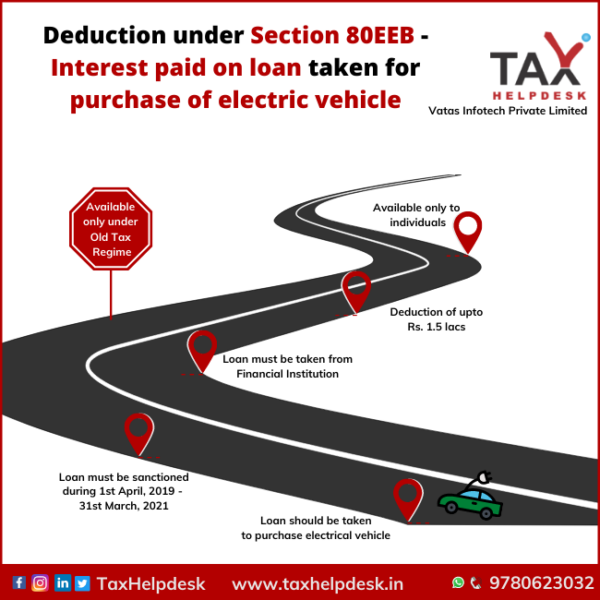

When paying off an EV loan a total tax exemption of up to Rs 1 50 000 is available under section 80EEB This tax break is applicable for both four wheeler and two wheeler electric vehicle purchases

You can get a maximum electricity tax credit of 2 400 from a single electricity meter if you have paid 6 000 for your electricity In addition to the tax credit for electricity a tax credit for household expenses such as renovations is granted separately according to the usual maximum amounts of household expenses 2 250 or 3 500

Printables for free include a vast assortment of printable documents that can be downloaded online at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and much more. The value of Tax Deduction On Electric Scooter lies in their versatility and accessibility.

More of Tax Deduction On Electric Scooter

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

Internal Revenue Code Section 30D g currently provides a credit for qualified 2 wheeled plug in electric vehicles The amount of the credit is 10 percent of the cost of any qualified 2 wheeled plug in electric vehicle placed in service by the taxpayer during the taxable year and cannot exceed 2 500

Explore the various tax implications and incentives associated with owning an electric scooter such as sales tax VAT and licensing fees Learn how these factors can vary depending on location and scooter type and how to

Tax Deduction On Electric Scooter have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Personalization You can tailor print-ready templates to your specific requirements, whether it's designing invitations or arranging your schedule or even decorating your home.

-

Educational Worth: Education-related printables at no charge can be used by students of all ages, which makes these printables a powerful resource for educators and parents.

-

The convenience of Fast access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Tax Deduction On Electric Scooter

Planning To Buy Electric Car Bike Scooter 80EEB Deduction shorts

Planning To Buy Electric Car Bike Scooter 80EEB Deduction shorts

A deduction of up to Rs 1 50 000 for interest payments is available under Section 80EEB Whether an individual taxpayer possesses an electric vehicle for personal or business use this deduction allows for

With this new announcement the upper cap has been brought down to a maximum of 15 of an electric vehicle s cost starting 1st June 2023 For example if you buy an electric scooter before 1st June the maximum subsidy amount that you would have got was Rs 40 000 However after 1st June the subsidy amount has been capped at Rs 15 000

Now that we've ignited your interest in Tax Deduction On Electric Scooter We'll take a look around to see where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Tax Deduction On Electric Scooter designed for a variety motives.

- Explore categories like decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs covered cover a wide range of topics, that range from DIY projects to planning a party.

Maximizing Tax Deduction On Electric Scooter

Here are some unique ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Deduction On Electric Scooter are a treasure trove of useful and creative resources that cater to various needs and preferences. Their accessibility and flexibility make them a valuable addition to each day life. Explore the vast array of Tax Deduction On Electric Scooter to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Tax Deduction On Electric Scooter really available for download?

- Yes you can! You can print and download these materials for free.

-

Does it allow me to use free printables for commercial use?

- It's contingent upon the specific usage guidelines. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions in their usage. Be sure to review these terms and conditions as set out by the author.

-

How do I print Tax Deduction On Electric Scooter?

- You can print them at home with a printer or visit a local print shop to purchase high-quality prints.

-

What software will I need to access printables at no cost?

- The majority of printables are in PDF format. These is open with no cost software, such as Adobe Reader.

Newest Scooter For Lady Two Wheeler Electric Scooter Free Tax Door To

Download Profit And Loss Statement Template 02 In 2022 Profit And

Check more sample of Tax Deduction On Electric Scooter below

Section 80EEB Of Income Tax Act Deduction On Purchase Of Electric Vehicle

Deduction On Electrical Vehicle For Interest Paid On Loan

Vespa VTS Donated To Habitat For Humanity Car Donation Wizard

Tax Benefits On Electric Car Bike Scooter Loan How To Get Tax

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Tax Benefits On Electric Vehicles In India

https://www.vero.fi/en/individuals/tax-cards-and...

You can get a maximum electricity tax credit of 2 400 from a single electricity meter if you have paid 6 000 for your electricity In addition to the tax credit for electricity a tax credit for household expenses such as renovations is granted separately according to the usual maximum amounts of household expenses 2 250 or 3 500

https://ebobbike.com/tax-benefits-on-e-scooters-and-e-bikes

For an E scooter with a minimum value of 2 500 applies a 13 5 deduction of half of the purchase price you can subtract from your profits Therefore you will pay less taxes over your profits However the MIA regulation does not apply to the E bike bike with electric pedal assistance

You can get a maximum electricity tax credit of 2 400 from a single electricity meter if you have paid 6 000 for your electricity In addition to the tax credit for electricity a tax credit for household expenses such as renovations is granted separately according to the usual maximum amounts of household expenses 2 250 or 3 500

For an E scooter with a minimum value of 2 500 applies a 13 5 deduction of half of the purchase price you can subtract from your profits Therefore you will pay less taxes over your profits However the MIA regulation does not apply to the E bike bike with electric pedal assistance

Tax Benefits On Electric Car Bike Scooter Loan How To Get Tax

Deduction On Electrical Vehicle For Interest Paid On Loan

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Tax Benefits On Electric Vehicles In India

Electric Scooter Health Benefits In Lichfield Okai Neon Pro

Tax Deduction On Payment To Release Bumi Lot Sep 01 2022 Johor

Tax Deduction On Payment To Release Bumi Lot Sep 01 2022 Johor

Section 194K Tax Deduction On Income From Mutual Fund Units