In this digital age, where screens rule our lives, the charm of tangible printed items hasn't gone away. Be it for educational use as well as creative projects or just adding an element of personalization to your space, Tax Deduction Moving Expenses 2022 have become an invaluable resource. This article will dive into the world "Tax Deduction Moving Expenses 2022," exploring what they are, how to find them, and how they can enhance various aspects of your lives.

Get Latest Tax Deduction Moving Expenses 2022 Below

Tax Deduction Moving Expenses 2022

Tax Deduction Moving Expenses 2022 -

Are Moving Expenses Tax Deductible Tax Reform Eliminated These Deductions for Most Taxpayers By William Perez Updated on May 19 2022 Reviewed by Ebony J Howard In This

You can deduct the expenses of moving your household goods and personal effects including expenses for hauling a trailer packing crating in transit

Tax Deduction Moving Expenses 2022 provide a diverse array of printable materials online, at no cost. These resources come in various kinds, including worksheets templates, coloring pages and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Tax Deduction Moving Expenses 2022

When Can You Claim Moving Expenses As A Tax Deduction

When Can You Claim Moving Expenses As A Tax Deduction

Information for those who moved to or from Canada or between two locations outside Canada Completing your tax and benefit return How to calculate and claim your

The flat rate for a job related move in 2022 is 18 cents per mile plus tolls and parking fees Finally in a corresponding move the TCJA suspended the tax

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Personalization This allows you to modify printed materials to meet your requirements for invitations, whether that's creating them or arranging your schedule or even decorating your home.

-

Educational value: Printing educational materials for no cost can be used by students from all ages, making them an invaluable resource for educators and parents.

-

Affordability: Fast access a variety of designs and templates reduces time and effort.

Where to Find more Tax Deduction Moving Expenses 2022

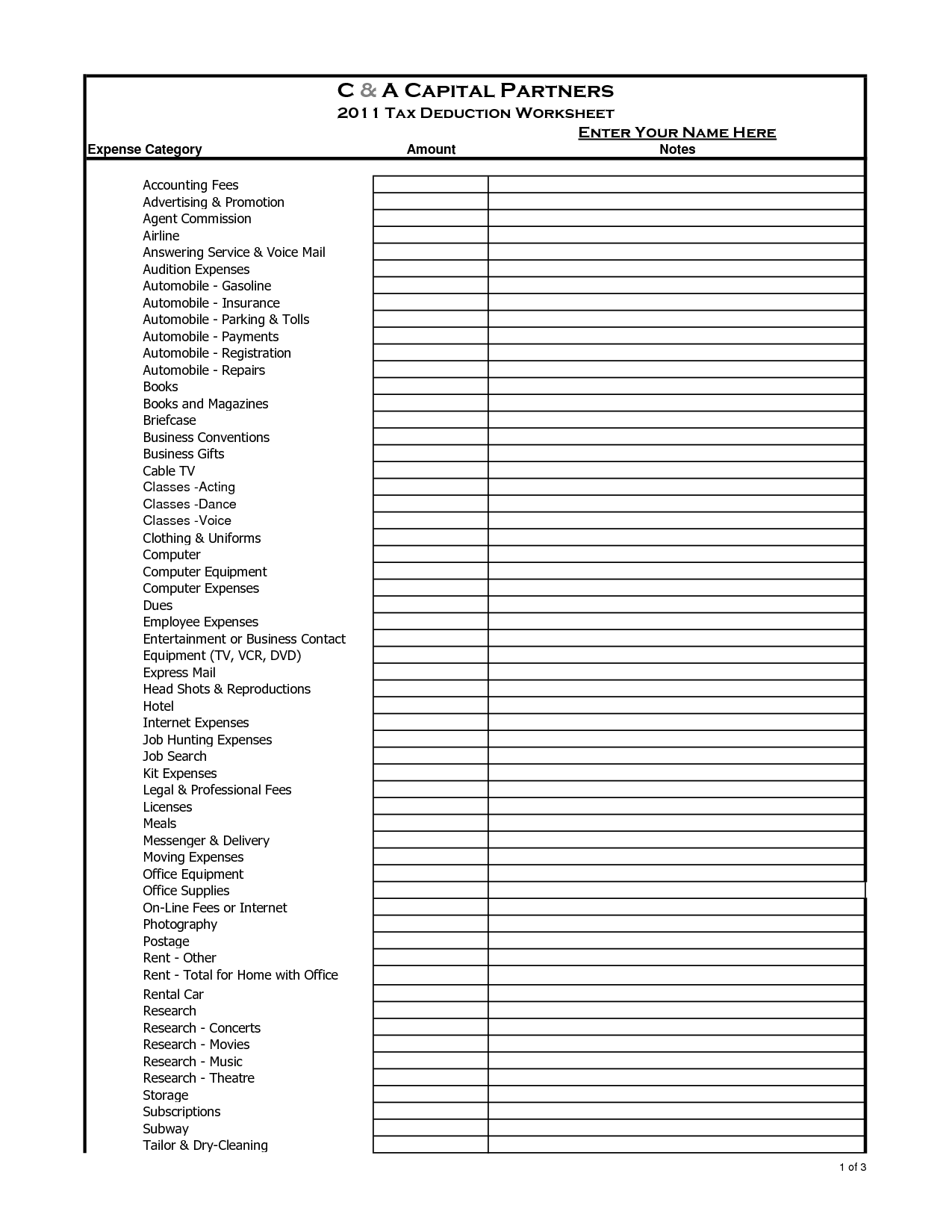

Tax Deductible Moving Expenses Moving Expenses Tax Deductions Deduction

Tax Deductible Moving Expenses Moving Expenses Tax Deductions Deduction

Use Form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work workplace If the new workplace is

However like most things IRS there are always some restrictions limitations and qualifications on who can claim a tax deduction We ll go through some of the basics and then get in to

Now that we've ignited your curiosity about Tax Deduction Moving Expenses 2022, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Tax Deduction Moving Expenses 2022 to suit a variety of needs.

- Explore categories such as decoration for your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs are a vast range of interests, starting from DIY projects to planning a party.

Maximizing Tax Deduction Moving Expenses 2022

Here are some ways how you could make the most use of Tax Deduction Moving Expenses 2022:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to aid in learning at your home as well as in the class.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Deduction Moving Expenses 2022 are a treasure trove of useful and creative resources that can meet the needs of a variety of people and desires. Their accessibility and versatility make them an essential part of both professional and personal life. Explore the vast collection that is Tax Deduction Moving Expenses 2022 today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes you can! You can print and download these items for free.

-

Can I utilize free templates for commercial use?

- It's all dependent on the terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may have restrictions on use. You should read the terms and conditions set forth by the creator.

-

How do I print Tax Deduction Moving Expenses 2022?

- You can print them at home with any printer or head to any local print store for higher quality prints.

-

What program do I need in order to open printables free of charge?

- The majority of printables are in the PDF format, and is open with no cost software, such as Adobe Reader.

IRS Moving Expense Tax Deduction Guide Moving Expenses Deduction

Moving Expenses During And After College

Check more sample of Tax Deduction Moving Expenses 2022 below

Miami Moving Tax Deduction Terms I Orange Movers Miami

How To Qualify For Tax Deductible Moving Expenses Moving Expenses

Are My Moving Expenses Tax Deductible MIC S MOVING

Tax Deduction For Moving Expenses

Are Moving Expenses Tax Deductible Under The New Tax Bill

Just Moved Make The Most Of Your Moving Expenses Tax Deduction Home

https://www.irs.gov/instructions/i3903

You can deduct the expenses of moving your household goods and personal effects including expenses for hauling a trailer packing crating in transit

https://turbotax.intuit.com/tax-tips/jobs-and...

You can deduct your unreimbursed moving expenses for you your spouse and your dependents You can t deduct expenses that are reimbursed or paid for directly by the

You can deduct the expenses of moving your household goods and personal effects including expenses for hauling a trailer packing crating in transit

You can deduct your unreimbursed moving expenses for you your spouse and your dependents You can t deduct expenses that are reimbursed or paid for directly by the

Tax Deduction For Moving Expenses

How To Qualify For Tax Deductible Moving Expenses Moving Expenses

Are Moving Expenses Tax Deductible Under The New Tax Bill

Just Moved Make The Most Of Your Moving Expenses Tax Deduction Home

Unpacking The Moving Expense Deduction Deducting Moving Expenses

Are Moving Expenses Tax Deductible

Are Moving Expenses Tax Deductible

8 Tax Preparation Organizer Worksheet Worksheeto