Today, in which screens are the norm and the appeal of physical printed items hasn't gone away. For educational purposes and creative work, or just adding an extra personal touch to your space, Tax Deduction For Individual Health Insurance Premiums are now an essential source. The following article is a take a dive to the depths of "Tax Deduction For Individual Health Insurance Premiums," exploring what they are, how to find them and how they can improve various aspects of your daily life.

Get Latest Tax Deduction For Individual Health Insurance Premiums Below

Tax Deduction For Individual Health Insurance Premiums

Tax Deduction For Individual Health Insurance Premiums -

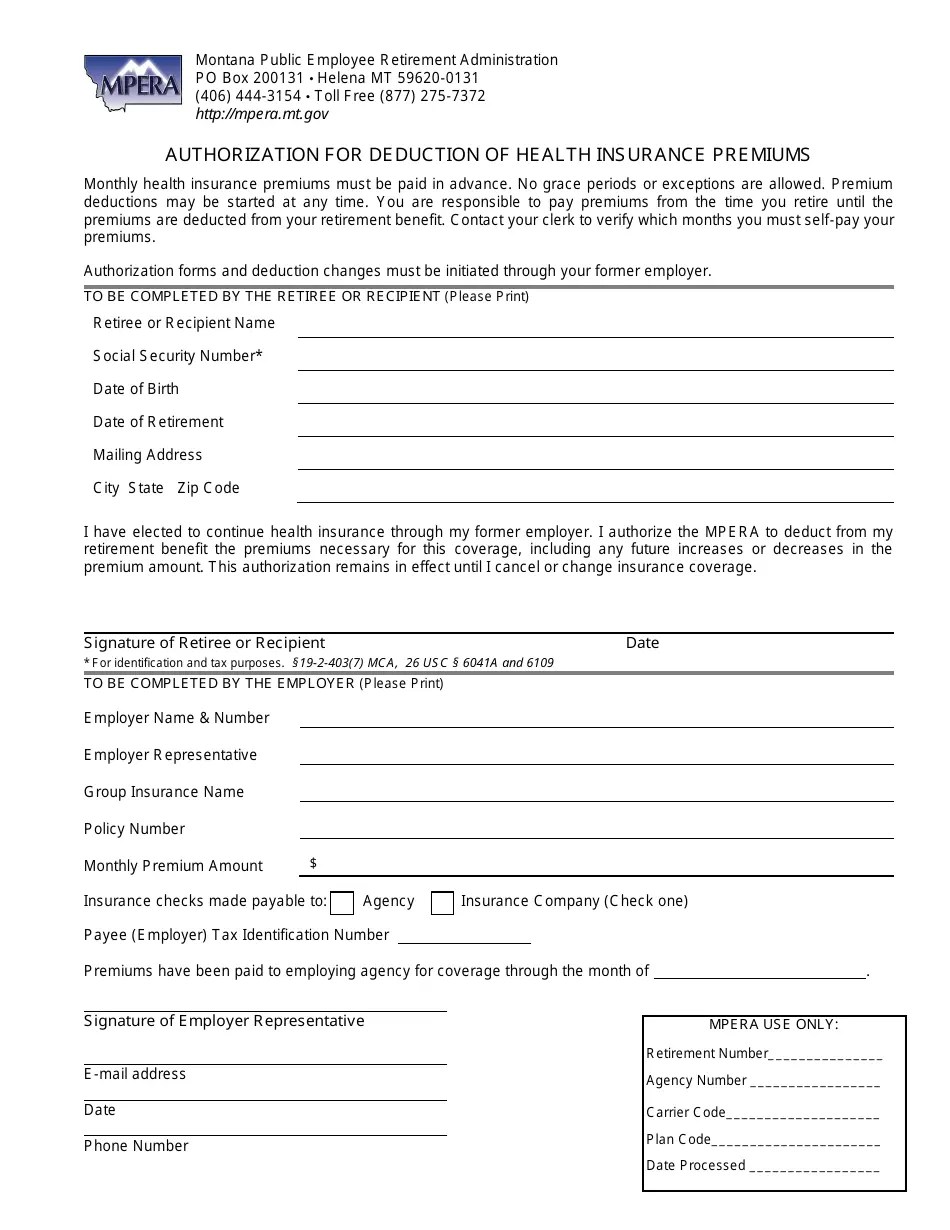

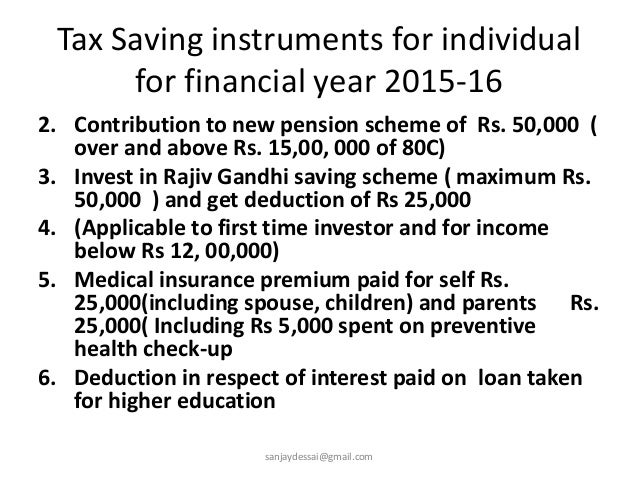

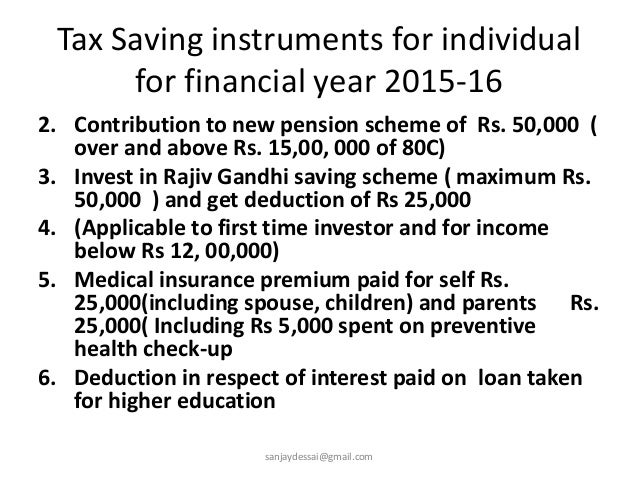

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes

Tax Deduction For Individual Health Insurance Premiums encompass a wide variety of printable, downloadable materials online, at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and more. The appealingness of Tax Deduction For Individual Health Insurance Premiums is their flexibility and accessibility.

More of Tax Deduction For Individual Health Insurance Premiums

Governor Hogan Announces Third Consecutive Year Of Lower Individual

Governor Hogan Announces Third Consecutive Year Of Lower Individual

You may qualify for an income based premium subsidy also called an advance premium tax credit APTC for coverage you bought through the Health Insurance Marketplace Any premium you

You may be eligible to deduct health insurance premiums on your taxes if you pay for your own insurance and meet certain requirements The self employed health insurance deduction allows you

Tax Deduction For Individual Health Insurance Premiums have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Flexible: It is possible to tailor the design to meet your needs for invitations, whether that's creating them planning your schedule or even decorating your home.

-

Educational Value Free educational printables offer a wide range of educational content for learners of all ages. This makes them an essential tool for parents and teachers.

-

Accessibility: Quick access to various designs and templates, which saves time as well as effort.

Where to Find more Tax Deduction For Individual Health Insurance Premiums

When Can You Claim A Tax Deduction For Health Insurance

When Can You Claim A Tax Deduction For Health Insurance

Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the

Now that we've ignited your curiosity about Tax Deduction For Individual Health Insurance Premiums We'll take a look around to see where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Tax Deduction For Individual Health Insurance Premiums designed for a variety applications.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a wide selection of subjects, that range from DIY projects to planning a party.

Maximizing Tax Deduction For Individual Health Insurance Premiums

Here are some ideas in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Utilize free printable worksheets to aid in learning at your home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Deduction For Individual Health Insurance Premiums are a treasure trove of practical and imaginative resources that can meet the needs of a variety of people and pursuits. Their availability and versatility make them a wonderful addition to both professional and personal life. Explore the many options of Tax Deduction For Individual Health Insurance Premiums today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes they are! You can download and print these tools for free.

-

Can I use free printouts for commercial usage?

- It's all dependent on the terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright concerns when using Tax Deduction For Individual Health Insurance Premiums?

- Certain printables could be restricted on usage. Be sure to review these terms and conditions as set out by the designer.

-

How do I print printables for free?

- Print them at home using your printer or visit an area print shop for more high-quality prints.

-

What program do I require to open printables for free?

- Many printables are offered in PDF format. These can be opened with free programs like Adobe Reader.

Before We Can Evaluate The Impact Of The Affordable Care Act On Health

Employee Deductions For Health Insurance Financial Report

Check more sample of Tax Deduction For Individual Health Insurance Premiums below

Iditarod Race Standings Top 5 Mushers 03 11 LGF Pages

Security Mutual Life Insurance ClientLine Newsletter December 2019

New Law Allows Small Employers To Pay Premiums For Individual Policies

Annual Enrollment Period November 1st Through December 15th Group

Tax Deduction Template

Rural Areas Have Higher Individual Health Insurance Premiums And Fewer

https://www.forbes.com/advisor/health-insur…

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes

https://www.verywellhealth.com/are-my-health...

Health insurance premiums can generally be paid with pre tax dollars For most people this just means that their employer sponsored health insurance is

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes

Health insurance premiums can generally be paid with pre tax dollars For most people this just means that their employer sponsored health insurance is

Annual Enrollment Period November 1st Through December 15th Group

Security Mutual Life Insurance ClientLine Newsletter December 2019

Tax Deduction Template

Rural Areas Have Higher Individual Health Insurance Premiums And Fewer

An Affordable Alternative To Traditional Health Insurance Health

Individual Health Insurance Tax Deduction Individual Health Insurance

Individual Health Insurance Tax Deduction Individual Health Insurance

:max_bytes(150000):strip_icc()/patient-giving-nurse-medical-identification-card-in-clinic-603707297-578d3dd75f9b584d2022dd8b-e7bcb7b40cf14ca295dd94a4ffa8ccef.jpg)

Do Employers Reimburse Individual Health Insurance Premiums