In a world where screens dominate our lives, the charm of tangible printed items hasn't gone away. No matter whether it's for educational uses or creative projects, or simply adding an individual touch to the area, Tax Deduction For Health Care Premiums have proven to be a valuable resource. For this piece, we'll take a dive into the world of "Tax Deduction For Health Care Premiums," exploring their purpose, where they are, and ways they can help you improve many aspects of your daily life.

Get Latest Tax Deduction For Health Care Premiums Below

Tax Deduction For Health Care Premiums

Tax Deduction For Health Care Premiums -

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower the amount of money you owe the IRS come April

Tax Deduction For Health Care Premiums cover a large assortment of printable items that are available online at no cost. They come in many forms, including worksheets, templates, coloring pages and many more. The appealingness of Tax Deduction For Health Care Premiums is their flexibility and accessibility.

More of Tax Deduction For Health Care Premiums

Health Insurance Costs Premiums Deductibles Co Pays Co Insurance

Health Insurance Costs Premiums Deductibles Co Pays Co Insurance

Amounts paid for insurance premiums to cover medical care or qualified long term care Certain costs related to nutrition wellness and general health are considered medical expenses More information about qualifications can be found in the Frequently asked questions about medical expenses related to nutrition wellness and

Updated on April 15 2024 Key takeaways Your health insurance premiums may be tax deductible depending on whether you itemize deductions your total medical costs employment status and other factors

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: The Customization feature lets you tailor printed materials to meet your requirements be it designing invitations and schedules, or even decorating your home.

-

Educational value: Printing educational materials for no cost cater to learners of all ages, making them a great tool for parents and educators.

-

Affordability: Instant access to a variety of designs and templates helps save time and effort.

Where to Find more Tax Deduction For Health Care Premiums

Qualified Business Income Deduction And The Self Employed The CPA Journal

Qualified Business Income Deduction And The Self Employed The CPA Journal

Updated May 22 2024 You can claim your health insurance premiums on your federal taxes if you buy your own health insurance itemize deductions and spent more than 7 5 of your income on medical expenses

Since there s no double dipping allowed you can t deduct your health insurance premiums on your tax return if they were already paid with pre tax money throughout the year i e deducted from your paycheck before your

Now that we've ignited your interest in Tax Deduction For Health Care Premiums Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Tax Deduction For Health Care Premiums for a variety motives.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- It is ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- The blogs covered cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Tax Deduction For Health Care Premiums

Here are some new ways in order to maximize the use use of Tax Deduction For Health Care Premiums:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to build your knowledge at home and in class.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Tax Deduction For Health Care Premiums are a treasure trove of innovative and useful resources for a variety of needs and passions. Their access and versatility makes them a wonderful addition to your professional and personal life. Explore the vast world of Tax Deduction For Health Care Premiums right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes you can! You can print and download these items for free.

-

Can I utilize free printouts for commercial usage?

- It's determined by the specific rules of usage. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may come with restrictions on usage. Be sure to read the terms and condition of use as provided by the creator.

-

How can I print Tax Deduction For Health Care Premiums?

- Print them at home with printing equipment or visit an in-store print shop to get top quality prints.

-

What program do I need to open printables for free?

- Many printables are offered in the PDF format, and is open with no cost programs like Adobe Reader.

Tax Deductions You Can Deduct What Napkin Finance

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

Check more sample of Tax Deduction For Health Care Premiums below

Irs Deduction For Health Insurance Premiums Dollar Keg

When Can You Claim A Tax Deduction For Health Insurance

When Can You Claim A Tax Deduction For Health Insurance The TurboTax

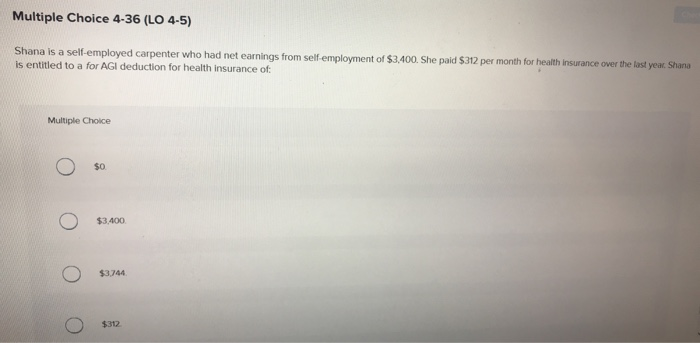

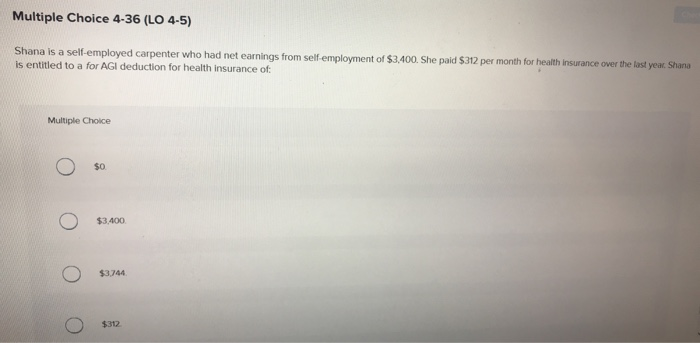

Solved Multiple Choice 4 36 LO 4 5 Shana Is A Chegg

Employee Deductions For Health Insurance Financial Report

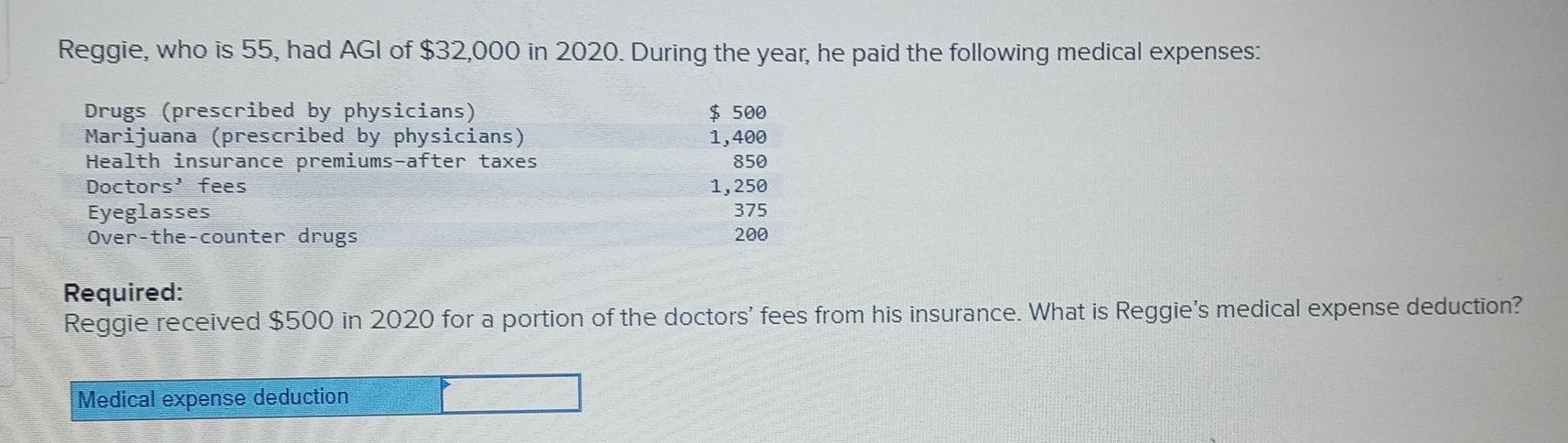

Solved Reggie Who Is 55 Had AGI Of 32 000 In 2020 During Chegg

https://www.forbes.com/advisor/health-insurance/is...

You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower the amount of money you owe the IRS come April

https://money.usnews.com/money/personal-finance/...

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but several

You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower the amount of money you owe the IRS come April

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but several

Solved Multiple Choice 4 36 LO 4 5 Shana Is A Chegg

When Can You Claim A Tax Deduction For Health Insurance

Employee Deductions For Health Insurance Financial Report

Solved Reggie Who Is 55 Had AGI Of 32 000 In 2020 During Chegg

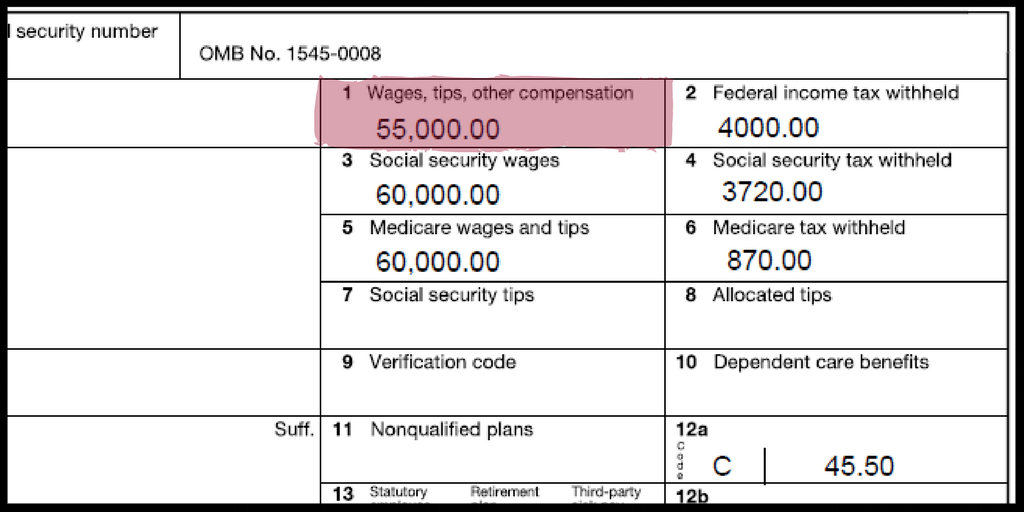

W 2 Doctored Money

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

Section 80D Deduction For Medical Insurance Health Checkups 2019