In this age of technology, in which screens are the norm The appeal of tangible printed products hasn't decreased. Be it for educational use or creative projects, or just adding some personal flair to your area, Tax Deduction For Car Donation 2021 are a great source. With this guide, you'll dive to the depths of "Tax Deduction For Car Donation 2021," exploring what they are, how you can find them, and how they can be used to enhance different aspects of your life.

Get Latest Tax Deduction For Car Donation 2021 Below

Tax Deduction For Car Donation 2021

Tax Deduction For Car Donation 2021 -

Key Takeaways The charitable deduction for a car that a charity sells is limited to the sales price even if the car s fair market value is higher If the sales price of your donated vehicle is less than 500 you can deduct 500 or your car s fair market value whichever is less

Qualified vehicle donation You don t need a written appraisal for a qualified vehicle such as a car boat or airplane if your deduction for the qualified vehicle is limited to the gross proceeds from its sale and you obtained a contemporaneous written acknowledgment CWA defined later If you donate a qualified vehicle

The Tax Deduction For Car Donation 2021 are a huge collection of printable materials available online at no cost. These resources come in many forms, including worksheets, coloring pages, templates and much more. The value of Tax Deduction For Car Donation 2021 lies in their versatility and accessibility.

More of Tax Deduction For Car Donation 2021

How Does Donating A Car Affect Taxes

How Does Donating A Car Affect Taxes

How much is the tax deduction for a vehicle donation That depends on what the vehicle is worth and how the charity intends to use your car If the vehicle is worth less than 500

Yes Habitat for Humanity is a 501 c 3 nonprofit organization Contributions including vehicle donations may be claimed as deductions on your federal tax return if you itemize How much can I deduct Once your vehicle is sold the selling price determines the amount of your donation

Tax Deduction For Car Donation 2021 have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: It is possible to tailor the design to meet your needs be it designing invitations and schedules, or even decorating your house.

-

Educational value: Educational printables that can be downloaded for free can be used by students of all ages, which makes these printables a powerful aid for parents as well as educators.

-

Easy to use: immediate access a plethora of designs and templates can save you time and energy.

Where to Find more Tax Deduction For Car Donation 2021

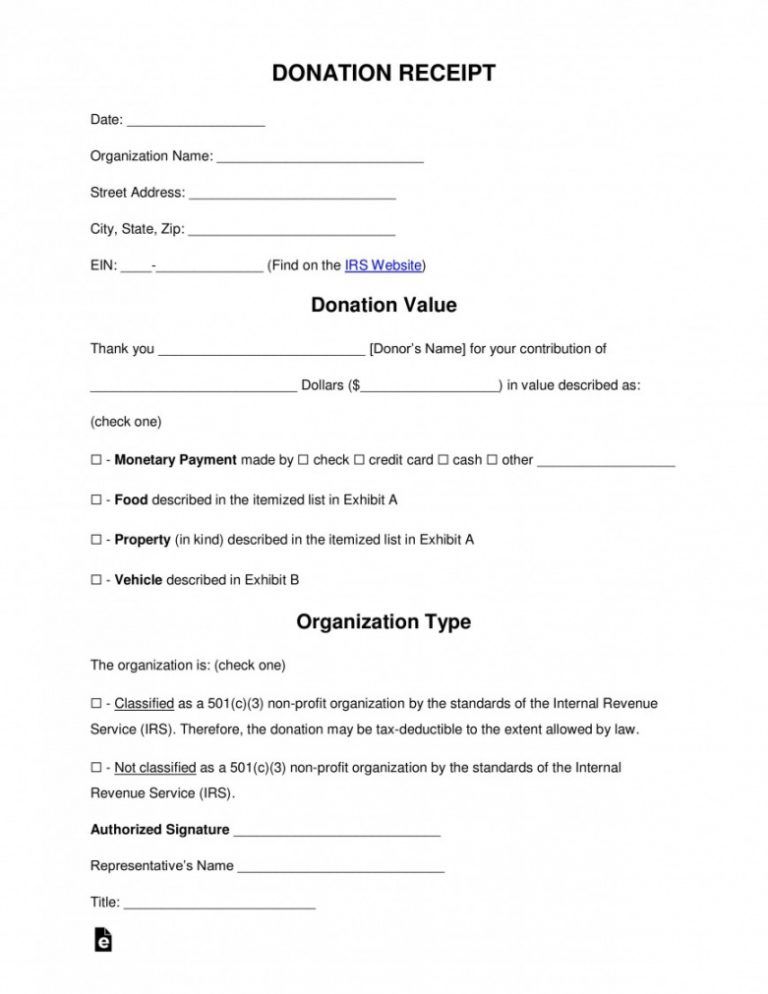

Free Tax Donation Form Template Addictionary Tax Deductible Donation

Free Tax Donation Form Template Addictionary Tax Deductible Donation

The new law generally extends through the end of 2021 four temporary tax changes originally enacted by the Coronavirus Aid Relief and Economic Security CARES Act Here is a rundown of these changes Deduction for individuals who don t itemize cash donations up to 600 qualify

Vehicle Donation Deductions of 500 or Less If the qualified organization sells the vehicle for 500 or less and the exceptions above do not apply you can deduct the smaller amount of 500 or the vehicle s FMV on the date of contribution

We hope we've stimulated your interest in Tax Deduction For Car Donation 2021 Let's look into where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Tax Deduction For Car Donation 2021 suitable for many motives.

- Explore categories like decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free as well as flashcards and other learning materials.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs are a vast variety of topics, from DIY projects to party planning.

Maximizing Tax Deduction For Car Donation 2021

Here are some inventive ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Tax Deduction For Car Donation 2021 are a treasure trove of useful and creative resources catering to different needs and hobbies. Their accessibility and versatility make these printables a useful addition to the professional and personal lives of both. Explore the vast world of Tax Deduction For Car Donation 2021 now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes they are! You can print and download these resources at no cost.

-

Can I download free printables for commercial use?

- It's based on specific usage guidelines. Always consult the author's guidelines before using printables for commercial projects.

-

Do you have any copyright violations with Tax Deduction For Car Donation 2021?

- Certain printables could be restricted regarding usage. Be sure to check the terms and conditions set forth by the designer.

-

How do I print Tax Deduction For Car Donation 2021?

- You can print them at home with your printer or visit an in-store print shop to get premium prints.

-

What software must I use to open printables free of charge?

- Most printables come in PDF format. They can be opened using free software, such as Adobe Reader.

13 Car Expenses Worksheet Worksheeto

Tax Deduction For Food Donation Guide Published The LL M Program In

Check more sample of Tax Deduction For Car Donation 2021 below

Car Donation Tax Deduction Kids Car Donations

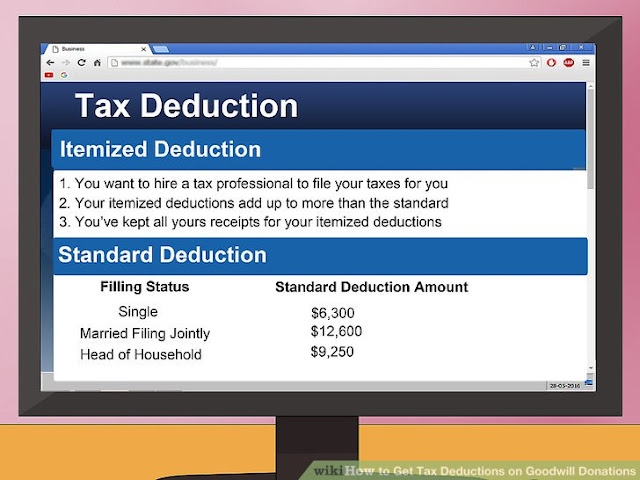

Education Tax Deductions For Charitable Donations How Much Can I

DONATE CAR TO CHARITY CHARITY TAX DEDUCTION Tax Benefits By Donating

Receive A Tax Deduction For Donating A Car

How To Donate A Car In California Donate Car To Charity California

Tax Deduction For Buying A Car For Business Everything You Should Know

https://www.irs.gov/publications/p526

Qualified vehicle donation You don t need a written appraisal for a qualified vehicle such as a car boat or airplane if your deduction for the qualified vehicle is limited to the gross proceeds from its sale and you obtained a contemporaneous written acknowledgment CWA defined later If you donate a qualified vehicle

https://www.gov.uk/.../hs342-charitable-giving-2021

Guidance HS342 Charitable giving 2021 Updated 4 April 2023 Contents 1 Gift Aid 2 Gifts of shares and securities to charity 3 Gifts of real property to charity This helpsheet tells you about

Qualified vehicle donation You don t need a written appraisal for a qualified vehicle such as a car boat or airplane if your deduction for the qualified vehicle is limited to the gross proceeds from its sale and you obtained a contemporaneous written acknowledgment CWA defined later If you donate a qualified vehicle

Guidance HS342 Charitable giving 2021 Updated 4 April 2023 Contents 1 Gift Aid 2 Gifts of shares and securities to charity 3 Gifts of real property to charity This helpsheet tells you about

Receive A Tax Deduction For Donating A Car

Education Tax Deductions For Charitable Donations How Much Can I

How To Donate A Car In California Donate Car To Charity California

Tax Deduction For Buying A Car For Business Everything You Should Know

Car Donation DealersU

How To Claim Tax Deduction For Car Donation In California

How To Claim Tax Deduction For Car Donation In California

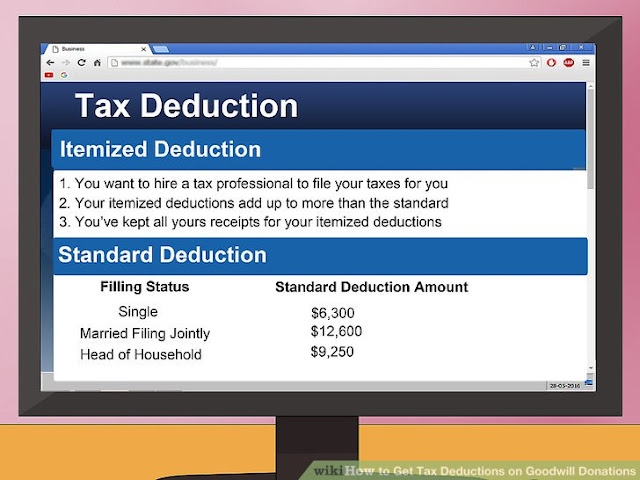

Printable Itemized Deductions Worksheet