In this age of technology, where screens rule our lives, the charm of tangible printed material hasn't diminished. Whether it's for educational purposes such as creative projects or simply to add personal touches to your area, Tax Credits For Energy Saving Home Improvements have become a valuable source. Through this post, we'll dive to the depths of "Tax Credits For Energy Saving Home Improvements," exploring the different types of printables, where to locate them, and how they can enrich various aspects of your daily life.

Get Latest Tax Credits For Energy Saving Home Improvements Below

Tax Credits For Energy Saving Home Improvements

Tax Credits For Energy Saving Home Improvements -

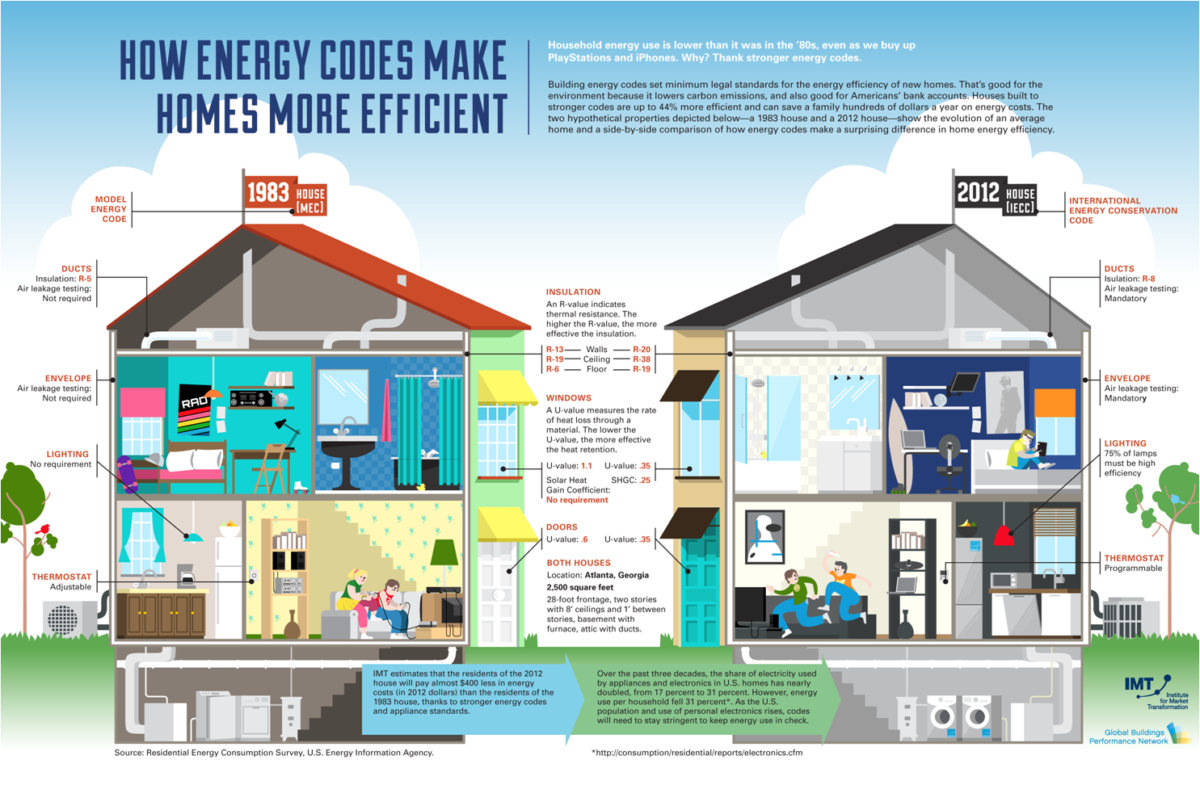

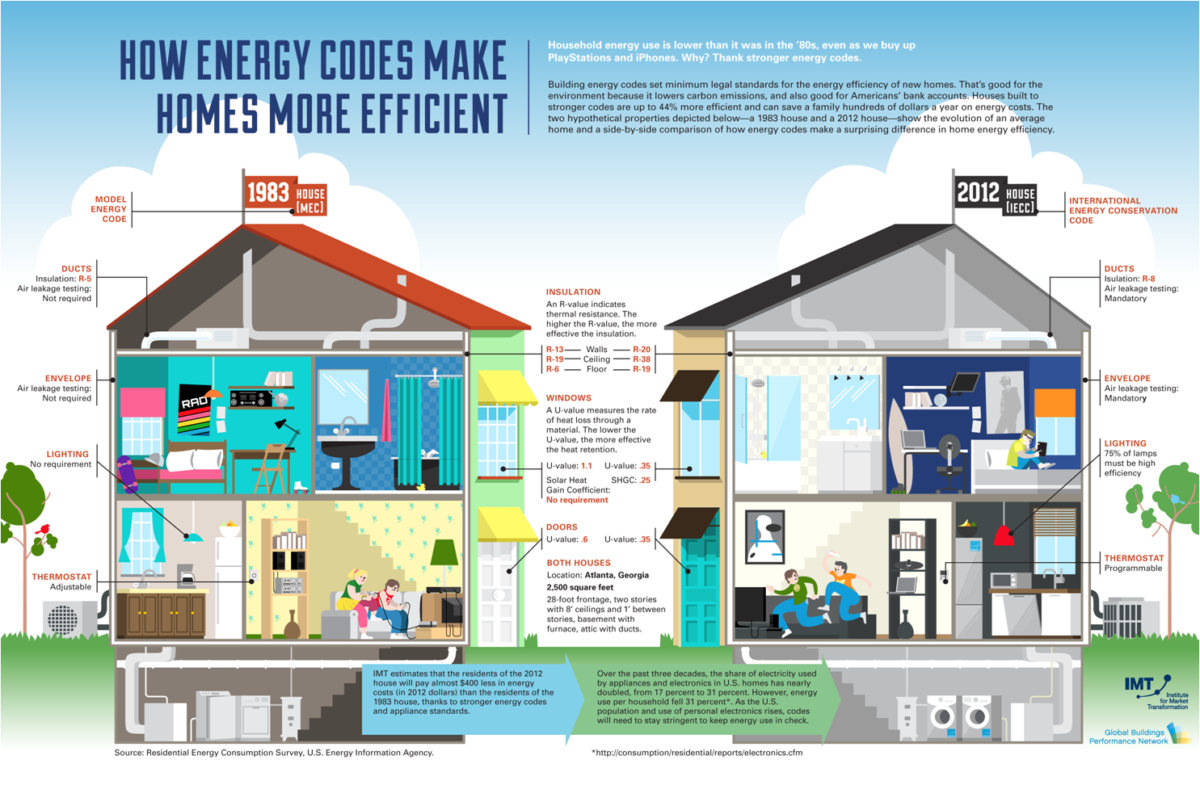

Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about saving money on home

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

Tax Credits For Energy Saving Home Improvements encompass a wide assortment of printable, downloadable resources available online for download at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and much more. The appealingness of Tax Credits For Energy Saving Home Improvements is in their versatility and accessibility.

More of Tax Credits For Energy Saving Home Improvements

Want To Save Energy Around Your Home Check Out This Infographic For

Want To Save Energy Around Your Home Check Out This Infographic For

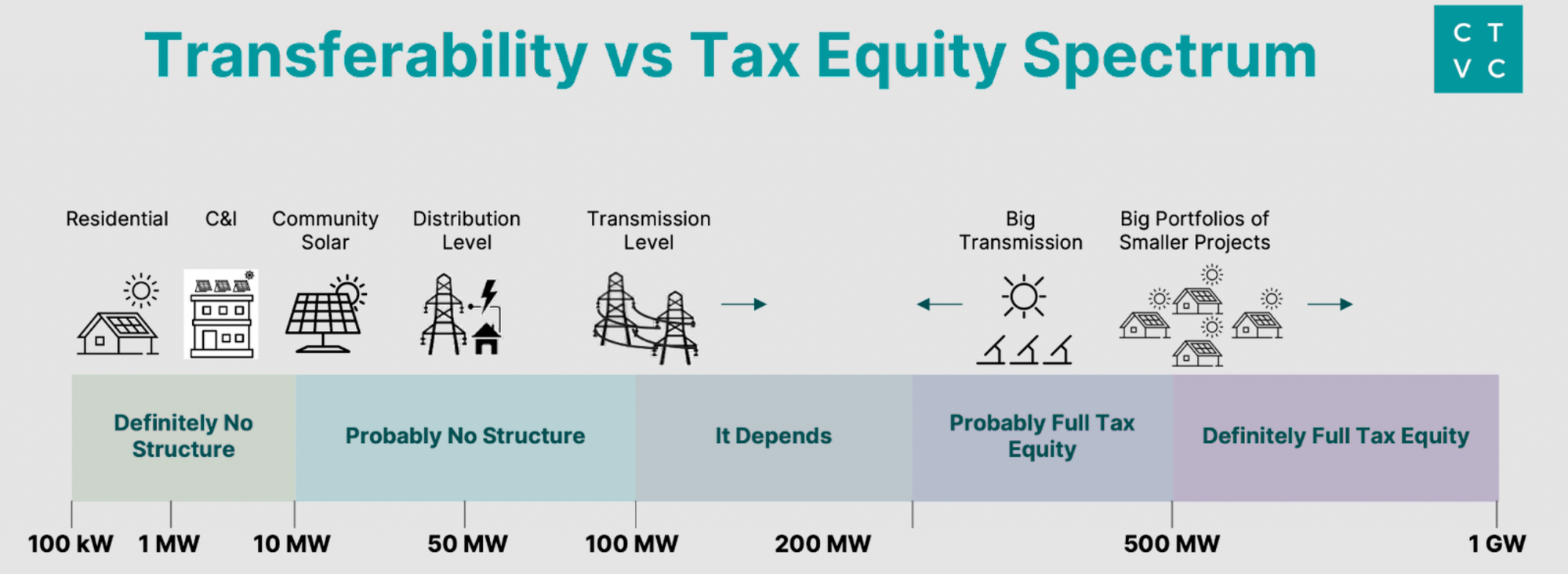

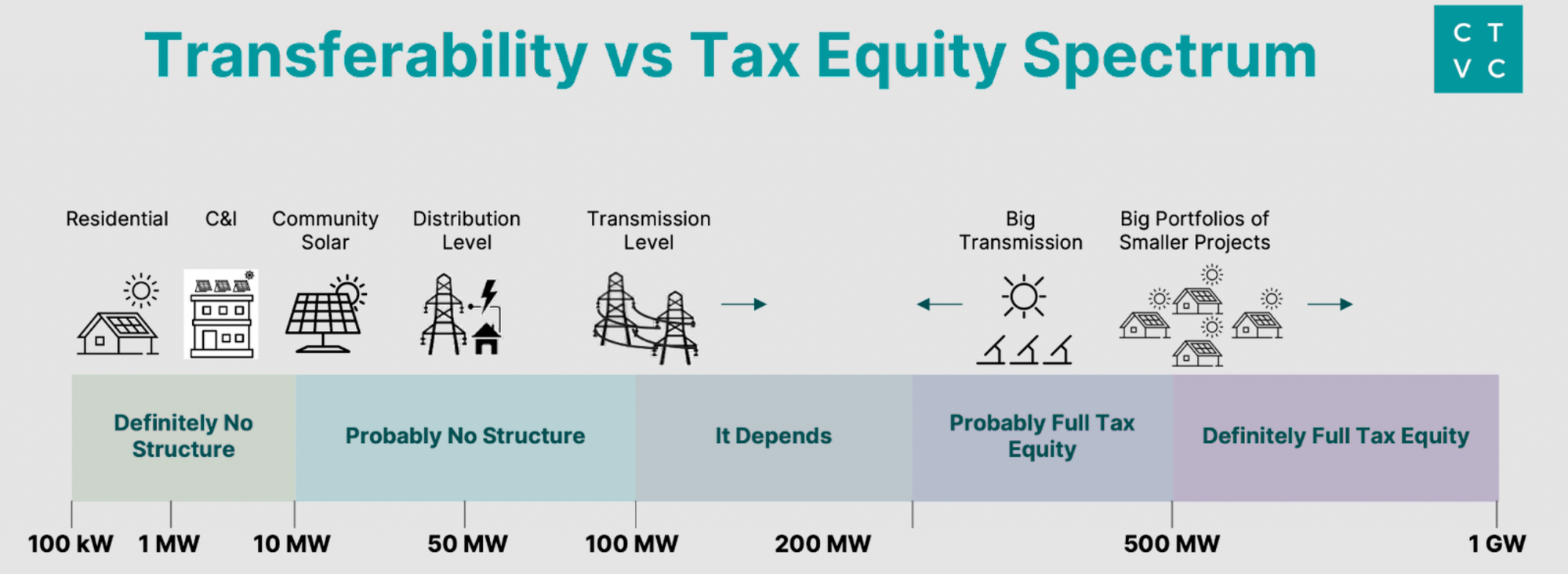

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE

These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades

Tax Credits For Energy Saving Home Improvements have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

customization This allows you to modify the design to meet your needs for invitations, whether that's creating them or arranging your schedule or decorating your home.

-

Educational Use: These Tax Credits For Energy Saving Home Improvements provide for students of all ages, which makes them a great source for educators and parents.

-

Convenience: instant access numerous designs and templates will save you time and effort.

Where to Find more Tax Credits For Energy Saving Home Improvements

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

The Inflation Reduction Act provides federal income tax credits that are specially targeted to home owners that make energy efficient home improvements involving insulation

1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 percent of the cost of installing clean energy

In the event that we've stirred your curiosity about Tax Credits For Energy Saving Home Improvements Let's find out where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and Tax Credits For Energy Saving Home Improvements for a variety purposes.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free, flashcards, and learning tools.

- It is ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a wide spectrum of interests, that range from DIY projects to planning a party.

Maximizing Tax Credits For Energy Saving Home Improvements

Here are some ideas in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Credits For Energy Saving Home Improvements are a treasure trove of creative and practical resources which cater to a wide range of needs and interest. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the plethora of Tax Credits For Energy Saving Home Improvements and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes, they are! You can download and print the resources for free.

-

Does it allow me to use free templates for commercial use?

- It's dependent on the particular conditions of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables could have limitations concerning their use. Make sure you read the terms of service and conditions provided by the designer.

-

How do I print Tax Credits For Energy Saving Home Improvements?

- You can print them at home using the printer, or go to any local print store for more high-quality prints.

-

What software must I use to open printables free of charge?

- The majority are printed in the format of PDF, which is open with no cost software such as Adobe Reader.

Tax Credits For Energy Efficient Home Improvements

SoCal Rebates For Energy saving Home Improvements Los Angeles Times

Check more sample of Tax Credits For Energy Saving Home Improvements below

Tax Credits For Energy Efficient Replacement Windows What You Should

The Inflation Reduction Act You Sapling

The Ultimate Energy Saving Home Improvements Abbey Partnership

Tax Equity In A Direct pay World EY US

Making Your Home Energy Efficient Is Tax Deductible Finerpoints

Breaking Down IRA s Tax credit Breaks

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

https://www.irs.gov/newsroom/irs-home-improvements...

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation

Tax Equity In A Direct pay World EY US

The Inflation Reduction Act You Sapling

Making Your Home Energy Efficient Is Tax Deductible Finerpoints

Breaking Down IRA s Tax credit Breaks

Tax Credits For Energy Efficient Home Improvements Kiplinger

Extended Tax Credits For Energy Efficient Windows Efficient Windows

Extended Tax Credits For Energy Efficient Windows Efficient Windows

Energy Efficiency JHMRad 45585