In this digital age, when screens dominate our lives it's no wonder that the appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons, creative projects, or simply to add some personal flair to your area, Tax Credit Refund Status are now an essential resource. With this guide, you'll take a dive into the world of "Tax Credit Refund Status," exploring what they are, how they are, and how they can enhance various aspects of your daily life.

Get Latest Tax Credit Refund Status Below

Tax Credit Refund Status

Tax Credit Refund Status -

Web Vor einem Tag nbsp 0183 32 IRS determines you are due a refund and calculates the amount Status update once approved Refund Sent 3 21 days after approval IRS issues your refund via direct deposit or paper check Direct deposit is faster Delivery Deposit 1 5 days Direct Deposit Receive your refund in your bank account

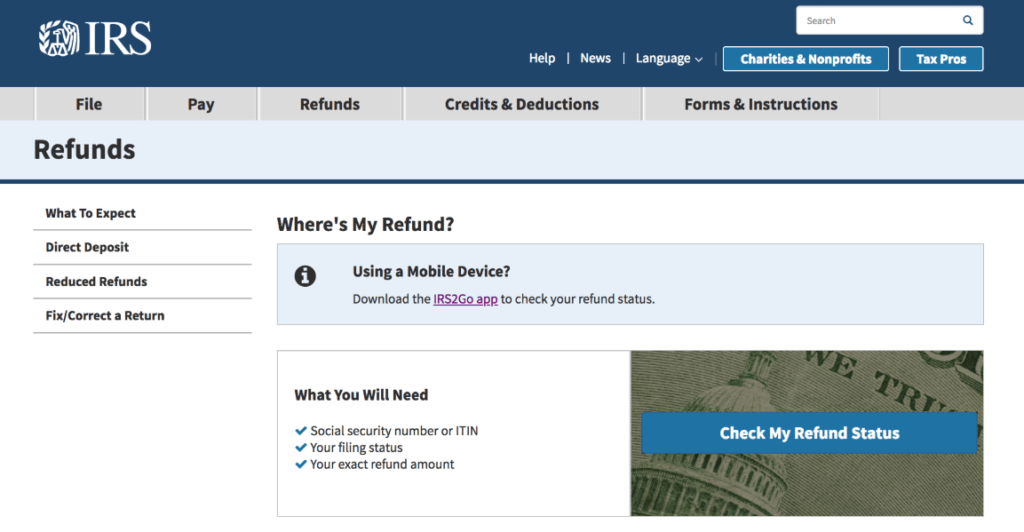

Web 29 Dez 2023 nbsp 0183 32 Get information about tax refunds and track the status of your e file or paper tax return You can check the status of your 2023 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2021 and 2022 tax year returns

The Tax Credit Refund Status are a huge range of printable, free items that are available online at no cost. These materials come in a variety of forms, like worksheets templates, coloring pages and more. The beauty of Tax Credit Refund Status is their versatility and accessibility.

More of Tax Credit Refund Status

65k R D Tax Credit Refund Innovation 4 Business

65k R D Tax Credit Refund Innovation 4 Business

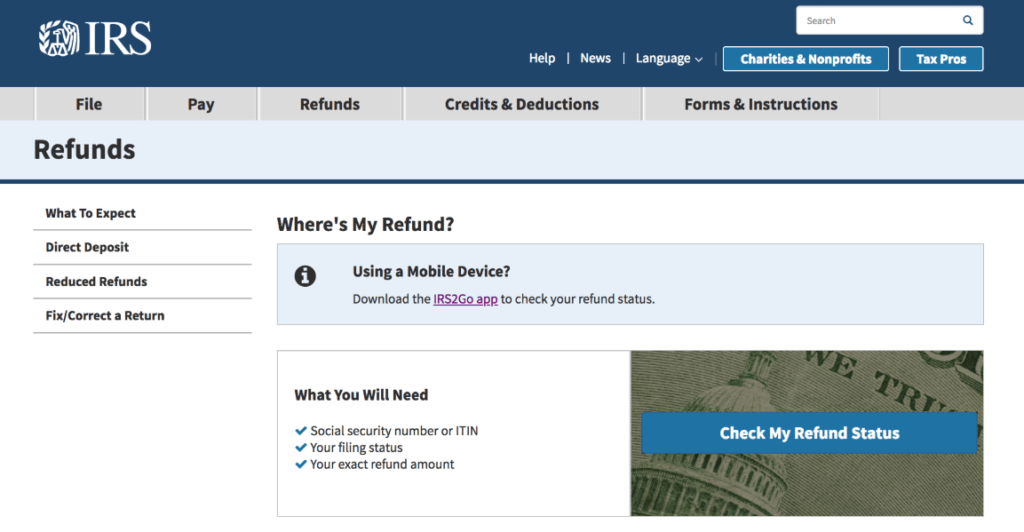

Web 19 Apr 2023 nbsp 0183 32 They can check the status of their refund easily and conveniently with the IRS Where s My Refund tool at IRS gov refunds and with the IRS2Go app Refund status is available within 24 hours of the IRS letting the

Web 11 Dez 2023 nbsp 0183 32 The tool provides the refund date as soon as the IRS processes your tax return and approves your refund It s Fast You can start checking on the status of your return sooner within 36 hours after you file your e

Tax Credit Refund Status have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization: Your HTML0 customization options allow you to customize the design to meet your needs whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational Benefits: These Tax Credit Refund Status cater to learners of all ages, making them a vital tool for teachers and parents.

-

An easy way to access HTML0: Fast access numerous designs and templates is time-saving and saves effort.

Where to Find more Tax Credit Refund Status

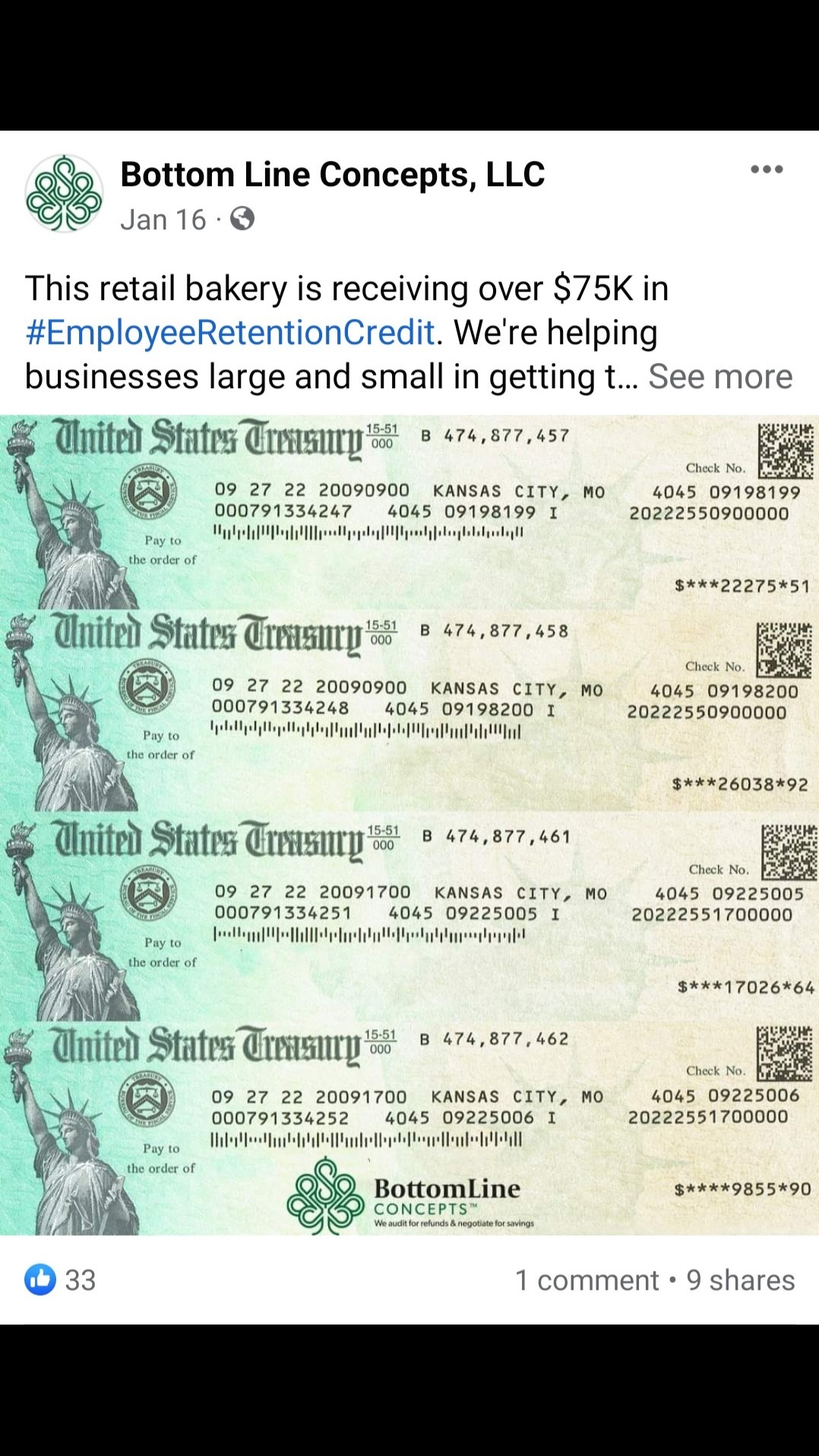

What Is The Employee Retention Tax Credit Refund YouTube

What Is The Employee Retention Tax Credit Refund YouTube

Web 30 Juni 2023 nbsp 0183 32 Navigate to the Get Your Refund Status section on the site Provide your Social Security number or ITIN your filing status and the total amount shown for the refund on your tax return Your Employee Retention Credit Refund status will then be displayed giving you a little peace of mind that it s on its way

Web 31 Jan 2023 nbsp 0183 32 Tax Refund Processing Start checking status 24 48 hours after e file Once you have e filed your tax return you can check your status using the IRS Where s My Refund tool You will need your Social security number or ITIN your filing status and your exact refund amount

In the event that we've stirred your interest in Tax Credit Refund Status We'll take a look around to see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Tax Credit Refund Status for various goals.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free including flashcards, learning materials.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad variety of topics, that range from DIY projects to party planning.

Maximizing Tax Credit Refund Status

Here are some creative ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Tax Credit Refund Status are a treasure trove of creative and practical resources that meet a variety of needs and preferences. Their accessibility and versatility make them a great addition to the professional and personal lives of both. Explore the vast world of Tax Credit Refund Status right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes you can! You can download and print the resources for free.

-

Can I download free printables for commercial uses?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns with Tax Credit Refund Status?

- Some printables may contain restrictions regarding usage. Be sure to read the terms and conditions set forth by the creator.

-

How can I print Tax Credit Refund Status?

- You can print them at home with any printer or head to a local print shop to purchase more high-quality prints.

-

What software do I need to open printables that are free?

- The majority of PDF documents are provided in the PDF format, and is open with no cost software such as Adobe Reader.

How To Check Nj Tax Refund Status Themecaqwe

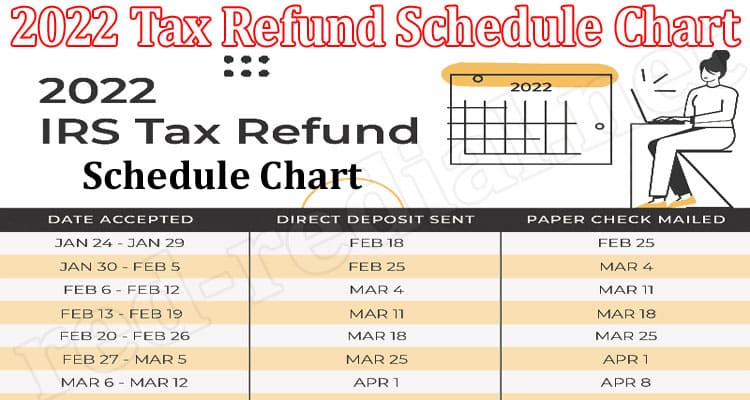

2022 Tax Refund Schedule Chart Mar A Precise Info

Check more sample of Tax Credit Refund Status below

How To Know The Status Of Your Tax Refund

Learn How To Claim Your ERC Tax Credit Refund In 2023 With This Free

Calam o Employee Retention Tax Credit Refund ERTC Financing Cash

How Do I Check The Status Of My Federal Tax Refund Where s My Refund

DOR Where s My Refund It s Refund 123

https://www.irs.gov/refund

Web 29 Dez 2023 nbsp 0183 32 Get information about tax refunds and track the status of your e file or paper tax return You can check the status of your 2023 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2021 and 2022 tax year returns

https://taxcreditfunder.com/refund-status

Web Looking for a Status Update on Your Refund We re happy to help You can contact the IRS refund department directly or we re glad to make the call for you Option 1 Do It Yourself CALL 800 829 0582 ext 653 AVERAGE WAIT TIME IS 2 3 HOURS You can call the IRS directly for a status update

Web 29 Dez 2023 nbsp 0183 32 Get information about tax refunds and track the status of your e file or paper tax return You can check the status of your 2023 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2021 and 2022 tax year returns

Web Looking for a Status Update on Your Refund We re happy to help You can contact the IRS refund department directly or we re glad to make the call for you Option 1 Do It Yourself CALL 800 829 0582 ext 653 AVERAGE WAIT TIME IS 2 3 HOURS You can call the IRS directly for a status update

Calam o Employee Retention Tax Credit Refund ERTC Financing Cash

How Do I Check The Status Of My Federal Tax Refund Where s My Refund

DOR Where s My Refund It s Refund 123

Is The Promise Of An Employee Retention Tax Credit Refund Too Good To

If You Have Not Yet Received An Income Tax Refund Check Your Refund

If You Have Not Yet Received An Income Tax Refund Check Your Refund

How Quickly Can I Get My Tax Refund 2019 Tax Walls