In this age of technology, where screens dominate our lives and the appeal of physical printed objects isn't diminished. No matter whether it's for educational uses for creative projects, simply to add personal touches to your space, Tax Credit For Spouse Not Working 2022 are now an essential source. With this guide, you'll dive to the depths of "Tax Credit For Spouse Not Working 2022," exploring their purpose, where to get them, as well as how they can enrich various aspects of your life.

Get Latest Tax Credit For Spouse Not Working 2022 Below

Tax Credit For Spouse Not Working 2022

Tax Credit For Spouse Not Working 2022 -

Eligibility What you ll get How to claim Leave and gaps in your employment Eligibility You can only make a claim for Working Tax Credit if you already get Child Tax Credit If you

The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21 430 for those filing single and 27 380 for spouses filing a joint return The maximum credit for taxpayers with no qualifying children is 1 502

Tax Credit For Spouse Not Working 2022 include a broad range of printable, free materials online, at no cost. They are available in numerous styles, from worksheets to coloring pages, templates and much more. The benefit of Tax Credit For Spouse Not Working 2022 lies in their versatility as well as accessibility.

More of Tax Credit For Spouse Not Working 2022

Homeschool Tips To Convince Spouse And Kids To Homeschool

Homeschool Tips To Convince Spouse And Kids To Homeschool

If your fiscal partner has no income he or she will not pay income tax Since every tax paying individual may deduct the general tax credit algemene heffingskorting from his or her income tax the non working spouse tax amount becomes negative i e a

How to claim the DTC on your tax return To claim the credit for the current tax year you must enter the disability amount on your tax return Any unused amount may be transferred to a supporting family member It is not refunded

Tax Credit For Spouse Not Working 2022 have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize designs to suit your personal needs such as designing invitations to organize your schedule or even decorating your house.

-

Educational Impact: Free educational printables can be used by students of all ages, making these printables a powerful device for teachers and parents.

-

An easy way to access HTML0: instant access the vast array of design and templates reduces time and effort.

Where to Find more Tax Credit For Spouse Not Working 2022

Is Your Family Down To A Single Income Here s How To Cope MeVest

Is Your Family Down To A Single Income Here s How To Cope MeVest

Disability tax credit People who are unable to work and are receiving disability payments might also qualify for a tax break called the credit for the elderly and disabled Your spouse could qualify for this credit if your spouse Retired from their job on permanent and total disability

The CWB is a refundable tax credit intended to supplement the earnings of low income workers This benefit has two parts a basic amount and a disability supplement To find out if you can claim the CWB see Schedule 6 Canada Workers Benefit

In the event that we've stirred your interest in Tax Credit For Spouse Not Working 2022 Let's take a look at where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and Tax Credit For Spouse Not Working 2022 for a variety reasons.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- These blogs cover a broad array of topics, ranging that includes DIY projects to planning a party.

Maximizing Tax Credit For Spouse Not Working 2022

Here are some inventive ways that you can make use use of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print worksheets that are free to enhance learning at home and in class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Tax Credit For Spouse Not Working 2022 are an abundance of fun and practical tools that can meet the needs of a variety of people and passions. Their accessibility and flexibility make them a great addition to each day life. Explore the wide world of Tax Credit For Spouse Not Working 2022 right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes, they are! You can print and download these files for free.

-

Does it allow me to use free printables for commercial purposes?

- It depends on the specific terms of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright issues with Tax Credit For Spouse Not Working 2022?

- Some printables could have limitations in use. Make sure to read these terms and conditions as set out by the creator.

-

How do I print Tax Credit For Spouse Not Working 2022?

- Print them at home with printing equipment or visit the local print shop for superior prints.

-

What software do I need to run printables for free?

- The majority of printed documents are in the format of PDF, which is open with no cost software like Adobe Reader.

The 2018 Electric Vehicle Tax Credit OsVehicle

Does The Child And Dependent Care Credit Phase Out Completely Latest

Check more sample of Tax Credit For Spouse Not Working 2022 below

2022 Child Tax Credit Refundable Amount Latest News Update

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Family Investment Center 401 k Or IRA Which Do You Fund First

How To Fill Out W 4 Form Married Filing Jointly 2023 Printable Forms

State Support For Families Charles University Staff Welcome Centre

https://www.irs.gov/newsroom/changes-to-the-earned...

The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21 430 for those filing single and 27 380 for spouses filing a joint return The maximum credit for taxpayers with no qualifying children is 1 502

https://www.canada.ca/en/revenue-agency/services/...

If you cannot claim the amount on line 30300 or you have to reduce your claim because of dividends your spouse or common law partner received from taxable Canadian corporations you may be able to reduce your tax if you report all of your spouse s or common law partner s dividends

The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21 430 for those filing single and 27 380 for spouses filing a joint return The maximum credit for taxpayers with no qualifying children is 1 502

If you cannot claim the amount on line 30300 or you have to reduce your claim because of dividends your spouse or common law partner received from taxable Canadian corporations you may be able to reduce your tax if you report all of your spouse s or common law partner s dividends

Family Investment Center 401 k Or IRA Which Do You Fund First

How To Fill Out W 4 Form Married Filing Jointly 2023 Printable Forms

State Support For Families Charles University Staff Welcome Centre

Not Working Spouse Law Office Of Patrick Crawford

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

How To Fill Out Form W 4 In 2022 2023

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

How To Fill Out Form W 4 In 2022 2023

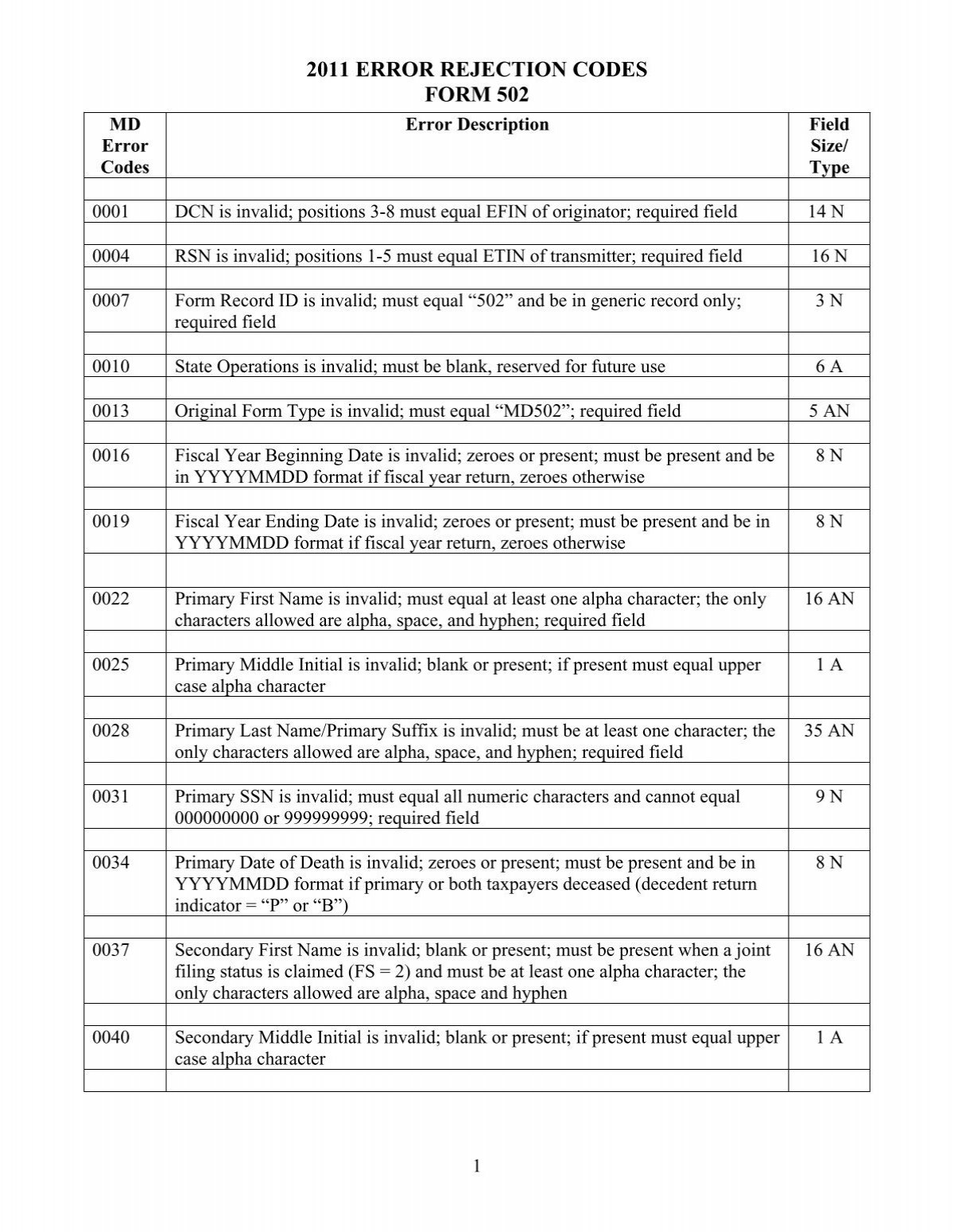

MD Error Code 2011