In this day and age where screens rule our lives, the charm of tangible printed materials hasn't faded away. Whatever the reason, whether for education as well as creative projects or just adding the personal touch to your space, Tax Credit For New Hvac System are now a vital source. With this guide, you'll dive into the world "Tax Credit For New Hvac System," exploring their purpose, where to find them and what they can do to improve different aspects of your life.

Get Latest Tax Credit For New Hvac System Below

Tax Credit For New Hvac System

Tax Credit For New Hvac System -

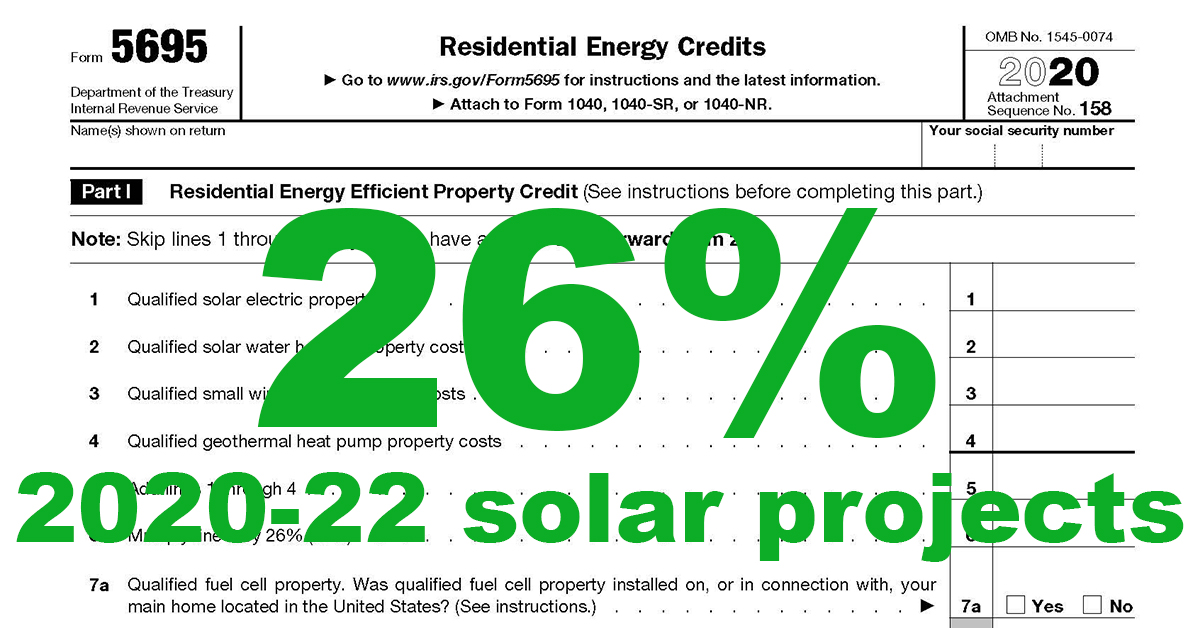

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Does a New HVAC System Qualify for Tax Credits Yes a new HVAC system can qualify for a federal energy efficiency tax credit as long as it s installed into an existing home Newly built homes however do not qualify

Printables for free include a vast array of printable materials that are accessible online for free cost. These resources come in many kinds, including worksheets templates, coloring pages, and much more. The attraction of printables that are free is in their variety and accessibility.

More of Tax Credit For New Hvac System

Your HVAC System Has 8 Components Trust Heating Air

Your HVAC System Has 8 Components Trust Heating Air

This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Individualization There is the possibility of tailoring printing templates to your own specific requirements in designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Education-related printables at no charge provide for students of all ages, making them an invaluable instrument for parents and teachers.

-

The convenience of Quick access to many designs and templates is time-saving and saves effort.

Where to Find more Tax Credit For New Hvac System

How Will The Re instated HVAC Tax Credit Affect You HB McClure

How Will The Re instated HVAC Tax Credit Affect You HB McClure

What are the available federal tax credits for HVAC systems in 2023 What Are HVAC Tax Credits and Who Qualifies in 2023 Home AC tax credits in 2023 are federal incentives designed to encourage homeowners to

For qualifying central air conditioners installed in your primary residence between January 1 2023 and December 31 2032 you can claim a tax credit of 30 of the total project with a max benefit of 600 New construction homes and

If we've already piqued your interest in Tax Credit For New Hvac System Let's see where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Tax Credit For New Hvac System suitable for many goals.

- Explore categories such as furniture, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a broad array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Tax Credit For New Hvac System

Here are some fresh ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Tax Credit For New Hvac System are an abundance filled with creative and practical information that satisfy a wide range of requirements and desires. Their availability and versatility make them an invaluable addition to any professional or personal life. Explore the vast world of Tax Credit For New Hvac System today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes they are! You can print and download these materials for free.

-

Can I use the free printables to make commercial products?

- It's all dependent on the usage guidelines. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download Tax Credit For New Hvac System?

- Some printables could have limitations on their use. Always read the terms and conditions set forth by the designer.

-

How do I print printables for free?

- You can print them at home with either a printer or go to an in-store print shop to get high-quality prints.

-

What software do I require to view printables that are free?

- Most PDF-based printables are available in PDF format, which is open with no cost software such as Adobe Reader.

US Hyundai Ioniq 5 Sales Decreased To The Lowest Level Since January

Hvac Systems New Tax Credit For New Hvac System 2013

Check more sample of Tax Credit For New Hvac System below

How To Claim The 3 600 Child Tax Credit For A Baby Born In 2021 YouTube

Should You Buy A New HVAC System For The Tax Credit Rosie On The House

Types Of Hvac Systems Rezfoods Resep Masakan Indonesia

HVAC Tax Incentives Enhanced In Sweeping Bill ACHR News

HVAC Tax Credit For New HVAC Systems

Air Conditioner Tax Rebate Federal Tax Credit For New Hvac Step By

https://airconditionerlab.com/what-hvac-systems...

Does a New HVAC System Qualify for Tax Credits Yes a new HVAC system can qualify for a federal energy efficiency tax credit as long as it s installed into an existing home Newly built homes however do not qualify

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

Does a New HVAC System Qualify for Tax Credits Yes a new HVAC system can qualify for a federal energy efficiency tax credit as long as it s installed into an existing home Newly built homes however do not qualify

Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

HVAC Tax Incentives Enhanced In Sweeping Bill ACHR News

Should You Buy A New HVAC System For The Tax Credit Rosie On The House

HVAC Tax Credit For New HVAC Systems

Air Conditioner Tax Rebate Federal Tax Credit For New Hvac Step By

HVAC Electrical Issues Do You Fix Or Replace Your Unit

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

Puget Sound Solar LLC