In the age of digital, with screens dominating our lives it's no wonder that the appeal of tangible printed objects isn't diminished. Whether it's for educational purposes in creative or artistic projects, or simply to add an element of personalization to your space, Tax Credit For Dependents 2023 are now a useful source. Here, we'll take a dive deep into the realm of "Tax Credit For Dependents 2023," exploring the benefits of them, where you can find them, and how they can enhance various aspects of your life.

Get Latest Tax Credit For Dependents 2023 Below

Tax Credit For Dependents 2023

Tax Credit For Dependents 2023 -

For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married filing jointly or 200 000 or below all

Tax Tip 2023 22 February 21 2023 Taxpayers with dependents who don t qualify for the Child Tax Credit may be able to claim the Credit for Other Dependents They can claim this credit in addition to the Child and Dependent Care

Printables for free cover a broad variety of printable, downloadable content that can be downloaded from the internet at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and more. The beauty of Tax Credit For Dependents 2023 is in their variety and accessibility.

More of Tax Credit For Dependents 2023

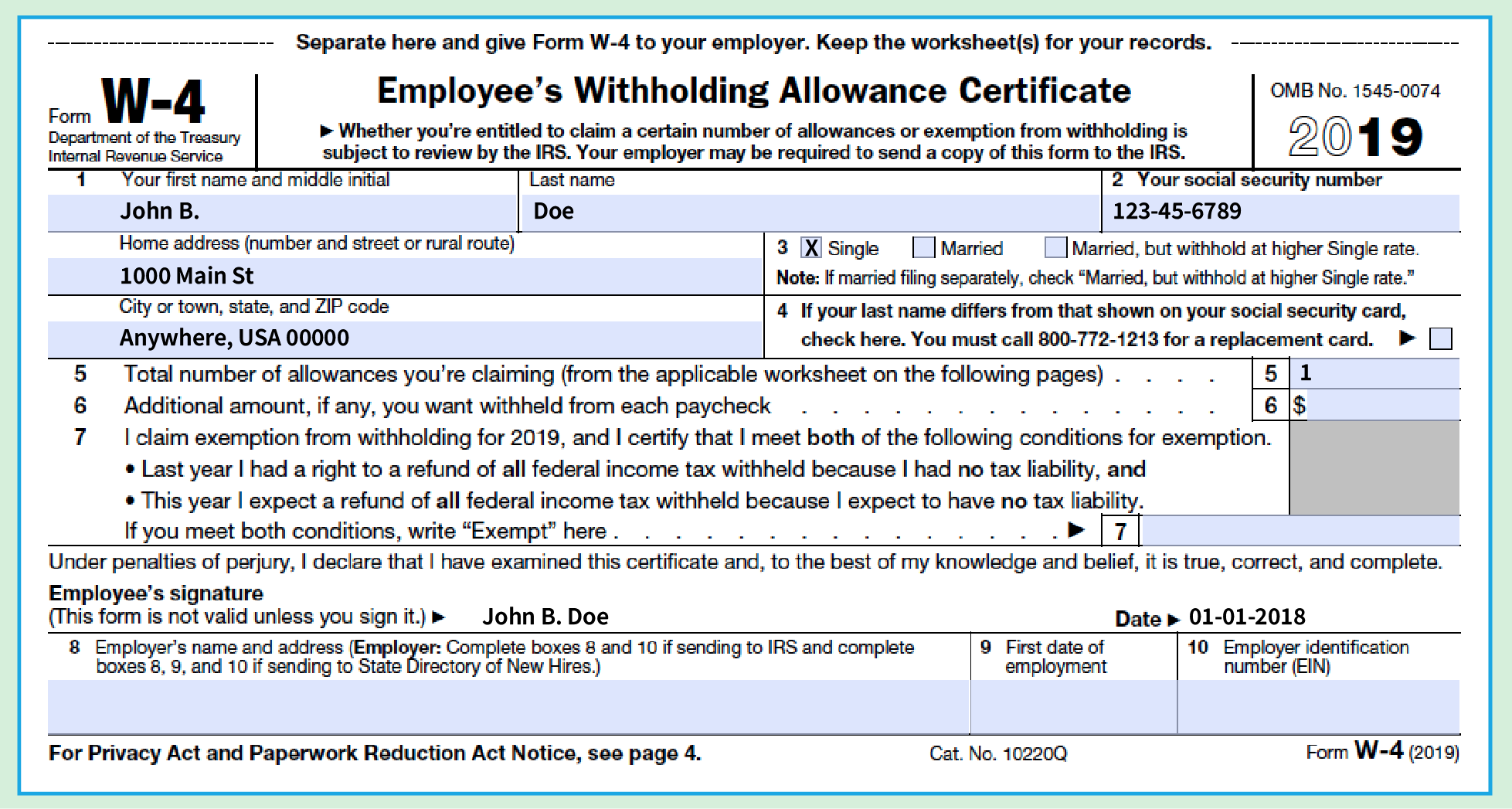

2021 W4 Calculator DulcieJacob

2021 W4 Calculator DulcieJacob

You can claim this for each qualifying relative you have on your tax return Adoption credit The 2023 adoption tax credit is a nonrefundable tax credit worth up to 15 950 of expenses you ve paid for the adoption of a child who isn t your stepchild This credit increases to 16 810 for 2024

22 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements when it comes to designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value: The free educational worksheets offer a wide range of educational content for learners of all ages, making them an essential tool for teachers and parents.

-

An easy way to access HTML0: The instant accessibility to various designs and templates, which saves time as well as effort.

Where to Find more Tax Credit For Dependents 2023

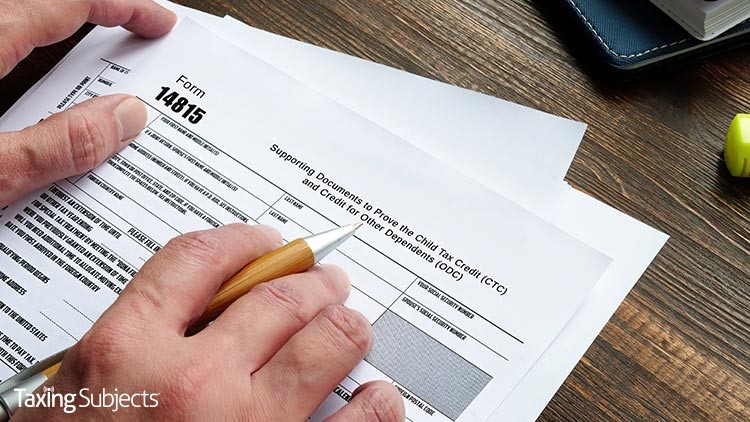

IRS Highlights Info About The Credit For Other Dependents American

IRS Highlights Info About The Credit For Other Dependents American

The maximum credit amount is 500 for each dependent who meets certain conditions This credit can be claimed for Dependents of any age including those who are age 18 or older Dependents who have Social Security numbers or Individual Taxpayer Identification numbers Dependent parents or other qualifying relatives supported by the

For the 2023 tax year the child and dependent care tax credit is 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents to cover day care and

We hope we've stimulated your curiosity about Tax Credit For Dependents 2023 Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Tax Credit For Dependents 2023 to suit a variety of needs.

- Explore categories like interior decor, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- These blogs cover a broad range of topics, that range from DIY projects to party planning.

Maximizing Tax Credit For Dependents 2023

Here are some new ways to make the most of Tax Credit For Dependents 2023:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print free worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Tax Credit For Dependents 2023 are an abundance with useful and creative ideas which cater to a wide range of needs and desires. Their availability and versatility make them an invaluable addition to any professional or personal life. Explore the endless world of Tax Credit For Dependents 2023 now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can print and download these items for free.

-

Can I download free printables in commercial projects?

- It's determined by the specific rules of usage. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Are there any copyright rights issues with Tax Credit For Dependents 2023?

- Some printables may contain restrictions regarding usage. Be sure to review the terms of service and conditions provided by the designer.

-

How can I print Tax Credit For Dependents 2023?

- You can print them at home with printing equipment or visit any local print store for higher quality prints.

-

What program must I use to open printables for free?

- The majority are printed in PDF format. These can be opened with free software, such as Adobe Reader.

2022 Tax Brackets Married Filing Jointly Irs Printable Form

IRS Explains Credit For Other Dependents Kates Notary And Tax Service

Check more sample of Tax Credit For Dependents 2023 below

Standard Deduction Worksheet For Dependents

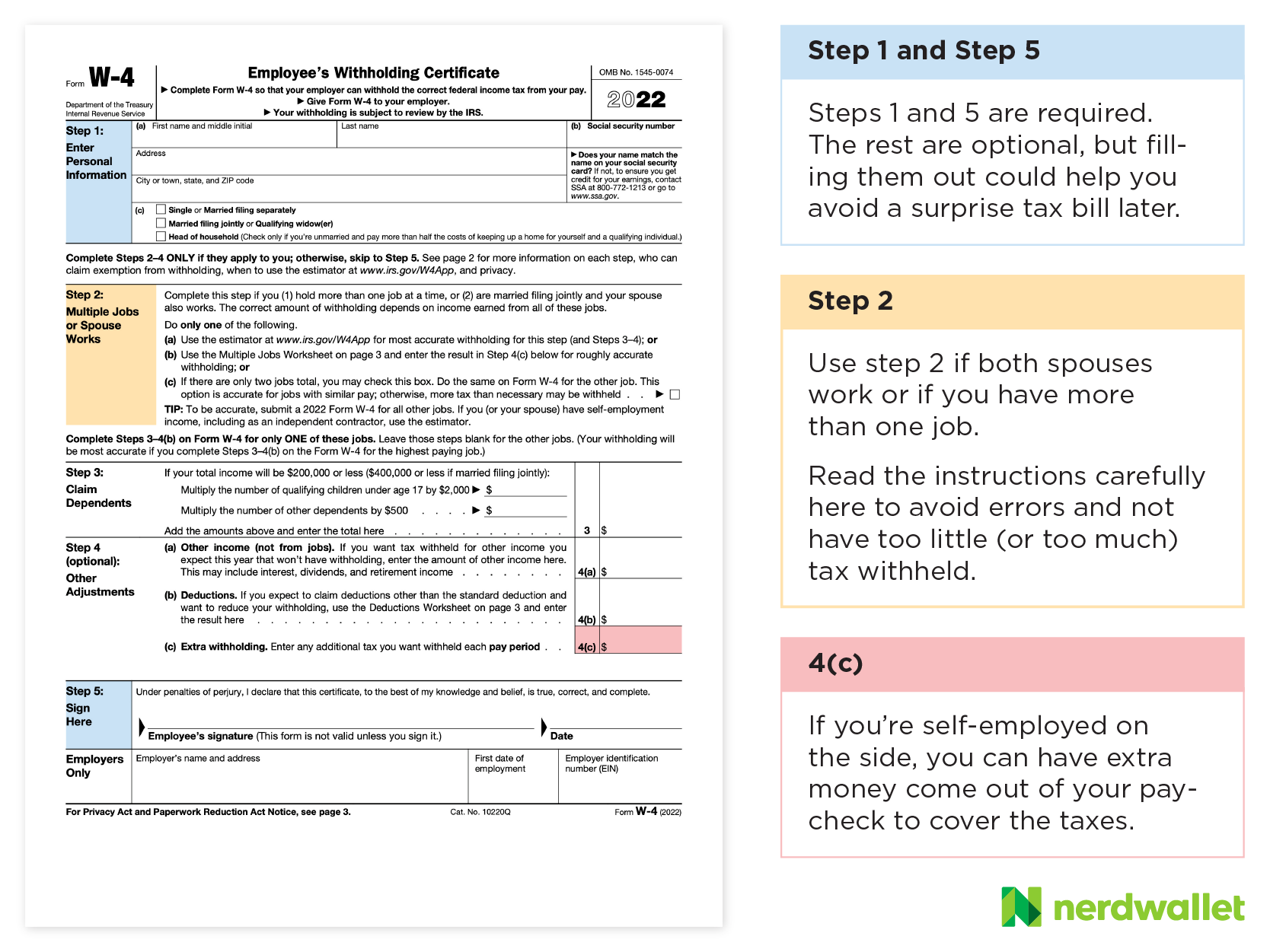

How To Fill Out Form W 4 In 2022 2023

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

IRS Highlights The Credit For Other Dependents Kates Notary And Tax

Care Credit Printable Application Printable Word Searches

What Is The Child Tax Credit Ctc And How Do You Claim It For

Child Credit Tax Fill Online Printable Fillable Blank PdfFiller

https://www.irs.gov/newsroom/understanding-the...

Tax Tip 2023 22 February 21 2023 Taxpayers with dependents who don t qualify for the Child Tax Credit may be able to claim the Credit for Other Dependents They can claim this credit in addition to the Child and Dependent Care

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States To be a qualifying child for the 2023 tax year your dependent generally must Be under age 17 at the end of the year

Tax Tip 2023 22 February 21 2023 Taxpayers with dependents who don t qualify for the Child Tax Credit may be able to claim the Credit for Other Dependents They can claim this credit in addition to the Child and Dependent Care

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States To be a qualifying child for the 2023 tax year your dependent generally must Be under age 17 at the end of the year

Care Credit Printable Application Printable Word Searches

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

How To Fill Out Form W 4 In 2022 2023

What Is The Child Tax Credit Ctc And How Do You Claim It For

Child Credit Tax Fill Online Printable Fillable Blank PdfFiller

Child Tax Credit And Credit For Other Dependents Cozby Company

One Important Tax Credit For People With Dependents The Motley Fool

One Important Tax Credit For People With Dependents The Motley Fool

Standard Deduction Worksheet For Dependents