In the digital age, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. Be it for educational use, creative projects, or simply to add a personal touch to your home, printables for free have become a valuable resource. Here, we'll take a dive through the vast world of "Tax Credit For Charitable Donations U S 61," exploring what they are, where you can find them, and how they can enrich various aspects of your lives.

Get Latest Tax Credit For Charitable Donations U S 61 Below

Tax Credit For Charitable Donations U S 61

Tax Credit For Charitable Donations U S 61 -

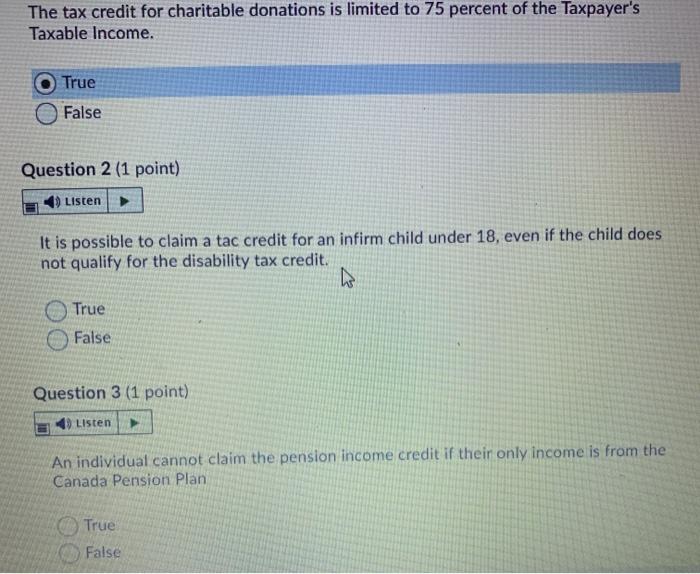

Entitlement of tax credit to persons for charitable donations under section 61of the ITO 2001 4 Exemptions related with withholding transactions of NPOs in section 159 of the

Special 300 Tax Deduction The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities

Printables for free include a vast collection of printable material that is available online at no cost. These resources come in various styles, from worksheets to templates, coloring pages, and many more. One of the advantages of Tax Credit For Charitable Donations U S 61 is in their variety and accessibility.

More of Tax Credit For Charitable Donations U S 61

Walsh King LLP Tax Rates And Charitable Donations

Walsh King LLP Tax Rates And Charitable Donations

April 2 2024 at 8 35 a m Getty Images Accuracy is important when estimating the value of noncash contributions Key Takeaways To get the charitable deduction you usually

This Article covers all principal topics including eligibility to receive deductible contributions eligible gifts the amount allowed as a deduction the specific rules for

Tax Credit For Charitable Donations U S 61 have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization They can make designs to suit your personal needs in designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: These Tax Credit For Charitable Donations U S 61 cater to learners of all ages, making the perfect tool for parents and educators.

-

Affordability: immediate access the vast array of design and templates saves time and effort.

Where to Find more Tax Credit For Charitable Donations U S 61

Tax Credit For Charitable Donations YouTube

Tax Credit For Charitable Donations YouTube

Donations eligible for direct deduction from income has been transposed into tax credit regime As a result of that overall upper limit for tax break for the donors in respect of

In general you can deduct up to 60 of your adjusted gross income via charitable donations but you may be limited to 20 30 or 50 depending on the

In the event that we've stirred your curiosity about Tax Credit For Charitable Donations U S 61 we'll explore the places they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Tax Credit For Charitable Donations U S 61 suitable for many reasons.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a broad range of topics, including DIY projects to party planning.

Maximizing Tax Credit For Charitable Donations U S 61

Here are some ideas ensure you get the very most use of Tax Credit For Charitable Donations U S 61:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Credit For Charitable Donations U S 61 are a treasure trove of practical and innovative resources that meet a variety of needs and preferences. Their access and versatility makes them an essential part of both personal and professional life. Explore the many options of Tax Credit For Charitable Donations U S 61 right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes they are! You can download and print these materials for free.

-

Can I utilize free printables for commercial use?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Do you have any copyright issues when you download Tax Credit For Charitable Donations U S 61?

- Certain printables may be subject to restrictions in their usage. Make sure you read the terms and conditions set forth by the author.

-

How can I print Tax Credit For Charitable Donations U S 61?

- Print them at home with either a printer at home or in a local print shop to purchase top quality prints.

-

What software do I require to open printables that are free?

- The majority are printed in PDF format. These can be opened using free software like Adobe Reader.

Charitable Donation Calculator Ativa Interactive Corp

What Is Arizona Charitable Tax Credit Donations Children s Care Arizona

Check more sample of Tax Credit For Charitable Donations U S 61 below

Solved The Tax Credit For Charitable Donations Is Limited To Chegg

Donations To Charity Rise Despite Fewer Donors CBC News

Taxation Of Charitable Donations In Kind DMCL

Walsh King LLP New For 2017 TAX RATES AND CHARITABLE DONATIONS

Give And Get Back Charitable Acts That Are Tax Deductible My Money

Scott Wants To Simplify VT Tax System

https://www.irs.gov/credits-deductions/individuals...

Special 300 Tax Deduction The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities

https://pkrevenue.com/fbr-issues-list-of-non...

April 1 2021 ISLAMABAD Federal Board of Revenue FBR has restricted the benefit of tax concession to 62 non profit organizations NPOs under Tax Laws Second

Special 300 Tax Deduction The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities

April 1 2021 ISLAMABAD Federal Board of Revenue FBR has restricted the benefit of tax concession to 62 non profit organizations NPOs under Tax Laws Second

Walsh King LLP New For 2017 TAX RATES AND CHARITABLE DONATIONS

Donations To Charity Rise Despite Fewer Donors CBC News

Give And Get Back Charitable Acts That Are Tax Deductible My Money

Scott Wants To Simplify VT Tax System

How Partially Refunding Charitable Donations Stimulates The Economy

Charity Tax Breaks Extended Through 2014 Only

Charity Tax Breaks Extended Through 2014 Only

Tax Deductible Charitable Donations What Can You Donate To Charity