In a world when screens dominate our lives The appeal of tangible printed objects isn't diminished. Whether it's for educational purposes, creative projects, or simply adding some personal flair to your home, printables for free are now an essential source. For this piece, we'll dive deeper into "Tax Credit Calculation India," exploring the different types of printables, where they are available, and the ways that they can benefit different aspects of your lives.

Get Latest Tax Credit Calculation India Below

Tax Credit Calculation India

Tax Credit Calculation India -

Verkko 13 kes 228 k 2023 nbsp 0183 32 Individual Other tax credits and incentives Last reviewed 13 June 2023 Tax incentives are eligible to be claimed from taxable income The incentives can be based on income investment or expenditure Some of them are detailed below

Verkko 16 hein 228 k 2020 nbsp 0183 32 Credit is available only if income corresponding to the taxes is offered for tax or assessed to tax in India during the year in which the credit is claimed In the cases where the income for which the foreign taxes paid or deducted is offered to taxes for more than one year the credit will be given across the years in the same

Printables for free cover a broad assortment of printable items that are available online at no cost. These materials come in a variety of designs, including worksheets templates, coloring pages, and much more. The attraction of printables that are free lies in their versatility and accessibility.

More of Tax Credit Calculation India

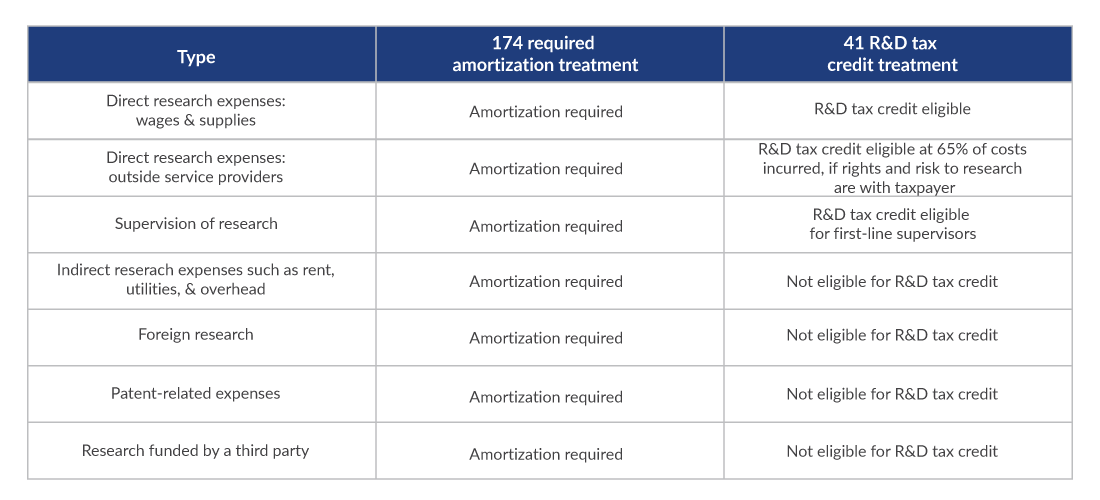

Excluded Activities 1

Excluded Activities 1

Verkko 3 lokak 2023 nbsp 0183 32 A tax credit serves as a valuable tool in reducing an individual s tax burden It represents an amount that can be subtracted directly from the total tax owed It s important to distinguish tax credits from deductions which operate indirectly by lowering the taxable base of an individual

Verkko 12 toukok 2023 nbsp 0183 32 The concept of claiming a deduction or credit of taxes paid in the Source State against tax liability in the Residence State is called Foreign Tax Credit FTC The concept of FTC in India As per the tax laws of India sections 90 and 91 of the Income Tax Act deal with the concept of FTC

Tax Credit Calculation India have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Flexible: Your HTML0 customization options allow you to customize printables to your specific needs whether you're designing invitations and schedules, or decorating your home.

-

Educational Value: The free educational worksheets are designed to appeal to students from all ages, making these printables a powerful instrument for parents and teachers.

-

The convenience of Access to various designs and templates can save you time and energy.

Where to Find more Tax Credit Calculation India

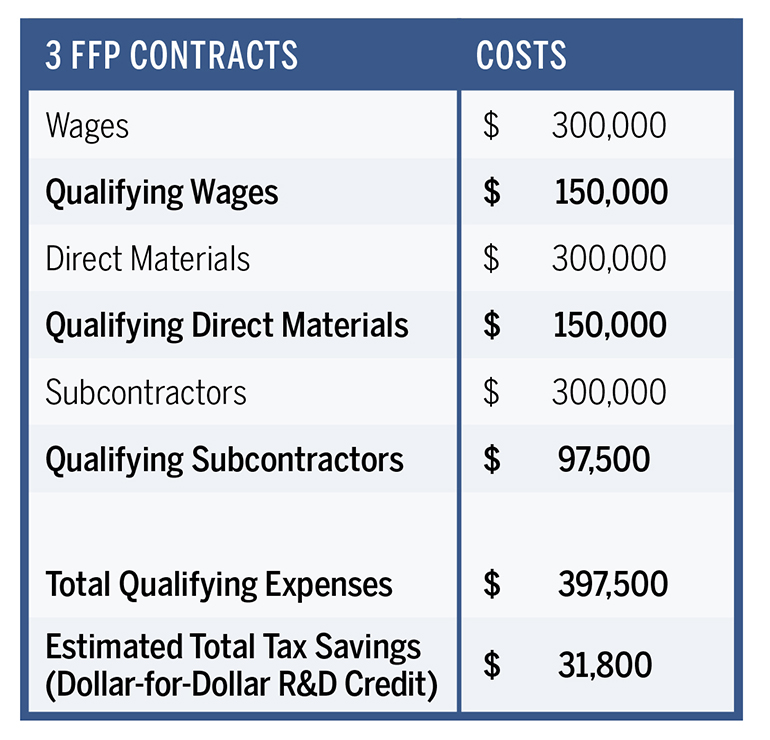

R d Tax Credit Calculation Example Simple Choice Blogged Photo Exhibition

R d Tax Credit Calculation Example Simple Choice Blogged Photo Exhibition

Verkko 13 kes 228 k 2023 nbsp 0183 32 The corporate income tax CIT rate applicable to an Indian company and a foreign company for the tax year 2022 23 is as follows Surcharge of 10 is payable only where total taxable income exceeds INR 10 million Effective tax rates include surcharge and health and education cess of 4

Verkko 1 huhtik 2016 nbsp 0183 32 The tax holiday periods range from five to ten years and the percentage of the rebate is 30 50 or 100 in initial years and 30 in the later years The number of years constituting initial and later years varies from sector to sector

If we've already piqued your curiosity about Tax Credit Calculation India Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Tax Credit Calculation India for different purposes.

- Explore categories such as decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs are a vast array of topics, ranging from DIY projects to planning a party.

Maximizing Tax Credit Calculation India

Here are some innovative ways create the maximum value of Tax Credit Calculation India:

1. Home Decor

- Print and frame stunning artwork, quotes or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Tax Credit Calculation India are an abundance of practical and innovative resources that can meet the needs of a variety of people and preferences. Their access and versatility makes them a valuable addition to every aspect of your life, both professional and personal. Explore the vast array of Tax Credit Calculation India to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can download and print these documents for free.

-

Can I make use of free printables to make commercial products?

- It's determined by the specific terms of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables might have limitations concerning their use. Make sure to read these terms and conditions as set out by the designer.

-

How can I print printables for free?

- You can print them at home using any printer or head to a local print shop for higher quality prints.

-

What program do I need to open printables free of charge?

- The majority of printables are in the PDF format, and can be opened with free software, such as Adobe Reader.

R D Tax Credit Calculation Ardius

ERTC Calculation Worksheet ERTCCalculator ai Simplify Your ERTC

Check more sample of Tax Credit Calculation India below

R d Tax Credit Calculation Example Simple Choice Blogged Photo Exhibition

Employee Retention Tax Credit Calculation KerrieVasilisa

R d Tax Credit Calculation Software Chun Walls

Fast ERC Tax Credit Calculation Free Eligibility Quiz For SMBs Non

Erc Worksheet 2021 Excel Printable Word Searches

Erc Worksheet 2021 Excel Printable Word Searches

https://taxguru.in/income-tax/foreign-tax-credit-indian-context.html

Verkko 16 hein 228 k 2020 nbsp 0183 32 Credit is available only if income corresponding to the taxes is offered for tax or assessed to tax in India during the year in which the credit is claimed In the cases where the income for which the foreign taxes paid or deducted is offered to taxes for more than one year the credit will be given across the years in the same

https://incometaxindia.gov.in/Rules/Income-Tax Rules/rule128.htm

Verkko 1 An assessee being a resident shall be allowed a credit for the amount of any foreign tax paid by him in a country or specified territory outside India by way of deduction or otherwise in the year in which the income corresponding to such tax has been offered to tax or assessed to tax in India in the manner and to the extent as specified

Verkko 16 hein 228 k 2020 nbsp 0183 32 Credit is available only if income corresponding to the taxes is offered for tax or assessed to tax in India during the year in which the credit is claimed In the cases where the income for which the foreign taxes paid or deducted is offered to taxes for more than one year the credit will be given across the years in the same

Verkko 1 An assessee being a resident shall be allowed a credit for the amount of any foreign tax paid by him in a country or specified territory outside India by way of deduction or otherwise in the year in which the income corresponding to such tax has been offered to tax or assessed to tax in India in the manner and to the extent as specified

Fast ERC Tax Credit Calculation Free Eligibility Quiz For SMBs Non

Employee Retention Tax Credit Calculation KerrieVasilisa

Erc Worksheet 2021 Excel Printable Word Searches

Erc Worksheet 2021 Excel Printable Word Searches

7 Step ERC Calculation Worksheet Employee Retention Credit

Income After Taxes Calculator California

Income After Taxes Calculator California

Employee Retention Tax Credit Calculator MartineMaili