In a world where screens dominate our lives The appeal of tangible printed items hasn't gone away. If it's to aid in education or creative projects, or simply to add personal touches to your home, printables for free are a great source. With this guide, you'll dive in the world of "Tax Breaks On New Home Construction," exploring the benefits of them, where to locate them, and how they can enrich various aspects of your life.

Get Latest Tax Breaks On New Home Construction Below

Tax Breaks On New Home Construction

Tax Breaks On New Home Construction -

If you bought built sold or renovated a home in 2023 you might be wondering what that means for your tax situation Don t worry the Canada Revenue Agency CRA is here to help We have information about tax incentives that can help you with housing costs

There are tax credits available for new home construction in 2023 and 2024 They come in the form of tax deductions tax breaks and and tax credits A credit is used to reduce the amount you pay and a deduction reduces your total taxable income Here are some of the tax write offs available to you now

Tax Breaks On New Home Construction provide a diverse range of downloadable, printable items that are available online at no cost. These materials come in a variety of designs, including worksheets templates, coloring pages, and many more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Tax Breaks On New Home Construction

Marjorie Taylor Greene And Her Husband Received Tax Breaks On Two

Marjorie Taylor Greene And Her Husband Received Tax Breaks On Two

Recent statistics indicate that property taxes on new constructions can vary significantly based on location size and other factors As you delve into this comprehensive breakdown you ll gain insights into the assessment process factors influencing your tax bill and strategies to navigate this financial obligation Stay with us

Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be able to claim tax credits up to 5 000 per home The amount of the credit depends on factors including the type of home its energy efficiency and the date when the home is acquired On this page Who is eligible Homes that qualify

Tax Breaks On New Home Construction have risen to immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Individualization It is possible to tailor printables to your specific needs such as designing invitations, organizing your schedule, or even decorating your house.

-

Educational Value The free educational worksheets offer a wide range of educational content for learners of all ages. This makes these printables a powerful device for teachers and parents.

-

The convenience of immediate access various designs and templates can save you time and energy.

Where to Find more Tax Breaks On New Home Construction

Here s How Crypto Traders Are Converting Worthless NFTs Into Tax Breaks

Here s How Crypto Traders Are Converting Worthless NFTs Into Tax Breaks

45L Tax Credits for Home Builders Federal Tax Credits for Builders of Energy Efficient Homes As part of the Inflation Reduction Act IRA the Section 45L New Energy Efficient Home Credit has been updated and extended through 2032

July 25 2023 The U S government has introduced tax credits for new home construction in 2023 and 2024 that are meant to promote the growth of the construction industry and incentivize homeowners to invest in developing new residential properties Highlights of the tax credits for new home construction in 2023 and 2024 include

In the event that we've stirred your interest in printables for free Let's look into where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Tax Breaks On New Home Construction for all motives.

- Explore categories like design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- Ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a broad range of topics, including DIY projects to planning a party.

Maximizing Tax Breaks On New Home Construction

Here are some fresh ways of making the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Tax Breaks On New Home Construction are a treasure trove of practical and imaginative resources designed to meet a range of needs and interests. Their accessibility and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the many options of Tax Breaks On New Home Construction and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can print and download these documents for free.

-

Can I use free printables for commercial use?

- It's all dependent on the conditions of use. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues when you download Tax Breaks On New Home Construction?

- Certain printables may be subject to restrictions on use. Always read the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with a printer or visit an in-store print shop to get the highest quality prints.

-

What software do I require to open printables that are free?

- The majority of printed documents are in the format PDF. This is open with no cost software like Adobe Reader.

Seoul To Extend Tax Breaks On Car Purchases Till The Year end

All Out Class War Imgflip

Check more sample of Tax Breaks On New Home Construction below

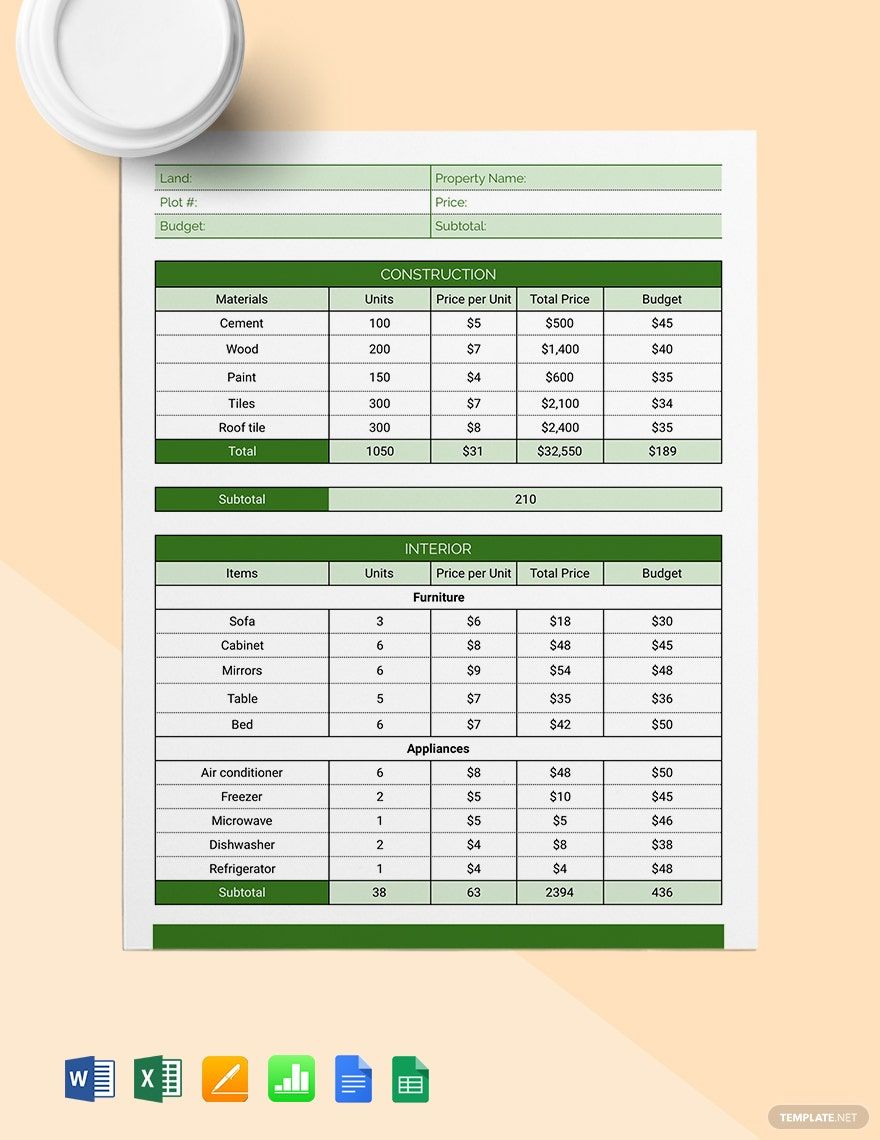

New Home Construction Budget Template Google Docs Google Sheets

Tax Breaks On Spanish Digital Nomad Visa Defined Travelzored

Owner Of Ann Arbor s Georgetown Mall Site Seeking Tax Breaks On 30

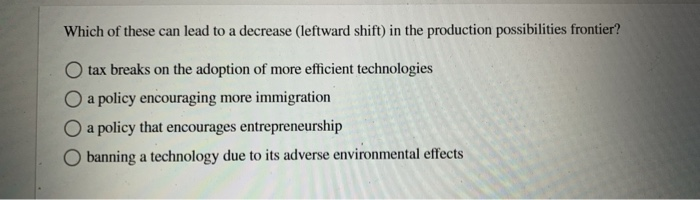

Solved 13 Of 50 Admission Prices To Dollywood Are 50 For Chegg

Florida Voters Approve Expanded Tax Breaks On Solar Energy Equipment FSRN

7 Tax Breaks Every First Time Homebuyer Must Know GOBankingRates

https://americantaxservice.org/tax-credits-new-home-construction

There are tax credits available for new home construction in 2023 and 2024 They come in the form of tax deductions tax breaks and and tax credits A credit is used to reduce the amount you pay and a deduction reduces your total taxable income Here are some of the tax write offs available to you now

https://www.simplybuildable.com/knowledge-center/new-home-build-taxes

New Home Construction Deductions Tax Credits in 2023 There are a few common tax deductions and credits for new home builds which we ve outlined below Mortgage Interest Deduction Mortgage interest on a construction loan used to build your home is generally deductible during the construction period The deduction for

There are tax credits available for new home construction in 2023 and 2024 They come in the form of tax deductions tax breaks and and tax credits A credit is used to reduce the amount you pay and a deduction reduces your total taxable income Here are some of the tax write offs available to you now

New Home Construction Deductions Tax Credits in 2023 There are a few common tax deductions and credits for new home builds which we ve outlined below Mortgage Interest Deduction Mortgage interest on a construction loan used to build your home is generally deductible during the construction period The deduction for

Solved 13 Of 50 Admission Prices To Dollywood Are 50 For Chegg

Tax Breaks On Spanish Digital Nomad Visa Defined Travelzored

Florida Voters Approve Expanded Tax Breaks On Solar Energy Equipment FSRN

7 Tax Breaks Every First Time Homebuyer Must Know GOBankingRates

Back to school Tax Breaks On The Books LB Carlson

How Reform Could Affect Our Favorite Tax Breaks The Blade

How Reform Could Affect Our Favorite Tax Breaks The Blade

Can I Get Tax Breaks For Seniors On This Home NJMoneyHelp