In this age of electronic devices, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Be it for educational use and creative work, or simply adding an element of personalization to your space, Tax Benefits On Education Loan In India are now an essential source. With this guide, you'll take a dive into the sphere of "Tax Benefits On Education Loan In India," exploring what they are, how to locate them, and ways they can help you improve many aspects of your lives.

Get Latest Tax Benefits On Education Loan In India Below

Tax Benefits On Education Loan In India

Tax Benefits On Education Loan In India -

Verkko 16 helmik 2021 nbsp 0183 32 You are eligible for tax benefits on education loan provisioned by the Income Tax Act of 1961 However certain conditions must be met before claiming any tax benefits Here are the ins and outs to know before you can claim tax benefits Who Can Claim Education Loan Tax Benefits

Verkko 19 hein 228 k 2023 nbsp 0183 32 a comphrehensive guide on education loan tax benefits under section 80 E of income tax this is over the Rs 1 5 lakh deduction permitted under Section 80C

Tax Benefits On Education Loan In India cover a large range of downloadable, printable materials online, at no cost. These printables come in different types, such as worksheets templates, coloring pages, and much more. One of the advantages of Tax Benefits On Education Loan In India is their versatility and accessibility.

More of Tax Benefits On Education Loan In India

Ultimate Guide On Education Loan Eligibility Interest Rates

Ultimate Guide On Education Loan Eligibility Interest Rates

Verkko 12 huhtik 2022 nbsp 0183 32 A legal guardian who is paying off the loan for the child can claim tax benefits Purpose of the loan Under section 80E you can only avail of a tax deduction for education loanstaken for higher studies in India or abroad Higher studies include any full time course you wish to pursue after passing the senior secondary exam or its

Verkko To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961

Tax Benefits On Education Loan In India have risen to immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Flexible: There is the possibility of tailoring printed materials to meet your requirements, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value: Free educational printables cater to learners from all ages, making them an essential aid for parents as well as educators.

-

It's easy: Quick access to a plethora of designs and templates saves time and effort.

Where to Find more Tax Benefits On Education Loan In India

Indian Bank Education Loan Eligibility Interest Rates Repayment

Indian Bank Education Loan Eligibility Interest Rates Repayment

Verkko 13 syysk 2022 nbsp 0183 32 Parents who have taken an education loan for their child s higher education in India or abroad can claim this deduction It helps them save tax on their total income

Verkko 25 elok 2022 nbsp 0183 32 Education loan income tax benefits are available only for a certain period You can claim the education loan tax deductions from the year in which you start paying the EMIs for a maximum of eight years This means if you ve taken your education loan for ten years you can claim the deductions for up to eight years only

If we've already piqued your interest in Tax Benefits On Education Loan In India we'll explore the places you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Tax Benefits On Education Loan In India to suit a variety of purposes.

- Explore categories such as home decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing Tax Benefits On Education Loan In India

Here are some fresh ways that you can make use use of Tax Benefits On Education Loan In India:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home also in the classes.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Tax Benefits On Education Loan In India are an abundance of useful and creative resources for a variety of needs and needs and. Their availability and versatility make them a fantastic addition to the professional and personal lives of both. Explore the world of Tax Benefits On Education Loan In India today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can download and print these resources at no cost.

-

Can I make use of free printables in commercial projects?

- It depends on the specific conditions of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright issues in Tax Benefits On Education Loan In India?

- Some printables may come with restrictions in their usage. Be sure to review the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer or go to a local print shop to purchase high-quality prints.

-

What software do I need to run printables at no cost?

- Most printables come in the PDF format, and can be opened using free software such as Adobe Reader.

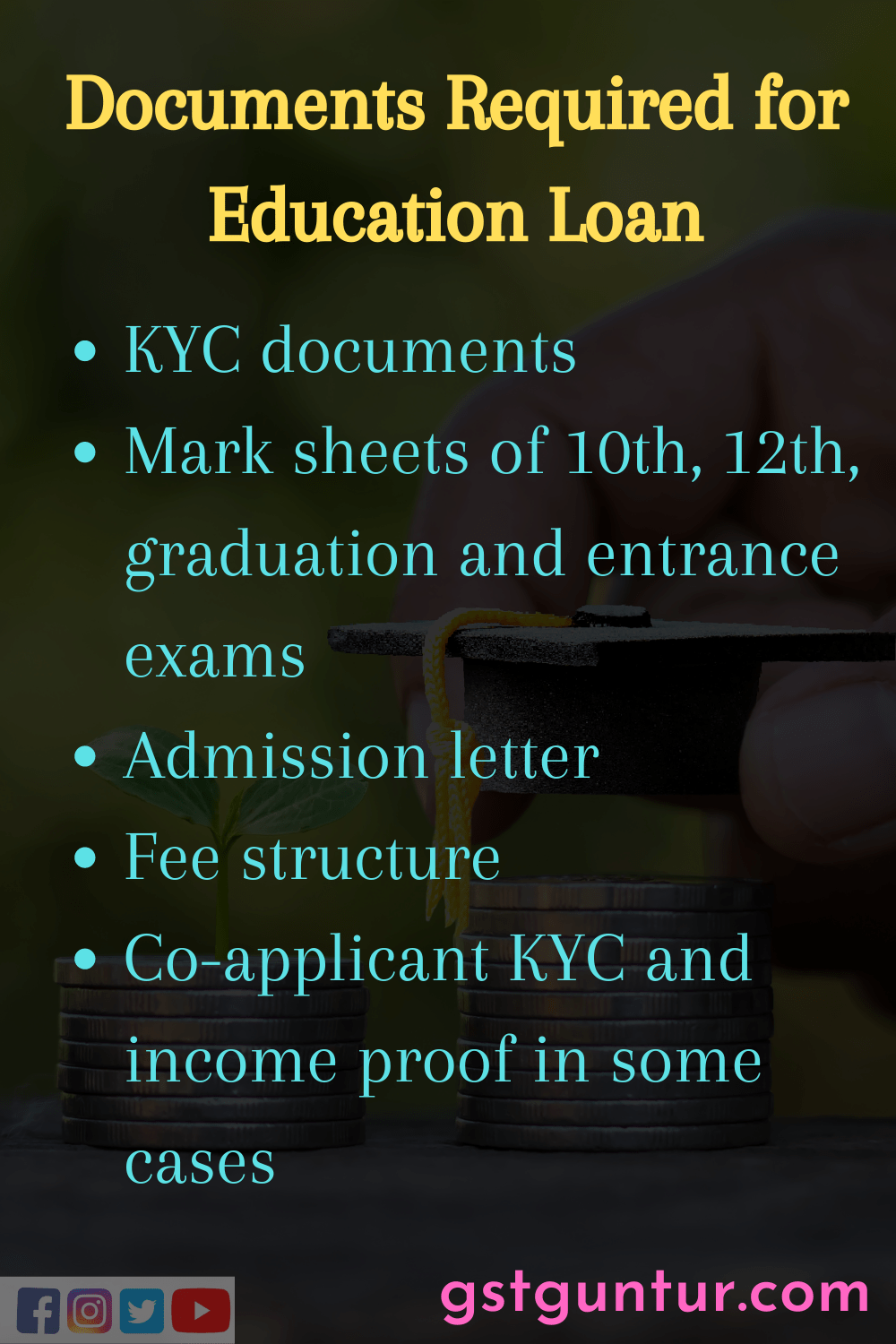

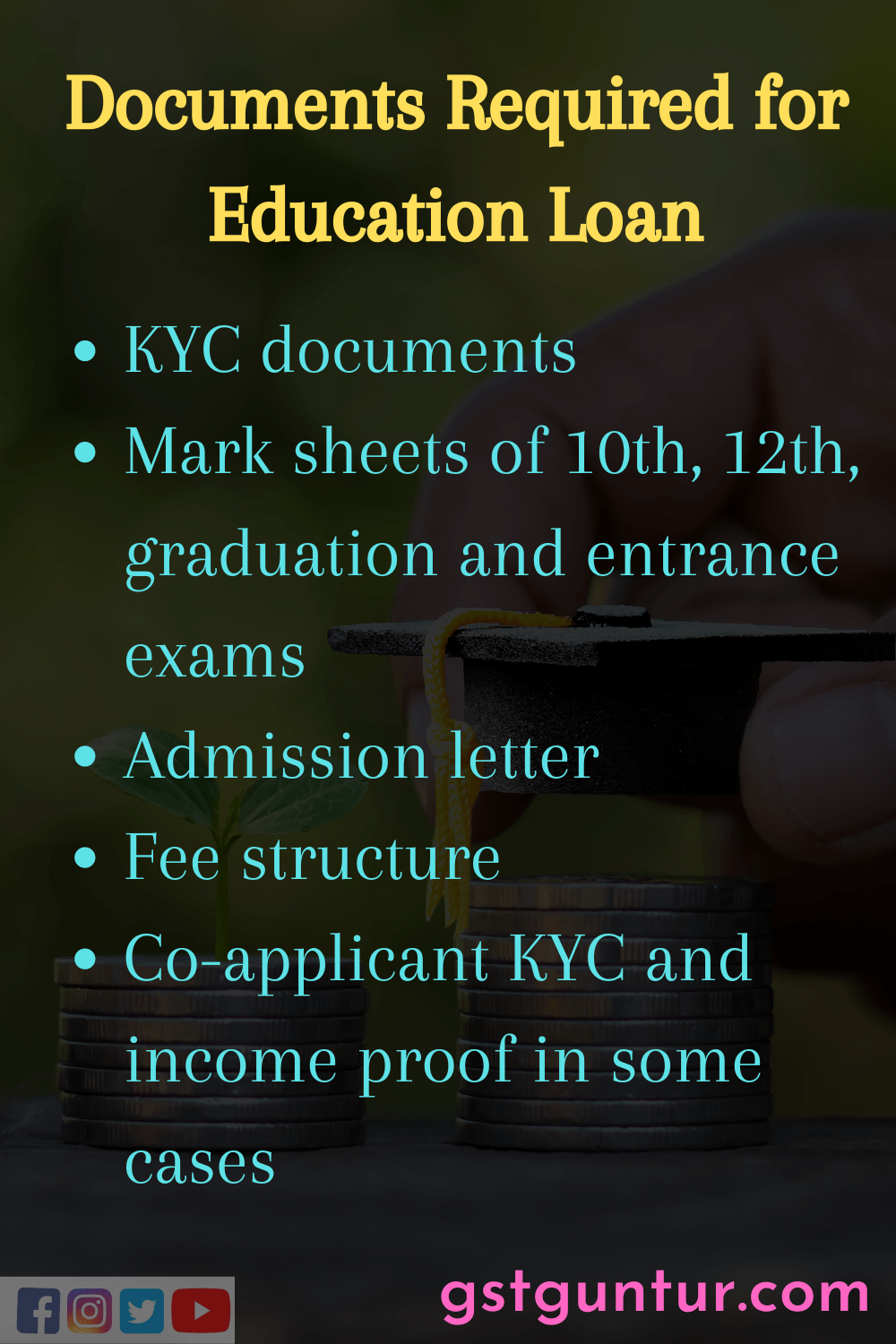

Documents Required For Education Loan In India 2022 Abroad Interest

HDFC Bank Education Loan In India 2023 Soon Abroad Interest Eligibility

Check more sample of Tax Benefits On Education Loan In India below

Vijaya Bank Education Loan Scheme Education Loan By Vijaya Bank For

Education Loan In India All Details You Need To Know

Which Bank Is Best For Education Loan In India Oscar has Bell

How To Get Education Loan In India Education Loan Kaise Milta Hai

How To Apply For Education Loan In India

Best Education Loan In India Exact Answer 2023 Education Portal

https://financeyatra.com/education-loan-tax-benefits

Verkko 19 hein 228 k 2023 nbsp 0183 32 a comphrehensive guide on education loan tax benefits under section 80 E of income tax this is over the Rs 1 5 lakh deduction permitted under Section 80C

https://cleartax.in/s/section-80e-deduction-interest-education-loan

Verkko 27 kes 228 k 2023 nbsp 0183 32 An education loan helps you not only finance your higher studies but it can save you a lot of tax as well If you have taken an education loan and are repaying the same then the interest paid on that education loan is allowed as a deduction from the total income under Section 80E

Verkko 19 hein 228 k 2023 nbsp 0183 32 a comphrehensive guide on education loan tax benefits under section 80 E of income tax this is over the Rs 1 5 lakh deduction permitted under Section 80C

Verkko 27 kes 228 k 2023 nbsp 0183 32 An education loan helps you not only finance your higher studies but it can save you a lot of tax as well If you have taken an education loan and are repaying the same then the interest paid on that education loan is allowed as a deduction from the total income under Section 80E

How To Get Education Loan In India Education Loan Kaise Milta Hai

Education Loan In India All Details You Need To Know

How To Apply For Education Loan In India

Best Education Loan In India Exact Answer 2023 Education Portal

5 Things You Must Know About Education Loan Tax Benefits In 2022

Income Tax Benefits On Housing Loan In India

Income Tax Benefits On Housing Loan In India

Know How You Can Get Tax Benefits On Home Loan