In the age of digital, when screens dominate our lives The appeal of tangible printed products hasn't decreased. For educational purposes for creative projects, just adding the personal touch to your area, Tax Benefit On Car Depreciation India are now an essential source. With this guide, you'll take a dive deep into the realm of "Tax Benefit On Car Depreciation India," exploring the different types of printables, where you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Tax Benefit On Car Depreciation India Below

Tax Benefit On Car Depreciation India

Tax Benefit On Car Depreciation India -

You can depreciate your car up to 15 in a year This depreciation can be deducted whether you opt for a Car Loan or not How to claim Car Loan tax benefit Claiming Car Loan tax benefits is easy as long as you are actually using the car for legitimate business purposes

By adding zero depreciation to your car insurance you can claim several benefits such as Save better with high payouts covering the depreciation of your car and damaged parts No depreciation is charged while settling an insurance claim helping you to claim a higher amount

Printables for free include a vast array of printable materials available online at no cost. These printables come in different forms, like worksheets templates, coloring pages and more. One of the advantages of Tax Benefit On Car Depreciation India is in their versatility and accessibility.

More of Tax Benefit On Car Depreciation India

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

In India Depreciation is considered as a most Important aspect from Taxation Point of view Recently our Finance Ministry Of India Hon Nirmalaji Sitaraman announced some measures for the auto sector to create demand for motor vehicles

One way to claim a car loan tax benefit is to prove the car as a depreciating asset and consider this depreciation as an expense One can claim depreciation on the car at 15 every year which reduces one s tax liability

The Tax Benefit On Car Depreciation India have gained huge popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Modifications: It is possible to tailor printables to your specific needs whether you're designing invitations making your schedule, or decorating your home.

-

Educational Value The free educational worksheets can be used by students of all ages. This makes them an essential source for educators and parents.

-

Simple: The instant accessibility to a myriad of designs as well as templates reduces time and effort.

Where to Find more Tax Benefit On Car Depreciation India

How To Calculate Depreciation Value In India Sapling

How To Calculate Depreciation Value In India Sapling

Under the Income Tax Act depreciation is allowed as a deductible expense for assets used in business or profession subject to certain conditions and limitations The amount of depreciation that can be claimed depends on the asset s useful life which is determined by the Income Tax Rules

The government of India offers a tax deduction of up to 1 50 000 on the interest paid on the car loan taken for buying an electric vehicle under section 80EEB of the Income Tax Act This is done to promote the sales of EVs in India

Now that we've ignited your interest in Tax Benefit On Car Depreciation India Let's find out where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection with Tax Benefit On Car Depreciation India for all needs.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- These blogs cover a broad array of topics, ranging everything from DIY projects to planning a party.

Maximizing Tax Benefit On Car Depreciation India

Here are some unique ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home as well as in the class.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Tax Benefit On Car Depreciation India are a treasure trove of useful and creative resources that can meet the needs of a variety of people and pursuits. Their accessibility and flexibility make them a great addition to both personal and professional life. Explore the vast collection of Tax Benefit On Car Depreciation India and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes they are! You can download and print these items for free.

-

Are there any free printables to make commercial products?

- It's all dependent on the terms of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions in their usage. Make sure to read the terms and conditions provided by the creator.

-

How can I print Tax Benefit On Car Depreciation India?

- Print them at home with the printer, or go to a print shop in your area for top quality prints.

-

What software must I use to open printables free of charge?

- The majority of printables are in PDF format. These can be opened with free programs like Adobe Reader.

UNDERSTANDING USED CAR DEPRECIATION RCOCASH4CARS COM

Income Tax Benefits On Car Loan Tata Capital

Check more sample of Tax Benefit On Car Depreciation India below

Canada Citizens Are Getting Huge Benefit On Car Loan If They Sign Up

What Is Car Depreciation And Which Factors Affect It

How To Claim Tax Benefits On Home Loan Bleu Finance

Depreciation On Car As Per Income Tax

Mercedes Profits To Be Hurt By Rupee Depreciation And Import Duty Hike

Do You Know Whats Car Loan Let s Find Out What A Car Loan Is And Its

https://cleartax.in/s/car-bike-depreciation-rate

By adding zero depreciation to your car insurance you can claim several benefits such as Save better with high payouts covering the depreciation of your car and damaged parts No depreciation is charged while settling an insurance claim helping you to claim a higher amount

https://cleartax.in/s/tax-benefit-salaried-employee-car-provided-employer

Tax benefits on the car lease facility provided by the employer can be claimed depending on the ownership of the car and expenses incurred Read more here

By adding zero depreciation to your car insurance you can claim several benefits such as Save better with high payouts covering the depreciation of your car and damaged parts No depreciation is charged while settling an insurance claim helping you to claim a higher amount

Tax benefits on the car lease facility provided by the employer can be claimed depending on the ownership of the car and expenses incurred Read more here

Depreciation On Car As Per Income Tax

What Is Car Depreciation And Which Factors Affect It

Mercedes Profits To Be Hurt By Rupee Depreciation And Import Duty Hike

Do You Know Whats Car Loan Let s Find Out What A Car Loan Is And Its

Theme For Rupee Still Remains Gradual Depreciation India

Whats Is Car Depreciation Rate Calculator IRDAI Vehicle Depreciation

Whats Is Car Depreciation Rate Calculator IRDAI Vehicle Depreciation

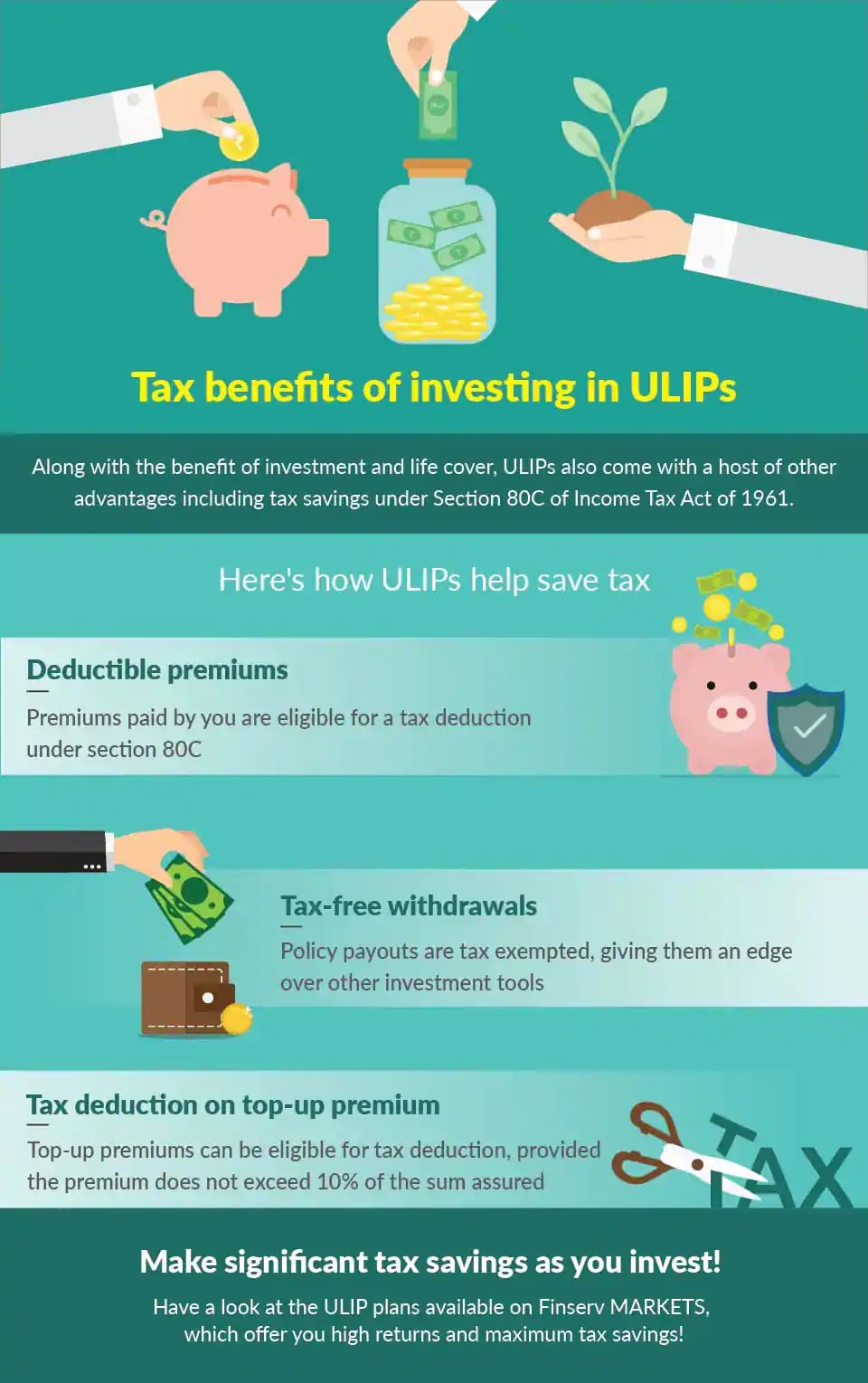

Know Everything About The Tax Benefits Of ULIPs