Today, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses or creative projects, or simply adding the personal touch to your area, Tax Benefit On 2nd Home Loan are now an essential source. This article will take a dive into the sphere of "Tax Benefit On 2nd Home Loan," exploring what they are, where they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Tax Benefit On 2nd Home Loan Below

Tax Benefit On 2nd Home Loan

Tax Benefit On 2nd Home Loan -

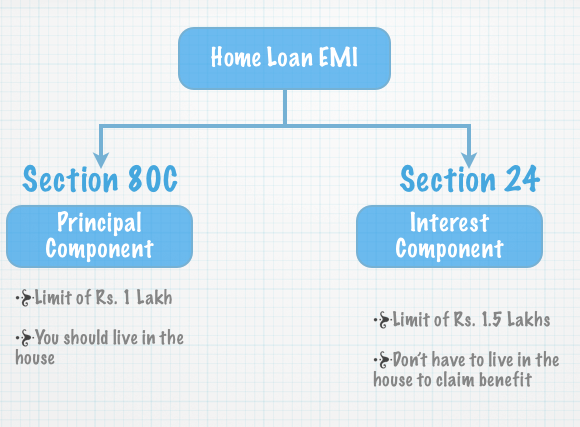

The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether your second home is a rental property or a personal retreat affects these benefits adding layers of complexity to the decision

Tax Benefit On 2nd Home Loan cover a large selection of printable and downloadable items that are available online at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages and more. The appeal of printables for free lies in their versatility and accessibility.

More of Tax Benefit On 2nd Home Loan

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Income tax benefit on 2 home loans home loan tax rebate Next Story Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for

However the TCJA signed into law in December 2017 changed how much you can save through mortgage interest deductions for both primary residences and second homes If the second home is

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: We can customize printing templates to your own specific requirements in designing invitations to organize your schedule or even decorating your house.

-

Educational Value: These Tax Benefit On 2nd Home Loan offer a wide range of educational content for learners of all ages, making them a useful instrument for parents and teachers.

-

Convenience: The instant accessibility to a variety of designs and templates cuts down on time and efforts.

Where to Find more Tax Benefit On 2nd Home Loan

Avail Tax benefit On Personal Loan MY Wicked Armor

Avail Tax benefit On Personal Loan MY Wicked Armor

Tax Benefits for Second Home Loan Those who own two homes are eligible for a bevy of tax breaks However if you have previously paid off your house loan in full you will not be eligible for this benefit Let s take a closer look at those advantages

For tax years prior to 2018 you can write off 100 of the interest you pay on up to 1 1 million of debt secured by your first and second homes and used to acquire or improve the properties This is made up of a maximum of up to 1M of mortgage debt plus a maximum of up to 100k of home equity debt

We hope we've stimulated your interest in Tax Benefit On 2nd Home Loan, let's explore where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Tax Benefit On 2nd Home Loan to suit a variety of motives.

- Explore categories like design, home decor, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets or flashcards as well as learning materials.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a broad array of topics, ranging that includes DIY projects to planning a party.

Maximizing Tax Benefit On 2nd Home Loan

Here are some creative ways to make the most of Tax Benefit On 2nd Home Loan:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Tax Benefit On 2nd Home Loan are a treasure trove of creative and practical resources which cater to a wide range of needs and needs and. Their availability and versatility make them an essential part of any professional or personal life. Explore the wide world of Tax Benefit On 2nd Home Loan to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can print and download these files for free.

-

Can I use the free printables to make commercial products?

- It depends on the specific terms of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright issues when you download Tax Benefit On 2nd Home Loan?

- Some printables may have restrictions in use. Make sure to read the terms and conditions provided by the author.

-

How do I print Tax Benefit On 2nd Home Loan?

- You can print them at home with an printer, or go to any local print store for more high-quality prints.

-

What program do I require to open printables at no cost?

- Most PDF-based printables are available in the PDF format, and can be opened with free software, such as Adobe Reader.

How To Claim Tax Benefits On Home Loan Bleu Finance

Second Home Loan Tax Benefit What It Is And How It Works

Check more sample of Tax Benefit On 2nd Home Loan below

Tax Benefits On Second Home Loan Tax Exemption On 2nd Home Loan PNB

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Second Home Loan Advantages BankBazaar The Definitive Word On

Home Loan Tax Benefit On Second Home The Inside Experience

Tax Benefit On Second Home Loan Money Doctor Show English EP 160

2nd Home Loan Rochester Hills MI 2nd Home Loan Experts Michigan

https://www.basichomeloan.com/blog/home-loans/tax...

The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether your second home is a rental property or a personal retreat affects these benefits adding layers of complexity to the decision

https://www.hdfcbank.com/personal/resources/...

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be available in case of your second house you can enjoy tax

The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether your second home is a rental property or a personal retreat affects these benefits adding layers of complexity to the decision

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be available in case of your second house you can enjoy tax

Home Loan Tax Benefit On Second Home The Inside Experience

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Tax Benefit On Second Home Loan Money Doctor Show English EP 160

2nd Home Loan Rochester Hills MI 2nd Home Loan Experts Michigan

Tax Benefits Of The Second Home Loan LoanDPR

What Are The Tax Benefit On Home Loan FY 2020 2021

What Are The Tax Benefit On Home Loan FY 2020 2021

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium