In this day and age where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. If it's to aid in education and creative work, or simply adding an individual touch to the space, Super Tax Deduction Qualifying Assets have become an invaluable resource. The following article is a take a dive deeper into "Super Tax Deduction Qualifying Assets," exploring the different types of printables, where you can find them, and ways they can help you improve many aspects of your lives.

Get Latest Super Tax Deduction Qualifying Assets Below

Super Tax Deduction Qualifying Assets

Super Tax Deduction Qualifying Assets -

What are the new allowances Both the super deduction and SR allowance give businesses investing in qualifying equipment a much higher tax deduction in the tax year of purchase than would otherwise normally occur a first year allowance FYA The allowances apply for capital investments made between 1 April 2021 and 31 March 2023

27 May 2022 Last updated 10 October 2023 See all updates Get emails about this page Contents Get help to check if you can claim and how much you can claim Check if your plant and machinery

Printables for free cover a broad assortment of printable, downloadable items that are available online at no cost. These resources come in many types, such as worksheets templates, coloring pages and more. The appealingness of Super Tax Deduction Qualifying Assets lies in their versatility and accessibility.

More of Super Tax Deduction Qualifying Assets

MedPoint The Super Deduction Tax Scheme

MedPoint The Super Deduction Tax Scheme

Qualifying assets Deducts 13m using the super deduction in year 1 Receives a tax saving of 19 x 13m 2 47m Eligibility criteria are outlined in the published tax

The super deduction is a new type of capital allowance which means companies can use it to claim tax relief on assets which in turn reduces their Corporation Tax It s a temporary measure available from 1st April 2021 until 31 March 2023 Purchases made from 1st April 2023 might instead be eligible for Full Expensing

Super Tax Deduction Qualifying Assets have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Flexible: The Customization feature lets you tailor print-ready templates to your specific requirements in designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free are designed to appeal to students from all ages, making them an essential tool for teachers and parents.

-

An easy way to access HTML0: immediate access the vast array of design and templates can save you time and energy.

Where to Find more Super Tax Deduction Qualifying Assets

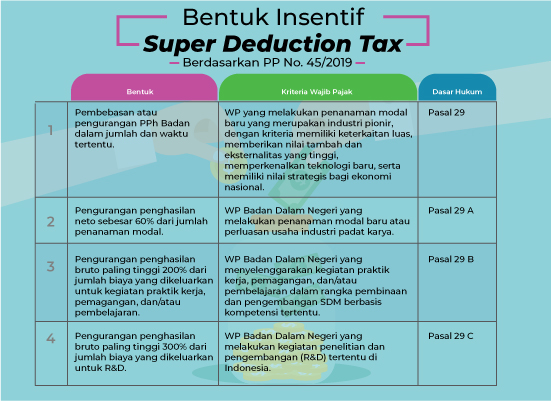

Super Deduction Tax Solusi Insentif Bagi Industri

Super Deduction Tax Solusi Insentif Bagi Industri

The government introduced the super deduction in 2021 the biggest two year business tax cut in modern British history to encourage companies to make additional investments and to bring

The kind of assets that qualify for the super deduction include but are not limited to Solar panels Computer equipment and servers Tractors lorries vans Ladders drills cranes Office chairs and desks Electric vehicle charge points Refrigeration units Compressors Further guidance on qualifying products has yet to be

We've now piqued your interest in Super Tax Deduction Qualifying Assets Let's take a look at where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Super Tax Deduction Qualifying Assets suitable for many applications.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a wide array of topics, ranging that range from DIY projects to party planning.

Maximizing Super Tax Deduction Qualifying Assets

Here are some innovative ways to make the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Super Tax Deduction Qualifying Assets are a treasure trove of creative and practical resources designed to meet a range of needs and needs and. Their access and versatility makes them a great addition to every aspect of your life, both professional and personal. Explore the wide world of Super Tax Deduction Qualifying Assets and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can download and print these resources at no cost.

-

Are there any free printables for commercial purposes?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with Super Tax Deduction Qualifying Assets?

- Some printables may come with restrictions in their usage. Be sure to read the terms and condition of use as provided by the creator.

-

How do I print Super Tax Deduction Qualifying Assets?

- You can print them at home using either a printer or go to any local print store for premium prints.

-

What program do I require to open Super Tax Deduction Qualifying Assets?

- The majority of printed documents are in the format PDF. This can be opened with free software, such as Adobe Reader.

Bentuk Insentif Super Deduction Tax Berdasarkan PP No 45 2019 Ortax

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Check more sample of Super Tax Deduction Qualifying Assets below

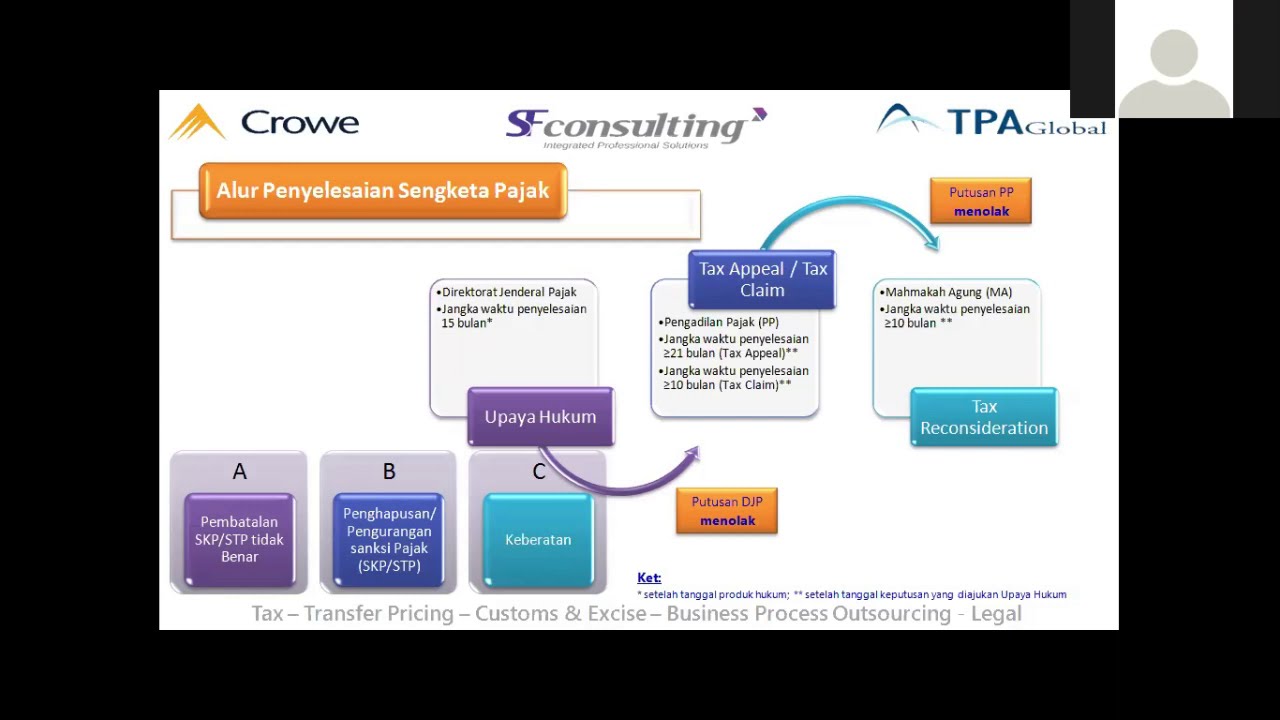

How To Deal With SP2DK And Super Tax Deduction YouTube

Cheng Cheng Taxation Reveals How Super Tax Deduction On R D

Contribute To Your Super And Claim A Tax Deduction Avance

5 Kelompok Biaya Vokasi Yang Dapat Fasilitas Super Tax Deduction

COACHING CLINIC SUPER TAX DEDUCTION VOKASI YouTube

Seniors May Be Able To Write Off Medicare Premiums On Their Tax Returns

https://www.gov.uk/guidance/check-if-you-can-claim...

27 May 2022 Last updated 10 October 2023 See all updates Get emails about this page Contents Get help to check if you can claim and how much you can claim Check if your plant and machinery

https://www.gov.uk/guidance/work-out-what-you-can...

Check how much you can claim for the super deduction If your accounting period ends before 1 April 2023 the rate of super deduction is 130

27 May 2022 Last updated 10 October 2023 See all updates Get emails about this page Contents Get help to check if you can claim and how much you can claim Check if your plant and machinery

Check how much you can claim for the super deduction If your accounting period ends before 1 April 2023 the rate of super deduction is 130

5 Kelompok Biaya Vokasi Yang Dapat Fasilitas Super Tax Deduction

Cheng Cheng Taxation Reveals How Super Tax Deduction On R D

COACHING CLINIC SUPER TAX DEDUCTION VOKASI YouTube

Seniors May Be Able To Write Off Medicare Premiums On Their Tax Returns

Employees At At A Construction Site In Stratford U K

Insentif Super Tax Deduction Dikhawatirkan Sepi Peminat

Insentif Super Tax Deduction Dikhawatirkan Sepi Peminat

Super deduction Scheme An Overview Old Mill