In the digital age, when screens dominate our lives but the value of tangible printed items hasn't gone away. Whatever the reason, whether for education for creative projects, simply to add the personal touch to your home, printables for free are now an essential resource. With this guide, you'll dive deep into the realm of "Spain Tax Refund Minimum Amount," exploring what they are, how to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Spain Tax Refund Minimum Amount Below

Spain Tax Refund Minimum Amount

Spain Tax Refund Minimum Amount -

The traveler may request a refund of the VAT incurred on their purchases in Spain provided that they meet all the legally required requirements and that the electronic refund document DER

You simply need to fill in the Tax Free form in the shops where you buy your purchases Then get the form validated at Customs within 3 months of the purchase date The electronic VAT

Spain Tax Refund Minimum Amount provide a diverse range of printable, free documents that can be downloaded online at no cost. These printables come in different types, like worksheets, templates, coloring pages and more. The value of Spain Tax Refund Minimum Amount lies in their versatility as well as accessibility.

More of Spain Tax Refund Minimum Amount

Spain Safety Tax Free

Spain Safety Tax Free

The minimum purchase amount to qualify for a VAT refund in Spain is approximately 90 How much is Barcelona tax refund The tax refund rate in Barcelona is

The standard VAT rate in Spain is 21 On average visitors can expect a refund of approximately 13 of the total purchace price although rates may vary What is the minimum

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Personalization The Customization feature lets you tailor printables to your specific needs whether it's making invitations to organize your schedule or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free cater to learners of all ages, which makes them a vital instrument for parents and teachers.

-

Easy to use: The instant accessibility to a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Spain Tax Refund Minimum Amount

Tax System In Spain 2021 Smartcitizenship

Tax System In Spain 2021 Smartcitizenship

Therefore Spain allows tourists and others who purchase goods within Spain for export to receive a refund of any VAT taxes paid In order to qualify to request a VAT refund in Spain you must

Shopping guide Guide to shopping abroad Global Blue official site Global Blue

Now that we've ignited your interest in Spain Tax Refund Minimum Amount and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Spain Tax Refund Minimum Amount to suit a variety of purposes.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a broad variety of topics, ranging from DIY projects to party planning.

Maximizing Spain Tax Refund Minimum Amount

Here are some fresh ways for you to get the best use of Spain Tax Refund Minimum Amount:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home also in the classes.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Spain Tax Refund Minimum Amount are a treasure trove with useful and creative ideas which cater to a wide range of needs and preferences. Their accessibility and versatility make them a fantastic addition to the professional and personal lives of both. Explore the vast world of Spain Tax Refund Minimum Amount right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Spain Tax Refund Minimum Amount truly absolutely free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I utilize free printables for commercial use?

- It depends on the specific terms of use. Always check the creator's guidelines before using printables for commercial projects.

-

Do you have any copyright issues in Spain Tax Refund Minimum Amount?

- Some printables could have limitations in use. You should read the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in a local print shop to purchase better quality prints.

-

What software will I need to access Spain Tax Refund Minimum Amount?

- Many printables are offered in the PDF format, and can be opened using free software like Adobe Reader.

How To Get Tax Refund In Spain

Spain Cryptocurrency Tax Guide 2022 Koinly

Check more sample of Spain Tax Refund Minimum Amount below

Large scale Tax Refund Minimum Wage Increase These New Regulations

Scottare Remo Privato Federal Refund Preferito Contratto Di Locazione

Suite 308 Mapes Hotel

Wealthsimple Tax Free Online Tax Filing Software 2022 CRA Netfile

Explosive Deals Tascrackers au

Betfair Review 2022 Sportsbook Casino Review

https://www.spain.info › gcc › en › travel_ideas › tax-free

You simply need to fill in the Tax Free form in the shops where you buy your purchases Then get the form validated at Customs within 3 months of the purchase date The electronic VAT

https://blogaboutspain.com › tax-free-shopping-how...

In Spain the minimum purchase amount to qualify for a VAT refund is 90 15 This means you must spend at least this amount in a single store on the same day Keep this in

You simply need to fill in the Tax Free form in the shops where you buy your purchases Then get the form validated at Customs within 3 months of the purchase date The electronic VAT

In Spain the minimum purchase amount to qualify for a VAT refund is 90 15 This means you must spend at least this amount in a single store on the same day Keep this in

Wealthsimple Tax Free Online Tax Filing Software 2022 CRA Netfile

Scottare Remo Privato Federal Refund Preferito Contratto Di Locazione

Explosive Deals Tascrackers au

Betfair Review 2022 Sportsbook Casino Review

Tax Free Shopping VAT Tax Refund Spain Planet

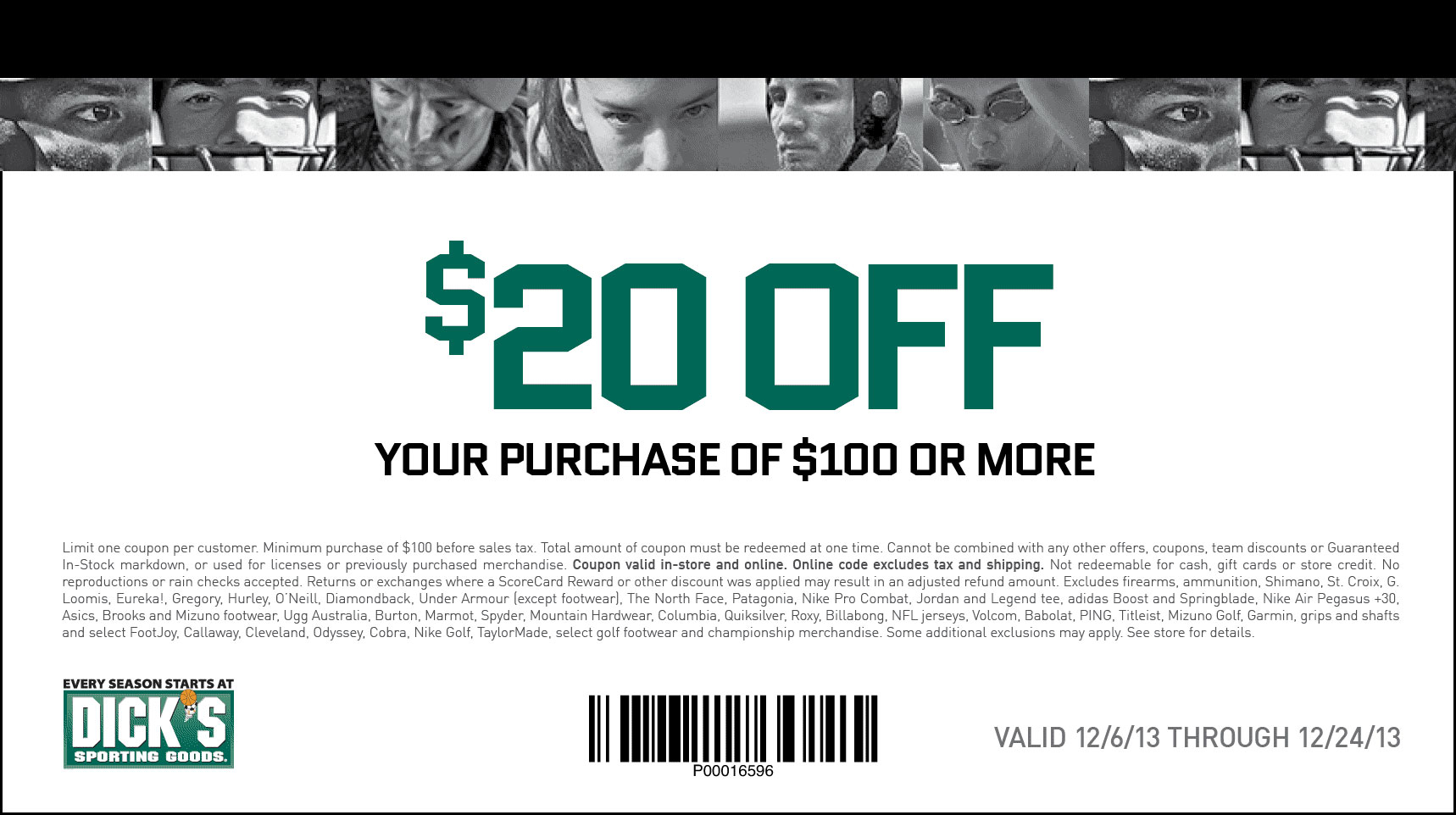

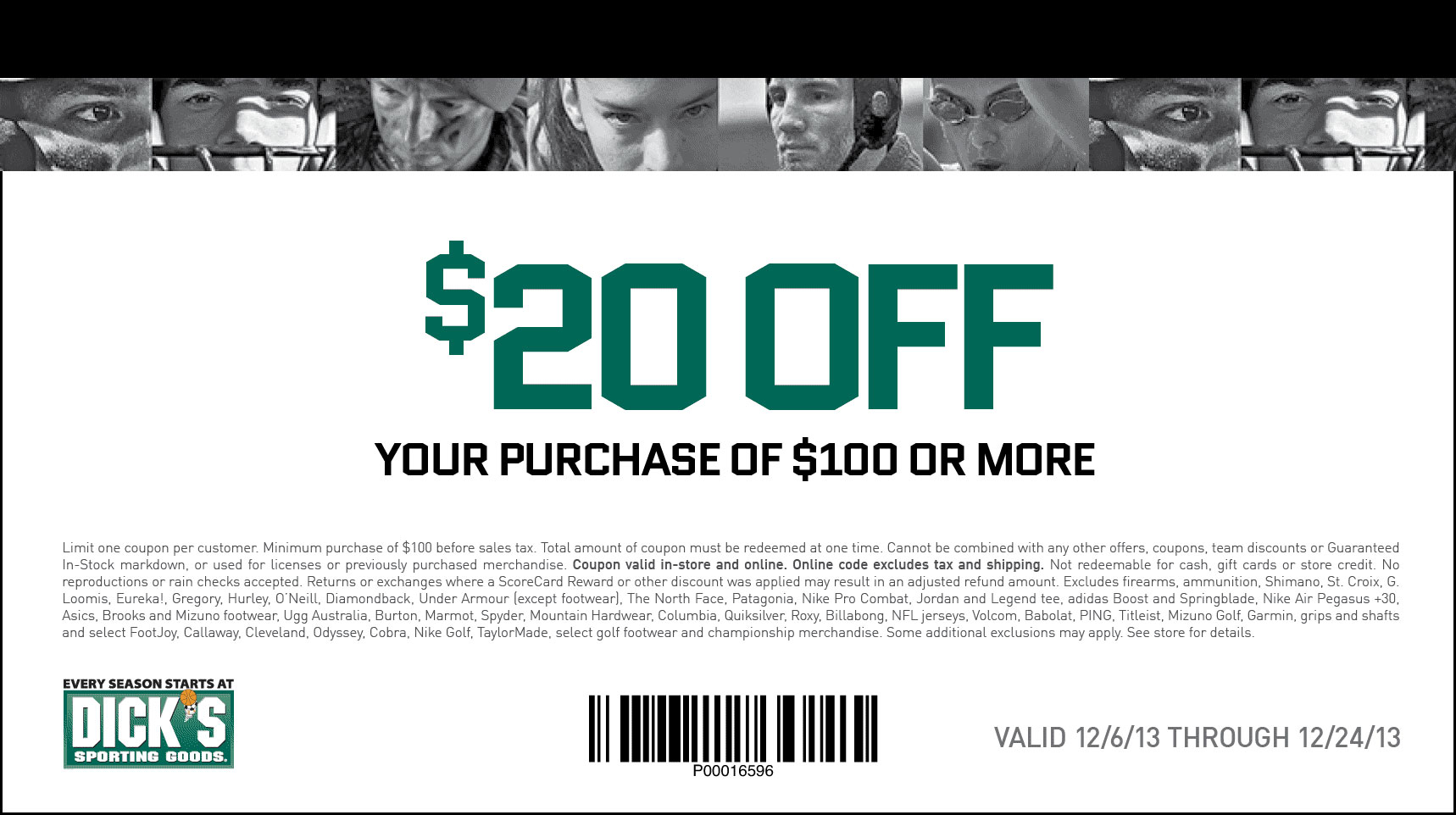

Dick s Sporting Goods Print 20 Off Coupon

Dick s Sporting Goods Print 20 Off Coupon

Income And Wealth Tax For Residents In Spain JF B Lawyers