Today, where screens rule our lives however, the attraction of tangible printed objects isn't diminished. If it's to aid in education project ideas, artistic or simply to add a personal touch to your space, Sovereign Gold Bond Investment Tax Exemption Under Section 80c are a great resource. Here, we'll dive through the vast world of "Sovereign Gold Bond Investment Tax Exemption Under Section 80c," exploring what they are, where to locate them, and how they can add value to various aspects of your lives.

Get Latest Sovereign Gold Bond Investment Tax Exemption Under Section 80c Below

Sovereign Gold Bond Investment Tax Exemption Under Section 80c

Sovereign Gold Bond Investment Tax Exemption Under Section 80c -

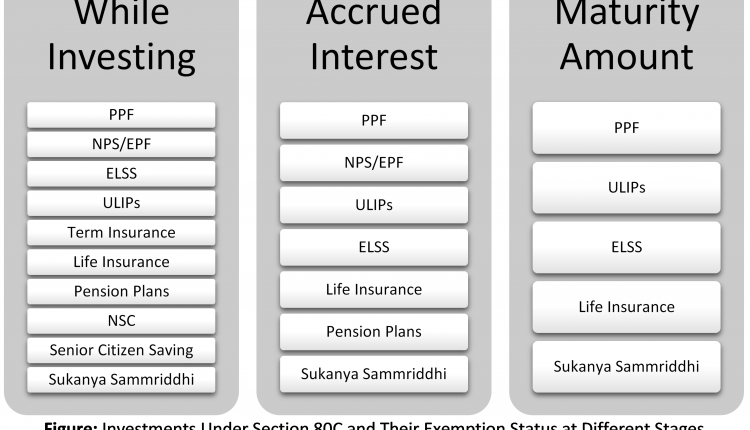

Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds SGBs Image Source Getty Images Indexation benefits SGBs also offer indexation benefits If an investor holds SGBs for more than three years they can claim the benefit of indexation on capital gains

He can claim a tax deduction of interest earned in the 80C limit if it s not fully utilized to make these bonds completely tax free Or else he can pay 20 on the total interest earned in that assessment year

Sovereign Gold Bond Investment Tax Exemption Under Section 80c offer a wide variety of printable, downloadable items that are available online at no cost. They are available in numerous forms, including worksheets, templates, coloring pages and much more. The appeal of printables for free lies in their versatility and accessibility.

More of Sovereign Gold Bond Investment Tax Exemption Under Section 80c

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

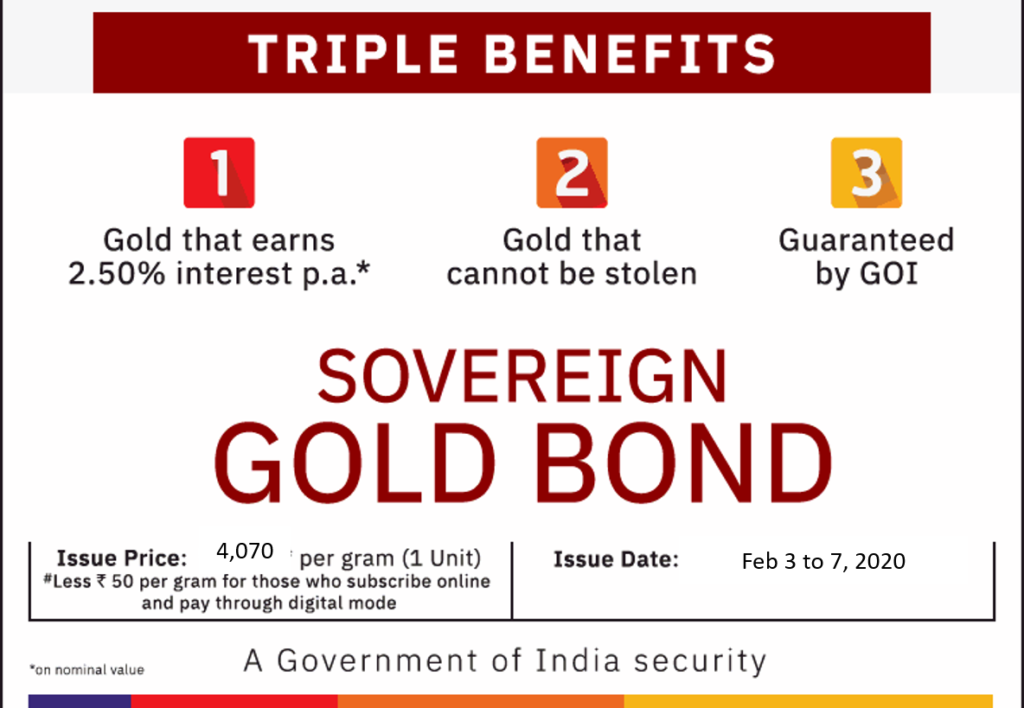

If you sell the SGB after 8 years of the lock in period the whole capital gain profit on an asset will be exempted from the taxable income Thus there are various tax benefits given by the government for investing in SGB

Nope FDs are not tax exempt Only investments in long term FDs are eligible for tax deduction under 80C And even that deduction is subject to overall limit of 1 50 Lakh per yr including PPF RPF MFs tuition fee etc But interest on these FDs is very much taxable

The Sovereign Gold Bond Investment Tax Exemption Under Section 80c have gained huge popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization Your HTML0 customization options allow you to customize printing templates to your own specific requirements in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational value: Free educational printables cater to learners of all ages, making them a vital instrument for parents and teachers.

-

Easy to use: The instant accessibility to a variety of designs and templates reduces time and effort.

Where to Find more Sovereign Gold Bond Investment Tax Exemption Under Section 80c

Sovereign Gold Bond Scheme How To Apply Returns Calculator And

Sovereign Gold Bond Scheme How To Apply Returns Calculator And

While the capital gains on the maturity of the SGB are exempt from taxation there is an anomaly about whether the realised gains are taxable if the bond is redeemed prematurely As per the frequently asked questions FAQs on the website of RBI realised gains on redemption of an SGB are tax free

This is an exclusive income tax benefit offered on gold bonds to encourage investors to shift to non physical gold 3 This exemption from capital gains tax is not available on other

Since we've got your interest in Sovereign Gold Bond Investment Tax Exemption Under Section 80c Let's look into where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Sovereign Gold Bond Investment Tax Exemption Under Section 80c for different applications.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs covered cover a wide variety of topics, from DIY projects to planning a party.

Maximizing Sovereign Gold Bond Investment Tax Exemption Under Section 80c

Here are some fresh ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Sovereign Gold Bond Investment Tax Exemption Under Section 80c are an abundance with useful and creative ideas which cater to a wide range of needs and interest. Their availability and versatility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the wide world of Sovereign Gold Bond Investment Tax Exemption Under Section 80c now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Sovereign Gold Bond Investment Tax Exemption Under Section 80c really completely free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I use the free printouts for commercial usage?

- It's based on specific usage guidelines. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright issues in Sovereign Gold Bond Investment Tax Exemption Under Section 80c?

- Certain printables could be restricted on use. You should read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home with an printer, or go to an area print shop for top quality prints.

-

What program do I require to open printables free of charge?

- Most PDF-based printables are available as PDF files, which is open with no cost software like Adobe Reader.

Gold Madhan s Money Tricks

Tax Saving Options Under Section 80C For Salaried Others TheSWO

Check more sample of Sovereign Gold Bond Investment Tax Exemption Under Section 80c below

Sovereign Gold Bond February 2020 How To Buy Tax Benefits

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Secure Your Future By Investing Wisely Invest In Public Provident

Income Tax Exemption Up To Rs 3 Lakh Under Section 80C Among Top Budget

Exemption Eligibility Available Under Section 54F For The House

Sovereign Gold Bond

https://profitsolo.com/sovereign-gold-bond-tax...

He can claim a tax deduction of interest earned in the 80C limit if it s not fully utilized to make these bonds completely tax free Or else he can pay 20 on the total interest earned in that assessment year

https://www.icicidirect.com/.../articles/taxation-on-sovereign-gold-bonds

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds SGBs The interest earned on SGB deposits is also not exempted from tax and must be declared as Income from Other Sources during tax returns

He can claim a tax deduction of interest earned in the 80C limit if it s not fully utilized to make these bonds completely tax free Or else he can pay 20 on the total interest earned in that assessment year

Tax Implications of SGBs Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds SGBs The interest earned on SGB deposits is also not exempted from tax and must be declared as Income from Other Sources during tax returns

Income Tax Exemption Up To Rs 3 Lakh Under Section 80C Among Top Budget

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Exemption Eligibility Available Under Section 54F For The House

Sovereign Gold Bond

Section 80C And 80D Exemption Apart From Section 80C And 80D How Many

Section 80 C Best Tax Saving Investment Option Under Sec 80C

Section 80 C Best Tax Saving Investment Option Under Sec 80C

Sovereign Gold Bond Scheme 2021 2022 Calendar