Today, in which screens are the norm and the appeal of physical printed objects hasn't waned. Whether it's for educational purposes in creative or artistic projects, or simply adding personal touches to your area, Should Rebates Be Recorded As Revenue are a great source. In this article, we'll dive into the sphere of "Should Rebates Be Recorded As Revenue," exploring the different types of printables, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Should Rebates Be Recorded As Revenue Below

Should Rebates Be Recorded As Revenue

Should Rebates Be Recorded As Revenue -

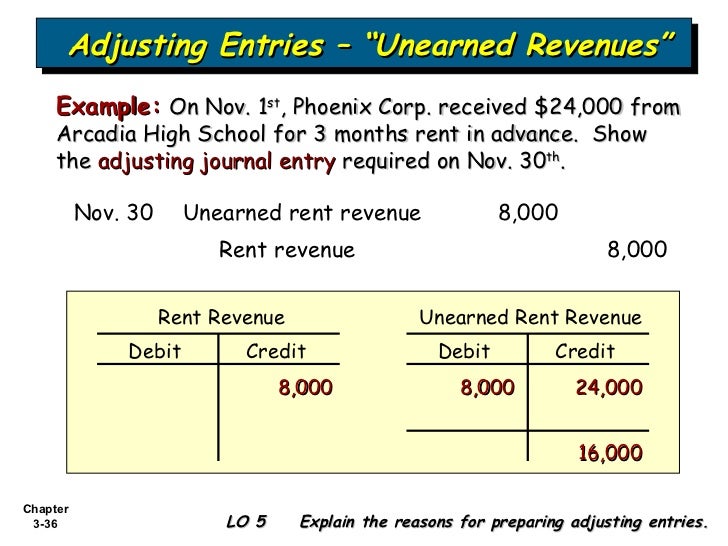

Web 5 sept 2012 nbsp 0183 32 Revenue the gross inflow of economic benefits cash receivables other assets arising from the ordinary operating activities of an entity such as sales of goods

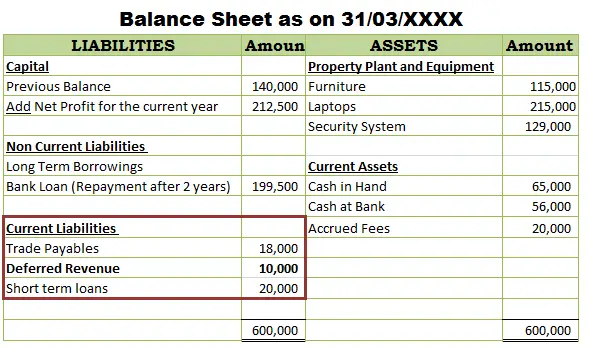

Web If receipt of the rebate is not probable or the amount cannot be measured reliably then the inventory should be recorded at its gross amount Again this assessment should be

Printables for free cover a broad assortment of printable, downloadable documents that can be downloaded online at no cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages, and many more. The great thing about Should Rebates Be Recorded As Revenue is in their variety and accessibility.

More of Should Rebates Be Recorded As Revenue

The New Revenue Recognition Standard The CPA Journal

The New Revenue Recognition Standard The CPA Journal

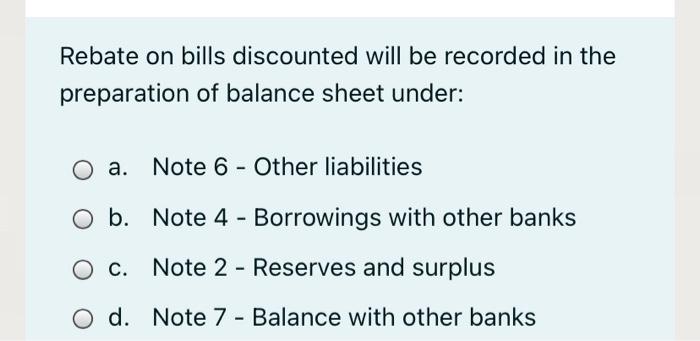

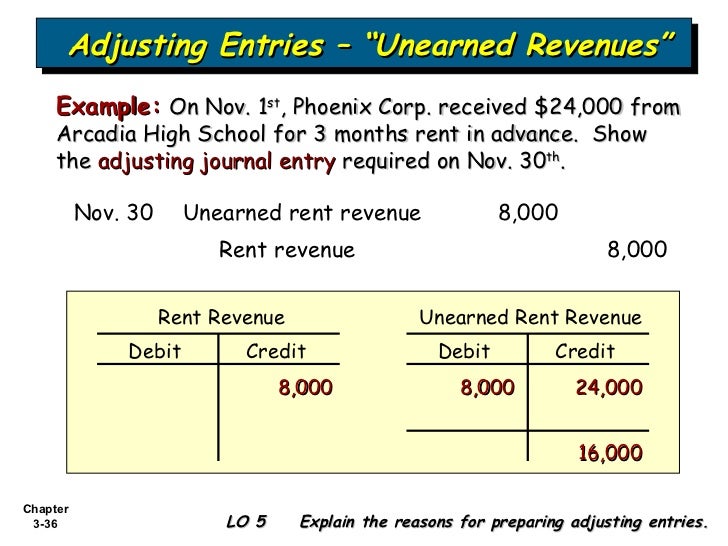

Web may arise as a result of discounts rebates refunds credits concessions incentives performance bonuses penalties and contingent payments variable consideration is only

Web Expenses and revenues must be matched in the same accounting period Everything from purchasing and rebate agreements to sales depends on financial periods If a mistake is made in terms of when a rebate is

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: You can tailor print-ready templates to your specific requirements such as designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: These Should Rebates Be Recorded As Revenue offer a wide range of educational content for learners from all ages, making them an invaluable tool for parents and educators.

-

Easy to use: Instant access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Should Rebates Be Recorded As Revenue

Solved The Total Of Deposits As Per The Balance Sheet Will Chegg

Solved The Total Of Deposits As Per The Balance Sheet Will Chegg

Web New model Current US GAAP Current IFRS Revenue should not be recognised for goods expected to be returned and a liability should be recognised for expected refunds to

Web ElectronicsCo should account for the rebate in the same manner as if it were paid directly to the Retailer Payments to a customer s customer within the distribution chain are

Now that we've ignited your curiosity about Should Rebates Be Recorded As Revenue Let's see where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and Should Rebates Be Recorded As Revenue for a variety applications.

- Explore categories like the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs covered cover a wide selection of subjects, that includes DIY projects to planning a party.

Maximizing Should Rebates Be Recorded As Revenue

Here are some innovative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Should Rebates Be Recorded As Revenue are an abundance with useful and creative ideas that satisfy a wide range of requirements and passions. Their accessibility and versatility make them a fantastic addition to both professional and personal life. Explore the wide world of Should Rebates Be Recorded As Revenue now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Should Rebates Be Recorded As Revenue really for free?

- Yes you can! You can print and download these items for free.

-

Can I make use of free printables for commercial purposes?

- It's dependent on the particular rules of usage. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with Should Rebates Be Recorded As Revenue?

- Some printables may contain restrictions in use. Check the terms and regulations provided by the creator.

-

How do I print printables for free?

- You can print them at home using a printer or visit the local print shop for superior prints.

-

What software will I need to access printables that are free?

- Most PDF-based printables are available in PDF format. They is open with no cost software such as Adobe Reader.

Pin On Tigri

Building Energy Retrofit Accelerator City Of Edmonton

![]()

Check more sample of Should Rebates Be Recorded As Revenue below

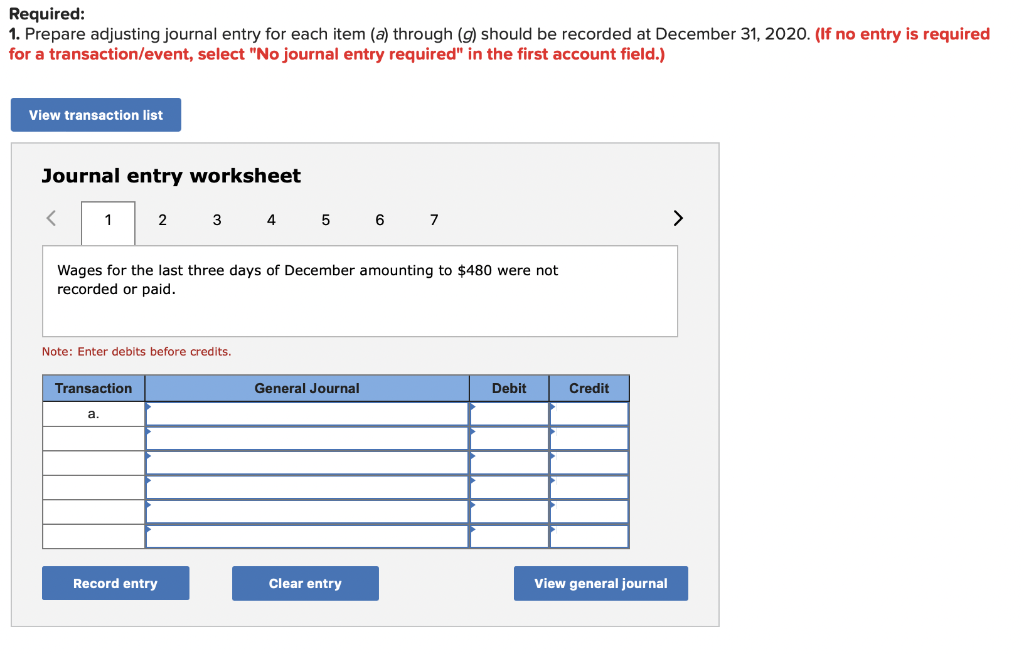

Solved The Following Transactions Are Typical Op SolutionInn

Bab 3 The Accounting Information System

Solved On December 31 2020 Dyer Inc Completed Its First Chegg

Fiscal Revenue Excluding Subsidies And Tax Rebates Increased By 5 1 In

6 A Construction Company Decides To Take A New Job The Estimated

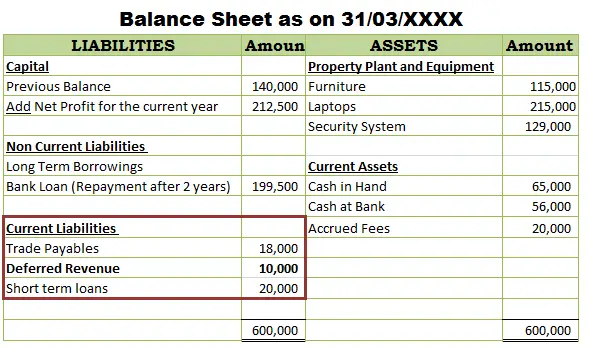

Is Deferred Revenue A Liability Accounting Capital

https://www.grantthornton.global/globalassets/1.-member-fir…

Web If receipt of the rebate is not probable or the amount cannot be measured reliably then the inventory should be recorded at its gross amount Again this assessment should be

https://www.proformative.com/questions/accounting-for-vendor-rebates

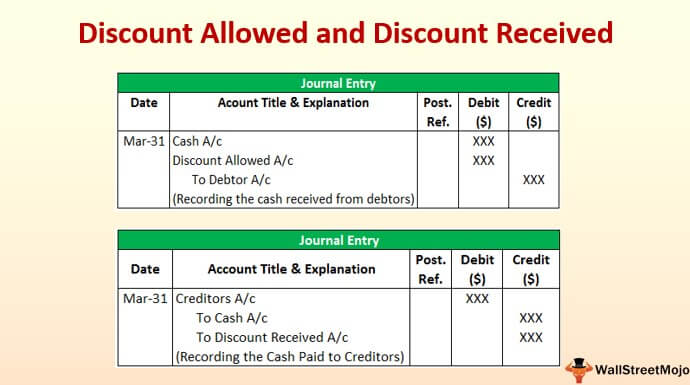

Web 30 oct 2015 nbsp 0183 32 I see GAAP guidance that VENDORS should record rebates as a reduction in their sales prices but how should those of us receiving them record them Should I

Web If receipt of the rebate is not probable or the amount cannot be measured reliably then the inventory should be recorded at its gross amount Again this assessment should be

Web 30 oct 2015 nbsp 0183 32 I see GAAP guidance that VENDORS should record rebates as a reduction in their sales prices but how should those of us receiving them record them Should I

Fiscal Revenue Excluding Subsidies And Tax Rebates Increased By 5 1 In

Bab 3 The Accounting Information System

6 A Construction Company Decides To Take A New Job The Estimated

Is Deferred Revenue A Liability Accounting Capital

Rebates Discounts And Rent Incentives Re Leased

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Discount Allowed And Discount Received Journal Entries With Examples