In this age of electronic devices, with screens dominating our lives The appeal of tangible printed material hasn't diminished. If it's to aid in education as well as creative projects or simply to add personal touches to your area, Self Education Exemption In Income Tax are now a vital resource. With this guide, you'll dive deep into the realm of "Self Education Exemption In Income Tax," exploring the benefits of them, where to find them and how they can be used to enhance different aspects of your lives.

Get Latest Self Education Exemption In Income Tax Below

Self Education Exemption In Income Tax

Self Education Exemption In Income Tax -

Purchase of basic supporting equipment for disabled self spouse child or parent 6 000 Restricted 4 Disabled individual 6 000 5 Education fees Self Other than a degree

Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make

Self Education Exemption In Income Tax cover a large assortment of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of designs, including worksheets coloring pages, templates and many more. The great thing about Self Education Exemption In Income Tax lies in their versatility and accessibility.

More of Self Education Exemption In Income Tax

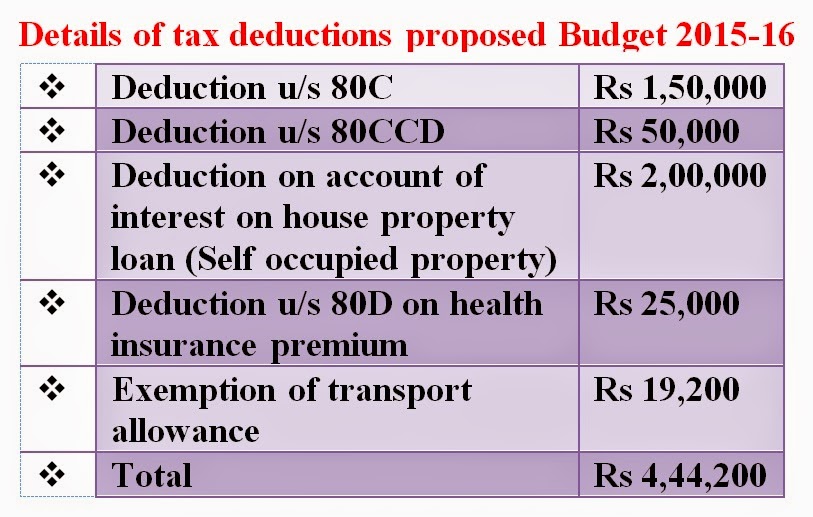

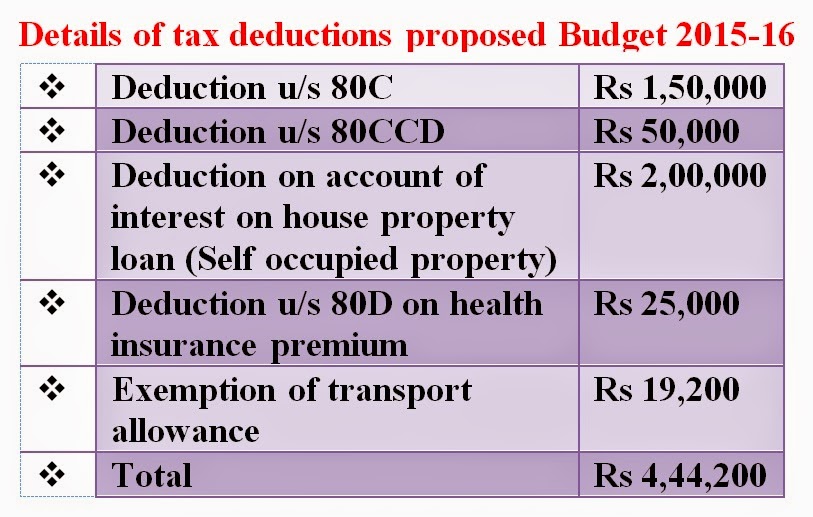

Income Tax Exemption Limit In The Budget 2015 16 StaffNews

Income Tax Exemption Limit In The Budget 2015 16 StaffNews

Self education expenses You can claim a deduction for self education expenses if the education relates to your employment activities Last updated 1 June

In addition to the two benefits explained above which are available for all the taxpayer whether one is salaried or self employed the tax laws also allow for

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization This allows you to modify printing templates to your own specific requirements such as designing invitations making your schedule, or decorating your home.

-

Educational Value: Printables for education that are free can be used by students of all ages. This makes these printables a powerful instrument for parents and teachers.

-

Easy to use: The instant accessibility to a plethora of designs and templates reduces time and effort.

Where to Find more Self Education Exemption In Income Tax

HRA Exemption Calculator In Excel House Rent Allowance Calculation

HRA Exemption Calculator In Excel House Rent Allowance Calculation

If any tax free educational assistance for the qualified education expenses paid in 2023 or any refund of your qualified education expenses paid in 2023 is received after you file your 2023 income tax return you must

Interest paid on education loans taken for higher studies of self spouse or children including for whom you are the legal guardian can be claimed as a deduction from the taxable income Eligibility for

Since we've got your curiosity about Self Education Exemption In Income Tax Let's look into where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Self Education Exemption In Income Tax for various applications.

- Explore categories such as decoration for your home, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs are a vast variety of topics, from DIY projects to planning a party.

Maximizing Self Education Exemption In Income Tax

Here are some innovative ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners along with lists of tasks, and meal planners.

Conclusion

Self Education Exemption In Income Tax are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and desires. Their accessibility and flexibility make them a wonderful addition to both professional and personal lives. Explore the vast collection of Self Education Exemption In Income Tax to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can download and print these materials for free.

-

Can I utilize free printouts for commercial usage?

- It's dependent on the particular rules of usage. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Certain printables could be restricted regarding usage. Be sure to read the terms and condition of use as provided by the creator.

-

How do I print Self Education Exemption In Income Tax?

- Print them at home using an printer, or go to an area print shop for higher quality prints.

-

What program will I need to access Self Education Exemption In Income Tax?

- The majority of printed documents are in PDF format. They can be opened with free programs like Adobe Reader.

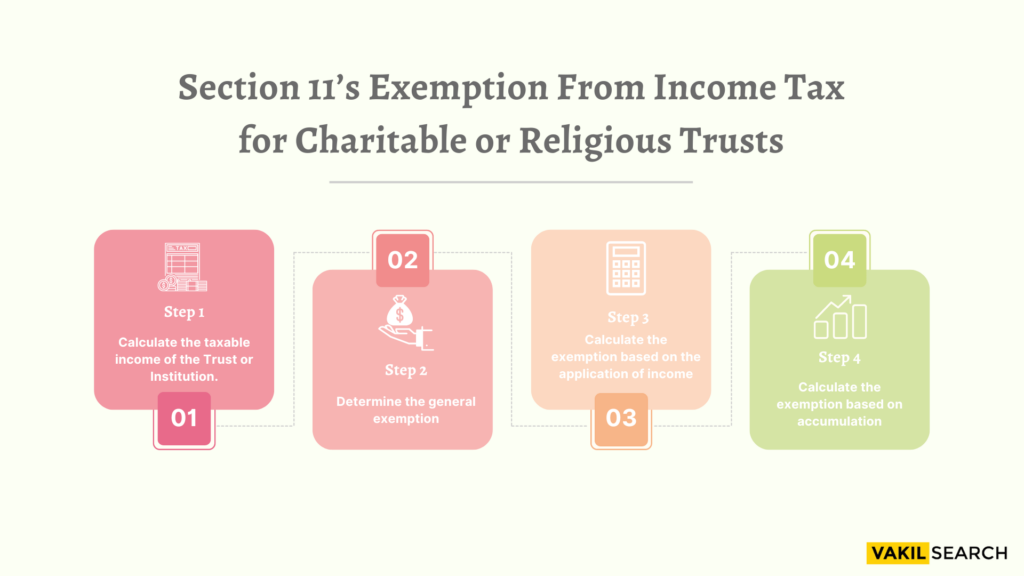

Section 11 Income Tax Act Exemptions For Charitable Trusts

Income Tax Slabs

Check more sample of Self Education Exemption In Income Tax below

Avoid Mistakes While Claiming HRA On The ITR Ebizfiling

Section 80U Tax Deductions For Disabled Individuals Tax2win

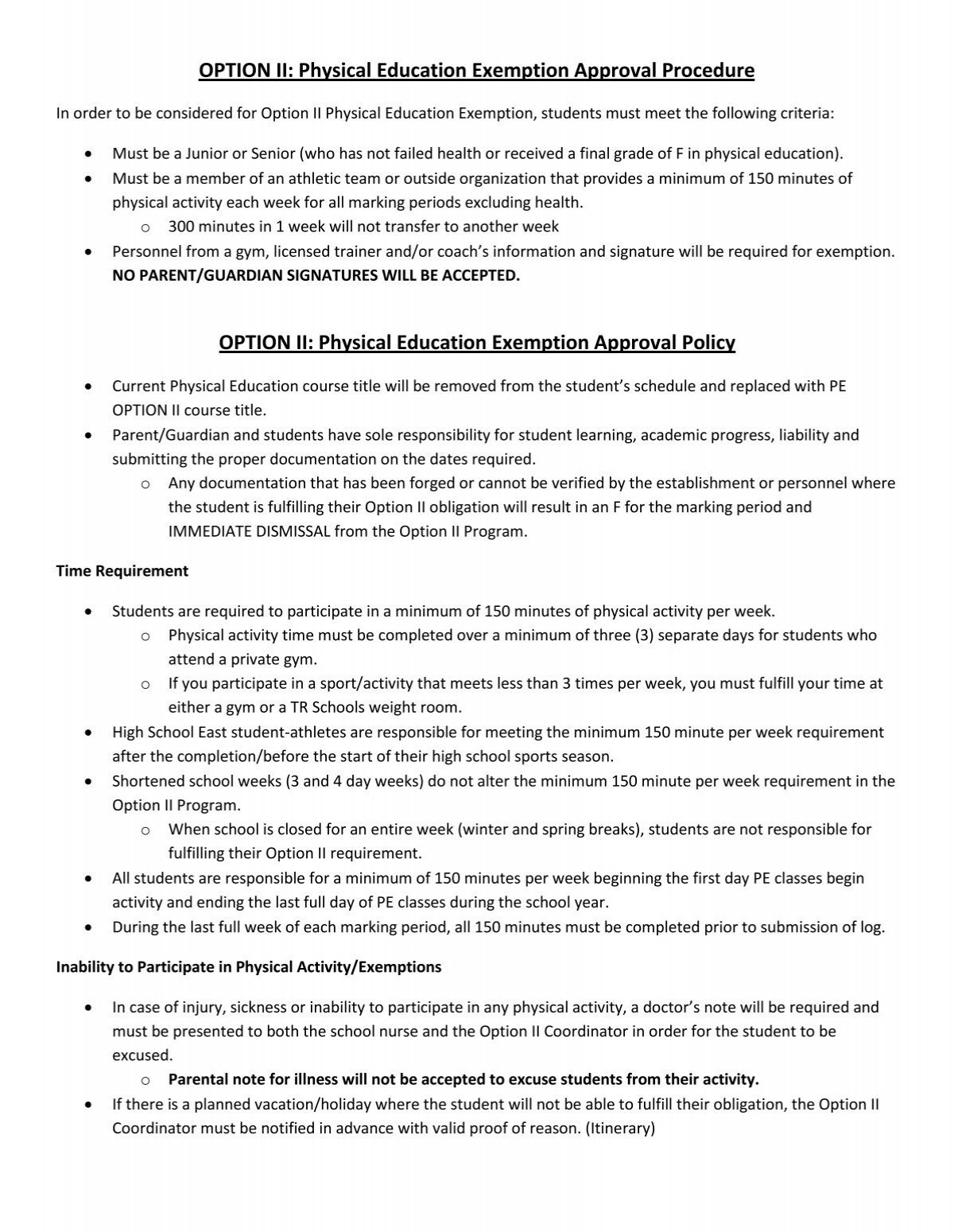

OPTION II Physical Education Exemption Approval Procedure

Budget 2023 Know In 10 Points What Are The Expectations From The

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

Exemptions Still Available In New Tax Regime with English Subtitles

https://taxguru.in/income-tax/exemptions-deduction...

Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make

https://www.gov.hk/.../deductions/selfeducation.htm

Expenses of Self Education Under Salaries Tax the expenses of self education SEE allowable for deduction include tuition fee and the related examination fee paid for a

Explore the exemptions and deductions allowed under the new tax regime for FY 2023 24 AY 2024 25 Learn about the options available to taxpayers and make

Expenses of Self Education Under Salaries Tax the expenses of self education SEE allowable for deduction include tuition fee and the related examination fee paid for a

Budget 2023 Know In 10 Points What Are The Expectations From The

Section 80U Tax Deductions For Disabled Individuals Tax2win

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

Exemptions Still Available In New Tax Regime with English Subtitles

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

HRA Exemption In Income Tax 2023 Guide InstaFiling

HRA Exemption In Income Tax 2023 Guide InstaFiling

Get FD Done In These 5 Government Banks Getting The Highest Interest