In the age of digital, with screens dominating our lives it's no wonder that the appeal of tangible printed material hasn't diminished. Whether it's for educational purposes for creative projects, just adding personal touches to your area, Self Assessment Tax Return Pension Contributions are now a useful resource. For this piece, we'll dive deeper into "Self Assessment Tax Return Pension Contributions," exploring what they are, how to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Self Assessment Tax Return Pension Contributions Below

Self Assessment Tax Return Pension Contributions

Self Assessment Tax Return Pension Contributions -

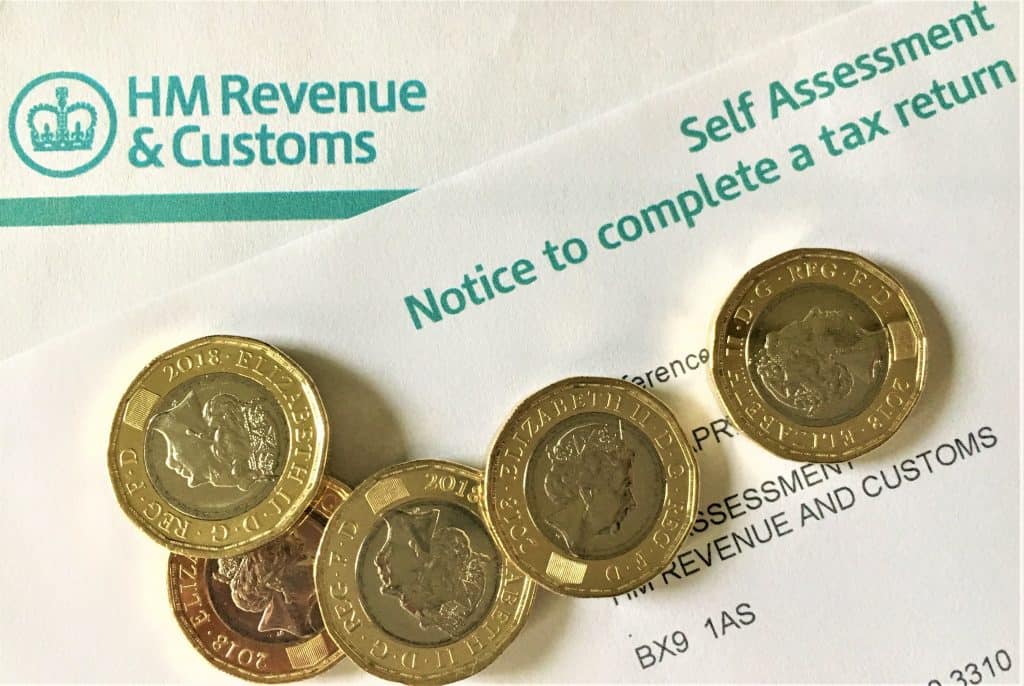

Verkko 13 lokak 2023 nbsp 0183 32 In the tax reliefs section of your SA100 Self Assessment tax return under Payments to registered pension schemes where basic rate tax relief will be

Verkko 12 toukok 2016 nbsp 0183 32 You can get tax relief on most contributions you make to registered pension schemes some overseas pension schemes You can t claim relief for

Self Assessment Tax Return Pension Contributions cover a large range of printable, free materials available online at no cost. These materials come in a variety of styles, from worksheets to coloring pages, templates and many more. The attraction of printables that are free is in their versatility and accessibility.

More of Self Assessment Tax Return Pension Contributions

Self Assessment Accounting For Universal Credit Pension Contributions

Self Assessment Accounting For Universal Credit Pension Contributions

Verkko your taxable income was over 163 100 000 if you earned over 163 50 000 in the 2022 23 tax year and make pension contributions you might have to complete an assessment

Verkko 13 huhtik 2023 nbsp 0183 32 If you are a higher or additional rate taxpayer and you normally complete a Self Assessment tax return tell HMRC about your pension contributions and claim any tax relief by

Self Assessment Tax Return Pension Contributions have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Modifications: The Customization feature lets you tailor printables to your specific needs in designing invitations or arranging your schedule or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost provide for students from all ages, making them an essential tool for teachers and parents.

-

Simple: The instant accessibility to a plethora of designs and templates will save you time and effort.

Where to Find more Self Assessment Tax Return Pension Contributions

How Soon Should I Submit My Self Assessment Tax Return

How Soon Should I Submit My Self Assessment Tax Return

Verkko 21 marrask 2017 nbsp 0183 32 Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher

Verkko Details This guide explains how to enter pension savings tax charges and taxable lump sums from overseas pension schemes on your Self Assessment tax return

In the event that we've stirred your interest in Self Assessment Tax Return Pension Contributions Let's find out where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Self Assessment Tax Return Pension Contributions for various needs.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free or flashcards as well as learning tools.

- The perfect resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs covered cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing Self Assessment Tax Return Pension Contributions

Here are some inventive ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use printable worksheets for free to reinforce learning at home and in class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Self Assessment Tax Return Pension Contributions are a treasure trove of useful and creative resources which cater to a wide range of needs and hobbies. Their accessibility and flexibility make them a great addition to each day life. Explore the vast world of Self Assessment Tax Return Pension Contributions and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Self Assessment Tax Return Pension Contributions really cost-free?

- Yes you can! You can print and download these resources at no cost.

-

Can I use the free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Do you have any copyright concerns when using Self Assessment Tax Return Pension Contributions?

- Certain printables could be restricted regarding usage. Make sure you read these terms and conditions as set out by the designer.

-

How can I print Self Assessment Tax Return Pension Contributions?

- You can print them at home with printing equipment or visit any local print store for top quality prints.

-

What program do I need in order to open Self Assessment Tax Return Pension Contributions?

- The majority of PDF documents are provided in PDF format. They can be opened using free software such as Adobe Reader.

Self Assessment Tax Returns FAQ Easy Accounting Services

Self Assessment Tax Return

Check more sample of Self Assessment Tax Return Pension Contributions below

Remember Your Pension In Your Self Assessment Tax Return

Accountant s Guide To Make Self Assessment Tax Return Process Easier

Pension Contributions And The UK Tax Return YouTube

Pension Contributions Tax Relief What You Need To Know YouTube

Self assessment Tax Return CIS Rebates Company Accounts CT600

How To File Your Self Assessment Tax Return On Time The Cheap Accountants

https://www.gov.uk/guidance/self-assessment-claim-tax-relief-on...

Verkko 12 toukok 2016 nbsp 0183 32 You can get tax relief on most contributions you make to registered pension schemes some overseas pension schemes You can t claim relief for

https://www.gov.uk/tax-on-your-private-pension/pension-tax-relief

Verkko Claim tax relief in your Self Assessment tax return if your pension scheme is not set up for automatic tax relief Call or write to HMRC if you do not fill in a tax return

Verkko 12 toukok 2016 nbsp 0183 32 You can get tax relief on most contributions you make to registered pension schemes some overseas pension schemes You can t claim relief for

Verkko Claim tax relief in your Self Assessment tax return if your pension scheme is not set up for automatic tax relief Call or write to HMRC if you do not fill in a tax return

Pension Contributions Tax Relief What You Need To Know YouTube

Accountant s Guide To Make Self Assessment Tax Return Process Easier

Self assessment Tax Return CIS Rebates Company Accounts CT600

How To File Your Self Assessment Tax Return On Time The Cheap Accountants

Tax Moore Financial Management

Self Assessment Tax Return Filing UK One Education

Self Assessment Tax Return Filing UK One Education

Four Pension Tax Tips For Your Self assessment Return Which News