In this age of technology, where screens dominate our lives it's no wonder that the appeal of tangible printed products hasn't decreased. If it's to aid in education and creative work, or simply to add an extra personal touch to your space, Section 24 Interest On Housing Loan Limit have become a valuable resource. We'll dive into the sphere of "Section 24 Interest On Housing Loan Limit," exploring the different types of printables, where to find them and how they can improve various aspects of your daily life.

Get Latest Section 24 Interest On Housing Loan Limit Below

Section 24 Interest On Housing Loan Limit

Section 24 Interest On Housing Loan Limit -

To summarize the maximum Income Tax Deduction allowed under Section 24 in case of a Self Occupied property is subject to a maximum limit of Rs 2 00 000 limit was

As per Sec 24 only Rs 2 lac will be allowed as interest deduction this will be setoff from other head income as house property loss Balance Rs 3 lac will not be

Section 24 Interest On Housing Loan Limit cover a large range of printable, free content that can be downloaded from the internet at no cost. They come in many forms, like worksheets templates, coloring pages and much more. The value of Section 24 Interest On Housing Loan Limit lies in their versatility as well as accessibility.

More of Section 24 Interest On Housing Loan Limit

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

Interest on Home Loan Interest payable on loans borrowed for the purpose of acquisition construction repairs renewal or reconstruction can be claimed as deduction Whereas Section 80C

The total amount of pre construction including the interest on the housing loan to be claimed should not exceed 2 lakh The deduction on this interest is allowed in five equal instalments Conditions

Section 24 Interest On Housing Loan Limit have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Customization: They can make printed materials to meet your requirements be it designing invitations or arranging your schedule or even decorating your house.

-

Educational Value Education-related printables at no charge are designed to appeal to students of all ages, making them a vital tool for teachers and parents.

-

Simple: Access to many designs and templates, which saves time as well as effort.

Where to Find more Section 24 Interest On Housing Loan Limit

Tax Implications Housing Non Housing Loan

Tax Implications Housing Non Housing Loan

How much interest on housing loan can be claimed as deduction under Section 24 What is the maximum deduction limit under Section 24 The maximum

Further deduction under Section 80C is maximum up to the limit of INR 1 50 000 Deduction for payment of interest can be claimed under Section 24

Since we've got your interest in printables for free Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of printables that are free for a variety of motives.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- The blogs are a vast range of topics, everything from DIY projects to planning a party.

Maximizing Section 24 Interest On Housing Loan Limit

Here are some fresh ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Section 24 Interest On Housing Loan Limit are an abundance of fun and practical tools that can meet the needs of a variety of people and hobbies. Their accessibility and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the wide world of Section 24 Interest On Housing Loan Limit now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Section 24 Interest On Housing Loan Limit really completely free?

- Yes you can! You can print and download these documents for free.

-

Are there any free printables in commercial projects?

- It's based on the rules of usage. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables could have limitations regarding usage. Make sure to read the terms and conditions set forth by the author.

-

How do I print Section 24 Interest On Housing Loan Limit?

- You can print them at home using any printer or head to a local print shop to purchase superior prints.

-

What program do I require to view printables that are free?

- A majority of printed materials are in PDF format. These can be opened with free programs like Adobe Reader.

Tax Benefits Of Taking A Home Loan YouTube

Tax Benefit On Home Loan Of Section 24

Check more sample of Section 24 Interest On Housing Loan Limit below

Tax Benefits On Home Loan Know More At Taxhelpdesk

Home Loan Eligibility Calculator Home First Finance Company YouTube

Interest On Housing Loan Home Loan Tax Benefits Deductions Section

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Section 80EE And 80EEA Interest On Housing Loan Deduction

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

https://tax2win.in/guide/interest-deduction-on-rented-house-property

As per Sec 24 only Rs 2 lac will be allowed as interest deduction this will be setoff from other head income as house property loss Balance Rs 3 lac will not be

https://scripbox.com/tax/section-24-of-i…

Section 24 provides for deduction for interest on a home loan of up to Rs 2 00 000 in a financial year The assessee can claim a deduction up to Rs 2 lakh while computing his her total taxable income

As per Sec 24 only Rs 2 lac will be allowed as interest deduction this will be setoff from other head income as house property loss Balance Rs 3 lac will not be

Section 24 provides for deduction for interest on a home loan of up to Rs 2 00 000 in a financial year The assessee can claim a deduction up to Rs 2 lakh while computing his her total taxable income

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Home Loan Eligibility Calculator Home First Finance Company YouTube

Section 80EE And 80EEA Interest On Housing Loan Deduction

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

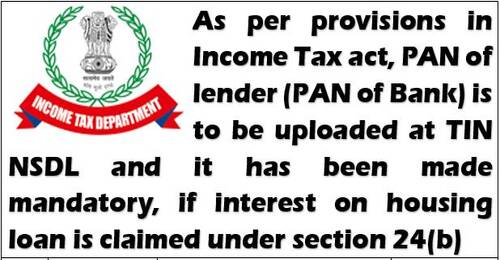

PAN Of Lender PAN Of Bank Required If Interest On Housing Loan Is

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog