In this day and age with screens dominating our lives and the appeal of physical printed products hasn't decreased. In the case of educational materials in creative or artistic projects, or simply adding an element of personalization to your area, Revenue Tax Relief Medical Expenses are a great resource. The following article is a dive into the sphere of "Revenue Tax Relief Medical Expenses," exploring the benefits of them, where you can find them, and what they can do to improve different aspects of your life.

Get Latest Revenue Tax Relief Medical Expenses Below

Revenue Tax Relief Medical Expenses

Revenue Tax Relief Medical Expenses -

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross income for the year

You can claim relief on health expenses through myAccount or Revenue Online Service ROS You can only claim for expenses that you have receipts for You can claim relief on the last four year s health expenses Expenses incurred over a number of years cannot be processed as a single combined claim

The Revenue Tax Relief Medical Expenses are a huge range of printable, free materials available online at no cost. They are available in numerous designs, including worksheets coloring pages, templates and more. The appeal of printables for free lies in their versatility and accessibility.

More of Revenue Tax Relief Medical Expenses

What Medical Expenses Are Tax Deductible

What Medical Expenses Are Tax Deductible

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

This leaves you with a medical expense deduction of 2 100 5 475 minus 3 375 This amount can be included on your Schedule A Itemized Deductions As a result of the Tax Cuts and Jobs Act TCJA of 2017 the standard deduction has nearly doubled from where it was in 2016

Revenue Tax Relief Medical Expenses have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Modifications: Your HTML0 customization options allow you to customize designs to suit your personal needs in designing invitations or arranging your schedule or even decorating your house.

-

Educational Worth: Education-related printables at no charge provide for students from all ages, making them a great device for teachers and parents.

-

Convenience: immediate access a variety of designs and templates reduces time and effort.

Where to Find more Revenue Tax Relief Medical Expenses

How To Get The Most Out Of Your Medical Expenses Elite Tax

How To Get The Most Out Of Your Medical Expenses Elite Tax

Medical expense deduction 2023 For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income

These frequently asked questions FAQs address whether certain costs related to nutrition wellness and general health are medical expenses under section 213 of the Internal Revenue Code Code that may be paid or reimbursed under a health savings account HSA health flexible spending arrangement FSA Archer medical

Since we've got your curiosity about Revenue Tax Relief Medical Expenses, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Revenue Tax Relief Medical Expenses for various purposes.

- Explore categories such as decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to party planning.

Maximizing Revenue Tax Relief Medical Expenses

Here are some innovative ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home and in class.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Revenue Tax Relief Medical Expenses are a treasure trove filled with creative and practical information that meet a variety of needs and desires. Their availability and versatility make they a beneficial addition to both personal and professional life. Explore the plethora of Revenue Tax Relief Medical Expenses today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes they are! You can download and print these files for free.

-

Can I use the free printables in commercial projects?

- It's dependent on the particular terms of use. Always check the creator's guidelines before utilizing printables for commercial projects.

-

Are there any copyright issues when you download Revenue Tax Relief Medical Expenses?

- Some printables could have limitations in their usage. Be sure to check the terms and conditions provided by the designer.

-

How do I print Revenue Tax Relief Medical Expenses?

- You can print them at home using printing equipment or visit a print shop in your area for more high-quality prints.

-

What software is required to open printables free of charge?

- Many printables are offered in PDF format. They can be opened using free programs like Adobe Reader.

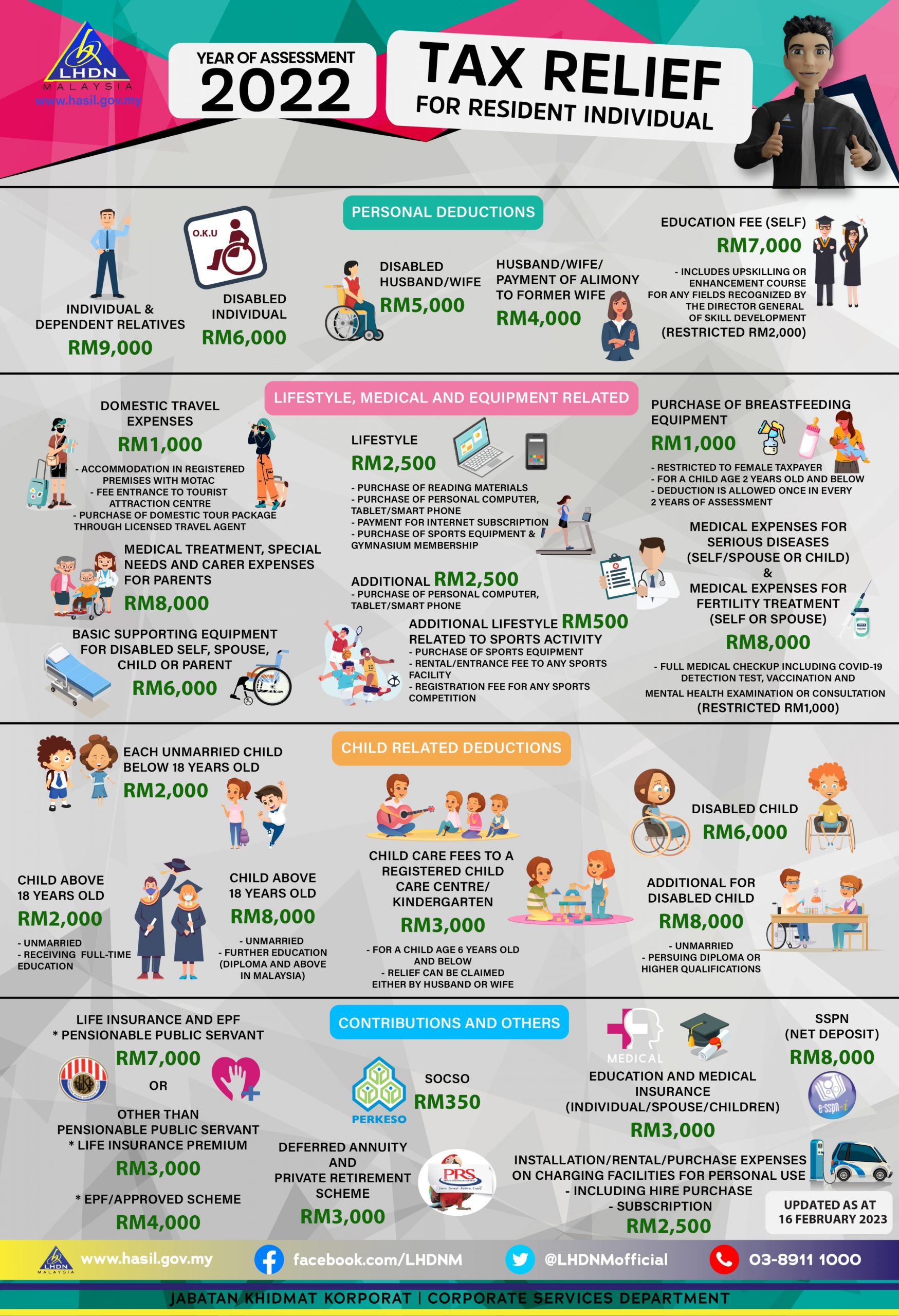

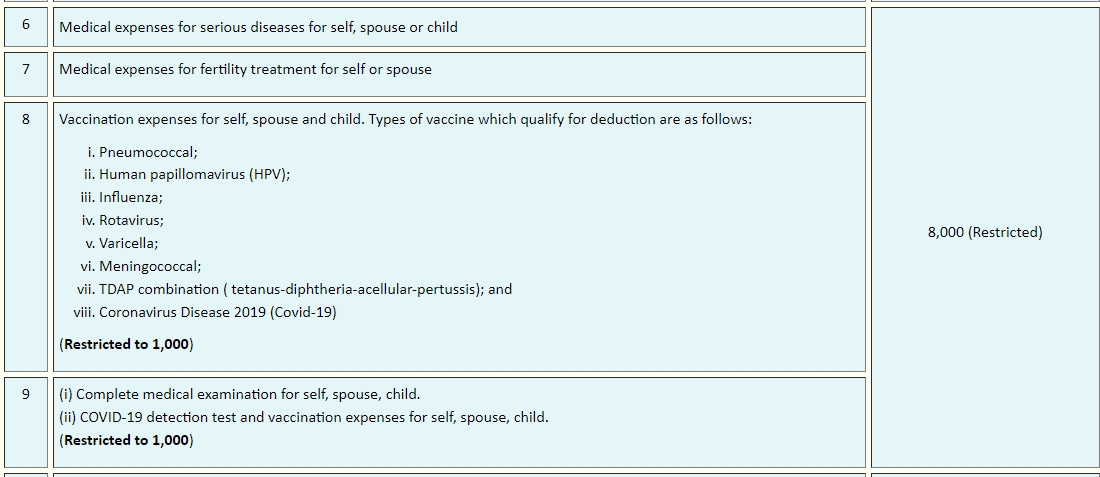

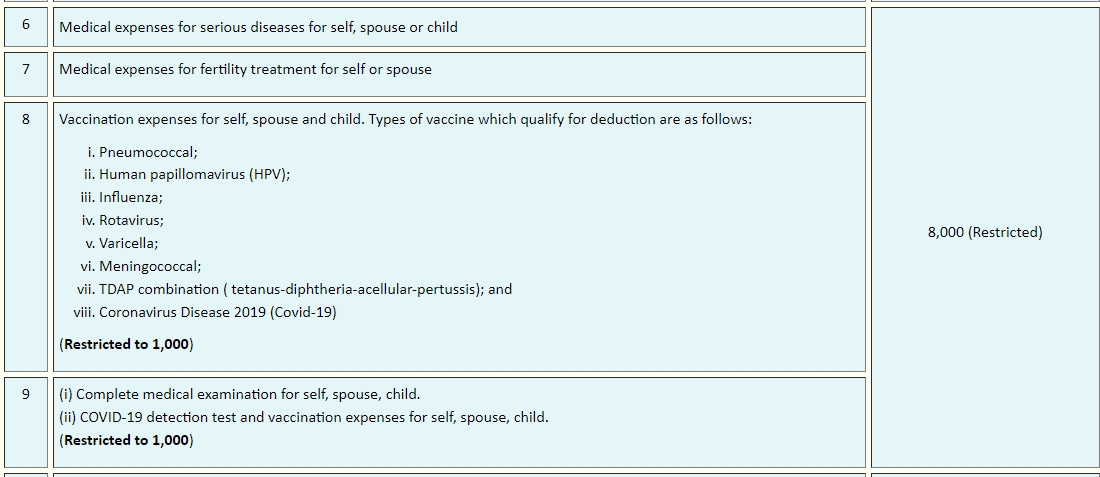

Malaysia Personal Income Tax Relief 2022

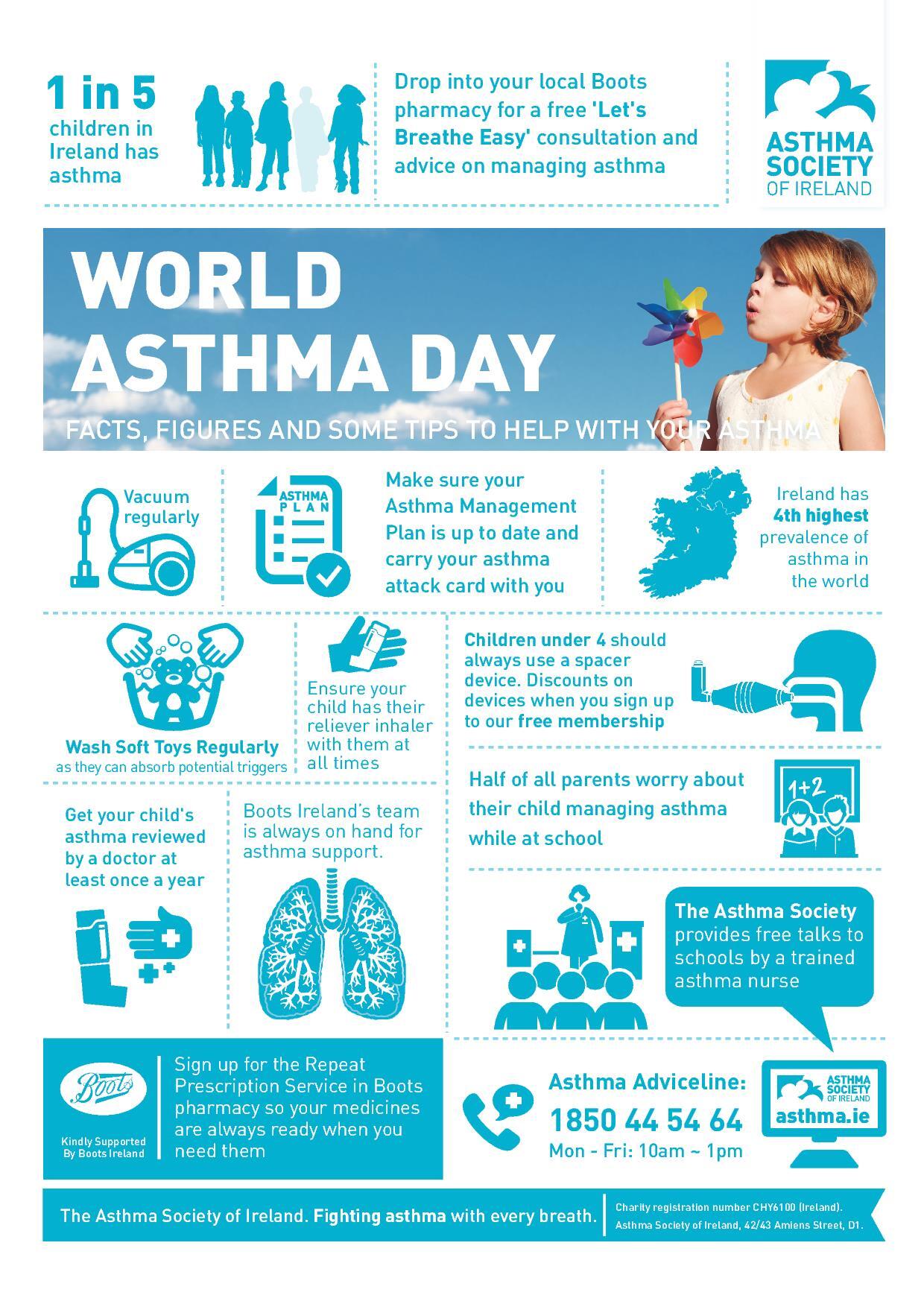

Is Asthma A Disability In Ireland KnowYourAsthma

Check more sample of Revenue Tax Relief Medical Expenses below

Tax Preparation Specialist Issues Tax Relief Guidance For Employees Who

Personal Tax Reliefs In Malaysia Legal Advice Malaysia

Get Tax Relief On Medical Expenses From Revenue Refund Your Tax

Case Studies Of Innovative Green Companies In Longford Local

Child Support And Bankruptcy RHM LAW LLP

Personal Tax Relief 2021 L Co Accountants

https://www.revenue.ie/en/personal-tax-credits...

You can claim relief on health expenses through myAccount or Revenue Online Service ROS You can only claim for expenses that you have receipts for You can claim relief on the last four year s health expenses Expenses incurred over a number of years cannot be processed as a single combined claim

https://www.citizensinformation.ie/.../taxation-and-medical-expenses

You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief on nursing home expenses is available at your highest rate of income tax You can claim tax relief on medical expenses you pay for yourself or for any other person

You can claim relief on health expenses through myAccount or Revenue Online Service ROS You can only claim for expenses that you have receipts for You can claim relief on the last four year s health expenses Expenses incurred over a number of years cannot be processed as a single combined claim

You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief on nursing home expenses is available at your highest rate of income tax You can claim tax relief on medical expenses you pay for yourself or for any other person

Case Studies Of Innovative Green Companies In Longford Local

Personal Tax Reliefs In Malaysia Legal Advice Malaysia

Child Support And Bankruptcy RHM LAW LLP

Personal Tax Relief 2021 L Co Accountants

Longford Firm Set To Revolutionise Ireland s Beer Industry Local

Lhdn Personal Tax Relief Sarah MacLeod

Lhdn Personal Tax Relief Sarah MacLeod

Claim Tax Relief As An Employee For Your Expenses Prestige Business